[b]Date: 10th July 2025.[/b]

[b]Will The Dow Jones Rebound Ahead Of Next Week’s Earnings?[/b]

The second quarter's earnings season is likely to impact the Dow Jones most among US indexes during its first days. Earnings Season is due to start on July 15th, starting this the banking sector, which makes up almost 18% of the Dow Jones. Currently, the Dow Jones is trading significantly lower than other indices, only edging up 4.85% in 2025 so far. Investors are contemplating if this is likely to change in the upcoming week.

Dow Jones And Earnings Season

During the first week of earnings season, the Dow Jones will see quarterly reports from JP Morgan, Goldman Sachs and Johnson&Johnson. Investors are particularly focused on the quarterly earnings report from Goldman Sachs. Goldman Sachs is the most influential stock for the Dow Jones, holding a weight of 9.63%.

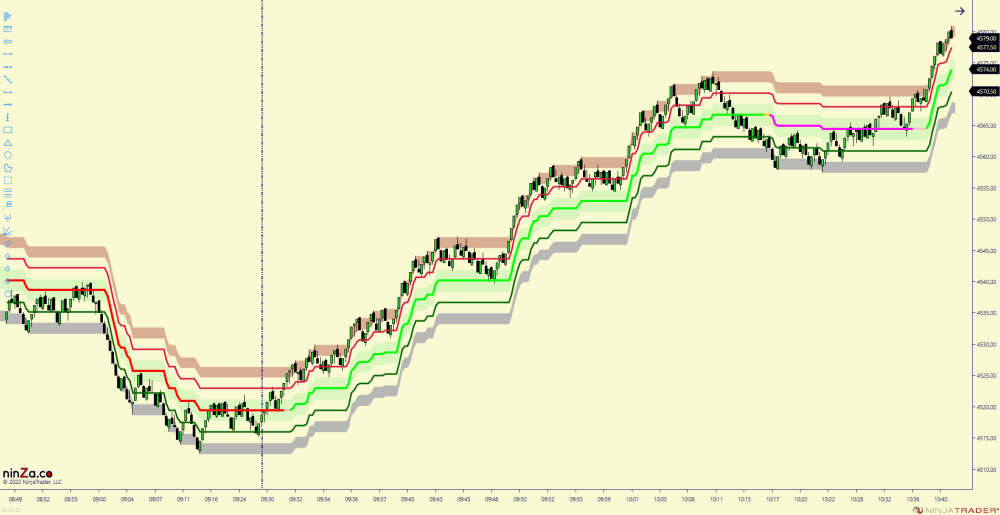

Dow Jones 2-Hour Chart

Goldman Sachs stocks have risen 21% in 2025 so far and have been one of the best-performing stocks for the Dow Jones. Zacks Investment Research, based on a survey of 7 analysts, forecasts a consensus earnings per share (EPS) of $9.37 for this quarter. The figure is up from the $8.62 EPS made public for the same quarter last year. The company has also beat its earnings expectations over the past 3 quarters.

JP Morgan will be the first company to release its quarterly earnings report. JP Morgan stocks are currently up 18% in 2025 and have beaten its earnings expectations over the past 4 quarters. In addition to this, Johnson&Johnson will also release their quarterly report on Thursday, but only holds a weight of 2.19%.

The performance of the Dow Jones will significantly depend on the performance of the 3 quarterly earnings reports. If all 3 companies confirm higher-than-expected earnings, the Dow Jones is likely to witness buy signals from both technical and fundamental analysis.

FOMC And Trade Dampening Market Sentiment

Even though earnings season and the upcoming reports from the banking sector may prompt a rebound, the Dow Jones is currently trading lower. This is largely due to trade tensions, which remain unchanged. More on this can be found in yesterday’s article. However, some positive developments could be seen from yesterday’s FOMC Meeting Minutes.

According to the Meeting Minutes, the Federal Reserve is split between when they should cut and how frequently cuts should be in the second half of 2025. Some members of the committee believe refraining from cuts would be appropriate due to trade policy uncertainties. Their fear is that tariffs and supply disruptions will trigger higher prices and inflation. On the other hand, the number of members leaning towards a rate cut is increasing.

Although it is also important for traders to note that the dovish members of the Federal Reserve are siding with rate cuts due to weaknesses within the employment sector. The meeting took place before last week’s US NFP data. Therefore, their fear may have cooled since the better-than-expected employment data, such as the unemployment rate declining to 4.1%. Nonetheless, the possibility of a September ‘pause’ has fallen from 35% to 28% according to the FedWatch Tool. This is positive for the Dow Jones and stocks in general.

Dow Jones - Price Analysis

Currently, the Dow Jones is trading lower during this morning’s Asia Session, but continues to remain higher than the 75-period moving average. The fact that the price is still above the moving average and the RSI is also forming higher lows will possibly indicate that buyers may still reenter the market. If the price increases above $44,398.45, buy signals may potentially materialise.

Dow Jones 5-Minute Chart

Key Takeaway Points:

The Dow Jones’ rebound will heavily depend on strong Q2 earnings from major banks like JPMorgan and Goldman Sachs. Earnings to start on July 15th.

Goldman Sachs, the Dow's most influential stock, has seen its shares rise 21% in 2025, and analysts project it will report strong Q2 earnings.

The Federal Reserve is split on rate cuts, as inflation concerns weigh against arguments for cuts due to employment weakness.

Despite current minor dips, the Dow's position above its moving average and positive RSI suggest potential buyer re-entry and a possible rally if it surpasses $44,398.45.

[b]Please note that times displayed based on local time zone and are from time of writing this report.[/b]

Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE!

[url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url]

[b]Michalis Efthymiou

HFMarkets[/b]

[b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.