All Activity

- Yesterday

-

roddizon1978 reacted to a post in a topic:

Viper Trading Systems

roddizon1978 reacted to a post in a topic:

Viper Trading Systems

-

ninja_under_da_roof reacted to a post in a topic:

HFT Algo

ninja_under_da_roof reacted to a post in a topic:

HFT Algo

-

ninja_under_da_roof reacted to a post in a topic:

HFT Algo

ninja_under_da_roof reacted to a post in a topic:

HFT Algo

-

ninja_under_da_roof reacted to a post in a topic:

who wants to try to unlock the Indicator Obsidian Overwatch?

ninja_under_da_roof reacted to a post in a topic:

who wants to try to unlock the Indicator Obsidian Overwatch?

-

ninja_under_da_roof reacted to a post in a topic:

advancedsoftwarefeatures.com

ninja_under_da_roof reacted to a post in a topic:

advancedsoftwarefeatures.com

-

ninja_under_da_roof reacted to a post in a topic:

Hier noch OrderBlocksPlus

ninja_under_da_roof reacted to a post in a topic:

Hier noch OrderBlocksPlus

-

ninja_under_da_roof reacted to a post in a topic:

files to crack @apmoo

ninja_under_da_roof reacted to a post in a topic:

files to crack @apmoo

-

ninja_under_da_roof reacted to a post in a topic:

iGRIDPACK2 needs a fix

ninja_under_da_roof reacted to a post in a topic:

iGRIDPACK2 needs a fix

-

ninja_under_da_roof reacted to a post in a topic:

scalperintel.com

ninja_under_da_roof reacted to a post in a topic:

scalperintel.com

-

ninja_under_da_roof reacted to a post in a topic:

Liquiditätsvolumen IQ NT8

ninja_under_da_roof reacted to a post in a topic:

Liquiditätsvolumen IQ NT8

-

I downloaded it earlier and used it, but for some reason, it didn’t function correctly. According to the website for this indicator, the current version (v1.0.0.13) has fixed some of the issues. You can check it out here: https://tradedevils-indicators.com/products/bar-replay-strategy-tester Hopefully, someone can help!

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 18th April 2025. Market Wrap-Up: Stocks Mixed as UnitedHealth and Nvidia Drag, While Netflix Surges. U.S. equity markets closed Thursday’s shortened session on a mixed note ahead of the Good Friday holiday. The Dow Jones Industrial Average slumped 1.33%, pressured by a 22% plunge in UnitedHealth Group after it cut its earnings forecast. The Nasdaq Composite also dipped 0.13%, led lower by a 2.9% drop in Nvidia, which continues to struggle amid chip export restrictions to China. In contrast, the S&P 500 managed a modest gain of 0.13%, supported by strength in energy stocks and a surprise earnings beat from Netflix. The streaming giant jumped in after-hours trading, driven by stronger-than-expected Q1 earnings, higher subscription prices, and robust ad revenue growth. On the technical front, Netflix’s RSI has rebounded off the 50 level—historically a reliable signal for renewed bullish momentum. Resistance now sits at $1,065 and $1,300, while support is seen near $821 and $697. Meanwhile, Treasury yields rose, erasing most of Wednesday’s gains. The 10-year yield climbed 4.8 basis points to 4.325%, and the 2-year yield rose to 3.785%, reflecting investor uncertainty and fading hopes for near-term Fed rate cuts. Political Pressure and Tariff Concerns Stir Volatility Markets also digested sharp political commentary that rattled confidence. Former President Donald Trump made headlines after attacking Federal Reserve Chair Jerome Powell, stating that his ‘termination cannot come soon enough.’ While Powell remains firmly in position, the remarks reignited fears over central bank independence—a cornerstone of monetary policy stability. Additionally, tariff tensions resurfaced as the former president hinted at a more protectionist trade stance. With global supply chains still vulnerable, investors grew wary of renewed U.S.-China trade friction—especially in the semiconductor and tech sectors, where Nvidia and TSMC remain key players. Asia Rallies in Holiday-Thinned Trading as TSMC Meets Expectations Asian equity markets mostly posted gains on Friday despite Wall Street’s choppy session, as investors reacted to Taiwan Semiconductor Manufacturing Co. (TSMC) earnings and stabilized sentiment in the region. Japan’s Nikkei 225 added 0.6% to close at 34,583.29. South Korea’s Kospi rose 0.3% to 2,478.39. Taiwan’s Taiex gained 0.8% after TSMC met forecasts and offered cautious optimism despite ongoing chip export risks. China’s Shanghai Composite slipped 0.3% to 3,272.09 amid continued weakness in domestic demand. Trading volumes remained thin across Asia ahead of the Easter holiday, with several regional exchanges closed. Global Policy Moves: ECB Cuts Rates, Mixed U.S. Data Keeps Traders Guessing In Europe, the European Central Bank (ECB) delivered a widely expected interest rate cut, yet investor reaction was subdued. The CAC 40 dropped 0.6% and Germany’s DAX declined 0.5%, reflecting concern that rate reductions may be arriving too late to stimulate faltering growth. Back in the U.S., economic data sent mixed signals. Weekly jobless claims fell more than anticipated, highlighting ongoing labour market strength. However, the Philadelphia Fed’s manufacturing index contracted unexpectedly, showing continued weakness in factory output. Combined, these updates reinforced the view that the Federal Reserve may remain on hold longer than investors had hoped, especially amid sticky inflation and political pushback. Dollar Holds Ground as Bond Yields Rise and Gold Retreats from Record Highs In the currency markets, the US Dollar Index remained steady near 99.44, posting a third consecutive close below the psychological 100 level. The greenback traded in a narrow range between 99.231 and 99.746. Meanwhile, the dollar eased slightly to 132.42 yen and the euro ticked up to $1.1373, maintaining its recent strength. Gold prices, which touched record highs earlier in the week, slipped 0.49% to close at $3,326.85 per ounce after hitting $3,343.12 on Wednesday. Meanwhile, oil prices rebounded sharply: WTI crude surged 3.5% to $64.68 a barrel. Brent crude rose to $67.96. The rally in energy was supported by bargain-hunting and concerns over global supply risks. Markets remained closed Friday in observance of Good Friday, pausing further moves in commodities and bonds. Final Takeaway: Markets Enter Holiday Pause with Unresolved Risks As the markets head into a long weekend, investor sentiment remains cautious. Strong earnings from companies like Netflix offer moments of optimism, but persistent concerns around tariff policy, Federal Reserve independence, and geopolitical tensions continue to weigh heavily on risk appetite. With bond yields creeping higher and volatility likely to return next week, traders should stay nimble and watch for cues from earnings reports, Fed speakers, and any developments on the trade or political front. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Hi apmoo, could you please fix the igrid indicator, it doesn't update itself on the chart thank you iGRIDPACK2 (2).zip

-

Re Up: https://workupload.com/file/F3dY7tTwEys https://www.sendspace.com/file/q7686d Latest

-

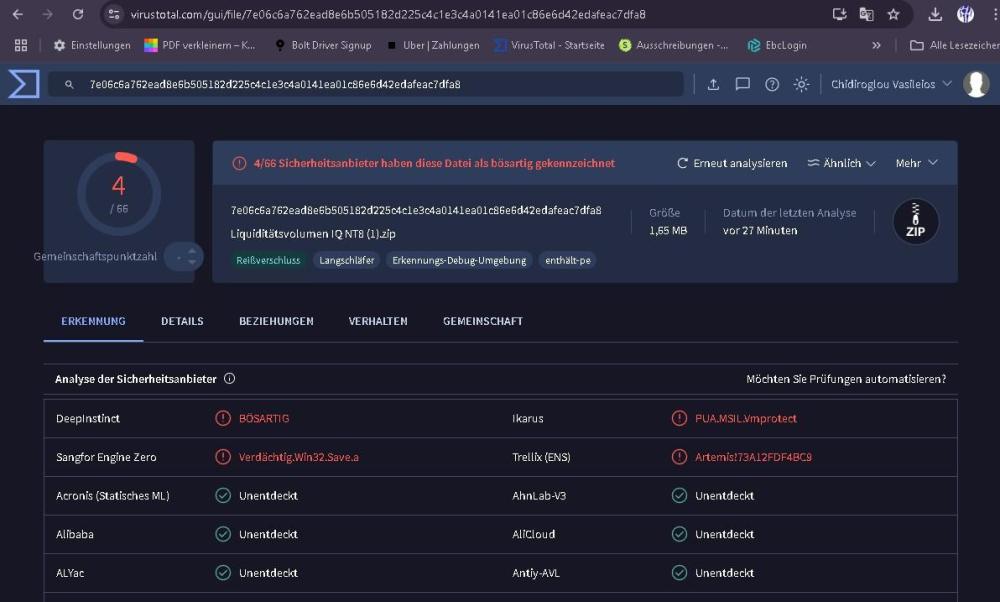

Let me check if are false positive or something more danger

-

https://workupload.com/file/GBznyCUQxUc Thanks

-

I did that BD for ya thats all i can get out of that folder Thanks

-

https://workupload.com/file/eaV6aZXUm4L Thanks Trader

-

Nobody told me i sent the wrong one lol https://workupload.com/file/yVQ9Lw68rs3 Fixed Thanks

-

-

hdhgh started following gomicators.com

-

Easter 2025 update: 1/3 of the year has passed from the original projections posted in the first week of January 2025. Those date-and-time stamped original projections above can be accessed directly from the link : https://indo-investasi.com/topic/92332-wd-ganns-master-forecast-method/?do=findComment&comment=720116&_rid=64650 Here are the same charts updated with price data to today 18 April 2025, which represents approximately one third of the year having now passed. No other comment seems necessary: DJIA projection for 2025 - Easter update: https://imgur.com/a/bhuRQ7O GBPUSD projection for 2025 - Easter update: https://imgur.com/a/howpyiO Whilst there is no guarantee that the projection will continue to be as accurate, there seems no reason why it should not and therefore it seems appropriate to be long GBPUSD until November 2025 and the next optimum time to buy DJ component stocks this year is the last two weeks of May 2025. Again DYOD and there is no advice offered, simply presented for interest and observation. A further and probably final update of the same charts will be posted much later in 2025. For those who have already asked me directly, there is no “service” for future years’ projection charts on offer: it may be possible to give a few individuals the same style charts for 2026 on an individual arrangement (cost) if you send a PM.

-

@apmoohttps://workupload.com/archive/Rb2h6uHYPv

-

https://workupload.com/archive/Rb2h6uHYPv

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) resumes rally — next target: 3,405 USD XAUUSD has broken above the upper channel boundary, signalling an end to the recent pullback. The current quote is 3,327 USD. Full analysis for 18 April 2025 below. XAUUSD forecast: key trading points Gold remains in demand amid uncertainty over US trade policy Central banks and private investors continue to accumulate gold Goldman Sachs forecasts gold at 3,700 USD by year-end XAUUSD forecast for 18 April 2025: 3,405 USD Fundamental analysis XAUUSD is regaining strength following a short-term pullback, still trading firmly within an upward channel. Demand for gold remains high as market participants seek refuge from ongoing US trade policy uncertainty. Investors are reacting to shifting signals from the Trump administration, which is reportedly considering new tariffs on semiconductor and pharmaceutical imports. Meanwhile, renewed trade talks with China are back in focus, with Beijing expressing willingness to resume dialogue — albeit under certain conditions. Analysts highlight continued strong demand for gold from both central banks and private investors. This provides a robust foundation for further price appreciation. According to Goldman Sachs, gold could reach 3,700 USD by the end of 2025. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 224 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

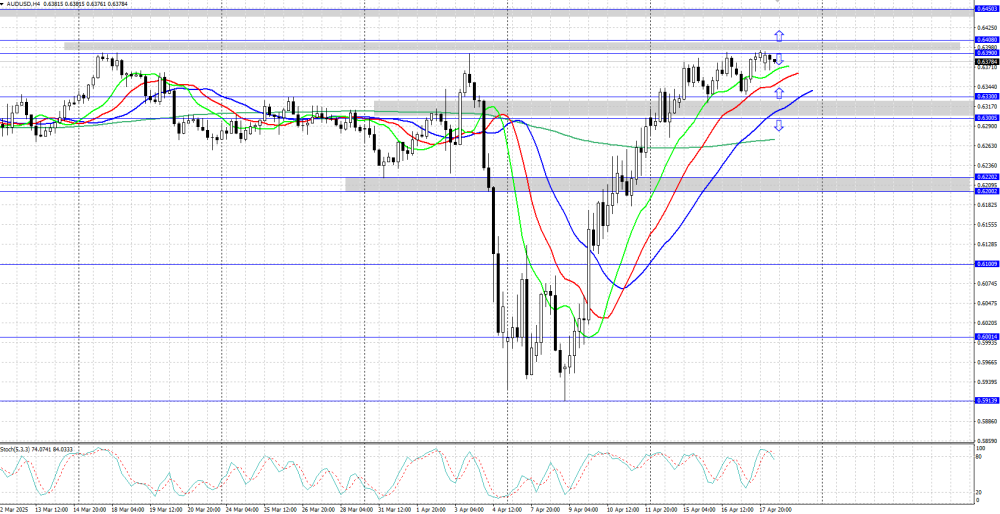

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD eyes breakout — yearly high under pressure AUDUSD is trading near its yearly high at 0.6408, continuing a strong uptrend. Further gains are likely. Full analysis for 18 April 2025 below. AUDUSD technical analysis AUDUSD is advancing within a clear bullish trend and is currently trading just below 0.6400. The Alligator indicator confirms the strength of the upward impulse. AUDUSD remains firmly in an uptrend, supported by USD weakness and strong commodity prices. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

PLS check , your file has virus inside.

-

Shane Corn joined the community

-

Well, a thought provoking write-up indeed. I have been saying the same thing for many years now. In the authors own words, it gives about 10% edge in forecasting, nothing more. So, dont put too much reliance on the software and use your discretion. The AI part is just opportunistic since we are in the age of AI and AI Agents so be careful on that part too.

-

https://workupload.com/file/23Fus6Xkc87 Thanks alodante