⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 6th November 2025. BoE’s Dovish Hold Sets Stage for December Cut as GBPUSD Forms Bearish ‘M’ Pattern. The Bank of England kept its benchmark rate unchanged at 4.00%, but the decision came through an unusually close 5-4 split vote, with four members already favouring a rate cut. The narrow margin underlines a growing shift within the Monetary Policy Committee (MPC) towards easing policy sooner rather than later, likely as early as December. A Dovish Hold with a Divided Committee The BoE’s policy statement revealed a notably softer tone, acknowledging that inflation risks have become less pressing and that domestic price pressures are easing faster than expected. Governor Andrew Bailey said the outlook is now ‘more balanced,’ though he remains cautious, insisting the Bank needs ‘further evidence’ before moving on rates. Among the nine MPC members, Breeden, Ramsden, Dhingra and Taylor voted for a 25 bps cut, arguing that monetary conditions have become too restrictive amid weakening demand and signs of fading inflation momentum. In contrast, Mann and Pill warned that premature easing could risk inflation persistence, preferring to maintain the current stance. The BoE’s revised guidance, now saying rates are ‘likely to continue on a gradual downward path,’ omitting the previous ‘careful’ qualifier, reinforces expectations for a rate cut in December, especially once the autumn budget passes. GBPUSD Reaction: Up but Off Highs Despite the dovish tilt, GBPUSD initially climbed to 1.31, buoyed by broad USD weakness and expectations that the BoE’s gradual easing path might still offer near-term support to sterling. However, the pair later retreated towards 1.3065, reflecting profit-taking and a shift in risk sentiment following a sharp rise in US job-cut data. US Challenger announced job cuts spiked 153.1k in October following the 54k increase in September. It is the largest gain for an October since 2003. Technology and warehousing led the jump. For the year-to-date, announced layoffs total 1.09k. The y/y pace surged to a 175.3% clip from -25.8% previously. Challenger noted some companies are downsizing after the pandemic boom. But AI, weaker consumer and business spending, and rising costs are factors too. Announced hirings increased 165.8k following September's 115.8k gain. Technology led the way with 250k, followed by retail at 16k. This was the largest October increase since 2003, a stark reminder that AI-driven restructuring and post-pandemic corrections are cooling the job market. The US dollar index (DXY) fell back below 100 following the data. Technical Picture: ‘M’ Formation Points to Potential Downside On the daily chart, GBPUSD has formed a clear ‘M’ formation, a classic double-top pattern signalling the long-term trend exhaustion. The neckline currently sits near 1.3150, and a confirmed continuation below this level could open the door toward the 1.27-1.28 area, especially if market sentiment turns risk-off or if US data support a dollar rebound. For now, the USD seems to have run out of steam. From a risk management perspective, sellers currently hold a better risk-to-reward setup near the 1.3150 resistance and the major downward trendline, aiming to target new lows if the bearish momentum extends below 1.3000. Buyers, on the other hand, will look for a decisive breakout above 1.3140 to gain conviction and potentially extend the pullback toward new highs. GBPUSD Technical Analysis – 4-Hour Timeframe On the 4-hour chart, the price action remains more constrained. The two key resistance zones are still clustered around 1.3140 and 1.3250, where the major descending trendline comes into play. Until a breakout occurs on either side, short-term traders are likely to see choppy consolidation, with intraday momentum dictated by incoming US labour and inflation data. Outlook The BoE’s dovish split marks a turning point for UK monetary policy, signalling that the next move is down, not up. With inflation decelerating and growth subdued, the Bank seems ready to prioritise supporting demand over tightening further. Still, the pound’s direction in the coming weeks will hinge on two key drivers: The December BoE meeting, confirmation of a cut could accelerate sterling weakness. US data trajectory, further signs of labour market stress or Fed dovishness could offset sterling downside through a softer dollar. For now, traders will be watching the 1.3050 neckline and 1.3140 resistance closely. A sustained break below the former could validate the M-formation and accelerate bearish momentum, while a rebound above the latter might signal the start of a corrective rally before December’s pivotal BoE decision. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

⭐ zbear reacted to a post in a topic:

Jhon Snow- Educator and contact

⭐ zbear reacted to a post in a topic:

Jhon Snow- Educator and contact

-

M Kr joined the community

-

Is the latest version of this indi v1.05 ?

-

I don't think he uses his protonmail anymore so contact has been through Telegram at @jhon_snow_0

-

TRADER reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

TRADER reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

-

@zbear does He notify you via email, Telegram or ???? His last response to me was on His Telegram channel and that was over a month ago. I am being patient, not much choice.

-

I've never had a problem with updates with Jhon. Sometimes he responds within a few hours. Sometimes he responds within a day or so. Just be patient and he'll get back to you. He is still the best educator that I know of.

-

All, Please share if anyone have Zion Trading Algos latest version(v2.4.2).. Thanks https://www.ziontradingalgos.com/

-

fxtrader99 reacted to a post in a topic:

TCAutoOptimizing

fxtrader99 reacted to a post in a topic:

TCAutoOptimizing

-

fxtrader99 reacted to a post in a topic:

livewireindicators.com

fxtrader99 reacted to a post in a topic:

livewireindicators.com

-

fxtrader99 reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

fxtrader99 reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

-

Oana SSS reacted to a post in a topic:

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

Oana SSS reacted to a post in a topic:

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

-

So much for customer service !!! Last response I got from him was when I asked if He had any updates to my purchases and also asked him where/how He posted notifications. His response was to quit asking for updates and He would notify when they were available. To this day I still don't know where to find the notification of updates. Anyone know ?

-

1P Algorithms - Premium Maximize Profits with AI-Driven Trading Bots

Wethekings replied to david's topic in Ninja Trader 8

what timeframe / contract am i supposed to be using on this? gaban es 7am just killed a W -

Wethekings reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

Wethekings reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

-

unfortunately not. thats what im looking for

-

⭐ techyamit reacted to a post in a topic:

Stock Traders Almanac 2026

⭐ techyamit reacted to a post in a topic:

Stock Traders Almanac 2026

-

hybrid76 reacted to a post in a topic:

Did Not Find Marker Plus 2025

hybrid76 reacted to a post in a topic:

Did Not Find Marker Plus 2025

-

⭐ osijek1289 reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

⭐ osijek1289 reacted to a post in a topic:

ChartSpots_BreakEven_v3 needs to crack

-

No , Hes just not pressed for money right now .

-

https://workupload.com/archive/h2eg9nLVRT Thanks

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index corrected by more than 6% The JP 225 stock index is trading in an uptrend, although volatility has increased significantly. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: the Bank of Japan set the interest rate at 0.50% per annum Market impact: the effect on the Japanese stock market is generally positive Fundamental analysis The Bank of Japan’s decision to keep the key interest rate unchanged at 0.50%, fully matching the forecast and previous level, means there was no monetary surprise for the market. For Japanese stock market participants, this signals that accommodative financial conditions will continue: borrowing costs for corporations and households remain low, and the equity risk premium relative to bonds remains attractive. For the JP 225 index, which includes a significant share of exporters, industrial companies and financial institutions, the overall effect of the decision appears moderately positive. The absence of surprises reduces short-term volatility and reinforces the base scenario for valuation models: stable monetary policy, controlled bond yields and favourable conditions for corporate financing. Unless the accompanying BoJ comments point to a faster pace of tightening in the coming quarters, the JP 225 index will likely maintain its upward momentum. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 356 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

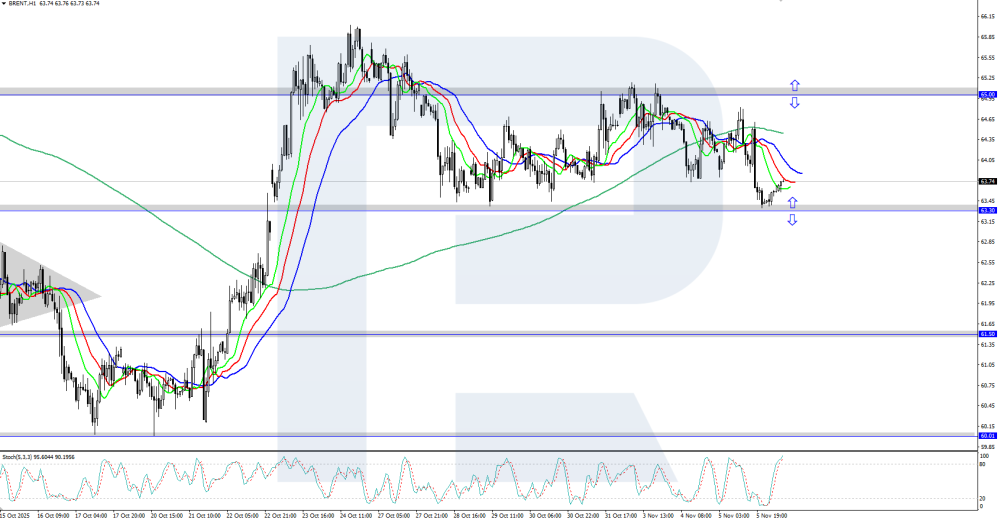

Brent prices declined towards support near 63.00 Brent oil prices fell to the 63.00 USD area amid a rise in US crude oil inventories according to the EIA data. Discover more in our analysis for 6 November 2025. Brent technical analysis On the H4 chart, Brent is moderately declining within a limited sideways range of 63.30–65.00 USD. The direction of the breakout from this price range will determine the future movement of the asset. Brent dipped towards support near 63.00 USD amid rising US crude oil inventories. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

I don't think so, he's not answering anymore either.

-

Bambang Sugiarto started following Anybody can recommend a broker for News trading??

-

Anybody can recommend a broker for News trading??

Bambang Sugiarto replied to venturefx's topic in Forex Brokers

I recommend Headway for its low spreads and fast execution. I have been using it for over two years and feel comfortable with it. Please try it out and take advantage of the Pro account offer with spreads starting at 0. -

Blues joined the community

-

Max joined the community

-

What are the main features of the best crypto exchange?

CryptoFluxor replied to Malenasanz's topic in Cryptocurrencies

The best crypto exchange offers strong security, low fees, high liquidity, and an intuitive interface. It supports many cryptocurrencies, provides fast transactions, and ensures transparent operations. Features like advanced trading tools, 24/7 customer support, regulatory compliance, and multiple payment options make it reliable and user-friendly for all investors. -

Bot that makes cryptos free without investing anything

CryptoFluxor replied to indo909's topic in Cryptocurrencies

A crypto-earning bot can collect free tokens from faucets, airdrops, and reward platforms without investment. It automates claims, tracks new opportunities, and manages wallets securely. While payouts are usually small, consistent use can build up holdings over time. Always verify sources to avoid scams and protect your private keys carefully. -

Bitcoin could reach $100K with strong momentum, rising adoption, and institutional demand. Analysts forecast continued growth into 2025, possibly exceeding $120K. However, volatility and regulation remain risks. Meanwhile, LMGX shows potential in blockchain innovation and strategic partnerships, attracting investor attention as both BTC and LMGX shape the evolving crypto landscape together.

-

@apmoo

-

@apmoo@kimsamplease help

-

all is play back in that envoirment you make millions ninja proceses and compreses data in 1 second batches for playback real time is uncompressed so it wont work just a waste of time

-

The good part about trading is you don’t need big machines or power. Just a phone or laptop is enough. You can buy spot crypto or CFDs anytime. That gives freedom to small investors.