⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Still missing the C:\\KwikPOP\\Bin\\KPCorex64.dll but will try the quantkey

-

https://workupload.com/file/LvTNpbT4P47 Needs fix

- Today

-

Traderbeauty reacted to a post in a topic:

Eds Retrace Plan

Traderbeauty reacted to a post in a topic:

Eds Retrace Plan

-

I think they would work on fixed NT8.

-

Are these educated ?

-

Traderbeauty reacted to a post in a topic:

Eds Retrace Plan

Traderbeauty reacted to a post in a topic:

Eds Retrace Plan

-

New files, templates, and workspace. https://workupload.com/file/gYB9NEYUQ9u

-

Hi, Thanks for the dll, I installed it and its working, when trying the custom signal, the plotmode its not working on the chart, just like you said, my question is, does it work inserting it from the strategies properties / Signal Entry Tag? Do you know how to insert it from there? it tried watching the videos , but no explanation, only on object mode, also tried inserting the indicator name, but it doesnt work, maybe because an error form my part....... OR does it only work on object mode? Thanks.

-

hybrid76 started following TradeSaber Predator X Strategies

-

hybrid76 reacted to a post in a topic:

TradeSaber Predator X Strategies

hybrid76 reacted to a post in a topic:

TradeSaber Predator X Strategies

-

Can you share the template or give more info please. Thanks

-

still waiting @kimsam

-

Which indicator generates the arrows? Thanks

-

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

-

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

-

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

⭐ fryguy1 reacted to a post in a topic:

(REQ) Kwikpop

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index hits new all-time high After a correction, the JP 225 stock index resumed its upward movement and reached a new all-time high. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s balance of trade for September came in at –234.6 billion JPY Market impact: the effect on the Japanese equity market is moderately negative Fundamental analysis Japan’s latest trade balance data for October 2025 showed a deficit of –234.6 billion JPY, compared with expectations for a 22 billion JPY surplus and a slightly smaller deficit in the previous period. This indicates that imports continue to outpace exports and that the trade gap is not narrowing. Such dynamics are typically interpreted as a sign of weakening external demand for Japanese goods and high sensitivity of the economy to imported energy resources. This raises the likelihood of lower industrial production figures and slower performance in export-oriented industries. The release will likely send the JP 225 index lower. However, the downside potential is expected to be limited, as the negative trade data will be balanced by the Bank of Japan’s commitment to maintain ultra-loose monetary policy. Overall, these results increase the risk premium associated with external trade imbalances. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 347 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Bambang Sugiarto reacted to a post in a topic:

What do you think about foreign brokers offering large bonuses — opportunity or marketing trap?

Bambang Sugiarto reacted to a post in a topic:

What do you think about foreign brokers offering large bonuses — opportunity or marketing trap?

-

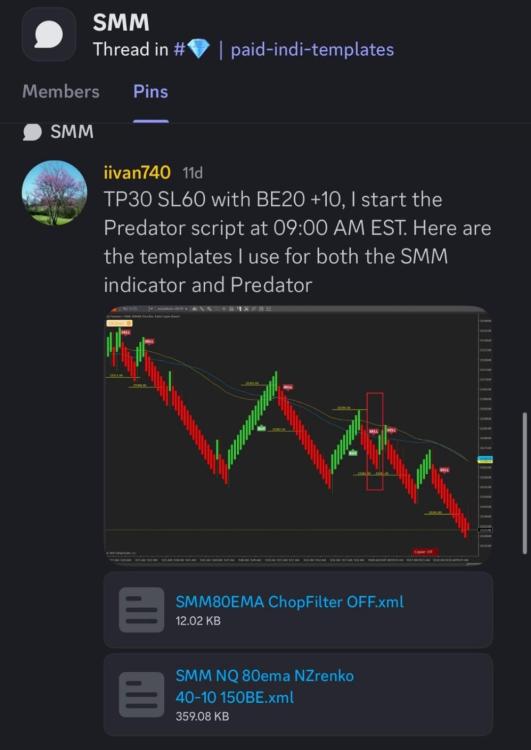

That ninzapullback has a negative sl/tp ratio but apparently it wins more than it lose, their SMM templates are also interesting

-

Try this URL - https://mega.nz/folder/cUs2XJDS#yWwGtuQZTmkE8NZYBYHBGw

-

https://workupload.com/file/kGRTYwhhHev Go for it kimsam

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent awakens: oil prices rise amid new sanctions Brent crude oil prices are once again recovering and trading near 64.20 USD per barrel. Find more details in our analysis for 23 October 2025. Brent technical analysis On the H4 chart, Brent quotes tested the lower Bollinger Band and formed a Hammer reversal pattern. They are currently following the signal in the form of an upward wave. Despite ongoing risks of global oversupply, Brent crude shows signs of recovery. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 23rd October 2025. Global Markets Mixed as Earnings, Sanctions, and Inflation Data Dominate Investor Focus. Global markets were mixed on Thursday as traders weighed a wave of corporate earnings, escalating sanctions on Russian oil producers, and rising anticipation for key US inflation data later this week. Wall Street Futures Struggle for Direction US stock futures were steady to mixed as investors assessed the latest third-quarter earnings. Contracts tied to the Dow Jones Industrial Average (YM=F) hovered slightly below the flat line, while S&P 500 (ES=F) futures rose 0.2%, and Nasdaq 100 (NQ=F) futures gained around 0.3%. Tesla (TSLA) shares slipped more than 3.5% after posting uneven quarterly results, marking the start of the “Magnificent Seven” earnings season. IBM (IBM) also fell by about 6.5%, as its strong profits were offset by weaker-than-expected software revenue. Investors are now turning their attention to upcoming results from T-Mobile (TMUS) and Blackstone (BX) before the market opens, followed by Intel (INTC) after the bell. Oil Prices Surge After New US Sanctions on Russia Oil markets rallied sharply after the United States imposed sanctions on Russia’s largest crude producers, Rosneft PJSC and Lukoil PJSC, in a bid to increase pressure on Moscow to negotiate an end to its war in Ukraine. Brent crude surged by as much as 3.9%, trading near $65 a barrel, while West Texas Intermediate (WTI) advanced towards $61. The sanctions, announced by President Donald Trump, marked a significant policy reversal just days after he signalled plans to meet Russian President Vladimir Putin. According to Warren Patterson, Head of Commodities Strategy at ING Groep NV in Singapore, the penalties “mark a shift in President Trump’s approach to Russia and open the door for tougher sanctions down the road, which could ultimately impact Russian oil flows.” The move has already unsettled key buyers. Senior refinery executives in India-one of the largest importers of Russian crude-said the restrictions would make it nearly impossible to continue purchases. Trump also revealed plans to speak with Chinese President Xi Jinping about Beijing’s continued imports of Russian oil during an upcoming meeting in South Korea. The US leader added that India’s Prime Minister, Narendra Modi, had assured him the country would begin winding down its Russian crude purchases. Both India and China have become the largest buyers of Russian oil since the invasion of Ukraine, stepping in as Western nations reduced imports. Last week, the UK also expanded its sanctions to include two Chinese energy firms involved in handling Russian oil, alongside measures against Rosneft and Lukoil. The sanctions pushed energy markets higher on Thursday, with WTI settling $2.31 higher at $60.81 per barrel and Brent crude up $2.38 to $64.97. Asian Stocks Follow Wall Street Lower Across Asia, markets mirrored Wall Street’s weakness as investors digested the sanctions and awaited fresh economic guidance from China. In Beijing, Communist Party leaders concluded a key meeting that will define policy priorities for the next five years, while in Hong Kong, the Hang Seng Index edged 0.2% lower to 25,738.00. The Shanghai Composite Index fell 0.7% to 3,886.19 following reports that Washington may tighten export restrictions on products developed using US software. In Japan, the Nikkei 225 dropped 1.3% to 48,683.84, weighed down by reports that Prime Minister Sanae Takaichi is preparing a stimulus package exceeding ¥14 trillion (approximately $92 billion). SoftBank Group shares sank more than 4% after announcing plans to issue US dollar and euro-denominated bonds to fund its artificial intelligence investments. Takaichi’s preference for maintaining near-zero interest rates contributed to a weaker yen, which slipped to ¥152.37 per US dollar from ¥151.94 previously. Elsewhere, South Korea’s Kospi fell 0.9% to 3,849.87, Taiwan’s Taiex slipped 0.4%, and Australia’s S&P/ASX 200 edged up 0.1%. In contrast, India’s Sensex climbed 0.8%. Debt, Inflation, and Fed Policy in Focus In the US, attention is turning to macroeconomic risks and fiscal concerns. The September consumer inflation report, delayed by the ongoing government shutdown, is now expected on Friday. With official data releases disrupted, the reading is viewed as a key indicator ahead of the Federal Reserve’s policy meeting next week, where markets remain divided on the likelihood of another quarter-point rate cut. Meanwhile, the US national debt surpassed $38 trillion, the fastest $1 trillion increase outside the pandemic period. Kent Smetters of the Penn Wharton Budget Model warned that sustained debt growth could fuel inflation and erode consumer purchasing power. The Government Accountability Office (GAO) added that rising debt could lead to higher borrowing costs, lower wages, and push prices for goods and services even higher. Outlook: Volatility Set to Intensify With corporate earnings, oil sanctions, and inflation data all dominating the headlines, investors are bracing for heightened volatility through to the end of the week. As the Federal Reserve, energy markets, and global policymakers navigate tightening conditions, traders will be closely watching how these factors shape the global economic outlook heading into the final months of 2025. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

That's your choice, i hope you making some good profits with the free capital. Have fun and be safe because nothing is free in this world and if you get it, enjoy!

-

Anybody got the manuals for this?

-

No, didn't work. Thanks for trying.

-

alad started following Convert2MS 2.2 cracked , Mtpredictor 8.1.1.1 new version and Sentient Trader 4.04.17

-

For discord members, can we get some of the member only strategies / indicators? The popular ones such as SMM, Edsretrace, Ninza Pullback etc. Thanks