All Activity

- Past hour

-

Have you looked at the TradeSaberPredator? It can be used as a trade manager/Order entry Atomatic/Semi-Auto/Manual. Apmoo as already worked his magic on it.

-

Looking for a trade manager that is like the trade devil one that's available

- Today

-

Do we have the script ?

-

samfourtimes started following HFT Min Bot Unlocked

-

⭐ goldeneagle1 reacted to a post in a topic:

HFT Min Bot Unlocked

⭐ goldeneagle1 reacted to a post in a topic:

HFT Min Bot Unlocked

-

⭐ goldeneagle1 reacted to a post in a topic:

ProSuite V5 + footrpintAlgo

⭐ goldeneagle1 reacted to a post in a topic:

ProSuite V5 + footrpintAlgo

-

Karmaloop started following HFT Min Bot Unlocked

-

Thank you very much for posting. I had the KNN bot running on a SIM account from the opening of the UK market all the way op to 1.5 hour after NY open. My opinion: bad performance. Currenty $1000 in the red. Standard settings used. SL 30, TP 11, short and long signals armed. 1 contract NQ, 1 minute timeframe. Fully automated mode.

-

⭐ goldeneagle1 reacted to a post in a topic:

Affordable Indicators copier manual

⭐ goldeneagle1 reacted to a post in a topic:

Affordable Indicators copier manual

-

raj1301 reacted to a post in a topic:

Affordable Indicators copier manual

raj1301 reacted to a post in a topic:

Affordable Indicators copier manual

-

Here you go Accounts-Dashboard-User-Manual-V10.pdf

-

sunny123 joined the community

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

sunny123 replied to TickHunter's topic in Ninja Trader 8

THANX -

samfourtimes started following ProSuite V5 + footrpintAlgo

-

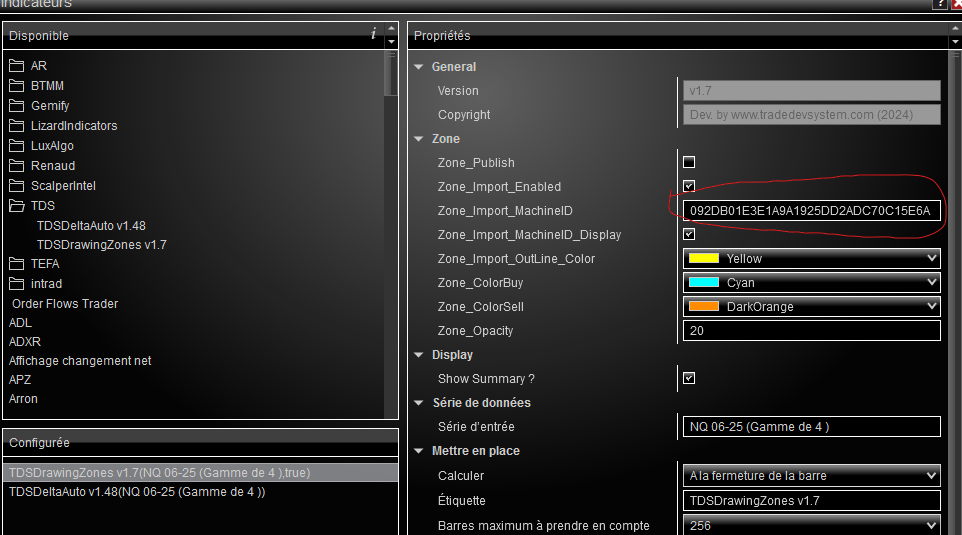

This machine is locked. If anyone can unlock it, with templates for NQ and ES that I'd like to share with you. thank you https://drive.google.com/file/d/1TFSEapcejMZW17d_vGNb8jhMMRTjsQhd/view?usp=sharing https://drive.google.com/file/d/1iztoZ4fgs7_VQX2t16_w0VXXqwVduInt/view?usp=sharing

-

Harrys reacted to a post in a topic:

aeromir.com

Harrys reacted to a post in a topic:

aeromir.com

-

Harrys reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Harrys reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Harrys reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Harrys reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Harrys started following www.tradedevsystem.com OrderFLow

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 5th June 2025.[/b] [b]ECB Rate Cut Expected Today: Inflation Drops Below 2% Target as Global Markets React.[/b] European Central Bank Poised for Second Rate Reduction in 2025. Financial markets are positioning for another interest rate reduction from the European Central Bank during today's highly anticipated monetary policy announcement. This potential move comes as eurozone inflation has fallen below the central bank's target threshold for the first time in months. May Inflation Data Strengthens Case for Monetary Easing Recent economic indicators have reinforced expectations for accommodative monetary policy across the eurozone. Consumer price inflation unexpectedly declined to 1.9% annually in May, representing a significant drop from April's 2.2% reading. This figure not only fell short of economist predictions of 2.0% but also marked the first instance of inflation dipping below the ECB's benchmark target since September 2024. The surprising inflation deceleration reflects broader economic headwinds, including business uncertainty stemming from international trade tensions and subdued consumer spending patterns. These factors have collectively undermined pricing power across multiple economic sectors. Core inflation metrics, which exclude volatile energy and food components, similarly demonstrated cooling trends. The measure retreated to 2.4% in May from 2.7% the previous month, falling below analyst estimates of 2.5%. Monthly core price increases registered a modest 0.1%, signalling persistent disinflationary pressures. Recent ECB Policy Context The central bank previously implemented a 25 basis point rate reduction during its April meeting, lowering the deposit facility rate to 2.25%. Market participants are now pricing in additional easing measures for June, though expectations for subsequent cuts remain divided. A potential pause in July as policymakers assess incoming economic data and inflation trajectories. Markets are now pricing in another cut in June, though expectations for further easing beyond that remain uncertain. A potential pause in July is gaining traction, as the ECB evaluates incoming economic data and inflation dynamics. Asian Markets Show Mixed Performance Amid Global Uncertainty Regional Stock Performance Varies Asian equity markets displayed divergent trends Thursday as Wall Street's recent momentum showed signs of fatigue following disappointing US economic reports. Futures contracts pointed lower while commodity prices experienced declines. Japan's Nikkei 225 index retreated 0.2% to close at 37,658.46, while Australia's S&P/ASX 200 declined marginally by 0.1% to 8,535.10. Conversely, South Korea's Kospi index surged 2.1% to 2,829.48, buoyed by political developments as the country's new president, liberal politician Lee Jae-myung, assumed office with promises to reinvigorate North Korean dialogue and strengthen trilateral cooperation with the United States and Japan. Hong Kong's Hang Seng index gained 0.9% to reach 23,856.54, while mainland China's Shanghai Composite remained essentially flat, declining less than 0.1% to 3,374.30. US Market Reaction to Economic Data Wednesday's US trading session concluded with mixed results as major indices responded to weaker-than-anticipated economic indicators. The S&P 500 finished virtually unchanged at 5,970.81, remaining 2.8% below its record high. The Dow Jones Industrial Average fell 0.2% to 42,427.74, while the Nasdaq composite advanced 0.3% to 19,460.49. Bond markets experienced more pronounced movements as Treasury yields declined sharply following disappointing economic updates. One report indicated contraction in the US services sector, contradicting economist expectations for growth. The Institute for Supply Management survey revealed that tariff-related uncertainty was hampering business forecasting and planning capabilities. A separate ADP employment report suggested significantly weaker private sector hiring than anticipated, potentially foreshadowing challenges in Friday's comprehensive Labor Department jobs report—one of Wall Street's most closely monitored monthly releases. Federal Reserve Policy Implications Trump Administration Pressure on Monetary Policy The weaker economic data prompted increased speculation about Federal Reserve rate cuts later this year. President Donald Trump publicly criticized Fed Chair Jerome Powell on his Truth Social platform, stating: "'Too Late' Powell must now LOWER THE RATE. He is unbelievable!!!" The Federal Reserve has maintained its current rate stance throughout 2025 after implementing cuts through late 2024. The central bank's cautious approach reflects an ongoing assessment of Trump administration tariff policies and their potential economic and inflationary impacts. While lower rates could stimulate economic activity, they might also contribute to inflationary pressures. International Trade Developments EU-US Trade Negotiations Trade tensions continue influencing global market sentiment as investors seek clarity on tariff policies. The European Union's chief trade negotiator, Maroš Šefčovič, met with US Trade Representative Jamieson Greer during OECD meetings, though concrete agreements remain elusive. Trump's steel and aluminium tariff increases took effect Wednesday, particularly impacting Canada and Mexico. Simultaneously, the administration requested ‘best offers’ from trading partners to prevent additional import levies scheduled for July implementation. Global Diplomatic Efforts International efforts to address trade uncertainties continue with Japan dispatching key negotiator Ryosei Akazawa for US discussions Thursday. Germany's new chancellor, Friedrich Merz, is also scheduled for Washington meetings as European leaders seek to minimize trade disruption. Currency and Commodity Markets Foreign Exchange Movements Currency markets reflected ongoing uncertainty with the dollar index rising 0.1% to 98.879, partially recovering from Wednesday's 0.5% decline. The dollar strengthened 0.2% against the yen to 143, while the euro remained relatively stable at $1.1411 following a 0.4% gain in the previous session. Commodity Price Action Precious metals and energy markets faced pressure as spot gold declined 0.2% to $3,367.30 per ounce, paring previous gains. Oil prices retreated following US inventory builds and Saudi Arabia's price cuts for Asian crude buyers, with US crude falling 0.5% to $62.58 per barrel. Australian Economic Indicators Consumer Spending Concerns Australian economic data revealed persistent consumption challenges despite monetary easing efforts. Household spending increased only marginally in April, indicating consumption continues lagging income growth despite lower borrowing costs and reduced inflation. Given that household spending represents approximately 52% of Australia's GDP, weak consumption significantly impacted first-quarter growth, which expanded by just 0.2%. The Reserve Bank of Australia previously revised consumption forecasts downward when implementing a quarter-point rate cut to 3.85% in May, and may require further downgrades. Market expectations suggest additional RBA easing as early as July, with rates potentially reaching 2.85% by early next year as policymakers address economic headwinds. Market Outlook and ECB Guidance Central Bank Communication Focus Market participants view today's ECB rate cut as virtually certain, shifting attention to President Christine Lagarde's forward guidance regarding future policy direction. Executive Board member Schnabel may have gone on record to note her preference for unchanged rates, but the dovish camp has dominated the headlines over the past weeks. On top of that, preliminary inflation reports for June and updated inflation forecasts are likely to back the arguments of the likes of Villeroy, who continues to argue for even lower rates. If the ECB fails to deliver a dovish statement today this could upset the equity markets as well as give the euro’s upward trend additional momentum. Alternatively, in the less likely, but possible event that the ECB keeps rates steady, it could well deliver another cut in July, when the tariff outlook may be clearer. Either way, the hurdles to additional cuts are starting to get higher and Lane's focus on being agile on rates amid heightened uncertainty suggests that the ECB could make a quick turnaround, if and when the outlook changes. The central bank's communication strategy will prove crucial as markets navigate competing forces of disinflationary pressures, trade policy uncertainty, and varying regional economic performance. Today's decision and accompanying guidance will likely influence global monetary policy expectations and market positioning heading into the summer months. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Market Technical Analysis by RoboForex

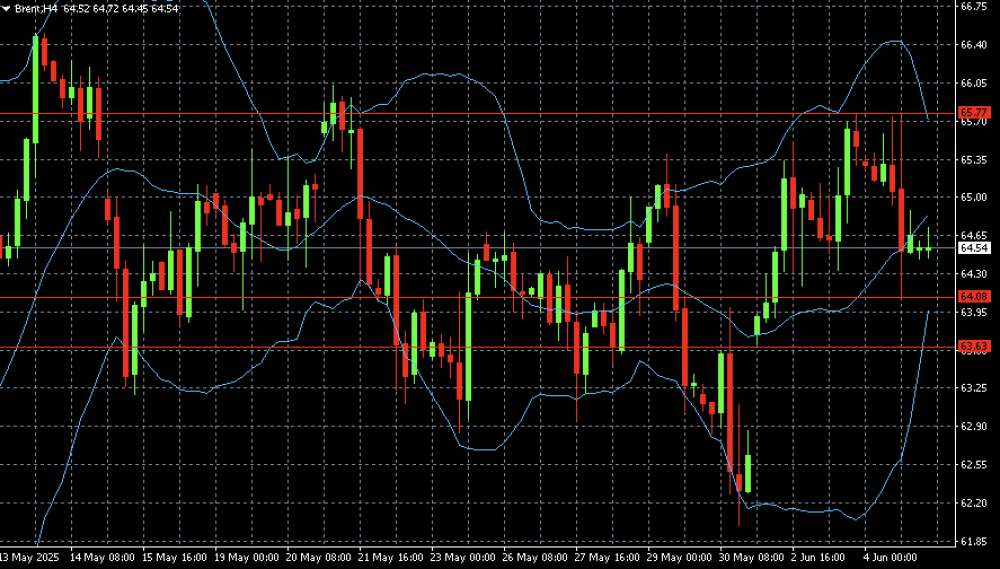

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent fears oversupply: sell-off possible Brent prices fell below 65 USD on Thursday as the market grew uneasy about a global oil glut. Find more details in our analysis for 5 June 2025. Brent technical analysis On the H4 chart, Brent is setting up for a decline towards 64.04. A breakout below the 64.00-64.05 area could pave the way for further selling down to 63.63. Brent prices are falling, with the market having plenty of justification. Read more -Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The Fed under pressure, market on hold: gold (XAUUSD) poised for rally Gold continues to form a pullback, and prices may fall to 3,338 USD as part of a corrective wave. Discover more in our analysis for 5 June 2025. XAUUSD forecast: key trading points US initial jobless claims: previously at 240 thousand, projected at 236 thousand Current trend: moving upwards XAUUSD forecast for 5 June 2025: 3,338 and 3,410 Fundamental analysis The XAUUSD outlook for 5 June 2025 considers gold maintaining resilience, trading near 3,370 USD per troy ounce. Investors remain cautious ahead of the US Non-Farm Payrolls report (NFP), which could shape market direction. Gold prices are supported by weak US economic data, including a decline in the services PMI to 49.9 and ADP employment growth of just 37 thousand. These figures reinforce expectations of a Federal Reserve rate cut. US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading stood at 240 thousand, with the XAUUSD price forecast suggesting a slight drop to 236 thousand. Although the change is marginal, if the actual figure matches or exceeds expectations, it could affect XAUUSD quotes. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 254 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

This machine is locked. If anyone can unlock it, thank you. https://drive.google.com/file/d/1_GbiQKEgLzjQbN1SXcIrGwlVN58PLvqM/view?usp=sharing https://drive.google.com/file/d/1mb12hoVuPINVygjN6YwMhP34dClzAf2O/view?usp=sharing

-

Hockman reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

Hockman reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Traderbeauty reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

Traderbeauty reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Traderbeauty reacted to a post in a topic:

new is latest version V2 proedgetrading.com

Traderbeauty reacted to a post in a topic:

new is latest version V2 proedgetrading.com

-

this works on educated ninjatrader, just install zip

-

Hockman joined the community

-

thank u tickhunter, HFT spectre also works good but the file posted on forum doesnt seem to be educated so the bot does not show signals in realtime

-

File is not valid mate. Could you resend it. thx

-

MODI DESIGNS joined the community

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

fxtrader99 replied to TickHunter's topic in Ninja Trader 8

@Ben6985 Thanks for the gift! I have attached a ZIP file of the DLLs that could be imported from NT8 control panel. UltimateScalperSuite2.zip -

angel938938 joined the community

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

prateekdubey07 replied to TickHunter's topic in Ninja Trader 8

Thank you so much! 🙂 -

This is a fully functioning version of HFT Min Bot. https://hftalgo.gumroad.com/l/minbot?layout=profile HFTMINBOT.zip

- Yesterday

-

Request : Orderflow indicator from [email protected]

roddizon1978 replied to ⭐ levelupdown's topic in Ninja Trader 8

It is almost the same as PIPFlow, probably better than it. But we need to let @apmoo work on it. -

Request indicator Pipflow advanced orderflow

roddizon1978 replied to TRADER's topic in Ninja Trader 8

@apmoo can you educate the files. Guys, do you have any information on Momentum trading? They are working In cooperation with Pipflow, they said that most Europeans are using this 2-site indicator and it is very successful. Thats why they probably win most of the Futures competition out there. -

ProEdgeATRsizing_5625.zip

-

ProEdgeATRsizing_5625.zip See if these are the original files to crack. EdgeRunnerAutoV2.0.zip

.thumb.png.d2342df9e4522b7908d9f6e3a988646f.png)