All Activity

- Past hour

-

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

-

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

-

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

⭐ goldeneagle1 reacted to a post in a topic:

Hawk Bot Plus ATM

-

⭐ goldeneagle1 reacted to a post in a topic:

Sidi footprint

⭐ goldeneagle1 reacted to a post in a topic:

Sidi footprint

-

⭐ goldeneagle1 reacted to a post in a topic:

Sidi footprint

⭐ goldeneagle1 reacted to a post in a topic:

Sidi footprint

-

⭐ goldeneagle1 reacted to a post in a topic:

(request) The Intentional Trader - Market data downloader

⭐ goldeneagle1 reacted to a post in a topic:

(request) The Intentional Trader - Market data downloader

-

⭐ goldeneagle1 reacted to a post in a topic:

nCatZorroFuturesTrader

⭐ goldeneagle1 reacted to a post in a topic:

nCatZorroFuturesTrader

-

⭐ goldeneagle1 reacted to a post in a topic:

nCatElliotWave

⭐ goldeneagle1 reacted to a post in a topic:

nCatElliotWave

-

⭐ goldeneagle1 reacted to a post in a topic:

nCatZones

⭐ goldeneagle1 reacted to a post in a topic:

nCatZones

-

⭐ goldeneagle1 reacted to a post in a topic:

nCatWhaleTrade

⭐ goldeneagle1 reacted to a post in a topic:

nCatWhaleTrade

-

Does anyone have the latest or find unlocked version? @apmoo do you need the v19 cs file to unlock it?

-

Edgeful Tool is accessed through browser but Im not sure if multple logins are allowed or if allowed may be flagged and the subscription cancelled

-

The idea here is once this is monthly subscription where the cost could be shared and it would be a possible way we can access to it.

- Today

-

yes its possible what does edgefull have to do with the vps/rdp

-

ampf started following Trading Room Idea

-

I would like to ask here if is technically possible to multiple users access to a vps/rdp/server without admin rights (where no chnages could be made) but could be accessed this tool https://www.edgeful.com/ ? Where anyone with access could do his research? Thank you

-

Can you please unlock this indicator. Thank you HFT_SPECTRE_LITE_Import.zip

-

If you have Amibroker 6.9 32 bit unregistered Ican try to crack it.

pashr replied to ⭐ Atomo12345's topic in Amibroker

ANyone suceeded in getting 64 bit any version of Amibroker -

magal joined the community

-

h**ps://www.sendspace.com/file/z6q6v6 (rar psw= Indo)

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 13th May 2025.[/b] [b]US-China Deal Eases Recession Fears, Goldman Raises 2025 Targets.[/b] Investors continue to focus on the weekend's trade deal between the US and China which continues to prompt vital trends. The agreement between the two largest economies changes the outlook for almost all assets. Although investors will also start to turn their focus to a pending trade agreement with the EU and this week’s inflation data. Global Stocks Rebound Aiming To Fully Regain Previous Losses The global stock market rose significantly after the announcement of a trade deal with China to lower tariffs. You can find the details of the agreement in yesterday’s article. The SNP500 rose 3.26% and has regained 79% of the stock market crash from March-April. Of the most influential components (stocks within the SNP500) 82% rose in value with mainly defensive stocks declining. Defensive stocks include Philip Morris, Johnson & Johnson and Coca-Cola. Due to the trade agreement most economies have lowered their projections for a recession in 2025. Previously economists were advising a 30-50% chance of a recession in the second half of the year. However, these projections have now significantly fallen and will do further if the US and EU also sign a trade agreement. In today’s early hours Goldman Sachs advised it is increasing its target within the stock market. Goldman Sachs strategists, such as David Kostin, now project the SNP500 to potentially rise to $6,500 within the next 12 months. Previously the estimate was between $6,100-6,200. However, analysts also note that the US-China agreement is still temporary and will expire in 89 days. In the short-term, investors will be laser focused on the Consumer Price Index (inflation). The CPI is due to be made public at 12:30 GMT. Analysts expect the US inflation rate to remain at 2.4%. If the rate reads as expected or lower, the stock market potentially can further rise as economists will expect a Federal Reserve rate cut. GBPUSD - The Pound Struggles Despite Positive Employment Data The US Dollar has been the best performing currency of the week as investors return to the Greenback. This is largely due to the trade agreement with China and investors correcting previous market pricings. However, the USD is retracing lower on Tuesday giving back some od this week’s gains. The Great British Pound on the other hand is also supported by the latest employment data from this morning. Although this has not been mirrored on the price. The UK Claimant Count Change fell to +5,200 and the Average Earnings Index read 5.5%. Both announcements were better than previous expectations. However, the GBP still remains the worst performing currency of the day so far after the USD. Yesterday, Bank of England Monetary Policy Director Megan Green stated that while wage and consumer price growth continues to slow, the figures remain meaningful. However, she also noted a rise in medium-term inflation expectations among the public. Gold Forms a Retracement Pattern and Obtains A Divergence Indication The price of Gold rose 0.88% on Tuesday almost fully correcting the bearish price action from Monday, bar the bearish price gap. Currently, the metal is finding support at the $3,201.00 support level from April 12th and May 1st. However, the upward price movement of the day is forming a similar pattern to previous retracements. Therefore, it is vital for Gold traders to note that the price movement could either be a retracement or change in trend. Currently, in terms of fundamentals, the data is indicating a bearish bias, although some positive factors remain. For example, if the Federal Reserve starts to take a more dovish tone due to the trade deal, Gold may continue to be used as a hedge against inflation. However, if countries continue signing trade deals and Ukraine and Russia reach an agreement in Thursday’s negotiations, renewed bearish momentum might hit Gold. According to the White House, President Trump may possibly attend the negotiations on Thursday between Ukraine and Russia. Key Takeaway Points: The weekend trade agreement between the US and China has boosted investor confidence and shifted the outlook across global assets, reducing recession fears for 2025. Global stock markets surged, with the S&P 500 up 3.26%. Defensive stocks underperformed, while 82% of components posted gains. Investor attention now turns to today’s US CPI data and the potential US-EU trade agreement. A softer inflation reading could trigger Fed rate cut expectations. The US Dollar leads among currencies but is slightly retracing. The Pound is supported by strong UK jobs data but remains one of the day’s weaker performers. Gold rose 0.88% Tuesday but remains at risk of renewed bearish pressure if global trade deals continue and Ukraine-Russia negotiations succeed. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD tumbles to the 1.1100 area; will the decline continue? The EURUSD pair plunged to 1.1100 following the US-China agreement on reducing reciprocal tariffs. Today's spotlight is on the US inflation report. Find more details in our analysis for 13 May 2025. EURUSD forecast: key trading points Market focus: today’s highlight is the US April inflation statistics, with the Consumer Price Index (CPI) scheduled for release Current trend: a downtrend prevails EURUSD forecast for 13 May 2025: 1.1200 and 1.1000 Fundamental analysis The EURUSD pair continues to decline as the US dollar gains strength amid optimism over a de-escalation in the US-China trade dispute. The two countries agreed to a 90-day reduction in tariffs after talks in Geneva, signalling a meaningful thaw in trade tensions that had intensified last month. Today, all eyes are on the US CPI data for April. The consensus forecasts suggest an increase of 0.3% month-on-month and 2.4% year-on-year. Any substantial deviation from these expectations could fuel heightened volatility in the EURUSD pair. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 237 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Japan’s economy under pressure, USDJPY poised to surge The downward revision of Japan’s GDP forecast may propel the USDJPY pair towards the 149.50 level. Discover more in our analysis for 13 May 2025. USDJPY technical analysis On the H4 chart, the USDJPY price tested the upper Bollinger Band and formed a Hanging Man reversal pattern, hovering around 147.60. It may now form a corrective wave following the signal from the pattern. Since the price remains within an ascending channel, it could reach 146.80. Coupled with the USDJPY technical analysis, the decline in Japan’s economic data suggests a correction towards 146.80 before growth. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

-

bwt presicion trading nt8 please give

Ninja_On_The_Roof replied to xplodvicky's topic in Ninja Trader 8

A full one was already posted and it works just fine. -

If you’re looking for a place to learn and trade without feeling overwhelmed, HFM is worth a look. Especially for new traders who prefer things in their own language.

-

thanks ad thanks ad

- Yesterday

-

Can you explain this more it’s interesting

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

roddizon1978 replied to MrAdmin's topic in Announcements

Sir: I I am not a long time member but I am a good contributing member, I help by contributing a lot of item. Can you make me a VIP member , instead of those who have no contribution . -

-

Check this out think its the same bot. He will demonstrate the bot and maybe share settings over the coming weeks.

-

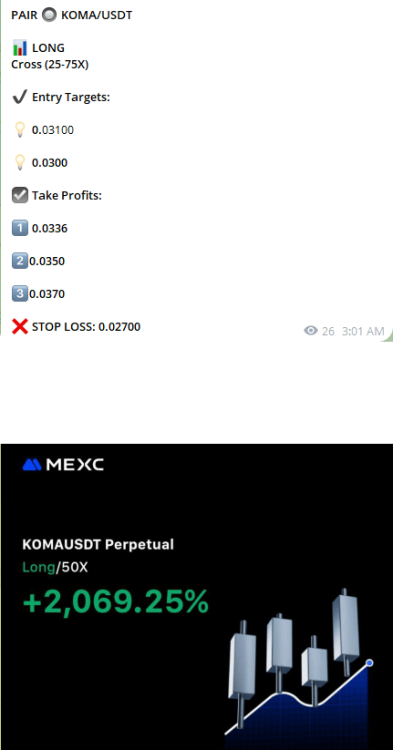

Guys I have ask ClubbingBuy to open a funded account for Crypto call on one server live. I have been doing trial from this server , and i got 5 and 5 win already on their call. I want to see all their call everyday and you could see it too ,if you participate. I will inforned you if it breaks throught, the faster the better. We have open before in the past a server calls and, the Nifty traders benefitted in gold trade and Forex trade. So participate so we could make the contribution less.

-

By the way, the best way to make money in the market is to find weakness or vulnerabilities in the thousands of asset class that is available to us, retail traders and trade the price action, NOT your strategy. A good pair is USDTRY, you just need to buy the strongest currencies and sell the weakest currency with high inflation and high interest rate and you make money, no stress

-

A telegram group already exists, Traderbeauty, is the admin feel free to reach her by the way what is this poweremini?

-

you need this ? h**ps://www.sendspace.com/file/zm4nzm (rar psw= Indo)