All Activity

- Today

-

Maybe someone could take out the loader that Val uses.

-

Harrys reacted to a post in a topic:

TDU Footprint & Footprint Trader 2.0.0.12 beta 3

Harrys reacted to a post in a topic:

TDU Footprint & Footprint Trader 2.0.0.12 beta 3

-

man does any one has virus free educated version of mboxwave ?

-

@kimsam@apmoo Here is another good app that permits creating strategies using any indicator in your arsenal with many options for time, days, trade, and money management. Unfortunately the licensing is server based and is said to be impossible to crack. Just another challenge to tackle. As always, Your work has been excellent is greatly appreciated. https://workupload.com/file/dETLMeyfWhA

-

⭐ laser1000it reacted to a post in a topic:

https://mboxwave.com/

⭐ laser1000it reacted to a post in a topic:

https://mboxwave.com/

-

Playr101 reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

Playr101 reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

-

⭐ trader65 reacted to a post in a topic:

https://mboxwave.com/

⭐ trader65 reacted to a post in a topic:

https://mboxwave.com/

-

Why not just post them here?

-

https://nexusfi.com/local_links.php?action=ratelink&catid=27&linkid=2708 thanks

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

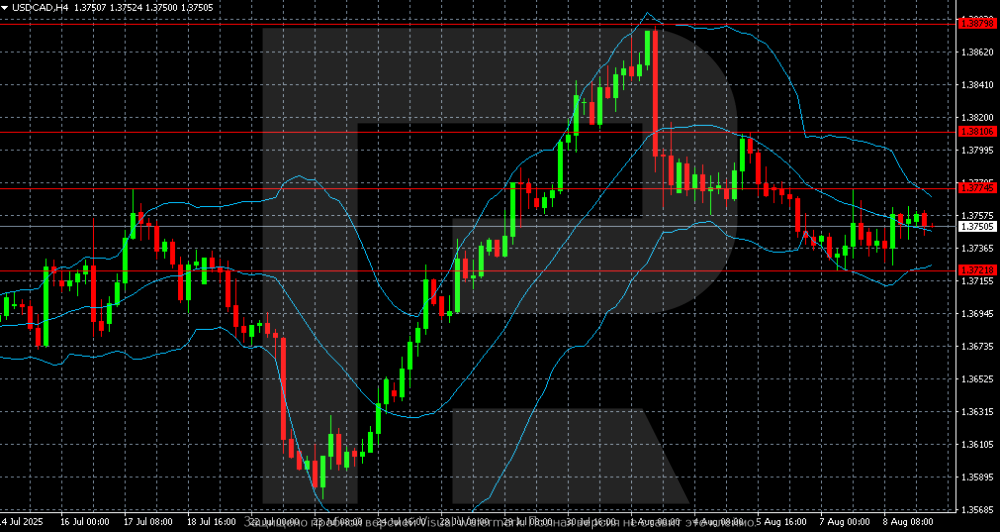

USDCAD pulls lower as risk appetite expands The USDCAD pair remains under pressure. The market is in a risk-on mood and unfazed by weak Canadian employment data. Find out more in our analysis for 11 August 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is trading at 1.3750 and remains within the 1.3720-1.3775 range. After climbing to 1.3880 in late July, quotes corrected and have mostly been moving sideways since early August. With the USDCAD pair remaining in a sideways range, the market may choose one of two directions. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index has formed a downtrend, but it is likely to be short-term The DE 40 stock index continues to correct after an uptrend. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s balance of trade for June 2025 totalled 14.9 billion EUR Market impact: a decline in the trade balance compared to forecasts and previous figures signals a slowdown in export activity, which will negatively affect the shares of exporting companies Fundamental analysis Germany’s trade balance for June 2025 came in at 14.9 billion EUR, below the forecast of 17.8 billion EUR and the previous reading of 18.6 billion EUR. The trade balance is the difference between a country’s exports and imports over a certain period. A positive figure indicates that Germany exported more goods than it imported. A drop in the trade balance compared to both the forecast and the previous figures signals a slowdown in export activity. This may indicate weak external demand for German goods, which is a negative factor for the German economy and its large export-oriented companies. The DE 40 index, which consists of the largest German companies, will come under pressure due to the worsening trade balance. Since most of the index companies operate in export-driven industries such as automotive, engineering, and chemical, a decline in exports will hurt their financial performance and negatively affect their share prices. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 295 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 11th August 2025.[/b] [b]USDJPY Analysis: Yen Weakens Amid US Tariff Pressure and BOJ Policy Signals.[/b] The USDJPY currency pair has been in the spotlight after the Japanese Yen weakened against the US Dollar. This movement was triggered by several key factors that are currently attracting market attention. On Friday, USDJPY strengthened by +0.39%, indicating selling pressure on the Yen. The main concerns driving this weakening are the potential impact of US tariffs on the Japanese economy, as well as less than satisfactory domestic economic data. Factors Driving Yen Weakening Weaker Japanese Economic Data - Japanese household spending data for June, which only rose +1.3% (y/y), far below market expectations of +2.7%, sent a dovish signal. This figure suggests that Japanese consumers are holding back, likely due to US tariff pressure and rising inflation. This situation reduces pressure on the Bank of Japan (BOJ) to raise interest rates soon. Rising US Bond Yields - Higher US government bond yields on Friday made the US dollar more attractive to investors. This increase negatively impacted the yen, known as a safe-haven currency. Hawkish Sentiment from BOJ Meeting: Hope Amid Challenges Nevertheless, there are several signals that could potentially be positive catalysts for the yen in the long term. Slightly Hawkish BOJ Meeting Minutes - The minutes of the July 30-31 BOJ meeting showed differences of opinion among board members. Some suggested gradual interest rate hikes to anticipate future inflationary pressures. One member even hinted at the possibility of a rate hike as early as late 2025, depending on the impact of US tariffs. Positive Signals from Economic Surveys - The EcoWatchers Japan Outlook Survey rose to 47.3 in July, reaching a six-month high. This reading was stronger than expected, indicating optimism among economic observers. This positive signal could be a bullish boost for the Yen. USDJPY Technical Analysis: Towards Key Levels Technically, the USDJPY is in a corrective phase. The significant rise from the 2021 low (102.58) towards the 2024 high (161.94) is seen as the main trend. USDJPY Key Upside Level: If USDJPY manages to break through minor resistance at 148.07, the market will likely retest the high of 150.91, or the 61.8%FR level. A rise above this level would open the opportunity for a continuation of the bullish trend to higher levels. Key Downside Level: On the other hand, key support is at 145.84. A breach of this level could signal a short-term bearish reversal, with the next support target at 142.66. For next week, the Yen's movement will likely be influenced by external data given the relatively quiet Japanese economic calendar. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Ady Phangestu HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Harrys reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

Harrys reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

-

after installing windows, the connector is activated and starts working again. maybe someone can suggest a program with which you can change the RAM, video card ID? In order not to constantly reinstall windows. I tried to change the MAC address, disk ID, but it did not work.

-

DM me your Discord i will show you many methods/strategies that are succesful to trade with mobx wave

-

ivan2007007 reacted to a post in a topic:

Quaderr Indicator

ivan2007007 reacted to a post in a topic:

Quaderr Indicator

-

SG8868 reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

SG8868 reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

-

⭐ ahmed ibrahim reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ ahmed ibrahim reacted to a post in a topic:

Sentient Trader 4.04.17

-

blooody1 joined the community

-

Trading is not only about buying and selling. You also need to control your mind. Fear and greed can make bad decisions. Demo trading can train your patience. It also shows how fast the market can change. When you are ready, you can trade small amounts of real money. Step by step is the safe way.

-

TDU Footprint & Footprint Trader 2.0.0.12 beta 3

yeet007 replied to ⭐ rcarlos1947's topic in Ninja Trader 8

Says the content has been removed. I would greatly appreciate if you could re-up elsewhere. Just want the footprint indi educated. Thank you - Yesterday

-

Already fixed.. i will upload it soon

-

Going forward starting with this version He seems to have gone to server based licensing, which may be more of a challenge. If it can be done, this an incredibly powerful trade manager and for indicator trade signal automation.

-

Already updated to 3.0.0.14

-

@kimsam

-

Re-post thought it had it. https://workupload.com/file/9hNzGSaakr4

-

Hi everyone, I heard many things about the mboxwaves trading method, but I don't know if the method deserves my attention. If anyone has good experience with it, please comment and share your experience here whit us. Thanks everyone.

-

Is the RenkoKings_ThunderZilla_NT8 file in here? I don't see it on my end.

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.