⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Today

-

jamesbrown2 reacted to a post in a topic:

Stock Traders Almanac 2026

jamesbrown2 reacted to a post in a topic:

Stock Traders Almanac 2026

-

zeibpro started following Network Bridge NT8 to Metatrader needs edu

-

I have the trail version for Network Bridge NT8 to Metatrader. Its very helpful for copying trades from Nt8 to MT4/5. If anyone can edu this, it would be great. setup.3.7.2.zip

-

IF someone can educate these it would be amazing because we have not seen the data feed edu anywhere else

-

@Mr_Wall Please can you post your settings for this?

-

This would be great to automate any indicator.

-

Did anyone figure this out?

-

Oana SSS reacted to a post in a topic:

Sniper Auto Trader v29

Oana SSS reacted to a post in a topic:

Sniper Auto Trader v29

-

⭐ goldeneagle1 reacted to a post in a topic:

Sniper Auto Trader v29

⭐ goldeneagle1 reacted to a post in a topic:

Sniper Auto Trader v29

-

⭐ goldeneagle1 reacted to a post in a topic:

ARC AI

⭐ goldeneagle1 reacted to a post in a topic:

ARC AI

-

⭐ goldeneagle1 reacted to a post in a topic:

ARC AI

⭐ goldeneagle1 reacted to a post in a topic:

ARC AI

-

⭐ goldeneagle1 reacted to a post in a topic:

Any body educated these file for me thanks

⭐ goldeneagle1 reacted to a post in a topic:

Any body educated these file for me thanks

-

⭐ goldeneagle1 reacted to a post in a topic:

Any body educated these file for me thanks

⭐ goldeneagle1 reacted to a post in a topic:

Any body educated these file for me thanks

-

⭐ goldeneagle1 reacted to a post in a topic:

Predator X entry V2.0.0

⭐ goldeneagle1 reacted to a post in a topic:

Predator X entry V2.0.0

-

⭐ goldeneagle1 reacted to a post in a topic:

Evolve AI Trading BOT

⭐ goldeneagle1 reacted to a post in a topic:

Evolve AI Trading BOT

-

which version did you run this? V19 or V28

-

@kimsam can you reupload this please

-

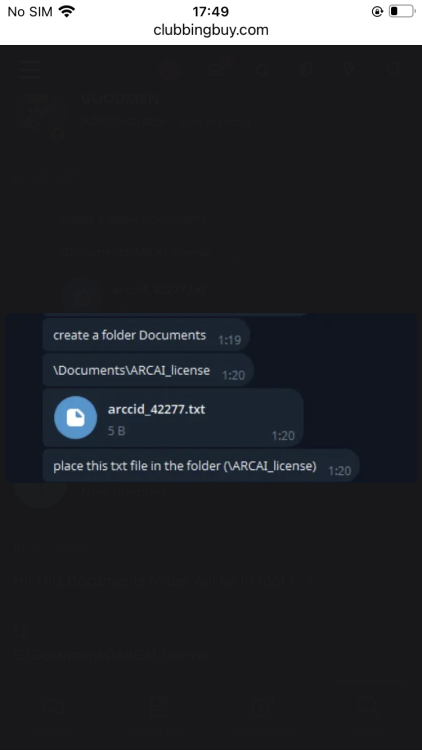

Please can you list the path to place the text file in? @fchot33

-

Waiting @kimsam

-

Perhaps the hitch is that I have release 8.028, while it seems to me that the screenshots coming from from 8.1x. UPDATE: is working....I deleted everything and tried again for now with v19 then I'll throw myself on the 28....even if the old one is fabulous....it loses money like a charm, so just invert Long with Short and and the problem is solved 🙂

-

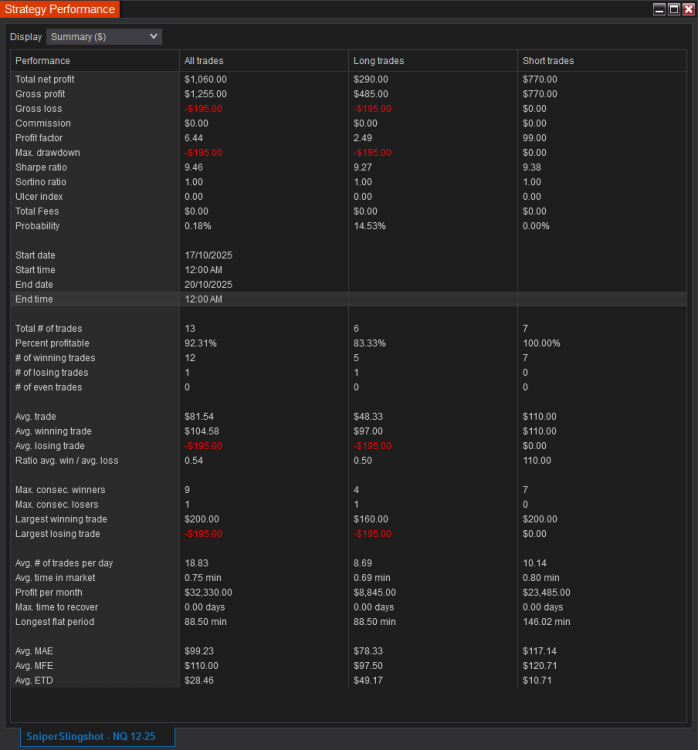

Just a quick trading update on a sim account using this strategy. I turned off the 'auto' trader once I made $1000, by clicking 'on' off. I will try using this strategy everyday to make $1000 per day, I'm back at work on Fri

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD rebounds after positive US news The USDCAD pair starts the week with a recovery attempt after last week’s decline, currently trading at 1.4023. Find more details in our analysis for 20 October 2025. USDCAD technical analysis The USDCAD pair continues to move within an ascending channel despite sellers’ attempts to trigger a correction. After a short-term decline, the price is testing the lower boundary of the channel, indicating that buying interest remains intact. The Stochastic Oscillator shows a rebound from oversold territory, with a potential upward crossover forming, confirming the market’s readiness to resume growth. With the US dollar strengthening and steady investor interest in Canadian assets, the short-term USDCAD outlook remains bullish. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index continues to decline The DE 40 stock index remains under pressure, although the pace of decline slowed significantly at the end of last week. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s PPI decreased by 0.5% in September 2025 Market impact: the data creates a mixed backdrop for the German stock market Fundamental analysis Germany’s latest Producer Price Index (PPI) for September showed a 0.5% month-on-month decline, compared to an expected fall of just 0.1%. This indicates that price pressure at the producer level is easing faster than anticipated. For the stock market, this is a crucial signal on two fronts – capital cost (interest rate expectations) and corporate earnings (balance between demand and costs). If the decline in PPI persists alongside a deterioration in leading indicators such as PMI and industrial orders, the market may need to revise its revenue forecasts – a clear risk for cyclical stocks. For the DE 40 index, the short-term baseline scenario points to a moderately positive reaction. However, the medium-term trajectory will depend on whether leading indicators such as PMI, industrial orders, and exports confirm a sustained weakness in demand. Conversely, if data shows that the PPI drop is temporary and not systemic, while orders remain stable, there will be more room for growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 344 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Ninza Captain Optimus Strong Needs Unlocking

doc martin replied to TickHunter's topic in Ninja Trader 8

Also very interested in this -

doc martin joined the community

-

Not sure if I left this here before. You have to create a text file with that license text in order to irk. Should be in your nt8 folder ARC_FullSuite_NT8_24.08.26a.zip arccid_42277.txt

-

Could anyone upload any working recent version if you don’t mind ? Super thanks