⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Ok cool. Thank you. Do either of you have any templates to get me started.? I’ll share any successful templates I come up with once I get started testing

- Today

-

Kellyman joined the community

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent forced to reassess its outlook Brent crude prices have slipped to 65.86 USD per barrel as the market reacts swiftly to changing headlines and shifting sentiment. Details — in our analysis for 28 October 2025. Brent forecast: key trading points Brent continues to decline and may enter a sideways range. Rapid changes in news flow are forcing investors to reassess the outlook. Brent forecast for 28 October 2025: 64.00 and 63.50. Fundamental analysis On Tuesday, Brent crude oil fell for the third consecutive session, dropping to 64.86 USD per barrel amid growing concerns of oversupply following signals from OPEC+ about a potential output increase. According to sources, at the upcoming Sunday meeting, members of the alliance are expected to discuss a moderate production hike for December, with Saudi Arabia reportedly pushing to regain lost market share. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 350 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

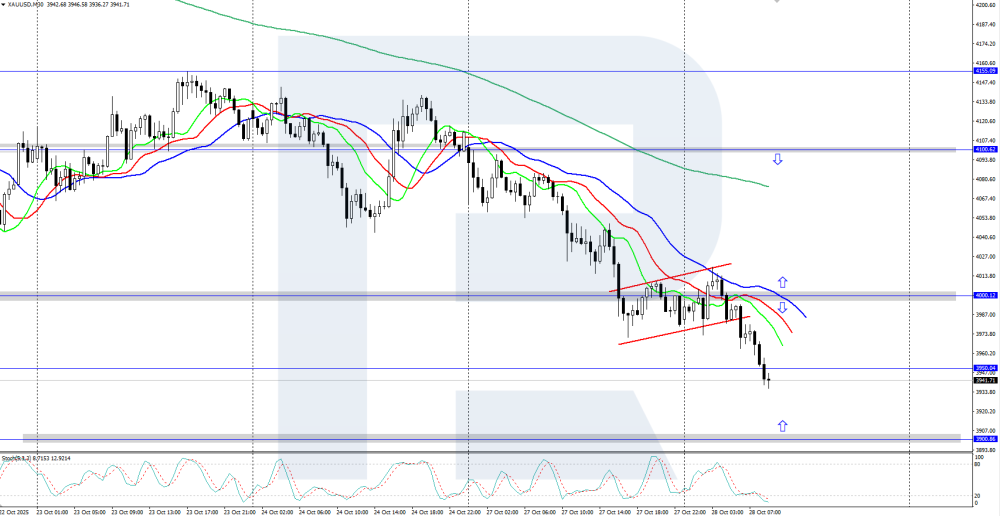

Gold (XAUUSD) falls below 4,000 USD Gold (XAUUSD) has dropped below the key 4,000 USD level amid an ongoing downward correction, as markets await the outcome of U.S.–China trade negotiations. Details — in our analysis for 28 October 2025. XAUUSD technical analysis XAUUSD has corrected lower from its record high of 4,380 USD, following a sharp decline in safe-haven demand. The Alligator indicator remains pointed downward, suggesting that the correction could continue in the short term. Gold (XAUUSD) continues to correct lower, slipping below the psychologically significant 4,000 USD mark as markets focus on U.S.–China trade developments. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 28th October 2025. Market Confidence Sinks Gold, But Will It Continue? Gold prices continue to decline for a second consecutive week, now trading 10% lower than their previous high. The key bearish drivers for gold are the reduced safe haven demand and the stronger US Dollar. However, traders are evaluating how low the price will fall before losing momentum. Investors are closely watching two major events this week: the US Federal Reserve’s interest rate decision on Wednesday at 20:00 (GMT+2) and a high-profile meeting between US President Donald Trump and Chinese President Xi Jinping at the APEC summit in Seoul later in the week. These events are expected to set the tone for global markets, influencing currency movements, bond yields, and risk sentiment. As a result, these events are having a strong influence on Gold prices. Most economists anticipate that, given the recent signs of labour market cooling and moderate inflation, which came in at 3.0% in September, slightly below expectations of 3.1%. The Fed is likely to cut interest rates by 25 basis points to 4.00%. Policymakers are also expected to signal a continued ‘dovish’ stance into December, emphasising flexibility and support for economic stability. The move would mark another step toward easing monetary conditions amid slowing growth momentum. However, traders should note that increasing interest rates are fully priced into Gold according to analysts. As a result, the effect of interest rates is significantly lower than in previous weeks. Experts advise that a rate cut for January is not priced into the market. According to the FedWatch Tool, there is a 48% chance of a rate cut in January. If this increases, Gold may attempt a further bullish increase. Meanwhile, optimism is growing around the upcoming US–China talks. Chinese representative Li Chengang confirmed that preliminary agreements have been reached on several key areas, including exports, transport fees, and curbing illegal fentanyl production. US Treasury Secretary Scott Bessent stated that the threat of 100% import tariffs has been lifted, while President Trump announced his intention to sign the trade deal. Analysts suggest that China may delay stricter export controls on rare earth metals for at least a year, while Washington could roll back some tariffs, paving the way for continued negotiations on the broader agreement. For this reason, the trade tensions are no longer adding to Gold’s previous bullish trend. XAUUSD 4-Hour Chart According to the 200-period Moving Average, the price of Gold has now declined enough to move into range-bound trading conditions. However, momentum-based technical indicators continue to point towards a continued decline. The bearish signal is likely to remain in place for as long as the price remains below $4,019.00. Lastly, technical analysts also note that the price is trading at the support level from October 9th. Key Takeaway Points: Gold extends losses: Prices have dropped for a second week, now 10% below recent highs amid weaker safe-haven demand and a stronger U.S. dollar. Focus on key events: The Fed’s rate decision and Trump–Xi meeting are driving market sentiment and influencing gold’s direction. The Federal Reserve is likely to cut rates tomorrow and again in December: analysts expect a 0.25% rate cut. Bearish trend persists: Gold trades below its 200-period moving average, with momentum still pointing lower unless it breaks above $4,019.00. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Bambang Sugiarto reacted to a post in a topic:

Do emotions determine profits more than analysis?

Bambang Sugiarto reacted to a post in a topic:

Do emotions determine profits more than analysis?

-

kimsam reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

kimsam reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

-

kimsam reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

kimsam reacted to a post in a topic:

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

BC77851620 reacted to a post in a topic:

S M M - NT8

BC77851620 reacted to a post in a topic:

S M M - NT8

-

BC77851620 reacted to a post in a topic:

S M M - NT8

BC77851620 reacted to a post in a topic:

S M M - NT8

-

StayAtHomeTrader joined the community

-

⭐ aniketp007 reacted to a post in a topic:

SMM Metrics Time filter refined

⭐ aniketp007 reacted to a post in a topic:

SMM Metrics Time filter refined

-

arrkain joined the community

-

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

TRADER replied to UTS's topic in Ninja Trader 8

@apmoo @Kimsam -

Bene reacted to a post in a topic:

SMM Metrics Time filter refined

Bene reacted to a post in a topic:

SMM Metrics Time filter refined

-

[REQUEST] MBO MARKET BY ORDER INDICATORS - bestorderflow.com

indicat replied to UTS's topic in Ninja Trader 8

this is original uneducated - use password as indo-investasi Original.7z -

SUBZERO reacted to a post in a topic:

SMM Metrics Time filter refined

SUBZERO reacted to a post in a topic:

SMM Metrics Time filter refined

-

Yes you can, I use predator.

-

I've been working on a striped down version of SMM indicator that I've been automating with predator. Essentially my signals are generated on the the ATR background flip and EMA alignment from the SMM dots. This is pretty close to how he (Justin) trades the system. Signals are pretty good, but like anything figuring out how how the manage the trade is the hard part. I find ATR profit targets and ATR trailing stops are working decently. Would love to see what youve come up with to get that 3+ factor!

-

The SMM guy said he have a rough time today , and almost breakeven, whie I profit all day long with my Gamma computation

-

raj1301 reacted to a post in a topic:

SMM Metrics Time filter refined

raj1301 reacted to a post in a topic:

SMM Metrics Time filter refined

- Yesterday

-

fxzero.dark reacted to a post in a topic:

TheVwap Full code

fxzero.dark reacted to a post in a topic:

TheVwap Full code

-

@kimsam Were you able to convert to NT8?

-

https://workupload.com/file/pFmnbDvQ6Fp

-

@kimsam @apmoo Please assist Thanks 🙏

-

@kimsam that would be awesome

-

Can convert it to ninjatrader .

-

I forgot to mention that this is tested 1 bar after the signal, wich means its only triggering the entry 1 bar later, so, its better because when you get the actual signal, you getting early 1 bar before the entry in the strategy, wich in fact, makes you get in at the actual signal for better prices.

-

-

5 minute time frame for those settings

-

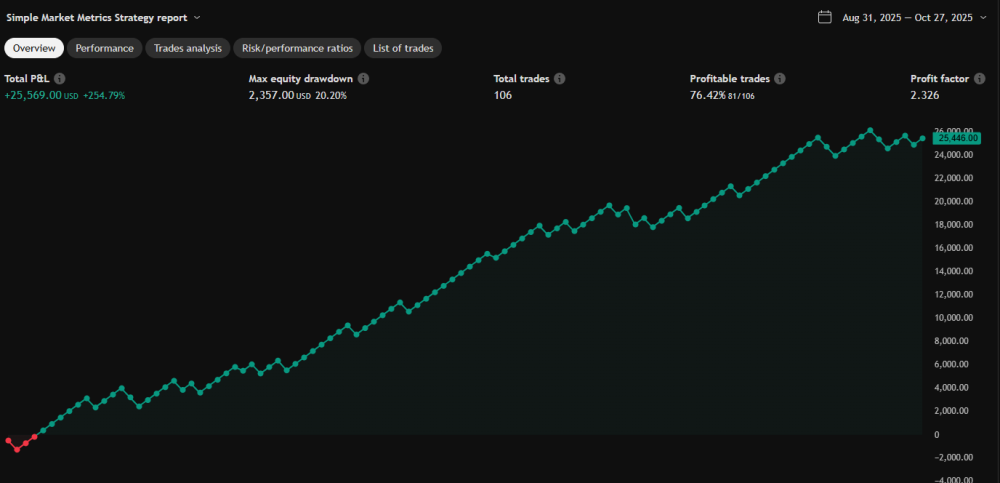

I refined the code in Tradingview, so, backtesting it can be the same as using Predator with the NT8 version. 111tick profit, 156 stop, 76% win rate since Aug 31. I took the test frim the closing of the candle and not the opening, since that reveals where the next candle will open to get the actual trade done. i am still working around win loss ratio and stops, but this one should get you started with those 100K prop acc, since we still have 20% drawdrawn on a 10k investment and a 254%return. I changed the code for time filter. starts at 9am NY till 4 oclock to get those results and stops btw 12 and 12.29 NY lunch. Play around with it Gonna keep trying to work on this but looks decent. @version=5.txt

-

@BC77851620 Yeah we can use the tradesaber's PredatorXOrderEntry

-

Much appreciated @Harrys