⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

TRADER reacted to a post in a topic:

complete bestorderflow need to edu

TRADER reacted to a post in a topic:

complete bestorderflow need to edu

-

automated-trading.ch indicators advanced very good

TRADER replied to TRADER's topic in Ninja Trader 8

@traderno check ur dm -

⭐ ralph kabota reacted to a post in a topic:

Ninza SpaceGPS Satellite

⭐ ralph kabota reacted to a post in a topic:

Ninza SpaceGPS Satellite

-

markscout reacted to a post in a topic:

anyone can share this indi please pack Scalping agresivo

markscout reacted to a post in a topic:

anyone can share this indi please pack Scalping agresivo

-

anyone using banks system? im not getting any trades from it. it shows active trades but nothing on the account or chart

-

⭐ rcarlos1947 reacted to a post in a topic:

Trading Services Group Buy - Telegram Group

⭐ rcarlos1947 reacted to a post in a topic:

Trading Services Group Buy - Telegram Group

- Today

-

fchot33 reacted to a post in a topic:

complete bestorderflow need to edu

fchot33 reacted to a post in a topic:

complete bestorderflow need to edu

-

⭐ epictetus reacted to a post in a topic:

complete bestorderflow need to edu

⭐ epictetus reacted to a post in a topic:

complete bestorderflow need to edu

-

Jacare joined the community

-

I’m currently developing two projects that are nearing completion, which is why I’ve started this third project: an MBO suite (along with some other L2/L1 indicators). If you can bear with me for a bit, I'll be able to offer you a very solid alternative."

-

fchot33 reacted to a post in a topic:

Trading Services Group Buy - Telegram Group

fchot33 reacted to a post in a topic:

Trading Services Group Buy - Telegram Group

-

can you repload plese?

-

Key Modes and Features 1. Session Volume Profile Automatically plots a volume profile for each trading session (e.g., RTH or ETH). Integrated Advanced VWAP Resets at session boundaries. Displays: Point of Control (POC) Value Area High (VAH) Value Area Low (VAL) Commonly used to: Identify prior session acceptance Trade rotations within balance Reference prior session POC as support/resistance 2. Composite Volume Profile Builds a single volume profile across multiple sessions. The trader defines how many sessions are included in the composite. Used to identify: Higher-timeframe balance Longer-term acceptance zones Major HVNs and LVNs that persist across days Particularly useful for: Swing context Week-to-date or month-to-date analysis Custom Select Profile Allows the trader to manually select a start and end point directly on the chart. Can be anchored to: A specific impulse move Consolidation range News event Any discretionary price window This mode is the most flexible and is often used for: Auction theory analysis Mapping initiative vs responsive behavior Planning trades around LVN breaks or HVN rotations DtRangeVolumeProfile.zip DT Reset Patch.rar

-

Before posting this, I asked the administrator of IndoInvestasi for permission... There's a Telegram group for sharing trading service subscriptions. Some of them are: Tradytics, QuantData, Seeking Alpha... It's a bit different than usual, but I found it interesting. https://t.me/groupbuytrading Like all groups of this type... it is what it is... everyone has to assess the risks.

-

"Hi everyone, I am looking for MZpack footprint templates and footprint action strategy templates. Could anyone who is satisfied with their current setup share their templates with me? I would appreciate it if you could provide the configuration files or settings that you find most effective. Thanks in advance!"

-

https://workupload.com/archive/4b4CGpVUMv Copy the resources file to bin/custom, then import RenkoKings_SpaceGPSSatellite_NT8 Credit to Ampoo, this is all his contribution Enjoy

-

not edu. needs to be activated to use.

-

⭐ osijek1289 reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ osijek1289 reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

Puzzle reacted to a post in a topic:

Please, I want Amibroker 6,43 64bit

Puzzle reacted to a post in a topic:

Please, I want Amibroker 6,43 64bit

-

⭐ Mestor reacted to a post in a topic:

SuperDOM Series

⭐ Mestor reacted to a post in a topic:

SuperDOM Series

-

@kimsam @apmoo please and thank you 🙂

-

Sadly I do not... lets see if someone can re up.

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ laser1000it replied to ngatho254's topic in Ninja Trader 8

I don't use any Rithmic patch , but if you want to contribute to other users it would be better to provide the psw.....thk in advance -

charlipro joined the community

-

yes this Val1312q tool can reset rithmic with nt 8.028

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at a new peak: higher levels ahead Gold (XAUUSD) prices have tested 4,600 USD, with the market relying on a pool of political risks. Find more details in our analysis for 12 January 2026. XAUUSD forecast: key trading points Gold (XAUUSD) prices surged to a new high A broad spectrum of geopolitical risks supports demand for safe-haven assets US statistics are also bolstering gold Fundamental analysis Gold (XAUUSD) prices rose by more than 1% on Monday and exceeded 4,601 USD per ounce, reaching a new all-time high once again. The rally was driven by rising geopolitical risks and expectations of further interest rate cuts in the US. On Sunday, Iran’s parliamentary speaker warned the US and Israel about the consequences of possible intervention following threats of military strikes by President Donald Trump. The statements came amid mass protests in Iran, which reportedly resulted in hundreds of deaths. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 394 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

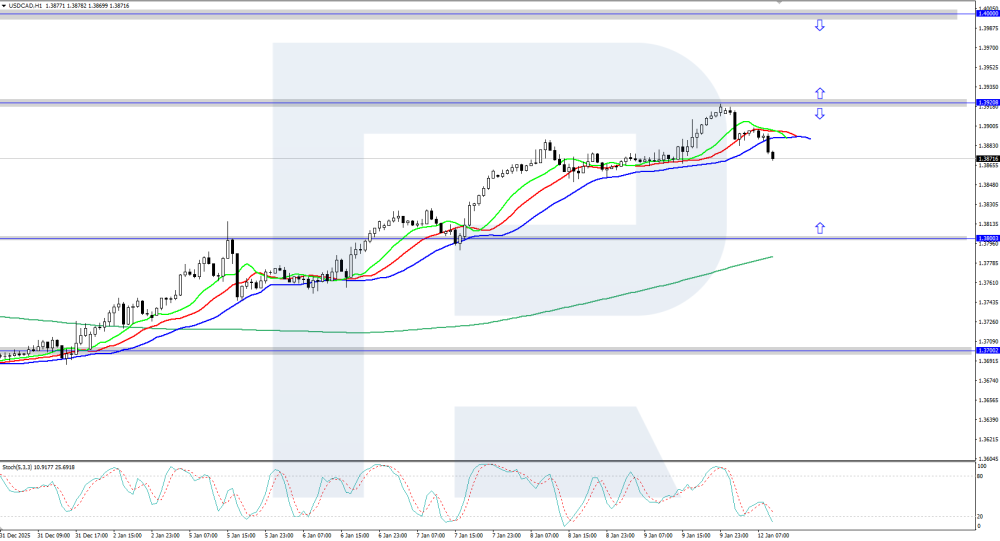

USDCAD rose to the 1.3900 area The USDCAD rate is on the rise, climbing into the area around 1.3900 amid an increase in unemployment in Canada. Discover more in our analysis for 12 January 2026. USDCAD technical analysis On the H1 chart, USDCAD quotes are showing upward momentum, reaching the 1.3900 area. The Alligator indicator is also pointing higher, confirming the current bullish dynamics. After a brief correction, the upward movement may continue. The USDCAD pair is showing upward dynamics, rising to the 1.3900 area. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:12th January 2026. Gold Hits All-Time Highs as the Fed Faces Political Pressure. Gold rises to new all-time highs as US prosecutors opened a criminal investigation into Jerome Powell over the weekend. In addition, the latest NFP figures continue to support more interest rate cuts in 2026, also supporting Gold prices. Analysts continue to point towards multiple reasons why institutions and investors are increasing Gold’s exposure levels. These include the threat to the Federal Reserve’s independence, employment data, and even US-EU tensions over Greenland. However, at what point is Gold too expensive? HFM - Gold Daily Chart Why Is the Federal Reserve Prompting Higher Gold Demand? The tensions between the Federal Reserve and the Trump administration have been well documented. The US government believes the Federal Reserve is not cutting interest rates at the pace it should be. The Federal Funds Rate currently stands at 3.75%, which is 1.75% lower than the highs from 2024. That said, interest rates are still considerably higher than those seen over the past decade. According to the Federal Reserve, they have been unable to cut at a faster pace due to tariffs creating uncertainties. More specifically, members of the Federal Open Market Committee had previously projected inflation would rise considerably due to tariffs. These projections have yet to materialise, providing Trump with additional grounds to criticize the Federal Reserve. Tensions have been on the rise over the past few days as US prosecutors started a criminal investigation into the head of the Federal Reserve, Jerome Powell. The investigation is looking at whether Mr Powell misled Congress about the scope and cost of a major $2.5 billion renovation of the Federal Reserve’s Washington office. President Trump and members of the administration have advised the cost is significantly higher than what the Chairman had disclosed. Particularly, Trump accused the Fed of adding ‘luxurious’ features to the renovation. However, Fed officials told journalists that these were later removed. The question is whether Powell gave misleading or false testimony to Congress about the renovation. According to Jerome Powell, the investigation is political pressure to force the Federal Reserve to cut rates. He said it is also meant as personal retaliation for not cutting rates so far. Powell told journalists the move raises concerns about the Fed’s independence. The risk to Federal Reserve independence is largely the development pushing Gold higher. NFP - Mixed Employment Data The NFP data from Friday had both positive and negative factors in the release. The Unemployment Rate fell back to 4.4%, lower than previous projections. However, the NFP Employment Change was only 50,000, lower than expectations. The employment data for December indicates the sector remains resilient, but risks do remain. According to analysts, the figures indicate the need for interest rate cuts but are not weak enough to significantly pressure the Federal Reserve. The chances of a Federal Reserve rate cut still remain low, a 5% possibility. However, investors will monitor if this changes after tomorrow's CPI figures. Gold (XAUUSD) - Technical Analysis As Gold has been increasing for six consecutive months, most indicators, particularly momentum indicators, point towards the bullish trend continuing. The question is whether the price is trading at an overpriced level. Certain timeframes do point towards the price potentially being overbought. For example, on the 4-hour timeframe, the price is trading at an overbought level on the RSI. In addition to this, on the daily timeframe, the price is forming a divergence pattern, which also signals a potential pullback. Momentum and trend-based indicators continue to point upward, and the price stays close to its average, suggesting investors do not overvalue it. In addition, fundamental factors continue to support Gold’s price. HFM - Gold 5-Minute Chart Certain Wall Street banks are also supporting the bullish trend maintaining momentum this year. Goldman Sachs has given a target price of $4,900. Bank of America and JP Morgan have given a target of $5,000. However, in the short-term, for bullish signals to be valid, the price must remain above $4,542.75, according to the 200-bar MA. Key Takeaways: Gold hit new all-time highs as US prosecutors launched a criminal investigation into Jerome Powell. Mixed NFP employment data supports the possibility of more Federal Reserve rate cuts in 2026. Investors increase Gold exposure due to Fed independence risks, employment trends, and US-EU geopolitical tensions. Technical indicators show Gold’s bullish momentum continues, though some timeframes signal potential overbought conditions. Major banks forecast Gold at $4,900-$5,000, with key support at $4,542.75 maintaining short-term bullish signals. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

anyone can share this indi please pack Scalping agresivo

Letho replied to TRADER's topic in Ninja Trader 8

up please -

Thank You very much

-

This is not a course from Dr Ernest Chan ! In fact the person speaking doesnt even mention his name. Moreover, this seems to be a 2nd part of some series if we understand correctly from the overview. Starts directly with Backtesting and then goes on to describe how to use Python. A lot of hours to go!

-

There's one more rithmic patcher (Rext 3) that I used on NT 8.0.22 It's from Val1312q and worked very fine for me. It's date locked to 13 Mar 2023, so run with date setter. It works both on Win10 and win11 Note: It may give positve warning on Antivirus like many other files from same author . https://workupload.com/file/B9XGWDgEnHL

-

thanks

-

Is ".exe" failing to open or patch NT? Have you attempted to use it in compatibility mode? Up until I switched to NT 28, everything was functioning properly for me, however, I am unable to test at this time.