⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

SUBZERO reacted to a post in a topic:

https://ninjabotai.pro/

SUBZERO reacted to a post in a topic:

https://ninjabotai.pro/

-

booster reacted to a post in a topic:

https://ninjabotai.pro/

booster reacted to a post in a topic:

https://ninjabotai.pro/

-

Metastock 18 end of day c*****d.

⭐ chullankallan replied to ⭐ Atomo12345's topic in Trading Platforms

One issue that I have observed in Metastock D/C 19 and the R/T 19 version is that selecting the Explore or the System Test tab option doesn't work for scans and exits the app prematurely. Other functions work well - charting, indicators etc. This is working correctly in the D/C 18 version shared here earlier which had a different emulator. Perhaps other users can test and report feedback on this. -

⭐ chullankallan reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ chullankallan reacted to a post in a topic:

Metastock 18 end of day c*****d.

- Today

-

⭐ chullankallan reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ chullankallan reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

babun reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

babun reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) enters consolidation: everyone is watching the future Fed rate decision Gold (XAUUSD) prices have declined to 4,050 USD, with the market uneasy about future prospects. Find more details in our analysis for 24 November 2025. XAUUSD forecast: key trading points Market focus: gold (XAUUSD) is tracking shifts in sentiment regarding the Fed interest rate Current trend: despite the pullback, gold remains one of the year’s top performers with a 54% gain XAUUSD forecast for 24 November 2025: 4,040 or 4,100 Fundamental analysis Gold (XAUUSD) fell to 4,050 USD per ounce on Monday, extending Friday’s decline. The market is awaiting new US data that could clarify the Federal Reserve’s monetary policy outlook. This week’s key releases include retail sales and the Producer Price Index for September, due on Tuesday, and weekly jobless claims, scheduled for release on Wednesday. Expectations for a December rate cut shifted noticeably after New York Fed President John Williams expressed support for another reduction in the coming months. The market now estimates the likelihood of a 25-basis-point rate cut in December at roughly 70%, up from about 40% on Thursday after strong labour market data. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 368 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

I downloaded it compiled it, worked!

-

mmicro reacted to a post in a topic:

Replikanto

mmicro reacted to a post in a topic:

Replikanto

-

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ iatin reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ iatin reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Oh compatriota. Ti scrivo in italiano. Scarica la versione corretta da questo link: https://www.mediafire.com/file/g3di70zn30nnv8o/MSRT19.exe/file Dopo averla installata applica il crack. Cerca l'icona: MetaStock RT for XENITH Offline Mode Devi avviare la versione offline e tutto funziona. Saluti Oh, fellow countryman. I am writing to you in Italian. Download the correct version from this link: https://www.mediafire.com/file/g3di70zn30nnv8o/MSRT19.exe/file After installing it, apply the crack. Look for the icon: MetaStock RT for XENITH Offline Mode You need to start the offline version and everything will work. Best regards

-

ciao I've installed ms19-03-25252 from you link then installed after I launch the crack > execute Metastovk DC for Zenit but it always asks me user/psw credentials with hostname https://api.reutersdatalink.com/services/Head thinking I was doing something wrong with the setup, I deleted everything with revo uninstaller and installed MSRT19 from the link at the beginning of the thread, but even in this case it still asks me for credentials... it starts in offline mode but it stops (I don't care about offline).... same credential problem whether you run MMU now or later where I'm wrong ?

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

What is cryptocurrency and how does it work?

bluemac replied to CryptoFluxor's topic in Cryptocurrencies

I see many cryptos are shaking these days becuase of the btc markets but still some of the coins are still stable during the bitcoin corrections. -

Oana SSS reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Oana SSS reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Due to metastock needing logging in every 21 days, you need to apply crack every 21 days.

-

Market Technical Analysis by RoboForex

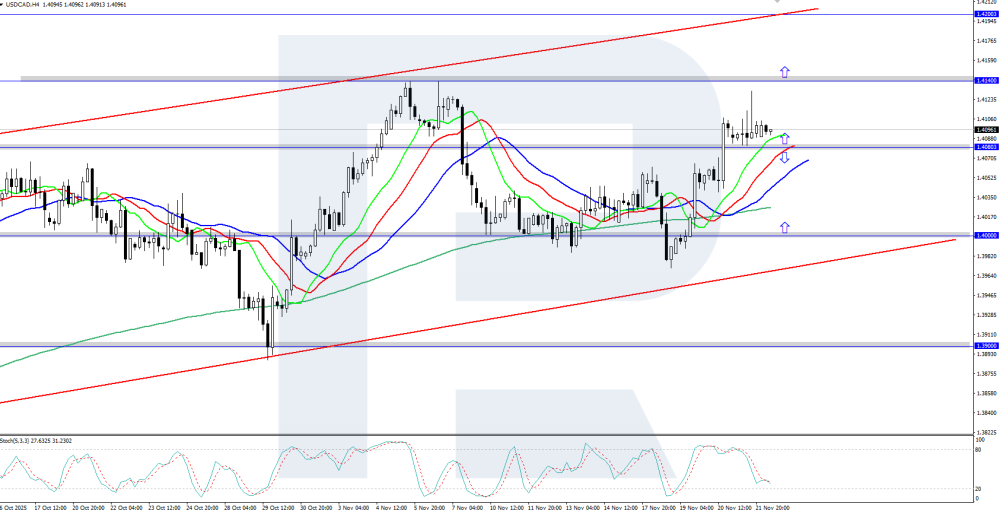

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD falls to support at 1.4080 The USDCAD rate declined towards 1.4080 during a downward correction amid rising expectations of another Fed rate cut. Discover more in our analysis for 24 November 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is declining within the current downward corrective phase. The overall daily trend remains bullish, meaning that once the correction ends, the pair may resume its upward movement. The USDCAD pair is moderately declining, approaching the 1.4080 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Do you mind sharing your settings? Here are mine for MNQ using backtest. London-7m.xml NY_AM_3m.xml

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 24th November 2025. Markets Rebound Ahead of Thanksgiving: Is a Fed Rate Cut Back on the Table? US stock futures climbed on Monday as markets entered the shortened Thanksgiving trading week, supported by growing optimism that the Federal Reserve may move towards an interest-rate cut in December. The rebound comes after a broad pullback earlier in the month that eased the pace of 2025’s strong AI-driven equity rally. Futures tied to major US indices showed a positive tone early in the day. Dow Jones Industrial Average futures edged higher by roughly 0.2%, S&P 500 futures advanced around 0.5%, and Nasdaq 100 futures gained close to 0.7%, signalling appetite for tech stocks after recent declines. The moves came as traders attempted to extend Friday’s rebound and position ahead of a data-heavy week. Market sentiment improved following comments from New York Federal Reserve President John Williams, who noted that a December rate cut remains a possibility. His remarks offered relief after a series of cautious statements from other policymakers. Still, November has been a difficult month for equities. The S&P 500 fell about 2% last week, widening its month-to-date decline to roughly 3.5%. The Nasdaq Composite lost 2.7% and is now down more than 6% in November, while the Dow slipped nearly 2% over the same period and is off close to 3% for the month. The declines reflect a broader reassessment of stretched valuations, particularly across AI-related sectors that led gains earlier in the year. The US is still dealing with the lingering impact of the longest government shutdown in its history, which has disrupted the release schedule for key data. Economic indicators are now slowly returning, and traders are watching closely. September’s producer price index and retail sales numbers are expected on Tuesday, followed by weekly jobless claims on Wednesday. These releases should help provide a clearer picture of inflation, consumer demand, and the potential timing of any Federal Reserve policy shift. Earnings season is also winding down with a relatively quiet lineup. Reports from Alibaba, Dell Technologies, Kohl’s, Best Buy, and a few other retailers will be the highlights of the holiday-shortened week. US markets will be closed on Thursday for Thanksgiving and will operate on a shortened schedule on Friday, closing at 1 p.m. Eastern Time. Trade policy remains another area of uncertainty. The Supreme Court is preparing to rule on whether the bulk of President Trump’s tariffs were imposed legally. According to reports, the Commerce Department and the Office of the US Trade Representative have been preparing contingency plans should the ruling go against the administration. The decision could have broad implications for global trade flows and corporate pricing strategies. Gold Prices Slip as Traders Weigh Prospects of a December Fed Rate Cut Gold prices edged lower on Monday as investors assessed the odds of a Federal Reserve rate cut before year-end, reducing demand for the precious metal. Gold futures traded near $4,055 an ounce after a modest weekly decline, with traders cautious amid mixed signals from US central bank officials. Despite the uncertainty, comments from New York Fed President John Williams, who noted that there may be scope for a near-term reduction in borrowing costs, helped gold pare some losses on Friday, although the metal still ended the session in the red. The delayed release of economic data due to the government shutdown has made it more difficult for markets to gauge the true likelihood of policy easing. The return of September retail sales and producer-price data on Tuesday, along with jobless claims on Wednesday, should provide a more reliable read on the economic landscape. Futures markets currently assign a little over 60% probability to a quarter-point rate cut in December. Gold has been consolidating after it surged to a record high above $4,380 per ounce on October 20. Even with recent softness, the metal remains up around 55% this year, supported by heightened geopolitical tensions, ongoing trade uncertainty, and concerns over deteriorating fiscal positions across major global economies. Analysts expect gold to continue trading within a relatively tight range for now. According to Ahmad Assiri, strategist at Pepperstone Group, the rate outlook is difficult to predict and may keep gold clustered around its current levels, creating an environment more conducive to two-way trading rather than sharp directional moves. Spot gold slipped 0.3% to around $4,051.69 an ounce in Singapore trading. Silver held steady, while platinum and palladium posted gains. The Bloomberg Dollar Spot Index was little changed, providing limited support for bullion. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Does anyone have the educated Ninza Solar Wind and Trend Magic Pro indicators to share? Thanks in advance!

-

For now I am using only Qzeus. I got the best backtesting results with it. Thank you. If anybody will crack it and I can get it, for sure I will try stealth mode.

-

Oana SSS started following https://ninjabotai.pro/

-

It’s not working gave csc code

-

Its OK I solve the problem, The problem is the chart or Market Profile doesn't work with 2 indicator MP, the indicator can work only by using one and there is a choice inside it to choose at least 4 time zone and it wll create its distinguish MP data according to its time zone

-

those files r not 2025 versions, people r posting same 2023/2024 files

-

Awesome! Much appreciated! can't wait for the others if you are doing them too!

-

True but look at the screenshots they attached.

-

I dont see them say it will be out on NT. They just keep saying EVO is coming to NT.

- Yesterday

-

Yeah, saw their announcement. Qmatrix seems to be based on HA candles rather than renko and available on NT but I don't see the file yet.

-

They just dropped QMatrix, a new algo. It is suposed to be very good.

-

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

TRADER replied to nanop's topic in Ninja Trader 8

u forget us @kimsam -

Put it in documents-ninjatrader 8-bin-custom & then open Ninjatrader. Click on new then click ninja script editor. Then click the compile button (keyboard with a down arrow). After the bot should show up in your list of strategies

-

do you have the .dll file? Or can I convert it to .dll?