⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

can someone please re upload this indicator ,I cant find it in my files thanks

- Today

-

LegendaryTrader Indicator - Newest Versions

maik wills replied to Ricardo44's topic in Ninja Trader 8

Hello, good evening. Can anyone help me? Version 6.0 isn't working for me; it's asking for a license. Thank you. -

Oana SSS started following NINZA Bo$$ Order Block

-

Oana SSS reacted to a post in a topic:

NINZA Bo$$ Order Block

Oana SSS reacted to a post in a topic:

NINZA Bo$$ Order Block

-

Thank you. I am going to test if on a prop firm. Not too many accepting EAs and using NT8 as a platform.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 20th November 2025. Nvidia’s Blowout Results Lift Global Stocks Ahead of Key NFP Jobs Data. Asian Markets Rally After Strong Nvidia Earnings Boost Global Risk Sentiment Asian stock markets surged on Thursday after Nvidia reported quarterly earnings far exceeding expectations, easing fears that the AI-driven market rally may have overheated. The tech giant’s exceptional results helped lift global sentiment, sending US futures, Asian indices, and major tech stocks sharply higher. Nvidia Earnings Spark Global Market Optimism Nvidia’s announcement of $57 billion in quarterly revenue, well above analyst forecasts, immediately reassured investors that demand for AI-related technologies remains resilient. The company’s earnings report helped push futures linked to the S&P 500 up 1.3% and Dow Jones futures up 0.7%, setting the tone for global trading. Nvidia, which recently became the largest company on Wall Street after briefly crossing a $5 trillion valuation, rose 2.8% during Wednesday’s session and surged more than 5% in after-hours trading. With its growing weight in the index, the company’s results continue to play a significant role in shaping broader market direction. Asian Markets Surge on Tech Strength Japan’s Nikkei 225 soared as much as 4.2% in early trading before settling to a 2.7% gain at 49,854.20 by the afternoon. Investors reacted positively to Nvidia’s performance, which lifted Asian semiconductor and technology stocks across the region. South Korea’s Kospi advanced 2.5% to 4,026.12, supported by renewed strength in the chip sector. Samsung Electronics climbed 5%, while SK Hynix added 2.2%. Optimism was further boosted by reports that the United States may delay planned semiconductor tariffs, providing additional relief to the region’s exporters. Not all markets shared in the rally. Chinese equities slipped, with the Hang Seng Index down 0.2% and the Shanghai Composite down 0.4%, as concerns resurfaced about the government’s next steps to stabilise the struggling property market. The People’s Bank of China left its one-year and five-year loan prime rates unchanged, adding to cautious sentiment. Elsewhere, Taiwan’s Taiex gained 3.2%, India’s Sensex rose 0.4%, and Australia’s S&P/ASX 200 climbed 1.2% on strong tech-sector performance. Wall Street Stabilises Ahead of Key US Data US markets experienced another volatile session on Wednesday before the S&P 500 closed 0.4% higher, breaking its longest losing streak in nearly three months. The Dow Jones Industrial Average added 0.1%, and the Nasdaq Composite rose 0.6%. Investors remained focused on Nvidia throughout the day, using the company’s results as a barometer for the broader AI investment cycle. Nvidia’s ability to consistently deliver strong profits is central to calming fears that AI valuations have become excessive. The stock had recently pulled back about 10% from its highs, making the latest earnings report a crucial moment for the market. Investors Await US Jobs Report and Fed Direction Market attention now shifts to the upcoming US September jobs report, a key indicator for assessing whether the Federal Reserve may continue cutting interest rates. The slowing labour market led the Fed to cut rates twice this year, and investors had been pricing in the possibility of another reduction in December. However, recent comments from Fed officials suggested that policymakers may take a more cautious approach, especially as inflation remains above the 2% target. A potential pause in rate cuts has added fresh uncertainty at a time when equities remain sensitive to monetary policy signals. Oil Prices Steady as Russia Sanctions Take Effect Oil prices stabilised after a sharp decline on Wednesday as traders assessed the impact of upcoming US sanctions on Rosneft and Lukoil, which take effect on Friday. Brent crude traded near $64 per barrel, while West Texas Intermediate hovered below $60. The sanctions have already begun redirecting global oil flows, particularly affecting shipments to India,and have prompted Lukoil to seek buyers for several international assets. At the same time, the European Union is exploring additional measures to tighten pressure on Moscow. Currency Market Movements Reflect Broader Policy Expectations The US dollar strengthened to 157.58 yen, reflecting expectations that Japan may delay fiscal tightening as Prime Minister Sanae Takaichi increases spending to support the economy. The euro slipped slightly to $1.1523 as broader market uncertainty persisted. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

This is using regular candles so I think it is good.

-

⭐ insaneike reacted to a post in a topic:

For insaneike. Your Amibroker 6.35.1 32 and 64 bit

⭐ insaneike reacted to a post in a topic:

For insaneike. Your Amibroker 6.35.1 32 and 64 bit

-

For insaneike. Your Amibroker 6.35.1 32 and 64 bit

⭐ insaneike replied to ⭐ Atomo12345's topic in Amibroker

Thanks mate. Totally appreciate it. I've a lot of code written in AFL and use multiple time frames and have EOD + Intraday data at my end in Amibroker. Will try Metastock as per your suggestion too as and when time permits. Thanks for sharing this though. -

For insaneike. Your Amibroker 6.35.1 32 and 64 bit with the crack for 32 bit. I counsel you to use Metastock 18 then Amibroker. https://e.pcloud.link/publink/show?code=XZuQzAZItWzD37goHRNLzrDg0lKAuzpVRKy

-

maik wills joined the community

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Boka replied to luludulu's topic in Ninja Trader 8

Did you find any good settings for current version -

AndyDiamond reacted to a post in a topic:

quantvue.io

AndyDiamond reacted to a post in a topic:

quantvue.io

-

AllIn reacted to a post in a topic:

quantvue.io

AllIn reacted to a post in a topic:

quantvue.io

-

dex reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

dex reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

Check above.. ynr already shared the link

-

Can you link to 1.0.0.8 that is edu?

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

By the way, they announced new release for this weekend. More presets and usable on RTY. Will share if I manage to get my hands on it. -

Thank you very much. You are very kind.

-

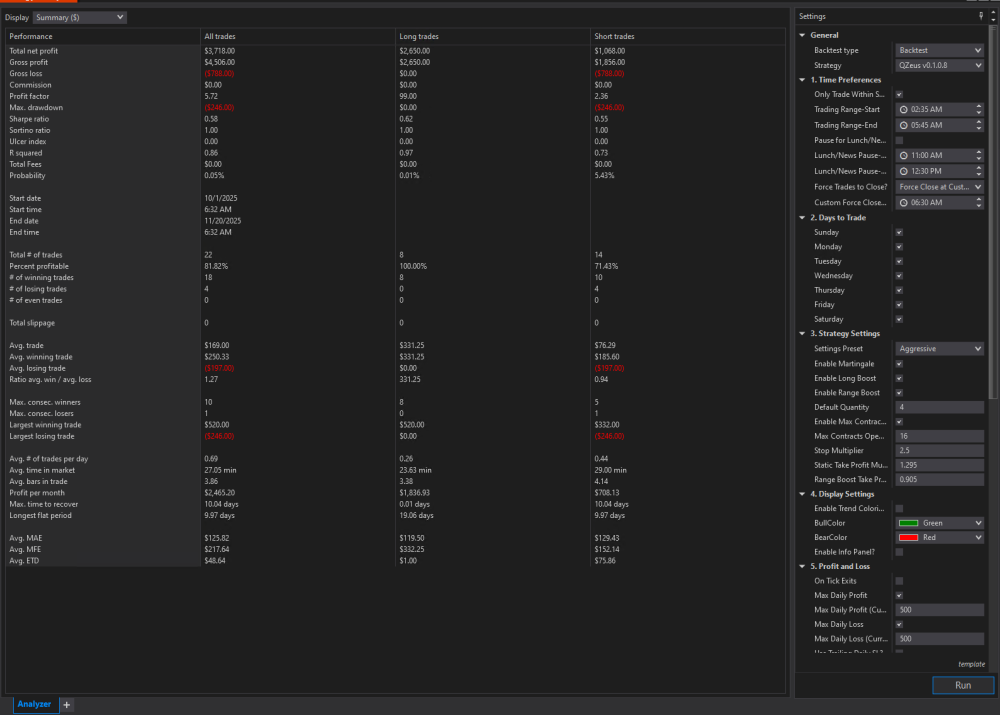

Thank you for sharing. I backtested it and also got a good profit factor, even for the entire 2025. Could the results actually be this good?

-

Oana SSS reacted to a post in a topic:

quantvue.io

Oana SSS reacted to a post in a topic:

quantvue.io

-

atljam reacted to a post in a topic:

quantvue.io

atljam reacted to a post in a topic:

quantvue.io

-

atljam reacted to a post in a topic:

quantvue.io

atljam reacted to a post in a topic:

quantvue.io

-

Thanks for sharing. Need to do more backtesting. Do you set specific time for London session (like 3:00AM EST to 5AM?

-

⭐ sapperindi reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ sapperindi reacted to a post in a topic:

Sentient Trader 4.04.17

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

it crashes if you are using older version of NT. Use newer one. -

Night reacted to a post in a topic:

quantvue.io

Night reacted to a post in a topic:

quantvue.io

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index forms a sideways channel The JP 225 stock index corrected towards the support level, but the global trend remains upward. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s GDP in Q3 2025 decreased by 1.8% Market impact: moderately negative for the Japanese stock market Fundamental analysis Japan’s annualised GDP indicator showed a decline of -1.8% versus the forecast of -2.5% and the previous growth of 2.3%. This means the economy shifted from expansion to contraction, although the downturn turned out to be less severe than analysts expected. Formally, this still signals cooling: companies on average produce and sell less than a year ago, and both domestic and external demand weakened. Such data is generally negative for the Japanese stock market because a weaker economy usually implies cautious consumer and business behaviour, slower investment activity, and pressure on company revenues, especially those focused on the domestic market. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 366 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

dotx joined the community

-

-

Is this available anywhere here, I dont see it, send link if you have please thanks

-

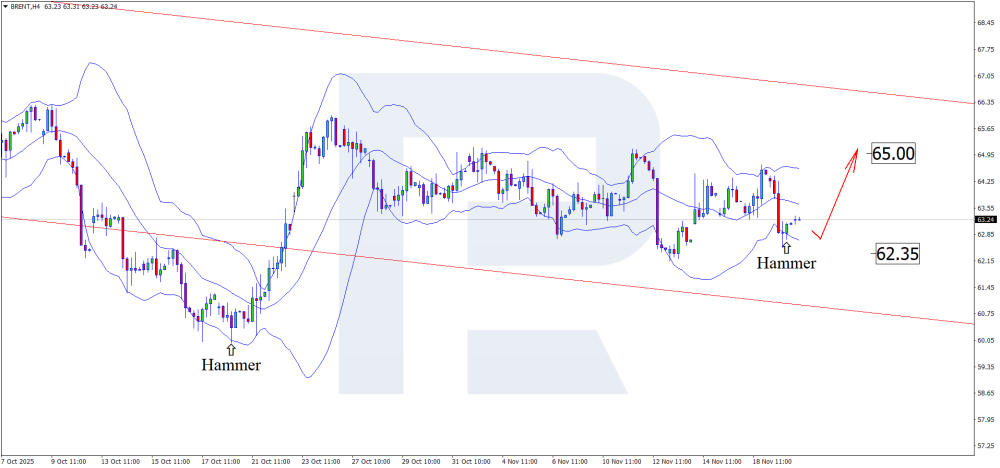

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Oversupply or shortage? Brent at the centre of market chaos Brent is forming an upward wave and is trading near 63.20 USD. Find out more in our analysis for 20 November 2025. Brent technical analysis On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. Quotes are currently following this signal in the form of an upward wave. Ahead of US data releases, Brent is attempting to regain lost ground. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

There are academic studies that show the possibility of brokers engaging in technical manipulation such as delaying orders, activating stop losses too early, or even “removing” profits from trader reports. Such practices could be one reason traders suspect that “the market is unfair” when trading with certain brokers.

-

Do emotions determine profits more than analysis?

bluemac replied to Bambang Sugiarto's topic in General Forex Discussions

Agreed with you mate, if we have a proper trade management plan and we stick to it there are no chances of emotions coming in affecting our trades. -

Is the License working already ?