⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY rises amid higher oil prices and shifting expectations for Fed rates The USDJPY pair is strengthening, with the Japanese yen under increasing pressure from oil price spikes and revised expectations for US monetary policy. The rate currently stands at 159.40. Find out more in our analysis for 13 March 2026. Technical outlook The USDJPY rate continues to move within an ascending channel, with buyers holding the price above the EMA-65, indicating persistent bullish pressure. Today’s USDJPY forecast suggests another attempt to extend the rally towards 160.35. A combination of factors, such as yen weakness, rising oil prices. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USD in the spotlight: expected rise in US job openings could push AUDUSD lower After a sharp rally, the AUDUSD pair continues to correct ahead of US data. The AUDUSD rate is testing 0.7020. Discover more in our analysis for 13 March 2026. AUDUSD forecast: key takeaways US job openings (JOLTS): previously at 6.542 million, projected at 6.760 million The USD continues to strengthen ahead of US data AUDUSD forecast for 13 March 2026: 0.6970 Fundamental analysis Today’s AUDUSD outlook favours the US dollar, which has a strong chance to continue recovering against the Australian dollar. The pair is currently trading around 0.7020. US job openings (JOLTS) is an economic indicator that shows the number of unfilled jobs in the country at the end of the month. The report is published by the US Bureau of Labor Statistics and provides insight into labour demand, the level of economic activity, and the balance between employers and job seekers. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 437 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 13th March 2026. Dollar Index Climbs to Five-Month High as Oil Volatility Dominates Markets. Oil prices are becoming the centre of attention when analysing other assets such as the US Dollar and Gold. The US Dollar saw strong gains on Thursday and also continues to increase in value this morning. Gold, on the other hand, has fallen to a three-day low due to Dollar pressure. Analysts do not expect volatility to fall on Friday as Trump advises that the war may potentially escalate today. In addition to this, the US is due to release its latest Core PCE Price Index and quarterly Gross Domestic Product. What has Triggered the Volatility from the Past 24 Hours? Investors are closely monitoring oil prices which continue to increase in value and trades at almost $100 per barrel. The IEA decided to release a record number of barrels from its reserves. However, prices remain elevated despite the US allowing more Russian oil purchases. Yesterday evening, the US issued a second authorisation allowing buyers to receive Russian oil cargoes already at sea, aiming to ease price pressure as the Middle East war continues. Another factor impacting the price action is the upcoming Federal Reserve meeting which is only five days away. Investors have almost completely removed any possibility of a rate cut this month or in April. A small percentage of analysts even believe the Federal Reserve will increase interest rates by 0.25%. EURUSD - US Dollar Rises As the ECB Indicates No Rate Hikes! Due to market expectations regarding the Fed’s monetary policy, the US Dollar is now trading close to a five-month high. The US Dollar is the day’s best performing currency and is still trading 0.50% below resistance levels. The Euro, on the other hand, is one of this week’s worst performing currencies. In addition to this the Dollar found support from oil prices, inflation and the Fed’s hawkish monetary policy. The European Central Bank is also supporting the US Dollar with its latest comments. Previously, economists were expecting the ECB to increase interest rates on two occasions this year due to higher inflation. However, members of the ECB have told journalists that this is far from reality. Officials have said they are not rushing to change interest rates, even with market volatility and rising oil prices. The head of the French Central Bank advises that inflation remains low enough that even with a moderate increase there may not be a need to respond in the short term. Due to the ECB’s dovishness, the Euro declines, but traders will continue to monitor their forward guidance. The new Iranian leader made his first public statement, offering no signs of de-escalation or willingness to negotiate. He made it clear Iran intends to keep the Strait of Hormuz closed and open additional fronts if the war continues. As a result, the chances of the conflict ending soon remain slim, supporting the US Dollar rather than Gold. Even though the price of Gold is declining, the price of the US Dollar is increasing at a faster pace. Due to this, the correlation is forming an indication of divergence which points towards the bullish trend of the Dollar losing momentum in the short term. HFM - EURUSD 30-Minutes Even though the US Dollar Index is at a five-month high as mentioned above, against the Euro the Dollar is at an eight-month high. The price is clearly below the VWAP and most moving averages providing a clear bearish indication for the currency pair. Momentum-based indicators are indicating the trend will continue downwards. When monitoring the past week’s price action, the price tends to form a retracement after the price deviates away from the 100-bar SMA by 0.55%. Currently, the price is at a deviation of 0.51% and at 18 on the RSI. Both are indicating the price may be oversold. For this reason, even though momentum indications are pointing towards a further decline, traders may also expect a retracement or slight correction in the short term. Key Takeaways: Oil prices near $100 per barrel are driving volatility across currencies and commodities. The US Dollar strengthened, reaching a five-month high, while Gold fell to a three-day low. Markets expect continued volatility with US Core PCE and GDP data due today. Fed rate cut expectations have disappeared, with some analysts even expecting a 0.25% hike. ECB dovish signals and Iran tensions are supporting the US Dollar and pressuring the Euro. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ rcarlos1947 reacted to a post in a topic:

PREdator lastest version 3.6.3.3 needs to educate

⭐ rcarlos1947 reacted to a post in a topic:

PREdator lastest version 3.6.3.3 needs to educate

-

RObos specialist in MGC, needs to educate

Ze_Pequeno replied to Ze_Pequeno's topic in Ninja Trader 8

Master! Did you manage to do anything? - Today

-

TraderMan reacted to a post in a topic:

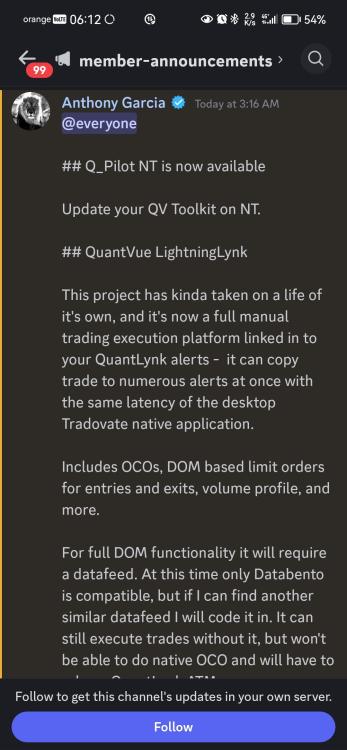

quantvue.io

TraderMan reacted to a post in a topic:

quantvue.io

-

Harrys reacted to a post in a topic:

buysideglobal.com

Harrys reacted to a post in a topic:

buysideglobal.com

-

Harrys reacted to a post in a topic:

buysideglobal.com

Harrys reacted to a post in a topic:

buysideglobal.com

-

Harrys reacted to a post in a topic:

PREdator lastest version 3.6.3.3 needs to educate

Harrys reacted to a post in a topic:

PREdator lastest version 3.6.3.3 needs to educate

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Khit Wong The C.O.R. MASTERCLASS

⭐ monkeybusiness replied to george09's topic in Forex Clips & Movie Request

Save your money skip it, I have seen it few years back, and it is totally crap. -

This is just my limited experience on convert2ms. The version 2.1 converted data was not able to read by some programs (can't remember which). Then I decided to use the version 2.2 converted data and it was readable. Perhaps you have to try it out yourself.

-

jamiestewd18 joined the community

-

⭐ suresh.hacker reacted to a post in a topic:

Convert2MS 2.2 cracked

⭐ suresh.hacker reacted to a post in a topic:

Convert2MS 2.2 cracked

-

⭐ suresh.hacker reacted to a post in a topic:

Convert2MS 2.2 cracked

⭐ suresh.hacker reacted to a post in a topic:

Convert2MS 2.2 cracked

-

mate. Kindly share a full working Convert2MS software.. most of the others doesn't convert completely. PS: I got it from your link @Atomo12345 Thank you so much for the great contributions. Only the 2.1 works fine the 2.2 doesn't works fine?..

-

⭐ suresh.hacker reacted to a post in a topic:

Metastock 20 realtime c*****d

⭐ suresh.hacker reacted to a post in a topic:

Metastock 20 realtime c*****d

-

https://workupload.com/file/5n6jv6V8vQk @Minigems can u educate this please @redux

-

Thank you bro

-

Dav reacted to a post in a topic:

Metastock 20 realtime c*****d

Dav reacted to a post in a topic:

Metastock 20 realtime c*****d

-

⭐ RichardGere reacted to a post in a topic:

MotiveWave v7 Ultimate Edition (Mac OS)

⭐ RichardGere reacted to a post in a topic:

MotiveWave v7 Ultimate Edition (Mac OS)

-

Yes. You should run/deploy "OfflineCache_GeneratorGUI" once every 20 odd days, when ever there is a msg requesting for login "to establish an online connection." Close/exit MS app & run "OfflineCache_GeneratorGUI" & start MS Regards

-

-

Please where is the link

-

Please I must open crack every 20 days

-

@Dav you can't join and in 4 minutes request something. please help the community any way you can. Show you are here for the right reason .thanks so much

-

Geometric Angles Applied To Modern Markets

kingmob6 replied to jameshoka's topic in Forex Clips & Movie Request

I have a bunch of Michael Jenkins stuff if anyone is interested. Let me know and I will post - Yesterday

-

SkN joined the community

-

Geometric Angles Applied To Modern Markets

george09 replied to jameshoka's topic in Forex Clips & Movie Request

i have sq9 course and Geometric only unfortunately if he can upload Master time factor i can upload rest 2 -

Geometric Angles Applied To Modern Markets

⭐ vinpiper replied to jameshoka's topic in Forex Clips & Movie Request

@KaiHue33: We are interested . Please fell free to upload/share them -

Geometric Angles Applied To Modern Markets

KaiHue33 replied to jameshoka's topic in Forex Clips & Movie Request

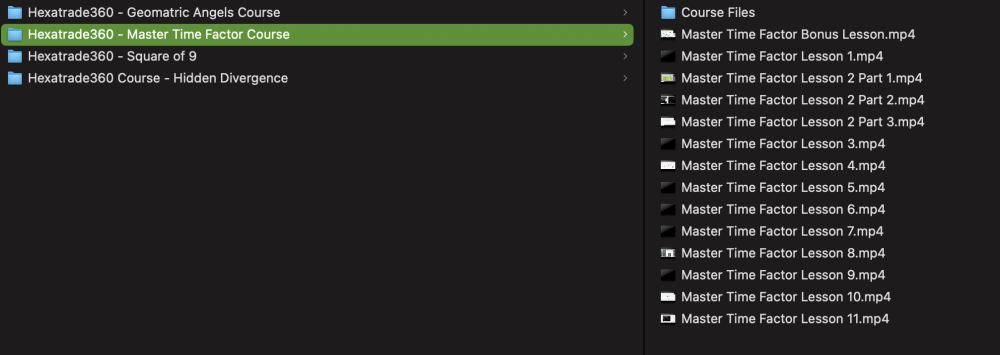

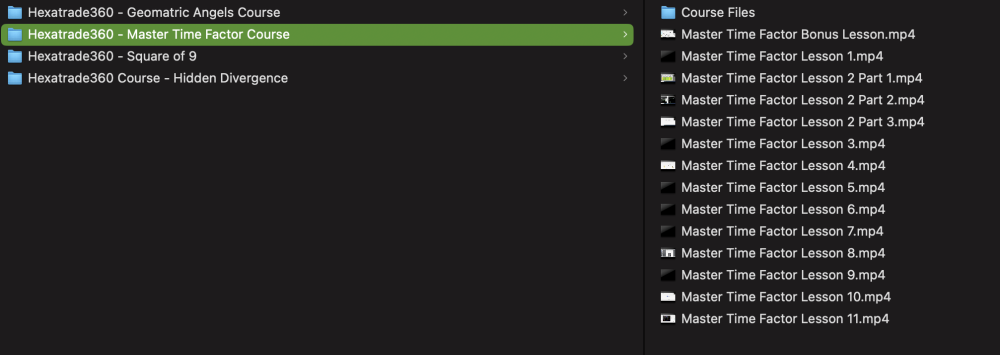

Hey I have the course Master Time Factor by Hexatrade360 if anyone is interested + I got other courses of him also... - Geometric Angels applied - Square of 9 - Hidden Divergence Divergence -

Hey I have the course Master Time Factor by Hexatrade360 if anyone is interested + I got other courses of him also... - Geometric Angels applied - Square of 9 - Hidden Divergence

-

KaiHue33 joined the community

-

Yes, today was red. Let us see tomorrow.