All Activity

- Past hour

-

gfinance reacted to a reply to a status update:

Can you fix this indicator please https://workupload.com/file/H3eduZd7bcL

gfinance reacted to a reply to a status update:

Can you fix this indicator please https://workupload.com/file/H3eduZd7bcL

-

gfinance reacted to a reply to a status update:

Can you fix this indicator please https://workupload.com/file/H3eduZd7bcL

gfinance reacted to a reply to a status update:

Can you fix this indicator please https://workupload.com/file/H3eduZd7bcL

- Today

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 23rd May 2025.[/b] [b]Dollar Drops as Fiscal Concerns Shake Markets, Euro and Yen Rebound.[/b] The US dollar softened on Friday, poised for its first weekly decline in five weeks against both the euro and the yen. The shift comes as mounting concerns over the US's deteriorating fiscal position have led investors to seek out safer assets. Following Moody’s recent downgrade of US debt, market attention turned sharply toward America’s staggering $36 trillion debt load. The renewed focus has been amplified by President Donald Trump’s proposed tax legislation, which is expected to significantly expand the deficit if passed. Labelled by Trump as a ‘big, beautiful bill,’ the tax package narrowly cleared the Republican-majority House of Representatives. It now heads to the Senate, where extended debate is expected—further contributing to near-term investor caution. The euro climbed 0.36% to $1.132 on Friday, on track to close the week with a 1.2% gain after four weeks of losses. Earlier dollar strength had been supported by a pause in tariff escalations, but sentiment has since shifted. Year-to-date, the euro has appreciated 9% amid ongoing turbulence sparked by tariff policy and a retreat from the dollar. ‘This week, the focus moved away from trade tensions to fiscal stability. That change has rattled markets,’ said Moh Siong Sim, currency strategist at Bank of Singapore. ‘The U.S. fiscal path now looks so concerning that investors are questioning its sustainability.’ The dollar index, which gauges the greenback against six major peers, was down 0.3% at 99.614 on Friday and is set for a 1.35% weekly loss. This drop comes despite a selloff in U.S. Treasuries, with 30-year yields hovering above 5% in Asian trading, close to their October 2023 peak of 5.179%—levels not seen since 2007. The rising yields have failed to support the dollar, as a wave of risk aversion fuels what some analysts have dubbed a “Sell America” movement, echoing trends seen last month. ‘What’s striking is how markets are reacting to the surge in long-term U.S. yields,’ said Chris Weston, head of research at Pepperstone. ‘These yields aren’t being driven by optimism about growth, but by deepening fears of fiscal irresponsibility and ballooning interest costs.’ He added that the combination of rising inflation expectations and waning foreign interest in U.S. debt has led to a notable spike in the term premium. The yen firmed to 143.47 per dollar, set for a 1.5% weekly rise after Japanese core inflation in April surged at its fastest pace in over two years. This could prompt the Bank of Japan to consider raising interest rates before year-end. Despite a fragile economy burdened by tariffs, super-long Japanese bonds reached record highs this week, though prices steadied on Friday. The Swiss franc gained slightly to 0.8264 per dollar and is up 1.2% this week, snapping a two-week losing streak. The Australian dollar strengthened 0.39% to $0.6434 after the Reserve Bank of Australia cut its cash rate to a two-year low of 3.85%, citing weaker global prospects and easing domestic inflation. Meanwhile, the New Zealand dollar rose 0.3% to $0.5916, on track for a 0.6% weekly increase. Asian Equities Rebound as Yields Retreat Asian stocks advanced early Friday as U.S. Treasury yields retreated after a volatile week driven by debt-related fears. The 10-year yield slipped to 4.52%, while the more Fed-sensitive two-year yield dropped to 3.98%. Oil prices declined amid speculation that OPEC+ may raise production at its next meeting. U.S. crude fell 51 cents to $60.69 per barrel, while Brent slid to $63.93. In Asia, Japan’s Nikkei 225 rose 0.8% to 37,289.60 after the government reported April core inflation at 3.5%, its highest since early 2023. Analysts now expect the BOJ to cautiously consider tightening policy. Still, ING’s Min Joo Kang noted that U.S. tariff pressures could limit the BOJ’s room to maneuver, especially with Japan’s export sector under threat. Hong Kong’s Hang Seng rose 0.4% to 23,627.99, Shanghai’s Composite Index gained 1% to 3,382.12, Seoul’s Kospi edged up 0.2% to 2,597.49, and Australia’s S&P/ASX 200 added 0.4% to 8,379.10. Wall Street Mixed as Policy Fears Linger U.S. stocks closed mixed on Thursday, with the S&P 500 down slightly to 5,842.01. The Dow ticked lower by 1.35 points to 41,859.09, while the Nasdaq rose 0.3% to 18,925.73, led by tech gains. Alphabet climbed 1.4% and Nvidia added 0.8%. Treasury markets steadied following the House’s passage of a tax bill expected to deepen the federal deficit. The package would extend $4.5 trillion in tax breaks and introduce new ones, while accelerating the phase-out of clean energy credits—sending solar stocks tumbling. Sunrun lost 37.1%, Enphase dropped 19.6%, and First Solar slid 4.3%. Healthcare stocks also fell after a federal agency announced broader audits of Medicare Advantage plans. UnitedHealth lost 2.1% and Humana plunged 7.6%. In the latest economic data, jobless claims edged slightly lower, signalling continued labour market resilience. Still, businesses remain cautious amid an ongoing trade war. A strong S&P Global report on U.S. manufacturing and services showed a rebound in May, though it also highlighted supply chain disruptions and cost pressures tied to looming tariffs. The jump in prices for goods and services marked the sharpest since August 2022. Currencies Update In early Friday trade, the dollar eased to 143.45 yen from 144.01. The euro rose to $1.1319 from $1.1279, reflecting continued pressure on the greenback. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

@expirechicken, Its best if you purchase from a person that will provide updates or changes to your machine ID that break your NT8 Edu. @Traderbeauty has provided 2 reliable providers:

-

Dragon- reacted to a post in a topic:

NinjaTrader 8 - Finding the Ideal Support and Resistance Levels

Dragon- reacted to a post in a topic:

NinjaTrader 8 - Finding the Ideal Support and Resistance Levels

-

Traderbeauty reacted to a post in a topic:

Any one has Bollinger%B Pro from Ninja.co??

Traderbeauty reacted to a post in a topic:

Any one has Bollinger%B Pro from Ninja.co??

-

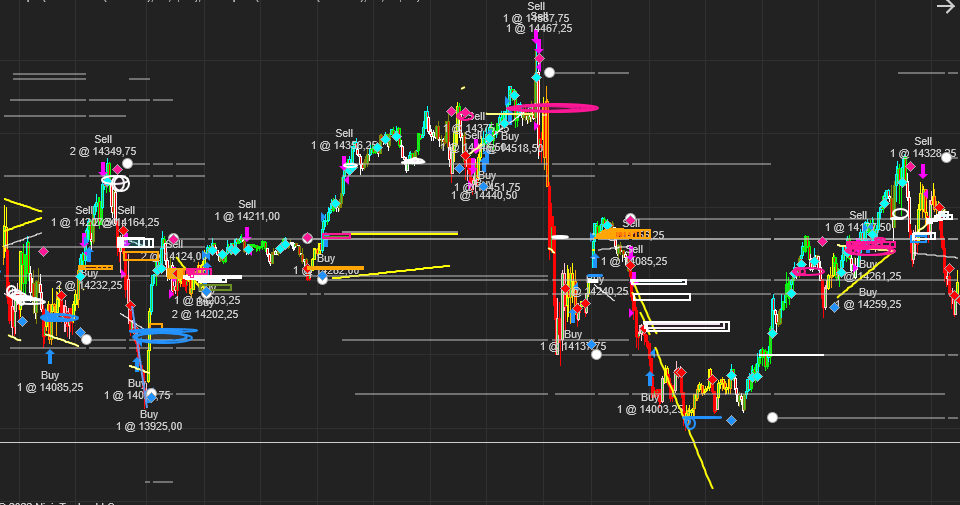

Q-Scalper by Quaderr is a trading tool designed to identify and validate support and resistance levels for more precise trading decisions. It works by: Detecting Key Levels: Finds significant support and resistance zones and filters out noise. Momentum Diamonds: Highlights strong market momentum, helping confirm breakouts. Dynamic Trendlines: Identifies trendline breaks that could lead to profitable trades. Bar Color System: Uses color-coded bars to indicate trend strength (e.g., blue for strong uptrend, red for strong downtrend). Trade Entry & Exit Signals: Helps traders enter trades when price exits a marked range and suggests stop-loss placements. Click the link below to learn more about SR levels, how to trade this indicator and what current users are saying. https://quaderr.com/q-scalper/ This indicator is available at a 50% discount for today only, use discount code SCALPER50 at checkout to get yours today.

-

- new

- ninjatrader

-

(and 2 more)

Tagged with:

-

samar reacted to a post in a topic:

Amiquote 4.18 c*****d

samar reacted to a post in a topic:

Amiquote 4.18 c*****d

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

samar replied to ⭐ Atomo12345's topic in Amibroker

Apologies! Found the archive on the net. Checked it for malware prior to sharing, but did not confirm 64 bit by installing it. -

samar reacted to a post in a topic:

The major update in Amibroker 6.93 c****ed, AFLWIZ.

samar reacted to a post in a topic:

The major update in Amibroker 6.93 c****ed, AFLWIZ.

-

Forex Basics 4 Advanced&Beginner Traders

bluemac replied to StefGrig's topic in General Forex Discussions

Forex is a very professional market which does not allow any trader's mistake so it is better to go and back test the strategy on a demo before implementing live. -

No doubt, the babypips remains a good resource for quite some time however there are many brokers like hfm etc offering free educational webinars for free.

-

@kimsam Have you succeeded?

-

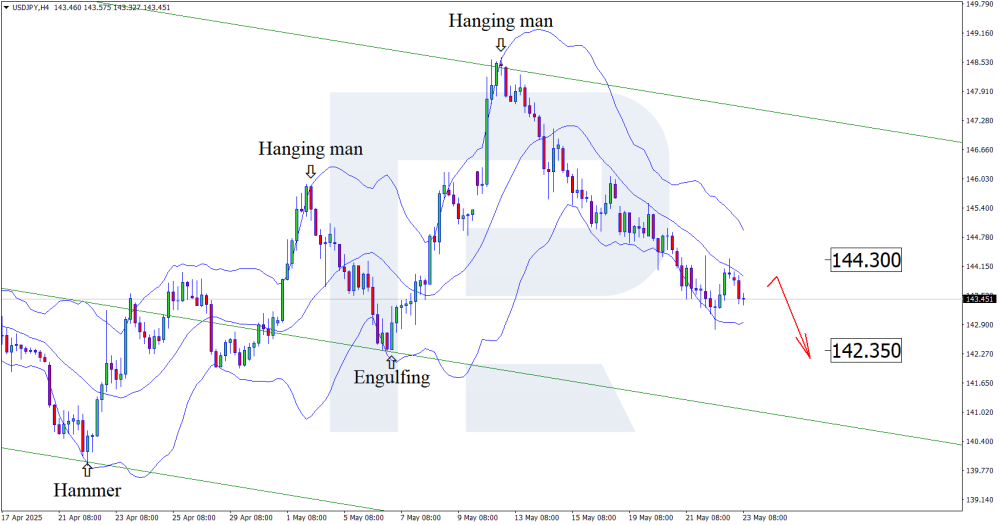

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Inflation surprise: yen strengthens, USDJPY declines The yen continues to strengthen, pushing the USDJPY rate lower with a potential move towards 142.35. Find out more in our analysis for 23 May 2025. USDJPY technical analysis Having tested the upper Bollinger Band, the USDJPY price formed a Hanging Man reversal pattern on the H4 chart near the 143.40 level. The pair may now continue its downward wave based on that signal. The increase in Japan's core CPI has strengthened the yen. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD trapped in a Triangle: market holds breath before a breakout The AUDUSD pair is rising after rebounding from support, with traders closely watching the 0.6495 resistance level. The price currently stands at 0.6433. Discover more in our analysis for 23 May 2025. AUDUSD forecast: key trading points Expectations of a Fed rate cut in the second half of 2025 support AUDUSD's current uptrend Traders anticipate a breakout from the consolidation range, which could trigger a strong directional move AUDUSD forecast for 23 May 2025: 0.6545 Fundamental analysis The AUDUSD rate strengthens but remains confined within a sideways consolidation. The US dollar is under pressure due to ongoing fiscal risks and the lack of progress in trade negotiations. Additional support for the Australian currency came from expectations of a Federal Reserve interest rate cut in the second half of 2025. Earlier this week, the Reserve Bank of Australia lowered its key rate by 25 basis points. Markets now price in over a 50% likelihood of a second rate cut at the next meeting in July. Against this backdrop, AUDUSD trading remains mixed and volatile. The price is squeezed in a consolidation range with the upper boundary at 0.6495 and the lower one at 0.6360. Traders are closely monitoring this phase as such consolidations often end with a strong breakout. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 245 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

@expirechicken I got it from telegram or clubbingbuy dont recollect.

-

expirechicken started following HFT Algo HFT SPECTRE

-

Where can I get the nt8 edu version?

-

Accurate calculation of the waves of Elliott, whit the projections of the minimum, typical and maximum of ABC (or third wave )and the minimum, typical and maximum of the five wave:bullishs or bearishs. Please import them with the Organiser of Metastock. Translate italian in English with Google translation: https://translate.google.com/?sl=auto&tl=en&text=tipiche&op=translate. https://e.pcloud.link/publink/show?code=XZGmJtZkMu58OYFOCVjSnSIHkqHTbD7SkXX

-

Thanks, is this unlocked?

- Yesterday

-

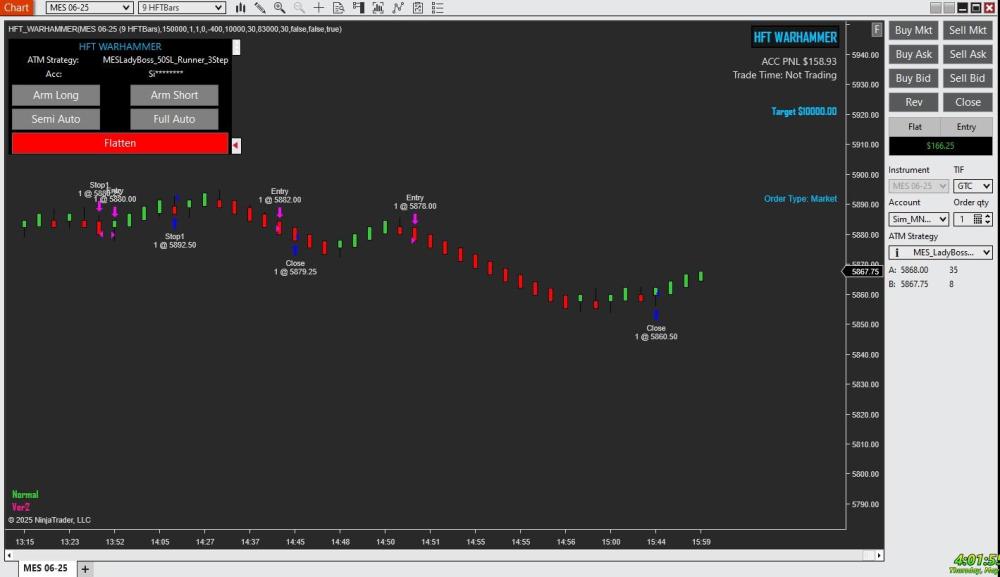

Everyone, My apologies. Spectre does not work, requires email verification.🙄

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Amibroker

This is 32 bit and not 64 bit. -

@sun, sorry, comments were referring to WarHammer, I try to load Spectre to see if it holds true.

-

We could now chart crypto currency on Ninja Trader 8 using Coinbase but we cannot trade it. Only crypto coins use by Coinbase, 1400 of them, I think

-

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

samar replied to ⭐ Atomo12345's topic in Amibroker

Strange! Works for me. Anyhow, https://www.fileconvoy.com/dfl.php?id=g7a794984bc93f04210005918497ecf1eeee1434115 Upload will self delete in 14 days -

Amiquote 4.18 c******d by me. https://e.pcloud.link/publink/show?code=XZnv5tZV8b8zIITSNVxNkdYmiQO5ShqfygX

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Amibroker

The file you requested has been blocked for a violation of our Terms of Service. Sorry! Any other link? -

Any one has Bollinger%B Pro from Ninja.co??

Ninja_On_The_Roof replied to SPAR's topic in Ninja Trader 8

https://limewire.com/d/6zWPA#XMqrwe0WHx -

Quaderr started following ⭐ rcarlos1947

-

@rcarlos1947 I'm using NT 8.1.3.1 edu but I see the license validation failed message. Can you screenshot yours,.

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

samar replied to ⭐ Atomo12345's topic in Amibroker

@Atomo12345 x64 6.30 full crack for reference. https://www.mediafire.com/file/6z9xxtz2qaashex/AmiBroker+6.30x64+&+AmiQuote+3.31+Full+Crack.rar/file

.thumb.png.6aec50cefc0a368fd5dc7ea9cec1b42c.png)