All Activity

- Past hour

-

Bene joined the community

- Today

-

They are all very suspicious to me. Why ? because the program i bought from them just stop, with no reason at all. Because most of them are token depended and if they change and work on their token server, your indicator will suddenly stop or not work. Probably they do it intentionally to get your attention or maybe they changed thing, we don't know, that's why it sucks.

-

Does anybody have an educated telegram to MT4 copier program Telegram Signal Copier | Telegram to MT4 | Telegram to MT5 | Telegram to cTrader

-

brokeyforamibroker

-

Are they? I didn't think they were, I had talked to one had a app, talked to the other and didn't? Both good who ever!

-

PredatorXOrderEntry_V3.0.0.1kM.dll this one works , maybe we can figure out why the plotmode doesnt reveal plots on the chart, Im using the PredatorIndicators_ANY dll that was in the last 3.0002

-

prodisoft reacted to a post in a topic:

orderflowlabs.com

prodisoft reacted to a post in a topic:

orderflowlabs.com

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 16th July 2025.[/b] [b]Mixed US CPI Data Clouds Fed Outlook While Global Markets React to Tariff Jitters.[/b] US financial markets remained choppy following the release of June's CPI report, which presented a mixed inflation picture. While headline consumer prices rose 0.3%—the largest gain since January—core inflation cooled slightly, increasing by just 0.2%. This combination has left investors and policymakers without a clear signal on the direction of the US economy, tempering hopes for a Federal Reserve rate cut in the near term. Rate cut expectations for the September FOMC meeting slipped to 60%, down from 68% earlier this week. Fed fund futures now reflect a lower implied rate of -14 basis points for September, compared to -18.8 bps after the June jobs report and -29 bps following weaker-than-expected ADP data on July 2. The probability of a second cut in December has also decreased, with the December contract pricing in -44 bps, down from a fully priced -50 bps earlier. Inflation Drivers and Tariff Impact June's CPI surge was driven by a 0.9% increase in energy prices, including a 1.0% rise in gasoline costs. Other contributors included medical care services (+0.6%), tobacco (+0.5%), and apparel (+0.4%). Meanwhile, vehicle prices dragged on the index, with new vehicles falling by 0.3% and used vehicles declining by 0.7%. Year-over-year, headline CPI rose to 2.7%, while core CPI edged up to 2.9%. Economists attribute much of the price pressure to the Trump administration’s tariff increases, particularly in sectors like coffee, furniture, and pharmaceuticals. As Fed Chair Jerome Powell previously warned, the inflationary effects of these tariffs are beginning to show, and could continue building into the third quarter, especially as the August 1 tariff deadline approaches. Treasury Yields Rise, Nasdaq Hits Record Despite the cooler core reading, Treasury yields rose sharply, with the 10-year yield reaching 4.495%, the highest since June 11. This movement was partially driven by technical selling and growing concerns that tariff-induced price hikes could spill over into PCE inflation data. Meanwhile, the tech-heavy Nasdaq rallied to fresh record highs, supported by a strong performance from AI bellwether Nvidia. Global Central Banks in Focus The Bank of England is also facing inflation challenges. UK inflation unexpectedly accelerated, with headline CPI rising to 3.6% year-over-year and core CPI climbing to 3.7%. Services inflation held steady at a concerning 4.7%. BoE policymaker Catherine Mann warned that job insecurity is driving consumer caution and increased savings, which may weigh on growth sectors like retail and hospitality. While another rate cut in August is still likely, these inflation numbers may reduce the likelihood of a rapid easing cycle. Asia, Oil, and Commodities Asian equity markets were broadly under pressure as rising US yields and a stronger dollar weighed on investor sentiment. The dollar climbed to its highest against the yen since early April, driven by speculation that the Fed may delay any easing. Mainland Chinese blue chips fell 0.5%, while South Korea's KOSPI declined 1%. Taiwan’s tech-heavy index bucked the trend, rising 0.9%. Meanwhile, oil prices hovered near recent lows, with Brent crude trading at $68.96 a barrel. Despite rising global inventories, Morgan Stanley noted that much of the buildup occurred outside OECD nations, limiting its impact on futures pricing. The bank retained its Brent forecast at $65 for Q4 2025, but warned that post-summer demand might not be enough to prevent a renewed surplus. Gold regained ground, trading near $3,340 an ounce, supported by continued geopolitical tensions and strong central bank buying. Bitcoin, meanwhile, rebounded 1% after a recent pullback from its record high above $123,000. Looking Ahead Investors are now turning their attention to upcoming producer price data for additional clues on inflationary trends. Meanwhile, earnings season is ramping up, with mixed results from major banks like JPMorgan and Citigroup and more reports due from Goldman Sachs, Morgan Stanley, and Bank of America. As global markets continue to digest a flurry of data and geopolitical developments, the coming weeks may provide more clarity on central bank policy paths and broader economic trends. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

While on demo, try intentionally losing money for a day. You will see it's not that easy and will learn more about money management and risk management by this practice than from any course.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

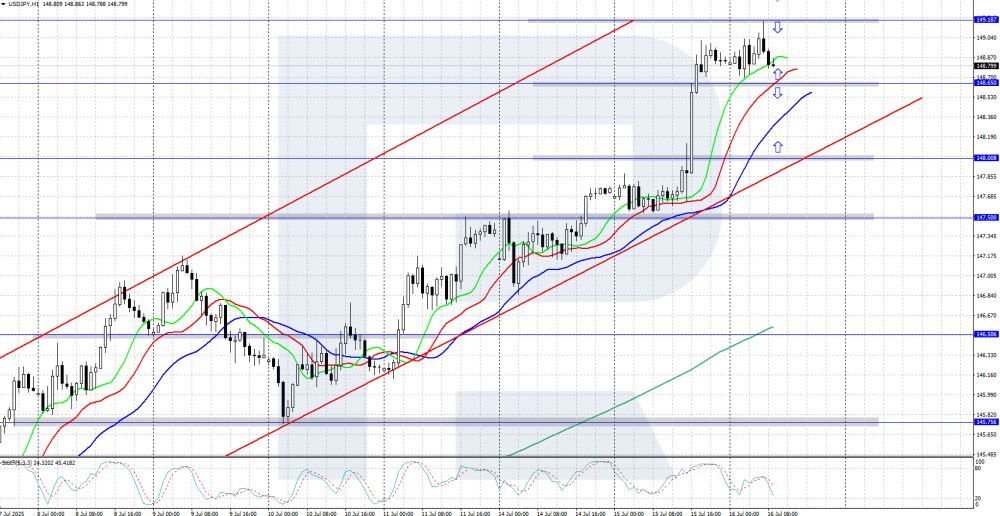

USDJPY jumps above 149.00 on US inflation data The USDJPY rate climbed into the 149.00 area as the dollar strengthened moderately after the release of US consumer inflation statistics. Find out more in our analysis for 16 July 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair continues to climb confidently, hitting an intraday high at 149.18. The Alligator indicator is trending upwards, confirming the current bullish momentum. However, the Stochastic indicator signals overbought conditions, which may trigger a corrective pullback. The USDJPY pair climbed to the 149.00 area during the ongoing uptrend. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rebound or failure? GBPUSD hangs in the balance In anticipation of data from the UK and the US, GBPUSD quotes may reverse and head towards the 1.3500 mark. Discover more in our analysis for 16 July 2025. GBPUSD forecast: key trading points UK Consumer Price Index (CPI): previously at 3.4%, projected at 3.4% US Producer Price Index (PPI): previously at 0.1%, projected at 0.2% GBPUSD forecast for 16 July 2025: 1.3500 Fundamental analysis The GBPUSD forecast for 16 July 2025 takes into account that the pair remains in a correction phase and is currently near the support level of the ascending channel. The UK Consumer Price Index reflects changes in the cost of goods and services for consumers and helps assess consumer behaviour trends and potential stagnation in the economy. Generally, if the CPI exceeds expectations, it has a positive impact on the national currency. The forecast for 16 July 2025 suggests the CPI for June 2025 may remain at 3.4%. Any increase would support the British pound. The US PPI is expected to rise to 0.2%, up from 0.1% previously. However, the increase is modest, and the actual figure may differ significantly from the forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 278 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Can re upload files pls

-

Demo accounts can be good way to learn without risking any real money.

-

Can re upload files pls

-

There is a saying to invest what you can afford to lose in the trading markets so money management is important in considering while preserve your actual capital.

-

knagendratl started following (REQ)TRADEGUIDER VSA For NT7) please John Help unLOCK and [Req] Tradeguider 4.5

-

Can anyone re-upload this tradeguider pls

-

⭐ osijek1289 reacted to a post in a topic:

cotbase.com

⭐ osijek1289 reacted to a post in a topic:

cotbase.com

-

Hi @apmoo @kimsam This indicator works perfectly, but an annoying popup appears during reloads or when adding it to a chart... Do you think you could fix this? Thank you, as always, for your work, and have a great summer!

-

yes anyone can re upload ?

-

Sunday reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

Sunday reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

-

Sunday reacted to a post in a topic:

SQUARING THE CIRCLE BY George Bayer

Sunday reacted to a post in a topic:

SQUARING THE CIRCLE BY George Bayer

-

(REQ)TRADEGUIDER VSA For NT7) please John Help unLOCK

knagendratl replied to a topic in Ninja Trader 7

Can re upload files pls -

Dhanush joined the community

-

LOL , Thats what I gonna say too, every time the other don't work, Joey or his programmer, is selling another version of his High frequency trading bot. Maybe try the Sniper Bot.

-

You have free Bookmap now you want free rithmic data, are you a real trader

-

roddizon1978 reacted to a post in a topic:

Is val1312q legit?

roddizon1978 reacted to a post in a topic:

Is val1312q legit?

-

fxzero.dark started following Edge Runner Auto (from Pro Edge Trading)

-

fxzero.dark reacted to a post in a topic:

𝕄ℤ ℙ𝕒𝕔𝕜 𝟛.𝟙𝟝 (Educated)

fxzero.dark reacted to a post in a topic:

𝕄ℤ ℙ𝕒𝕔𝕜 𝟛.𝟙𝟝 (Educated)

-

can kindly attach the file here? Thank you.

-

= downloadtradingsoftware

-

All bots look "promising" on the websites where they are being advertised and sold. Until your bank account gets depleted and you then suddenly realize, you already had hundreds and thousands of other bots on your computer, not in use since long ago.

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.