⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Alain reacted to a post in a topic:

Two System Portfolio NQ - capstone trading systems

Alain reacted to a post in a topic:

Two System Portfolio NQ - capstone trading systems

-

⭐ rcarlos1947 reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

⭐ rcarlos1947 reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

-

card2006 reacted to a post in a topic:

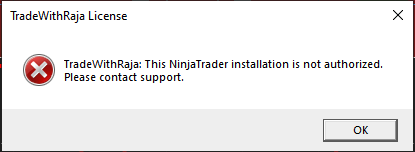

TradewithRaja

card2006 reacted to a post in a topic:

TradewithRaja

-

⭐ ajeet reacted to a post in a topic:

TradewithRaja

⭐ ajeet reacted to a post in a topic:

TradewithRaja

-

⭐ ajeet reacted to a post in a topic:

daytradelikeapro.com

⭐ ajeet reacted to a post in a topic:

daytradelikeapro.com

-

⭐ ajeet reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

⭐ ajeet reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

-

⭐ ajeet reacted to a post in a topic:

D@yTradeL1keAProTargetTradingSystem

⭐ ajeet reacted to a post in a topic:

D@yTradeL1keAProTargetTradingSystem

- Today

-

Guys is anyone is here??? Please help me to get RTM course video please

-

⭐ aniketp007 reacted to a post in a topic:

TradewithRaja

⭐ aniketp007 reacted to a post in a topic:

TradewithRaja

-

TRADER reacted to a post in a topic:

TradewithRaja

TRADER reacted to a post in a topic:

TradewithRaja

-

⭐ aniketp007 reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

⭐ aniketp007 reacted to a post in a topic:

Need to EDU ADTS Systems Full pack

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Short-term USDCAD dynamics remain bearish The USDCAD pair continues to decline amid positive macroeconomic data from Canada. The current quote stands at 1.3763. Details — in our analysis for 15 December 2025. USDCAD technical analysis The USDCAD pair is consolidating below the EMA-65, confirming persistent bearish pressure. The price structure points to the formation of a Triangle pattern with a projected target near 1.3680. The USDCAD outlook for today suggests a continuation of the decline, with the nearest target at 1.3690. Short-term USDCAD dynamics remain under pressure. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index reached its target level and corrected The DE 40 stock index has corrected, but the support level has held and the trend remains upward. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s CPI declined by 0.2% m/m Market impact: the data creates a mixed backdrop for the German equity market Fundamental analysis Germany reported a monthly CPI change of -0.2% m/m. The figure matched market expectations (-0.2%) but was significantly lower than the previous reading (+0.3%). In practical terms, this indicates a short-term decline in consumer prices and easing inflationary pressure compared with the previous month. For the German equity market, the key transmission channel is expectations for interest rates and bond yields. Lower inflation generally reduces the likelihood that the euro area will need to maintain high interest rates for an extended period. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 383 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 15th December 2025. Asian Markets Slip as BOJ Rate Hike Looms; Bitcoin Under Pressure. Asian equity markets opened the week lower, while bitcoin prices retreated as investors positioned ahead of a widely expected interest-rate hike by the Bank of Japan (BOJ) later this week. Broader risk sentiment remained fragile, with traders balancing central bank policy expectations, slowing Chinese growth signals, and renewed volatility in global technology stocks. Japan Stocks Fall Despite Improving Business Sentiment Japan’s Nikkei 225 index declined 1.3% to 50,168.11, even as the BOJ’s quarterly Tankan survey pointed to improving sentiment among large manufacturers. The diffusion index measuring optimism rose to 15 from 14 in the previous quarter, marking its highest level in four years. The Tankan index reflects the percentage of firms reporting favourable business conditions minus those reporting unfavourable ones. While current conditions improved, expectations for the coming quarter were less optimistic, highlighting ongoing uncertainty in Japan’s economic outlook. Japan’s economy contracted at an annualised pace of 2.3% in the July-September quarter, its first contraction in six quarters. However, uncertainty for export-heavy sectors eased following an agreement between Japan and the United States that limits baseline import tariffs to 15%, providing relief to major automakers and electronics manufacturers. BOJ Rate Hike Expectations Pressure Bitcoin and Risk Assets The stronger Tankan results reinforced market expectations that the BOJ will proceed with a 25-basis-point interest rate hike, lifting the benchmark rate to 0.75%. Higher domestic yields are expected to attract capital back into Japan, reducing demand for alternative assets such as cryptocurrencies. Bitcoin prices dropped below $88,000 early on Monday from around $92,000 before recovering to just above $90,000 later in the session, according to CoinDesk data. Chinese Markets Decline on Weak Investment Data Elsewhere in Asia, Chinese equities moved lower after fresh data underscored persistent weakness in domestic demand. Government figures showed fixed-asset investment, including spending on infrastructure and factory equipment, fell 2.6% year-on-year in November. This implied an 11.1% decline over the first eleven months of the year. Retail sales increased 4% over the January-November period, while industrial output rose 4.8%, offering limited reassurance amid broader concerns over economic momentum. The data followed a high-level meeting of China’s Communist Party leadership last week, which delivered no major policy changes. Officials reiterated commitments to boosting consumer spending and investment to support domestic demand. While policy support could drive a partial recovery in the coming months, it is unlikely to prevent China’s growth from remaining weak throughout 2026. Asia-Pacific Market Performance Overview Hang Seng (Hong Kong): Fell 1.4% to 25,625.60 Shanghai Composite: Declined 0.6% to 3,867.92 Kospi (South Korea): Dropped 1.8% to 4,090.59 ASX 200 (Australia): Slipped 0.7% to 8,640.60 Taiwan Benchmark Index: Lost 1.2% India Sensex: Little changed Wall Street Futures Stabilise After Tech-Led Sell-off US equity futures pointed modestly higher, with S&P 500 futures rising 0.2% and Dow Jones futures up 0.3%. On Friday, Wall Street retreated from record highs, with the S&P 500 falling 1.1% for its worst session in three weeks. Technology stocks led the decline, dragging the Nasdaq Composite down 1.7%, while the Dow Jones Industrial Average shed 0.5%. Broadcom weighed heavily on market sentiment, plunging 11.4% despite reporting quarterly profits that exceeded analyst expectations. While analysts described the results as solid, investor concerns surrounding the sustainability of the artificial-intelligence rally intensified. Oracle fell nearly 11% despite delivering a profit beat, fuelling broader worries about AI-related valuations. Nvidia shares declined 3.3%, while Oracle extended losses with an additional 4.5% drop. Markets Update In early Monday trading, US crude oil rose 26 cents to $57.70 per barrel, while Brent crude added 29 cents to $61.41 per barrel. The US dollar weakened against the Japanese yen, slipping to 155.16 from 155.92 late Friday. The euro edged lower to $1.1733 from $1.1739. Bitcoin and Crypto Markets Remain Range-Bound Bitcoin traded near $89,000 as Hong Kong markets reopened after the weekend, surrendering last week’s post-Federal Reserve rally. FlowDesk noted that demand faded quickly once the 25-basis-point Fed rate cut was delivered, with liquidity thinning into year-end. Bitcoin and Ether retraced midweek highs, while altcoins remained under pressure. The broader crypto market continues to reflect macro-driven caution rather than outright risk aversion. Despite surface-level hesitation, positioning beneath the market remains relatively stable. In a Telegram note, FlowDesk highlighted that leverage remains low, volatility is muted, and capital is rotating towards short-dated yield. Market participants are locking in longer-term funding at compressed rates, signalling a focus on balance-sheet optimisation rather than directional trades. Glassnode observed that bitcoin’s range-bound price action has prompted renewed buying from digital-asset treasury companies. Periods of reduced accumulation by such buyers have previously been cited as a factor behind bitcoin’s stagnation earlier in the year. This combination of cautious trading and quiet accumulation has left bitcoin confined to a broad trading range, with upside momentum fading but downside pressure remaining limited. Until leverage returns or macro conditions prompt accelerated treasury buying, price action is likely to stay subdued, even as ownership shifts toward longer-term holders. Market Movement Snapshot Bitcoin (BTC): Trading near $89,000, constrained by low liquidity and weak follow-through after giving back post-Fed gains. Ethereum (ETH): Showing relative resilience, holding gains better than Bitcoin amid selective demand and lower selling pressure. Gold: Consolidating near record highs around $4,300 per ounce, supported by global rate cuts, elevated debt levels, and sustained central bank demand. Nikkei 225: Asian markets opened lower as investors assessed Wall Street’s pullback, China’s November activity data, and Japan’s improving business sentiment. Oil Prices Edge Higher Amid Glut Concerns and Geopolitical Risks Oil prices rose modestly from the lowest levels in nearly two months, supported by signs of stronger Chinese demand even as oversupply concerns continue to weigh on the market. Brent crude hovered near $62 a barrel, while West Texas Intermediate traded close to $58 in thin holiday trading ahead of Christmas and New Year. China’s apparent oil demand and refining activity were higher year-on-year in November, though other economic indicators pointed to broader weakness. Oil prices are on track for an annual decline amid expectations of a growing surplus as OPEC+ and other producers increase output despite soft demand growth. Oversupply concerns are increasingly evident in Middle Eastern crude markets, although geopolitical risks continue to provide a floor under prices. Ukraine intensified attacks on Russian energy infrastructure over the weekend, striking a major refinery and an oil depot in an effort to disrupt revenue streams funding Moscow’s war effort. Meanwhile, US President Donald Trump dispatched envoys to Berlin for another round of talks aimed at ending the conflict. In parallel, Iran reported seizing a foreign tanker in the Gulf of Oman suspected of carrying smuggled fuel, while the United States intercepted a vessel off Venezuela as pressure mounts on President Nicolás Maduro’s regime. Trump has also reiterated threats of US strikes against drug cartels. With Brent crude trading volumes below daily averages, price movements are likely to be amplified, increasing the risk of choppy and volatile market conditions. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

-

I tried to import and got an error saying it's for older version of NT. Which version of NT are you using?

-

Unext started following can anyone help me to get rtm course please

-

can anyone help me to get rtm course , please please please please .

-

can you show us what settings to use?

-

Can someone share Read The Market Courses?

Unext replied to devils_advocate's topic in Forex Clips & Movies

hey can you please re upload those file please , please anyone? please guys. -

Hey everyone, I need RTM video. Please help me to get this. I belong to very poor family, I wanted to do something in trading I want to learn.please help me to get those video.

-

Private Training Course by RTM founder Ifmyante

Unext replied to ⭐ insaneike's topic in Forex Clips & Movies

Hy everyone,hope you all are fine , I come from very lower class family, i want to learn and doing somethings in trading . i come here with alots of hopes, i searched everywhere abbout RTM but i coludn't find the things what i wanted, this is my last hope and option to post here for help. if anyone have old or new rtm video link please help me. -

Unext joined the community

-

Thanks Wonderfull

-

https://workupload.com/file/4HcJdbTJuvt Thanks

-

Thanks, @apmoo ! Seems to work great. I cannot post more screenshots or file.. I found this YT channel: https://www.youtube.com/@FreeLearnTradewithraja

-

@apmoo @kimsam Thanks 🙏

-

@apmoo @kimsam Thanks 🙏

-

https://workupload.com/file/RkjxrZcrcQx Thanks

-

is this new version? i think old version ADTS has been posted here sometime ago

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

just Sharing here if @apmoo unlock it and any body wants use it thanks ADTS_full_pack 2.zip