⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

hi all can any one tellme the process of installation of sentient 4.04, please?

-

-

SUBZERO reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

SUBZERO reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

- Today

-

Michael S. Jenkins Personal Seminars

jackson replied to Bill Bundle's topic in General Discussions and Lounge

could you please share more, i want to attend his seminar as well -

Michael S. Jenkins Personal Seminars

jackson replied to Bill Bundle's topic in General Discussions and Lounge

but missing something i guess? -

You actually have to go to the post and downloaded it there. I just tried and it's working. Open the thread, it will work. Enjoy

-

The links on this seam to be dead. Can you please repost NQ Ultra?

-

https://www.youtube.com/watch?v=GrpxZgLvd68 Jit

-

Geostrading started following automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

-

Import the strategy and click on the joint files it will do the rest. The settings are there too. They're called mode, where you're working on strategy, 3 main modes, NQ Asia, NQ NY, GC!.

-

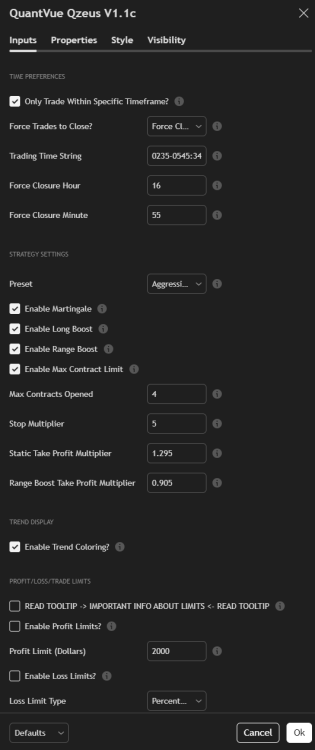

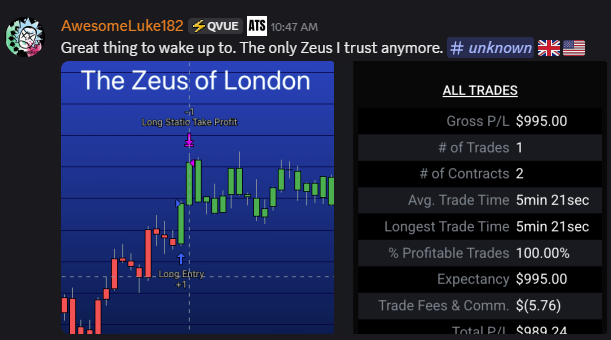

I posted it in here and to be honest .. its way better and simpler, just have to keep it on MNQ, and running on asia and NY, but you can also improve the setting. Qzeus is still amazing but there are other strategies that can be taken manually as a confluence. For now they will be releasing amazing ones, that are giving amazing results on Tradingview, if we're lucky will have them.

-

luludulu reacted to a post in a topic:

quantvue.io

luludulu reacted to a post in a topic:

quantvue.io

-

nanop started following automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

-

Needs to be educated https://workupload.com/file/m2FE4yHs3AL Description The ICT Concepts Indicator[Advanced] is a premium NinjaTrader 8 indicator which displays key concepts of the ICT trading methodology and style. Those key concepts are the following: Change of strucutre (or Change of Character or Market Structure Shift) that indicates that the trend might change Break of Strucutre (or Market Structure Break) that indicates a continuation of the trend Faire Value Gaps which represent displacements of price and are defined as instances of inefficiencies or imbalances visualized by three consecutive candles containing one large middle candle whose bordering candles' upper and lower wicks do not overlap. Order Blocks which represent crucial support and resistance levels derived from aggresive price movement, and that can be used as entry or exit levels Immediate Rebalances which represents price regions that represent No Inefficiencies nor Imbalances and no gap that the price need to return to. NWOG (New Week Opening Gap) which is the price gap between Friday's closing price and Sunday's opening price NDOG (New Day Opening Gap) which is the price gap between yesterday's closing price and Today's opening price RTHG (Opening Range Gap) which marks the distance between the first opening tick of a session and the previous session's close Interactively control and manipulate the ICT zones on the chart Multi-Timeframe capabilities

-

-

ynr reacted to a post in a topic:

quantvue.io

ynr reacted to a post in a topic:

quantvue.io

-

Can you share NQ Ultra settings.. thxs

-

yeah, to be honest, it is supposed to be their flagship bot but I havent been impressed so far. NQ Ultra is much better, in my opinion.

-

I'm aware, this wasn't a martingale trade yesterday for mine either, just a massive loss lol.

-

QZeus does martingale so you need to be careful with the maximum number of contracts you are willing to use. Personally, I only set to 2 on MNQ.

-

Night reacted to a post in a topic:

quantvue.io

Night reacted to a post in a topic:

quantvue.io

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Europe surprises with data, EURUSD gears up for takeoff Growth in US factory orders fails to impress the market, and the EURUSD rate may continue its upward trajectory towards 1.1655. Find more details in our analysis for 18 November 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may form an upward wave following the signal. Since the price remains within the descending channel, the EURUSD rate could attempt to break above the upper boundary and move towards 1.1655. Today’s EURUSD outlook favours the euro, with technical analysis suggesting a rise towards the 1.1655 resistance level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index corrects after resuming the uptrend The DE 40 stock index has rebounded from the lower boundary of the medium-term sideways channel and has entered a new correction phase. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany's ZEW Economic Sentiment Index came in at 38.5 Market impact: the data creates an ambiguous background for the German stock market Fundamental analysis Germany’s ZEW Economic Sentiment Index reached 38.5 points in November, below both the forecast of 41.0 and the previous value of 39.3. This indicates that analysts and major institutional investors remain optimistic overall, as the index is still well above zero, meaning that the majority of market participants expect an improvement in the economic situation over the coming months. However, the decline from the previous month and weaker-than-expected figures suggest that optimism has faded slightly. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 364 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

AndyDiamond reacted to a post in a topic:

Ninza Request Thread

AndyDiamond reacted to a post in a topic:

Ninza Request Thread

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 18th November 2025. Stocks Slide: Nvidia, NFP and Asia Shake Up the Week. Global financial markets started the week under heavy pressure, with a sharp sell-off in US equities rippling across Asia-Pacific trading. Concerns over overextended tech valuations, a deeper risk-off shift, and two major US events, Nvidia’s earnings and the long-delayed September US jobs report, drove volatility higher across asset classes. This broad downturn exposed deeper structural anxieties around inflation, interest rates, and the sustainability of the AI-driven rally that has powered equity markets throughout 2024 and 2025. Wall Street Falls as Volatility Surges and Fear Index Hits Extreme Levels US markets started the week on the back foot after an aggressive wave of selling hit major indices on Monday. Dow Jones Industrial Average sank 557 points (-1.18%) S&P 500 shed 0.92% Nasdaq Composite fell 0.84% The downturn was accompanied by a spike in volatility indicators: The VIX surged about 13% CNN’s Fear & Greed Index plunged into ‘extreme fear’ territory,the lowest reading since early April Investors were particularly cautious given concerns that the Federal Reserve may alter its rate-cut expectations in light of stubborn inflation and stretched tech valuations. US futures extended losses early Tuesday: S&P 500 futures: -0.6% Dow futures: -0.4% This indicates risk aversion extending into the next trading session. Nvidia Earnings Take Centre Stage as AI Trade Faces its Biggest Test Markets worldwide are focused on Nvidia, which is set to release its earnings on Wednesday. As the flagship of global AI optimism,and a major contributor to the S&P 500’s gains ,Nvidia’s performance could set the tone not only for US equities but for global semiconductor markets. Analysts expect quarterly revenue around $54 billion to $55 billion for Q3 FY2026. One commentary described the report as a ‘crucial test for the entire AI market.’ Some analysts warn the stock could swing 6-8% upon release. Nvidia shares were down about 1.8% Monday, though still up nearly 40% year-to-date. Other AI-linked stocks suffered steeper declines, including Super Micro Computer (-6.4%). Investors are increasingly questioning whether the AI trade has legs, particularly as the tech-heavy Nasdaq is already down about 5.5% since its late-October record high. Bitcoin Drops Below $90,000, Extending Six-Week Sell-off Crypto markets mirrored the negative tone: Bitcoin slid below $90,000 for the first time in seven months, losing more than 28% in just six weeks. Crypto-exposed equities also fell sharply: Coinbase (COIN) -7.1%, Robinhood Markets (HOOD) -5.3%. The decline reflects not only speculative unwinding, but a broader reduction in risk appetite across asset classes. Asian Markets Tumble as US Tech Weakness Spreads Globally The US tech-led sell-off spilled into Asian trading on Tuesday. Benchmarks in Japan, South Korea, and Taiwan, all heavyweights in global semiconductor supply chains, suffered sharp declines as investors reassessed chip demand and valuations. Japan: Nikkei Declines as Bond Yields Spike Nikkei 225 fell ~3% by midday Tokyo Electron -5.4% Advantest -4.6% A key driver was the surge in long-term Japanese government bond yields: 30-year JGB yields hit ~3.31%, the highest in years. The yen hovered above ¥155 per dollar, near its weakest level since February, and reached its lowest level against the euro since 1999. Asia: Chip Giants Lead Declines Kospi dropped ~3.1% Samsung Electronics -2.9% SK Hynix -5.7% South Korea’s economy, heavily reliant on semiconductors, was especially vulnerable to global tech turmoil. Taiex fell ~2.3% TSMC -2.4%: The global chip demand fears weighed heavily in Taiwan’s market. Hang Seng Index: -1.5% Shanghai Composite: -0.6% ASX 200 (Australia): -2.1% These markets, though less tech-concentrated, were not immune to the global sell-off. Fed Expectations Shift as Traders Reassess December Rate-Cut Odds One of the dominant narratives this week is the reshaping of interest-rate expectations. Just a month ago, markets priced in about a 94% probability of a December rate cut from the Fed. Today, that probability has sharply fallen to around 45%. Traders and investors are reacting to: Persistent inflation above the Fed’s ~2% target The US government shutdown, which delayed key economic releases Mixed labour-market signals Uncertainty around rate-cut timing Fed officials have recently suggested that more clarity is needed before proceeding with another cut,in light of weaker data and the end of the shutdown. Thursday’s US Jobs Report Could Shift the Entire Market Narrative The delayed September Non-Farm Payrolls (NFP) report, now due on Thursday, carries outsized importance this week. Key points: A strong number would reduce the chance of a December rate cut. A weak number would raise recession concerns and could push the Fed to accelerate easing. A mixed print may leave markets in limbo. Oil, Forex & Global Macro Moves Reflect Risk-Off Mood Commodity and currency markets also shifted into defensive mode: WTI Crude: ~$59.49 (-$0.42) Brent Crude: ~$63.77 (-$0.43) FX and bond markets responded to the risk-off environment: USDJPY ~ 155.08 EURUSD ~ 1.1600 With rising yields in Japan and USD weakness, global macro flows tilted toward safe-haven dynamics. Alphabet Buckets the Trend as Berkshire Takes Major Stake One rare bright spot in Monday’s US session was Alphabet Inc. (GOOGL), which gained ~3.1% after Berkshire Hathaway disclosed a new ~$4.34 billion stake. Warren Buffett’s investment is seen as a value-oriented vote of confidence, providing a counterbalance to the broader technology sell-off. What Traders Should Watch Next Markets enter mid-week with a high-stakes setup: Wednesday: Nvidia earnings: the major test of the AI trade Semiconductor sector reaction and global chip supply chain sentiment Thursday: US September Non-Farm Payrolls: pivotal for Fed policy and the dollar Potential strong volatility in indices, FX, and crypto Friday and beyond (Aftermath): Market digestion of earnings and jobs data Fed commentary and updated rate expectations Continued focus on Asian bond yields and semiconductor earnings With valuations stretched, volatility elevated, and major catalysts lined up, this week may prove decisive for the direction of global markets. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Wealth building emerges naturally when crypto and e-gaming intersect, combining digital asset growth with competitive earning opportunities. Players can monetize skills, trade in-game assets, and benefit from tokenized ecosystems. This model supports sustainable income streams, offering both investment potential and active rewards as gaming economies continue expanding globally.

-

Bitcoin’s aggregated volume remains steady, with consistent activity across major spot and derivatives venues. Rising volume during small price moves suggests accumulating interest, while any sharp increase could signal an upcoming breakout. If volume tapers off, expect short-term range-bound trading until stronger conviction returns.

-

Bitcoin shows consolidating momentum above key support, with rising volume hinting at a potential breakout. RSI remains neutral, offering room for upside if buyers strengthen. Watching the 200-day EMA is essential. lmgx sentiment trends cautiously bullish, echoing broader crypto risk-on signals while remaining sensitive to macro volatility in the near-term.

-

Mikidacat started following (REQ) Trading 2gether LMS Course

-

Hi, I need Trading 2gether LMS Course. If anyone has it please upload. Thanks ! 🙏

-

⭐ alazif reacted to a post in a topic:

quantvue.io

⭐ alazif reacted to a post in a topic:

quantvue.io

-

⭐ traderwin started following quantvue.io

-

Traderbeauty reacted to a post in a topic:

quantvue.io

Traderbeauty reacted to a post in a topic:

quantvue.io

-

Harrys reacted to a post in a topic:

quantvue.io

Harrys reacted to a post in a topic:

quantvue.io

-

Harrys reacted to a post in a topic:

quantvue.io

Harrys reacted to a post in a topic:

quantvue.io

-

raj1301 reacted to a post in a topic:

quantvue.io

raj1301 reacted to a post in a topic:

quantvue.io

-

Qzues took a huge loss today and people in the discord are pissed. $8700 for the ATS program any this is the flagship algo. was something like a 250point loss on NQ. I cut that s*** after it broke structure to the downside. Still a massive loss of like $800 or so on 3MNQ. Members posting 5k, 10k and even 15k losses in personal accounts today. I like the algo, but set and forget it’s not. Make sure you have controls in place to limit losses like this! Also still pumped for Evo release!