⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

This is the real Mooretech Deltabars trial with the reversal parameter. Perhaps @kimsam can work his magic on this. DeltaBars Moore.zip

-

⭐ rcarlos1947 reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

⭐ rcarlos1947 reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

- Today

-

-

Oana SSS reacted to a post in a topic:

quantvue.io

Oana SSS reacted to a post in a topic:

quantvue.io

-

Bitcoin dominance is rising again as the crypto market rallies, showing investors’ preference for stability amid volatility. Capital is flowing back to Bitcoin from altcoins, reinforcing its position as the market leader. This trend suggests renewed confidence in Bitcoin’s strength while smaller tokens like LMGX gain attention from niche investors.

-

What to Make of the Bullish Resilience of Bitcoin

CryptoFluxor replied to taxfreelt's topic in Cryptocurrencies

The bullish resilience of Bitcoin suggests strong investor confidence and market maturity. Despite volatility and external pressures, sustained demand indicates belief in its long-term value. Institutional interest, limited supply, and growing adoption support price stability. This resilience may signal renewed bullish momentum and broader acceptance of Bitcoin as a digital asset. -

To perform ETH price analysis, combine technical, fundamental, and sentiment approaches. Study charts for trends, support and resistance, and indicators like RSI or MACD. Analyze Ethereum’s network activity, upgrades, and adoption. Monitor market news, on-chain data, and investor sentiment. Compare ETH’s performance with Bitcoin and macroeconomic factors.

-

Anybody have new Bookmap Adds On ?

-

traderlion-oliver-kell-swing-trading-masterclass

AR99 replied to ⭐ insaneike's topic in Forex Clips & Movies

@saig064Could you please re-upload the traderlion-oliver-kell-swing-trading-masterclass ? Mega link doesn't work anymore. Thank you. -

can you relink? The link's dead @sarutobi

-

⭐ timein reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

⭐ timein reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

-

MaxNguni reacted to a post in a topic:

TCAutoOptimizing

MaxNguni reacted to a post in a topic:

TCAutoOptimizing

-

raj1301 reacted to a post in a topic:

Any body educated these file for me thanks

raj1301 reacted to a post in a topic:

Any body educated these file for me thanks

-

techfo reacted to a post in a topic:

Any body educated these file for me thanks

techfo reacted to a post in a topic:

Any body educated these file for me thanks

-

techfo reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

techfo reacted to a post in a topic:

RenkoKings Flazh Infinity Cracked

-

do you happen to have a link to get the kingrenko bars? love how this looks

-

Zlucky reacted to a post in a topic:

quantvue.io

Zlucky reacted to a post in a topic:

quantvue.io

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

files need to educate

⭐ goldeneagle1 reacted to a post in a topic:

files need to educate

- Yesterday

-

https://workupload.com/archive/9xSUFs6nbY @apmoo @kimsam please

-

can you see these indi please @apmoo

-

Yall cut it out heheehehehe I took the bot out still got errors but i think the indicators are ok pls try and LMK https://workupload.com/file/kUTh4S3KpZB Thanks

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: November 7, 2025. Stocks Struggle Due to US Shutdown and AI fears. The NASDAQ drops to a 2-week low as investors grow uneasy about high tech valuations during the ongoing US government shutdown. The lack of employment data is also concerning investors, as neither the market nor the Fed are able to appropriately price the market. The US ADP Employment Change is the only employment figure still being made public. The figure rose above expectations and read higher than the previous month. NASDAQ-US Shutdown Creating a Low Risk Appetite The NASDAQ fell by 1.75% on Thursday and is the worst-performing index of the week along with the Nikkei 225. When analyzing the individual stocks within the NASDAQ, the downward price movement is not necessarily being caused by large losses. The real damage lies in the limited number of stocks showing gains or even maintaining their value. From the most influential stocks, only 11% rose in value on Thursday. For this reason, analysts can see the price is not being pulled down by a limited number of stocks experiencing high losses but the overall market sentiment. The main concern for the market is the ongoing US shutdown (38 days) which is now the longest in history. In addition to this, investors are concerned that the price is trading very close to all-time highs while significant risks within the market remain. Senate Republicans plan a key vote this afternoon on a funding bill to extend operations beyond November 21st. However, talks remain stalled as Democrats push for renewed health-care subsidies, which Republicans oppose. In addition to the US shutdown, AI is also another concern, particularly after the NVIDIA CEO said in a recent interview that China may win the 'AI race' due to lower energy costs and access to materials. Live Market Analysis AI Doubts & Expenses Pressuring the NASDAQ Rising fears of an AI valuation bubble have sparked sell-offs across major tech stocks. Even strong earnings from companies like Palantir failed to reassure investors, who now question the sustainability of AI-driven growth. Meanwhile, Meta's soaring AI infrastructure costs have fueled concerns over low returns and increasing risk. On Thursday, Palantir Technologies fell by 6.85% and AMD fell by 7.25%. The stock which saw the strongest gains was Datadog, which rose by 23% due to strong earnings. However, Datadog stocks only hold a weight of 0.21%. US Supreme Court Hearing on Tariffs Investors are watching the US Supreme Court review of the Republican administration's trade tariffs. Justices questioned Trump's authority, noting that the tariffs act as a new tax on businesses and consumers and expand executive power over Congress. The announcement and final decision are likely to create high volatility amongst US stocks and the US Dollar. No ruling has been issued, but Treasury Secretary Scott Bessent said the White House will seek alternative protectionist measures if the decision is negative. NASDAQ (USA100) - Technical Analysis The price of the NASDAQ is now trading at the resistance level which has been flipped into a support. This is a well-known support level. However, if the price does not find support here, the next support level can be found at $24,009, which is almost 5% lower than the current price. NASDAQ (USA100) 2-Hour Chart On the 2-hour timeframe, the price is trading below the main moving averages and in line with the VWAP. The price is also forming clear lower lows and lower highs. For this reason, technical analysis is pointing towards continued price weakness. However, if the NASDAQ rises above $25,512, the bearish bias starts to fade. Key Takeaways : NASDAQ falls 1.75% to a 2-week low, driven by weak market sentiment amid the 38-day US government shutdown. Limited stock gains, not large losses, are causing the downturn; only 11% of the most influential NASDAQ stocks rose on Thursday. AI concerns and rising infrastructure costs at companies like Meta fuel fears of an AI valuation bubble. Investors monitor the US Supreme Court tariff review, which could trigger volatility in US stocks and the Dollar. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyze the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

yes, I agree. I am now testing it on Playback and also sim. Fingers crossed.

-

@apmoo please

-

backtest results using Heikin Ashi (HA) candles will be completely inaccurate. Always rely on backtest results based on regular candles, as HA distorts the actual price movements.

-

Try testing it on HA proedge 3 min. It gives pretty good results in backtest, testing it on SIM.

-

The owner uses Qzeus and Qkronos Evo on his account. Both seem pretty good.

-

Sorry for the miscommunication. The version 18 end of day run very well,without any bugs. If someone have Metastock 18 real time, we can analyse also the intraday data. Actually I analyse them with Metastock 11 real time. Thank you once again daddypenguin.

-

It was miscommunication, as I'm not giving it to anyone else I will think about it when the new version comes out though

-

Metastock 18 end of day c*****d.

⭐ chullankallan replied to ⭐ Atomo12345's topic in Trading Platforms

Is the crack for Metastock 19 D/C and R/T from daddypenguin on a paid basis? -

$50 dollar bonus for opening an account

bluemac replied to mrtrade's topic in Trading Contests & Bonuses

So are you doing any such contests so far for building these skills. -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

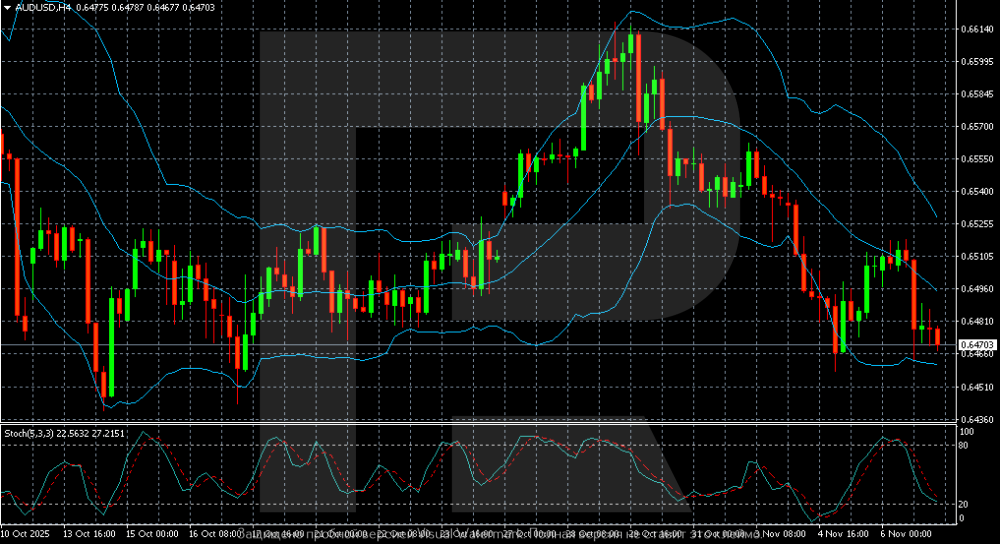

AUDUSD hit by risk aversion and AI-related concerns The AUDUSD pair fell to 0.6470. The sell-off is not over, as sellers remain highly active. Discover more in our analysis for 7 November 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair maintains its downward momentum, hitting a new local low. After a brief rally in late October, the market turned downwards, with sellers remaining in control, and the price moving along the lower boundary of the Bollinger Bands range, indicating sustained pressure. The AUDUSD pair remains under pressure and appears weak Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team