All Activity

- Past hour

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Amibroker

The file you requested has been blocked for a violation of our Terms of Service. Sorry! Any other link? - Today

-

raj1301 reacted to a post in a topic:

Any one has Bollinger%B Pro from Ninja.co??

raj1301 reacted to a post in a topic:

Any one has Bollinger%B Pro from Ninja.co??

-

Any one has Bollinger%B Pro from Ninja.co??

Ninja_On_The_Roof replied to SPAR's topic in Ninja Trader 8

https://limewire.com/d/6zWPA#XMqrwe0WHx -

Quaderr started following ⭐ rcarlos1947

-

@rcarlos1947 I'm using NT 8.1.3.1 edu but I see the license validation failed message. Can you screenshot yours,.

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

samar replied to ⭐ Atomo12345's topic in Amibroker

@Atomo12345 x64 6.30 full crack for reference. https://www.mediafire.com/file/6z9xxtz2qaashex/AmiBroker+6.30x64+&+AmiQuote+3.31+Full+Crack.rar/file -

Please note, once you have downloaded the free indicators, please email your machine id to [email protected] Your licenses will then be activated and you will be notified via email. Happy Trading

-

Any one has Bollinger%B Pro from Ninja.co?? Looks like it is helping to take good trades.

-

https://limewire.com/d/bsPnB#Eom1L652Ax

-

I know it's too long... But if you Post it again mate. will do it..

-

Mine is NT8.1.4.1, not sure if it works on older versions.

-

Maybe it depends on what kind of NT8 EDU you have... in my case (even if I don't use the platform) nothing works

-

⭐ QuBit reacted to a post in a topic:

snowflaketrader.com

⭐ QuBit reacted to a post in a topic:

snowflaketrader.com

-

Does anyone have this educated indicator: Ninzaimbalanceprofile.lidar_NT8?

-

Panda joined the community

-

I'm sure those folks that have NT8edu have discovered that it works as is, no modification required. I've added this to my BOT arsenal for testing sometime, but for now, back to discretionary testing.

-

ImpulS joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 22nd May 2025.[/b] [b]Bitcoin Surges Above $111K for the First Time as Institutional Demand and Regulatory Optimism Fuel Rally.[/b] Crypto markets outperform as equities stumble under bond market pressure and rising US debt concerns. Bitcoin hit a new record high on Thursday, crossing the $111,000 threshold for the first time amid growing institutional interest and hopes for improved regulatory clarity in the US. The digital asset rose as much as 3.3% to reach $111,878, according to Bloomberg. Ethereum, the second-largest cryptocurrency, also saw notable gains, climbing up to 5.5% intraday. Sentiment was lifted by progress in the US Senate on a key stablecoin bill, which investors interpret as a sign of potential pro-crypto regulation under President Donald Trump. This comes alongside mounting demand from major institutional players, including Michael Saylor’s Strategy, which now holds over $50 billion in Bitcoin. There’s no shortage of demand for BTC from SPAC and PIPE deals, which is manifesting in the premium on Coinbase spot prices. Several newly formed or obscure public companies are driving fresh demand, funding their Bitcoin purchases through convertible debt, preferred equity, and other instruments. One example is Twenty One Capital Inc., a new firm modelled after Strategy and launched by an affiliate of Cantor Fitzgerald LP in partnership with Tether Holdings SA and SoftBank Group. Meanwhile, a merger between a subsidiary of Strive Enterprises Inc., co-founded by Vivek Ramaswamy, and Nasdaq-listed Asset Entities Inc. will create a Bitcoin treasury company. ‘This rally is not just momentum-driven’, said Julia Zhou, COO of Caladan, a crypto market maker. ‘It’s supported by tangible, sustained demand and supply dislocations’ Bitcoin’s dominance is growing, as alternative cryptocurrencies struggle. An index tracking smaller altcoins has declined about 40% in 2025, while Bitcoin is up 17% year-to-date. In the ETF space, 12 US Bitcoin exchange-traded funds have attracted around $4.2 billion in inflows this month. On Deribit, the largest crypto options exchange, open interest is heavily concentrated around June 27 expiry calls at $110,000, $120,000, and even $300,000. The latest breakout confirms the broader bullish trend. The sharp pullback from January’s highs to below $75,000 in April now looks like a correction within a bull market. A firm break above $110,000 could set the stage for a move toward $125,000. The latest rally coincides with a private dinner on Thursday between Trump and top holders of his memecoin at his golf club near Washington. Ethics experts warn that such events raise concerns about potential conflicts of interest and access through financial contributions. However, analysts say the meeting has had minimal direct market impact. Asian Markets Retreat on Bond Market Worries and US Debt Concerns Asian equity markets fell sharply on Thursday as pressure from rising US Treasury yields and concerns over surging American debt rattled investor confidence. Japan’s Nikkei 225 dropped 1.0% to 36,944.55, while Hong Kong’s Hang Seng Index fell 0.9% to 23,615.21. Mainland China’s Shanghai Composite edged 0.1% lower to 3,383.10. Australia’s ASX 200 slid 0.5% to 8,342.80, and South Korea’s Kospi lost 1.1% to settle at 2,595.69. The US still has the biggest markets and deepest liquidity, but not even dollar inertia can outrun compound interest and structural deficits forever. The weaker US dollar also weighed on regional markets. A depreciating dollar undermines the value of Asian nations’ dollar-denominated assets and negatively impacts exporters like Japan’s automakers, whose overseas profits diminish when converted to local currency. In currency markets, the greenback slipped to 143.27 Japanese yen from 143.68 yen. The euro strengthened slightly to $1.1335 from $1.1330. A year ago, the dollar was trading near 150 yen. Investors are also increasingly wary of President Trump’s policy decisions, particularly on tariffs that affect Asian firms and ongoing negotiations in Congress over a major funding bill. Wall Street Flat Ahead of Tax Vote US stock futures were little changed early Thursday as markets awaited the outcome of a vote on President Trump’s proposed tax reform bill. Dow futures dipped 0.1%, while S&P 500 and Nasdaq 100 futures traded flat. Despite internal GOP disagreements, House Speaker Mike Johnson said a floor vote could happen as early as Thursday night. The latest version of the bill includes more generous deductions for state and local taxes (SALT), aimed at appeasing Republican holdouts. However, unresolved issues surrounding Medicaid funding and green energy tax credits have investors concerned. Moody’s recently downgraded the US credit outlook, citing the bill’s potentially massive deficit implications as a contributing factor. Markets reacted on Wednesday with broad declines and a jump in bond yields. The 30-year Treasury yield briefly breached 5%, its highest in months, amid renewed concerns over the US’s growing debt burden. Beyond politics, investors on Thursday will also digest key economic data, including weekly jobless claims, existing home sales, and the ISM’s Purchasing Managers’ Index (PMI). [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Visit quaderr.com to purchase an all access pass, which allows you to trial 10 premium products. Should you wish to purchase a product after your trial period, your initial payment will be deducted from the product's price.

-

- trading

- ninjatrader

-

(and 2 more)

Tagged with:

-

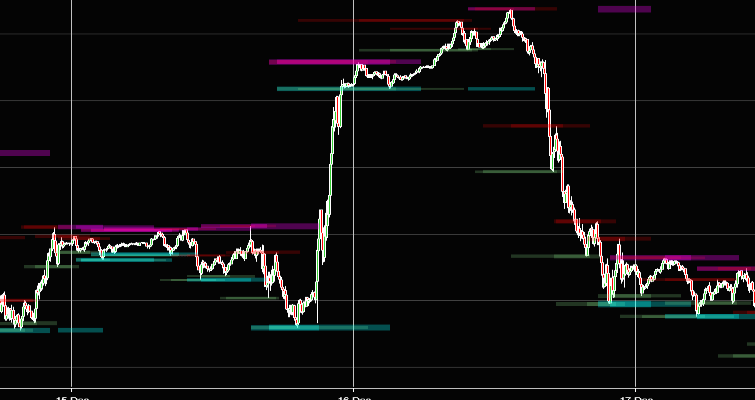

Greetings all members Today I would like to showcase our Free QSR Indicator. Support and Resistance (SR) levels are levels where the market found it hard to move beyond that level. These levels often determine ranges where the markets will move within or between. When the market breaks above or below these significant levels we can generally expect a big move. When the markets fail to break these levels we can generally expect the market to revert from these levels back to some other level. How to Trade it? Entries: When the market approaches a SR level we wait to see whether the market pulls back from this level or breaks out through this level. So when the market breaks above the resistance level you have a break out and you go long. When the market fails to break a resistance level you have a reversion trade and you can short the market. The opposite is true for support levels. Exits: Support and Resistance levels provides us with good profit target levels. Exit a long trade at a resistance level above your entry level and exit a short trade at a support level below your entry price. Stoplosses: It works well to place your stoploss at your SR level below your entry price for a long and at a level above your entry price for a short. You can trail this stoploss upwards in a long trade as the market breaks above resistance levels by moving your stoploss level upwards along with the break outs of these resistance levels. For more info and to download this great tool visit: https://quaderr.com/q-sr/

-

nobody can really predict exactly what the market’s gonna do so it’s totally normal to feel a bit of fear when trading but greed is where things can get risky fear can make you cautious which isn’t always a bad thing but greed pushes people to overtrade chase losses or take big risks hoping for quick wins that usually don’t end well in my experience keeping emotions in check is just as important as knowing your strategy i’ve been trading with lmfx for a while and what helps is how they lay out the market info clearly so you can make decisions based on facts not just feelings

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent declines as US crude oil inventories rise Brent prices dropped to around 64.00 USD following the release of US crude oil inventory data from the EIA. Discover more in our analysis for 22 May 2025. Brent technical analysis On the H4 chart, Brent shows a downward correction following its recent rise. Prices are currently trading within a broad sideways range between 63.00 and 66.00 USD. The breakout direction from this range will determine the asset’s next move. Brent quotes are falling following the EIA’s report of a 1.328 million barrel rise in US oil inventories. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at two-week high: US budget prompts risk-off shift Gold (XAUUSD) prices have climbed to 3,338 USD as investors are seeking safe-haven assets amid concerns over US fiscal policy. Discover more in our analysis for 22 May 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices have been rising for four consecutive trading sessions with no signs of slowing Demand for safe-haven assets grows amid mounting uncertainty in the US and the Middle East XAUUSD forecast for 22 May 2025: 3,346 and 3,358 Fundamental analysis Gold (XAUUSD) has posted its fourth consecutive daily gain, reaching 3,338 USD per troy ounce. Investors are increasingly seeking reliable assets amid growing concerns about the US fiscal outlook. Risk appetite declined following the release of a proposed US federal budget, which could further widen the already large deficit. Additional pressure came from Moody’s recent US credit rating downgrade, citing rising debt levels, alongside a cautious economic outlook from the Federal Reserve. Geopolitical uncertainty also supports gold’s appeal, with ongoing tensions in the Middle East adding to market anxiety. According to Chinese customs data, gold imports surged to an 11-month high in April, reaching 127.5 thousand tonnes (+73% m/m). The jump reflects strong demand and additional import quotas granted by the central bank amid rising trade tensions with the US. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 244 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

This traderpot is increasing in value, i don't know how long will this promotion last! Good for the forex traders in my opinion.

-

Depends on how much risk we can take, scalpers and news traders usually have high risk averse and also experienced to hedge against the market therefore, new traders should instead try to avoid trading during news or high volatile market conditions.

- 305 replies

-

- forex broker

- hotforex

-

(and 1 more)

Tagged with:

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

jameswood32 joined the community

-

@apmoo can you look at this one?

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

epajfl00 replied to ⭐ Atomo12345's topic in Amibroker

We need a 64bit cracked version, so we can compare and adapt changes to other versions. Anyone? I previously provided the link to 6431 x64, but uneducated.

.thumb.png.6aec50cefc0a368fd5dc7ea9cec1b42c.png)

.thumb.png.0b32089938a14a553ce51d5f423068b7.png)