Date: 28th October 2025.

Market Confidence Sinks Gold, But Will It Continue?

Gold prices continue to decline for a second consecutive week, now trading 10% lower than their previous high. The key bearish drivers for gold are the reduced safe haven demand and the stronger US Dollar. However, traders are evaluating how low the price will fall before losing momentum.

Investors are closely watching two major events this week: the US Federal Reserve’s interest rate decision on Wednesday at 20:00 (GMT+2) and a high-profile meeting between US President Donald Trump and Chinese President Xi Jinping at the APEC summit in Seoul later in the week. These events are expected to set the tone for global markets, influencing currency movements, bond yields, and risk sentiment. As a result, these events are having a strong influence on Gold prices.

Most economists anticipate that, given the recent signs of labour market cooling and moderate inflation, which came in at 3.0% in September, slightly below expectations of 3.1%. The Fed is likely to cut interest rates by 25 basis points to 4.00%. Policymakers are also expected to signal a continued ‘dovish’ stance into December, emphasising flexibility and support for economic stability. The move would mark another step toward easing monetary conditions amid slowing growth momentum.

However, traders should note that increasing interest rates are fully priced into Gold according to analysts. As a result, the effect of interest rates is significantly lower than in previous weeks. Experts advise that a rate cut for January is not priced into the market. According to the FedWatch Tool, there is a 48% chance of a rate cut in January. If this increases, Gold may attempt a further bullish increase.

Meanwhile, optimism is growing around the upcoming US–China talks. Chinese representative Li Chengang confirmed that preliminary agreements have been reached on several key areas, including exports, transport fees, and curbing illegal fentanyl production. US Treasury Secretary Scott Bessent stated that the threat of 100% import tariffs has been lifted, while President Trump announced his intention to sign the trade deal.

Analysts suggest that China may delay stricter export controls on rare earth metals for at least a year, while Washington could roll back some tariffs, paving the way for continued negotiations on the broader agreement. For this reason, the trade tensions are no longer adding to Gold’s previous bullish trend.

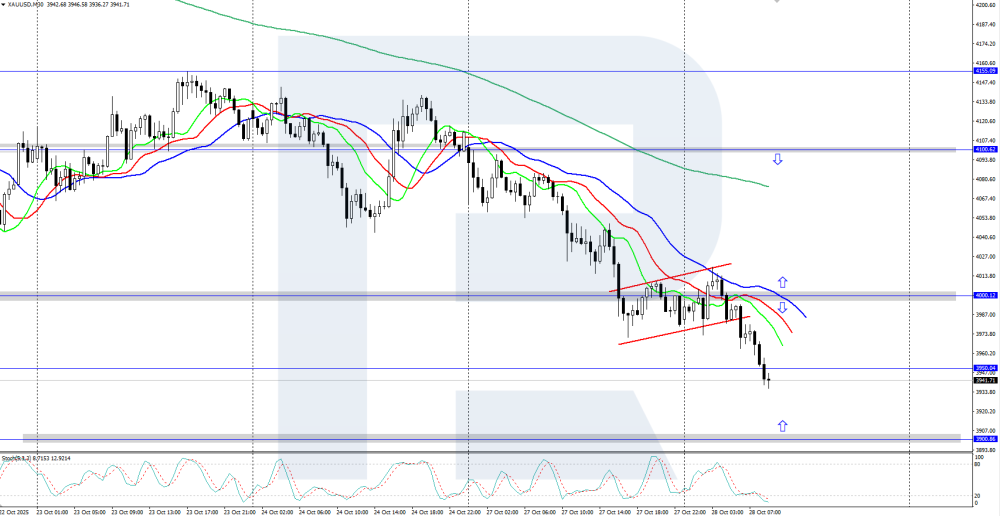

XAUUSD 4-Hour Chart

According to the 200-period Moving Average, the price of Gold has now declined enough to move into range-bound trading conditions. However, momentum-based technical indicators continue to point towards a continued decline. The bearish signal is likely to remain in place for as long as the price remains below $4,019.00. Lastly, technical analysts also note that the price is trading at the support level from October 9th.

Key Takeaway Points:

Gold extends losses: Prices have dropped for a second week, now 10% below recent highs amid weaker safe-haven demand and a stronger U.S. dollar.

Focus on key events: The Fed’s rate decision and Trump–Xi meeting are driving market sentiment and influencing gold’s direction.

The Federal Reserve is likely to cut rates tomorrow and again in December: analysts expect a 0.25% rate cut.

Bearish trend persists: Gold trades below its 200-period moving average, with momentum still pointing lower unless it breaks above $4,019.00.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.