All Activity

- Past hour

-

Harishkc01 joined the community

-

Elliott Wave International’s Educational Video Series

Harishkc01 replied to fdd2k2's topic in Forex Clips & Movies

Can please someone share working link again here. God bless you. -

Investors be aware: Copy Trading Investment Scam

fxtrader99 replied to fxtrader99's topic in Announcements

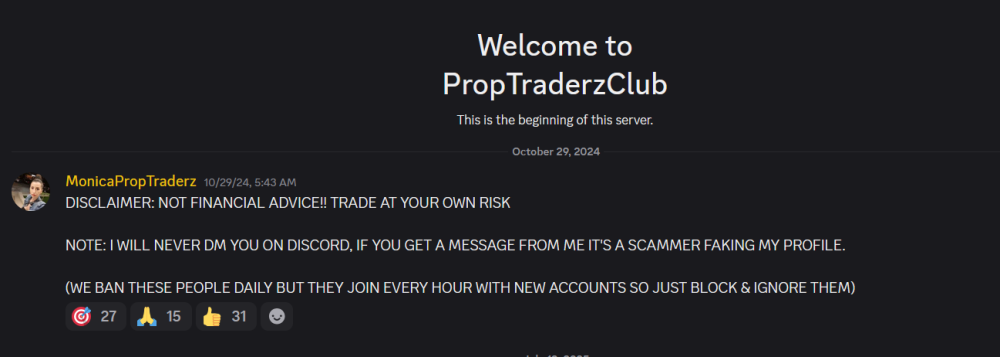

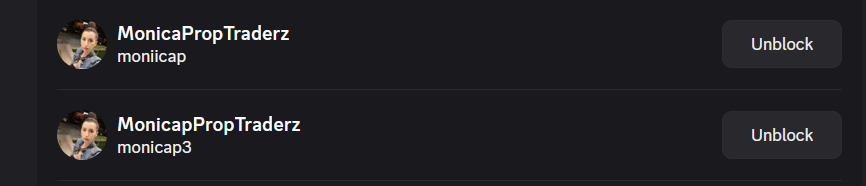

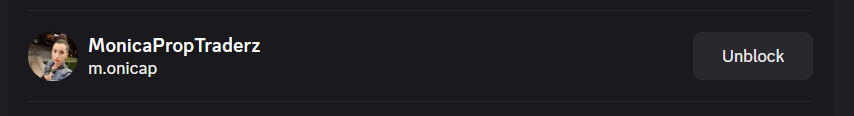

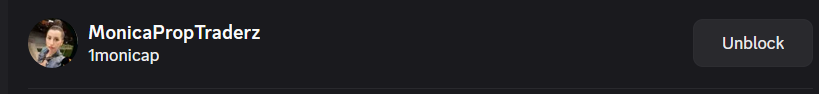

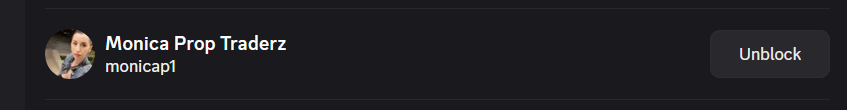

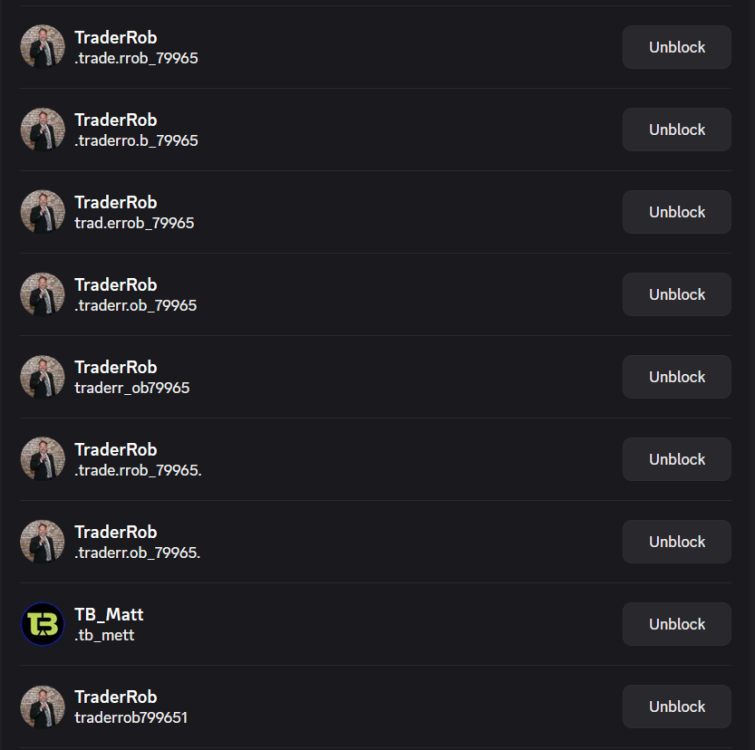

@DAO, who are you really & why are you so mad? I have already said to the real MonicaPropTraderz (monicap) that I would refer MonicaPropTraderz mentioned in my post as a fake and impersonator, and I am trying to get the post edited by the moderator. As I was new to Discord and unaware of impersonators, I didn't double-check for the fake IDs. Also, I joined that channel with the fake invite posted in one of the threads here. So, the impersonator was a member her too. As I mentioned, I didn't ask the right questions and ignored the red flags. If I was able to spot the difference in Discord ID, I would not have been scammed. That is the reason for this post so that novice investors/traders become aware of such scams. -

Bene reacted to a post in a topic:

https://www.alphaautotrading.com/

Bene reacted to a post in a topic:

https://www.alphaautotrading.com/

-

Bene reacted to a post in a topic:

Interesting bots

Bene reacted to a post in a topic:

Interesting bots

-

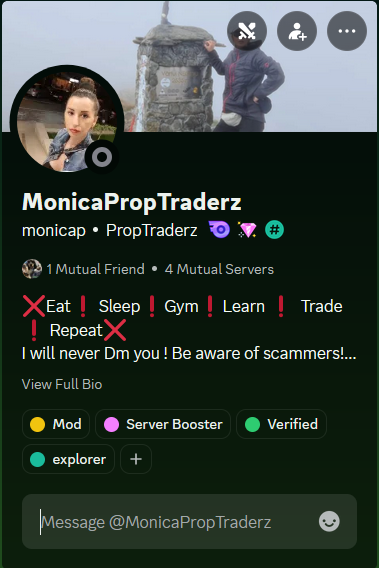

Are you capable to spot the difference in the names? Can you see the mutual servers listed in her profile?

-

-

Let's get something straight. You are a member on her server, read the rules and the paragraph where she specifically said she will never DM anyone or offer any services yet you decided to go ahead and carry on a conversation with the impersonator. If you have been on Discord for more than one day you should know every single server owner has dozens of impersonators who are taking advantage of naive people and scamming them out of their money easily. Then you never ever posted a question on her server asking if that is really her, or ask anyone if they are having her trade for them. Never did any due diligence. Awesome. At least you know how to cry about it. No, you did not. Then you start crying she scammed you. And you are still not sure it was an impersonator. Good job dude. Smart people (scammers) are separating fools from their money. Check this out:

- Today

-

eure reacted to a post in a topic:

Investors be aware: Copy Trading Investment Scam

eure reacted to a post in a topic:

Investors be aware: Copy Trading Investment Scam

-

⭐ mangrad reacted to a post in a topic:

Interesting bots

⭐ mangrad reacted to a post in a topic:

Interesting bots

-

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ sapperindi reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

- Yesterday

-

Read more

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

AR99 reacted to a post in a topic:

IBD Home Study Program

AR99 reacted to a post in a topic:

IBD Home Study Program

-

Ninja_On_The_Roof reacted to a post in a topic:

Interesting bots

Ninja_On_The_Roof reacted to a post in a topic:

Interesting bots

-

truthsavvyyy joined the community

-

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

(12) Facebook (12) Facebook This are two scammers, scam me, and still scamming people on crypto, report them as scammer by cliking the 3 period from the right top and will see a report profile, get rid of them before somebody you care will be victimized. -

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

Download it quickly I need a favor for you guys , to take out a facebook scammer , just report him as a scammer. He scam me last 2 month ago, we need to take down, somebody who is hurting the trading community -

kadi reacted to a post in a topic:

https://www.alphaautotrading.com/

kadi reacted to a post in a topic:

https://www.alphaautotrading.com/

-

-

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

-

Harrys reacted to a post in a topic:

HFT SPECTRE Group Buy

Harrys reacted to a post in a topic:

HFT SPECTRE Group Buy

-

Anyone can educate with Viper Trading Indicator?

⭐ fryguy1 replied to Tasfy's topic in Ninja Trader 8

https://anonymfile.com/nWz7b/2-3-ld-le-sd-se-rd-re-what-are-those.mp4 https://anonymfile.com/g3Qby/1-1-phantom-trade-details.mp4 https://anonymfile.com/9BW0W/1-2-midband-tradesetups-details.mp4 https://anonymfile.com/bVbQa/1-3-line-in-the-sand.mp4 https://anonymfile.com/oeqXO/2-1-object-trader-initial-setup.mp4 https://anonymfile.com/BXLBY/2-2-t-b-buttons.mp4 -

I don't use ARC but this file is not educated

-

I don't use ARC but this file is not educated

-

Investors be aware: Copy Trading Investment Scam

fxtrader99 replied to fxtrader99's topic in Announcements

Thanks @Azazel This is good information. I wish I knew or read about this earlier! -

Investors be aware: Copy Trading Investment Scam

fxtrader99 replied to fxtrader99's topic in Announcements

Ah! You @DAO joined an hour ago and post this reply immediately. There must be something you have to gain by posting this! -

Looks to be in Spanish, looks interesting. Use browser to translate. https://www.fondeotrading.net/bots-ninjatrader-8 https://brunomeza.com/en/

-

DAO joined the community

-

You fell for the great work of a Discord impersonator and it is nobody's fault but yours. Monica has nothing to do with and even at this point you can't comprehend that fact which says a lot about how and why you got scammed.

-

Thank you for wanting to raise awareness, but I want to clarify something important: while your intention is appreciated, your post still contains misleading information because it shows my real name and brand directly, rather than clearly stating that the scammer was impersonating me. Even if the fake username appears lower in the post, the headline and context may confuse others into thinking I was involved, which can damage my reputation. To avoid confusion, please update the post to clearly state: “This was a scammer impersonating Monica from PropTraderz,” rather than just listing my name. Let’s protect the community without unintentionally harming real people. Thank you for understanding.

-

PTZ changed their profile photo

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: index hits a new all-time high US 500 approached a resistance level and may enter a downward correction before resuming its upward movement. The forecast for US 500 today remains positive. US 500 forecast: key trading points Recent data: US Leading Economic Index (LEI) for June declined by 0.3% Market impact: This is a negative signal for equities, as the LEI consists of 10 components reflecting future economic activity Fundamental analysis The US Leading Economic Index (LEI) dropped by -0.3% in June, compared to expectations of -0.2% and a flat reading the previous month. The decline in the LEI serves as a warning of a potential slowdown in economic activity over the next 6–12 months. While the drop isn’t critical, it signals a weakening growth momentum in the US economy. This could limit risk appetite in the stock market and strengthen expectations of Federal Reserve rate cuts. The decline in the LEI, against already subdued expectations, supports a more cautious approach. In the short term, investors may rotate from cyclical into defensive sectors. If signs of slowing growth persist, this could increase the likelihood of more accommodative monetary policy, potentially supporting the tech sector. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 283 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD: the pair surged above 1.3500 The GBPUSD rate climbed above 1.3500, as markets anticipate the signing of a free trade agreement between the UK and India. Full details in our analysis for 23 July 2025. GBPUSD technical analysis On the H4 chart, GBPUSD shows a clear upward momentum, having bounced from daily support at 1.3370. The Alligator indicator is pointing upwards and rising steadily, suggesting the uptrend may continue. GBPUSD confidently rose above 1.3500. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

jaych08 joined the community

-

Hello. Any news about this?

-

hybrid76 started following dtb strategy pack need edu

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 23rd July 2025.[/b] [b]Nikkei225 Surges on US-Japan Trade Deal: Can the Rally Hold?[/b] President Trump confirms that US and Japanese negotiators have agreed on a trade deal that covers more than just the reciprocal trade tariffs imposed by the US. As a result, the NIKKEI225 increased 4.45%, the strongest bullish price movement since April 10th 2025. Can the NIKKEI225 maintain the current bullish momentum? US-Japan Trade Deal On July 22nd, President Trump informed journalists that the US and Japan have agreed on a trade deal after weeks of negotiations. Previously, the NIKKEI225’s price momentum was muted by fear of trade tariffs and trade clashes with the US. Over the past 2 weeks the White House advised they were aiming for 25% tariffs on Japan and other Asian countries. Instead of 25% reciprocal tariffs on Japanese imports, the US will impose a 15% rate, which is significantly lower than the initial proposal. In return, there will be $550 billion worth of Japanese investments in the US, with 90% of the returns returning to American stakeholders. The two countries also confirm a joint venture on liquefied natural gas from Alaska. However, a negative factor for Japan continues to be the Steel and Aluminium tariffs, which will remain at 50%. The deal provides much-needed relief for the Japanese economy and stocks. Particularly, the car industry. Toyota stocks are currently surging 14% during this morning’s session. Can The NIKKEI225 Maintain Its Bullish Momentum? The NIKKEI225 rose 4.45% forming a bullish breakout and increasing to its highest level since July 17th 2025. On smaller timeframes, such as the 15-minute chart, the RSI and other oscillators are indicating an overbought price. The price has also lost momentum since the opening of the EU session. However, investors should note that an increase of 4.50% is not out of character for the NIKKEI225. The last time the index saw a similar increase was on April 10th, where the price rose more than 9.00%, almost double the current increase. Therefore, upward price movement remains possible despite overbought indications on smaller timeframes. However, it is vital for bullish momentum to be regained. Traders should also note that the price is not at an all-time high despite the magnitude of the recent bullish price movement. The all-time high remains 2.70% higher than the current price. This level is a known resistance level, and traders should be cautious of its psychological edge over investors. Though a further increase is needed to reach this level. Yen and BOJ Supports NIKKEI225 Growth Other positive factors for the Nikkei 225 include a weaker yen and no rate hikes from the Bank of Japan. The yen has declined following upper house elections, where the ruling LDP–Komeito coalition failed to secure 50 of 124 seats, its second straight defeat after losing the lower house last fall. While Prime Minister Shigeru Ishiba remains in power, his minority government now depends on opposition support for economic action, which experts say will be challenging. Ishiba has stated he will stay in office until a US trade deal is finalised, which it now has been. Lastly, the Bank of Japan has not raised interest rates in six months. This is despite earlier expert expectations that the policy rate would rise to 1.00%. The lack of interest rate hikes supports the NIKKEI225. However, technical analysts will be keen for the instrument to rise above 41240.50 in order for buy signals to return. NIKKEI225 12-Hour Chart Key Takeaway Points President Trump confirmed a trade deal with Japan, reducing proposed tariffs from 25% to 15%. This is sparking a 4.45% surge in the Nikkei 225, which rises to its highest level in 2025. Despite the strong breakout, technical indicators show overbought conditions on small timeframes. Buy signals remain for the medium-term. A declining yen and the Bank of Japan’s six-month pause on rate hikes continue to support the Nikkei 225. Toyota stocks increase by more than 14% and Japan’s car industry rebounds as a trade deal is agreed. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.