All Activity

- Past hour

-

shyan started following egindicators.org

-

Dear apmoo Here is the latest update for EG Indicators Thank you The Dynamic FVG ICT.pdf The E.G. Trigger Bot.pdf The E.G. Divergence Indicator.pdf The E.G. Confluence.pdf The E.G. Trailing Stop.pdf The E.G. Price Action.pdf The E.G. Dynamic Fibonacci.pdf The E.G. AI Accelerometer.pdf EG_DynamicFVG.zip EG_TriggerBot.zip EG_Divergence.zip EG_Confluence.zip EG_TrailingStop.zip EG_AIAccelerometer.zip EG_DynamicFibonacci.zip EG_PriceAction.zip

-

I followed their pdf with the instructions quite carefully. All I got was WTT in panel 2 (only a few candles) and nothing showing in the main chart window. And I keep getting notes in NS Output window "Indicator 'WTT_WhaleTrail_Indicator_FreeTrial': Error on calling 'OnStateChange' method: Object reference not set to an instance of an object."

-

Kermit 1981 reacted to a post in a topic:

https://www.hawk-trading.com/

Kermit 1981 reacted to a post in a topic:

https://www.hawk-trading.com/

- Today

-

⭐ trader65 reacted to a post in a topic:

eminifuturesdaytrader.com

⭐ trader65 reacted to a post in a topic:

eminifuturesdaytrader.com

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 28th April 2025.[/b] [b]Can a Busy Week For the USD Revive The Dollar?[/b] The first week of May for the US Dollar is likely to be the most important within the whole month. During this week, the US will confirm its NFP employment data, job openings, PCE Inflation, US company earnings and the Gross Domestic Product. The US Dollar has been the worst performing currency in 2025, but can this week’s releases change its performance? Currency Market In April, the best performing currencies are the Swiss Franc, Euro and Japanese due to their safe haven nature and a known alternative to the Dollar. The worst-performing currencies have been both the US Dollar and Australian Dollar. However, the US Dollar had slightly improved during the previous week meaning traders need to be cautious as to if the USD may retrace slightly higher. AUDUSD The performance of the US Dollar is likely to continue to depend primarily on the US trade policy. According to experts, over the past week, investor sentiment has improved but for this to continue the news will need to provide a positive tone. Lastly, the Japanese Yen could see volatility in either direction as the Bank of Japan is due to announce its rate decision later this week. Analysts expect the rate to remain unchanged but Governor Ueda is likely to provide indications of future rate hikes. Australian Dollar and Australian Elections The main developments which will influence the dynamics of the Australian Dollar is the Consumer Price Index (inflation) on Wednesday, Retail Sales and the elections over the weekend. The Australian Dollar Index is trading 1.85% higher over the past month. However, the AUD is still underperforming compared to other currencies. The AUDUSD has struggled to cross above the 0.64069 resistance level over the past month. The Australian Dollar has been struggling over the past month as economists believe the inflation rate will continue to fall close to the 2.0% target. Current expectations are that the inflation rate will fall from 2.4% to 2.3%. Economists say the likelihood of an interest rate cut in May is diminishing but was previously the main expectation. The Australian Dollar has recovered from the sharp decline that had triggered urgent calls for action from the Reserve Bank. However, if the US Dollar is to increase in value traders may take into consideration two opinions. The first is to trade the AUDUSD as the Australian Dollar is the worst-performing currency or the USDCHF as the Swiss Franc is the best-performing currency and can more easily give up recent gains. US Dollar and Upcoming Releases The US Dollar was 1.65% after starting the previous week on a negative price gap. However, even with the upward price movement, the US Dollar Index remains relatively cheap and still trades at its lowest since July 2024. Gold also declines during Monday’s Asian Session which is another positive sign for the USD. The US will release the following data in the upcoming days: JOLTS Job Opening - Tomorrow ADP Non-Farm Employment Change - Wednesday US GDP - Wednesday Employment Cost Index - Wednesday Core PCE Price Index - Wednesday Weekly Unemployment Claims - Thursday ISM Manufacturing PMI - Thursday NFP Employment Change and Unemployment Rate - Friday A big factor this week will continue to be the US Trade Negotiations. Yesterday, US President Donald Trump announced that negotiations between Washington and Beijing had already begun. However, Chinese officials denied that any talks were underway, fueling traders' uncertainty and dampening appetite for riskier assets. Nonetheless, the tone has been positive as both Trump and China advise they can make a trade agreement. China has already advised some goods will see tariffs lowered as a show of good faith. Meanwhile, Trump signed an executive order to start a deep-sea mining initiative aimed at countering China’s dominance in certain commodities. The US plans to boost domestic production of nickel, copper, and rare earth elements. Currently, the Federal Reserve is reluctant to cut interest rates but this can quickly change if employment data deteriorates. If the data this week beats expectations, the Fed is likely to stick to this tone and the US Dollar can gain bullish momentum. However, if this data reads weaker than the projections, the confidence in the Dollar can deteriorate and the Fed may be pressured to cut interest rates further pressuring the currency. Key Takeaway Points: This week’s major US data releases could decide whether the US Dollar rebounds or continues to lag. Safe-haven currencies like the Swiss Franc and Yen remain stronger, but risks of losing momentum increase. The Australian Dollar faces pressure from slowing inflation, soft retail sales, and upcoming elections. Stronger US data and positive trade negotiations could fuel a Dollar recovery; weak data may trigger Fed rate cut fears. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ mangrad reacted to a post in a topic:

eminifuturesdaytrader.com

⭐ mangrad reacted to a post in a topic:

eminifuturesdaytrader.com

-

Harrys reacted to a post in a topic:

riosquant.com

Harrys reacted to a post in a topic:

riosquant.com

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rises above 143.00; will growth continue? The USDJPY pair climbed to the 144.00 area amid easing trade tensions and ongoing negotiations. Find out more in our analysis for 28 April 2025. USDJPY forecast: key trading points Market focus: ongoing tariff negotiations between the US and Japan Current trend: correcting upwards USDJPY forecast for 28 April 2025: 144.00 and 143.00 Fundamental analysis The USDJPY rate climbed into the 144 yen per dollar area on Monday, driven by easing global trade tensions. Japan's chief trade negotiator, Ryosei Akazawa, is expected to visit Washington this week for a second round of bilateral talks. Meanwhile, the Bank of Japan is scheduled to hold its policy meeting this Thursday. The regulator is widely expected to maintain its benchmark interest rate at 0.5%, as policymakers continue to assess the potential impact of newly imposed US tariffs on Japan’s export-oriented economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 230 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

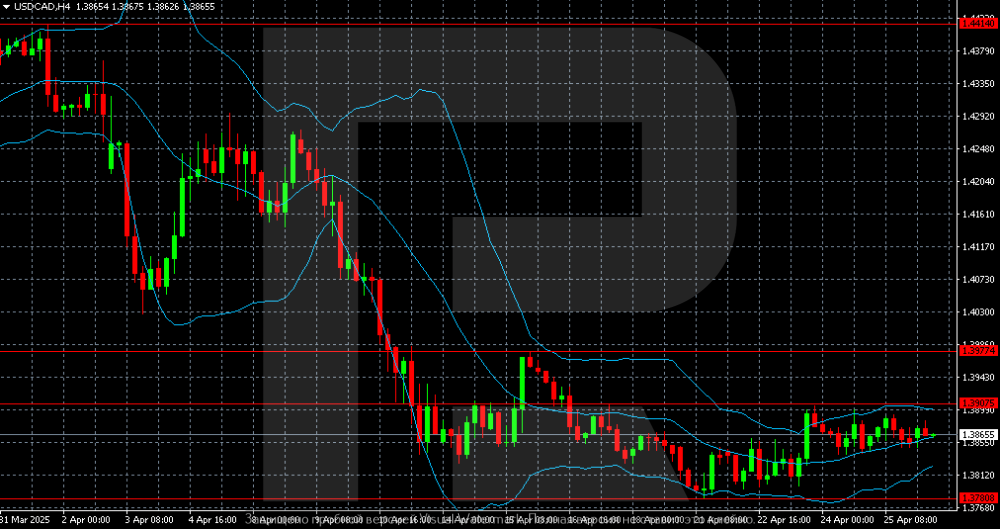

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD: sideways movement for now, but further decline expected The USDCAD pair is hovering around 1.3863. The market is assessing the prospects of easing US-China trade tensions and closely following the Canadian elections. Discover more in our analysis for 28 April 2025. USDCAD technical analysis On the USDCAD H4 chart, the sideways range is limited by the 1.3780 and 1.3907 levels. A breakout above the upper boundary could trigger a corrective move towards 1.3977. The USDCAD pair has temporarily halted its decline but retains a bearish outlook. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

⭐ Mestor reacted to a post in a topic:

riosquant.com

⭐ Mestor reacted to a post in a topic:

riosquant.com

-

⭐ Mestor reacted to a post in a topic:

grayboxtrading.com

⭐ Mestor reacted to a post in a topic:

grayboxtrading.com

-

Not tested yet .. have you ?

-

⭐ laser1000it reacted to a post in a topic:

files need to fix @apmoo

⭐ laser1000it reacted to a post in a topic:

files need to fix @apmoo

-

I have not used that yet, I use the other one and is working Remember that this script track data and momentum, and set to default of 15 days to work properly and you must not put it on RTH. It look at the high/.low/close of the last day and comparing it . You must have the CS file , it is tracking several indicator listed on that. Let me get more data so I will publish what I learn from this script.

-

Thank you Kimsam. This bot is truly easy, as EZ🤗

-

Same goes for me.

- Yesterday

-

Theres a silver cycle with 90% accuracy around 180 day mark. I didn't include the true cycle. You job is to find it. I found this today, in less than 20 minutes and backtested it, 90% accuracy following the rules.

-

I told you to study the orb period from Ray, I didn't tell you to take his work and try to rework it with timing solutions. I see you still don't understand how cycles work. GO find the cycle on Bitcoin. It's actually very easy to use and see. It's less than 6 months long. When you find it, report back all the lows that occurred at the end of the cycle. If you cannot do something simple like this. You post above is meaningless, as you still can't understand cycles and look at software for an answer. Edit: You seem like a lazy analyst.

-

@roddizon1978 Are you trying the 24x5. It does not seem to work at all as a strategy - maybe the parameters for ES.

-

None of this i post will get a profit at the end of year. Only you can make that happen. TB can't figure it out for you. ONLY YOU

-

If the fix takes more than 5 mins I'm really not interested. My brain cells can't handle it. 😄 You have to go to the BIG DAWGS. $$$$$ Thanks

-

pofmk joined the community

-

Trader, Apmoo, Of the batch provided, OrderFlows Catalyst is another Valtos creation. Others I believe have been cracked, so hopefully this will not prove to too difficult. Trade, Thank you for your contributions, Apmoo thank you for the many hours you're putting in to make miracles happen.

-

i checked the igrid to my humble opinion is just a grid bs- they just added the I before to make it more important. it seems like a moving average with some other simple indicators he stole from other vendors. could not find any edge . please correct me if i am wrong. listen everyone- the fact that a vendor asks a fortune for their indicators does not mean that its any good. always- test a system on a choppy section of the market , then test it on a section with sharp moves, if it gets you in and out in time without losing too much then it passed the first test out of many. DO NOT and i repeat- DO NOT look at indicators or systems when there are big moves giving you big winners- normally the market goes sideways sucking back all you profits. What do i mean giving you an EDGE ? - it means using LEADING indicators. The ones that will tell you what is going on BEFORE everyone else knows it. Examples- Fibs, Price action, MBOX . If you think thA=at you can take all these indicators that APMOO- the amazing , educated for us and blindly run all of them live you are mistaken, if you think that there is a magical time frame with magic settings then again- you are mistaken. The market is alive and composed from millions of traders and bots you cannot tame it or predict where it goes. just my 5 cents lol Again- APMOO- thank you so much you are a legend. Traderbeauty-Jane

-

This one need to be fix as it doesn't update itself in the live chart

-

https://workupload.com/file/rekAuctABEx Thanks

-

Thank You @apmoo , I will, There may be a reason why they are not lowering their price or just maybe another bust

-

@Traderbeauty Do you got the new The Orderflow Automation Bundle

-

https://workupload.com/file/qdUDUBYDHzC roddizon1978 keep us posted Thanks

-

still this indicator acting weird, I suspect because it have no CS file

-

Trader these are not easy quick fixes it will take some time. Thank you

-

Need the originals Not able