-

Posts

83 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Articles

Posts posted by g1080

-

-

Hi I just followed this instructions and make my own, also found some made in python in github.

https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/

This is CBOE link. https://www.cboe.com/delayed_quotes/spy/quote_table

-

-

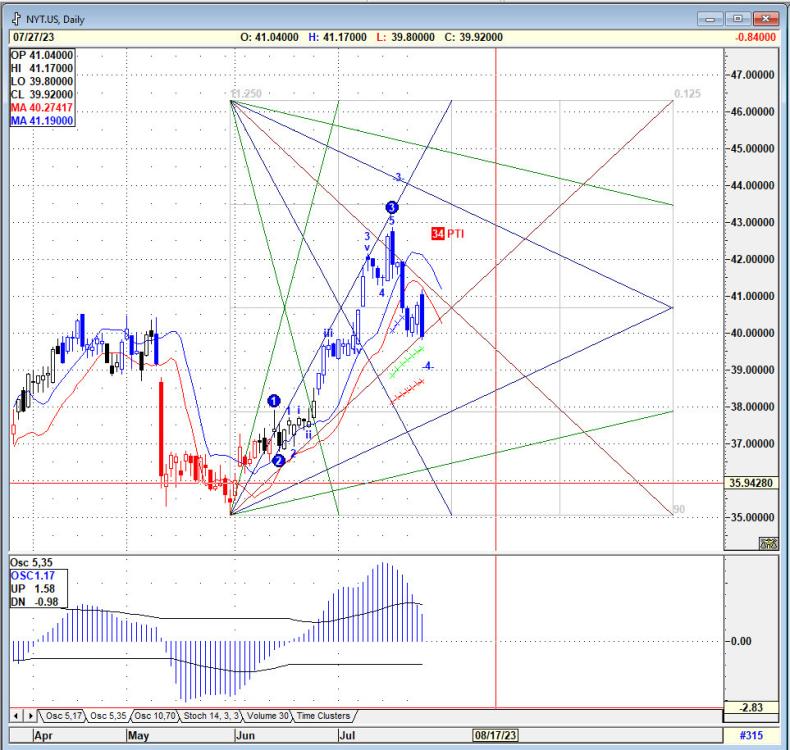

So far today.

-

-

Hi nehal,

Below you´ll find this weeks webinar where Tom goes through this weeks market on spx and spy. These are free weekly webinars.

I´m dwindling around the idea of how to determine if there's is more buying than selling on 0dte strikes as a hole and how to trigger the trade. The idea of using a low delta with relative high gamma gives a edge but im looking for another signal to hit the button.

Gamma levels, can be easily calculated on CBOE data from yesterdays close and from my experience does de job bc having it updated in real time does not bring a lot to the table, i mean at certain levels market makers will hedge and that's based on how they closed yesterday.

Pros I see on 0dte.

- no carry overnight positions.

- low capital (depending on size) but at 30 delta on spy is manageable.

- options premiums will move in a decent amount although time decay could hurt.

Cons.

- how to measure your trading "system"

- days when the market ranges like Monday this week can hurt

- Soft stop loss because options swings are wide so you have to relay on delta and your guts.

-

Hi, anyone trading 0DTE on SPY using Gamma Exposure? if so please let me know I´d like to share some ideas.

For the ones interested, below you´ll find a guide to manually calculate GEX based on free CBOE data. And a link to T0m J0seph free weekly webinars on this subject.

https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/

-

-

Pass is in the name of the file - 111111

I have been using this with E-signal, not sure how to use it with offline data, but I think if you just put

anything in for ID and Pass when you start it - will not get data but E-signal should still launch

Hiwcicom are you still an active esignal user? I´m looking for some files published on esginal forum but it seems only for registered users. Also, if 10.6 version works with EOD files in ascii format could you please share it again? thanks!

-

Thinkorswim imho

-

You can use https://stooq.com/ to download as ASCII format EOD data. No options data here usually you have to subscribe to to some datafeed to get options data.

you can use LookBack from tasty trade to https://lookback-beta.tastytrade.com/tutorials.html to backtest with options data.

-

I´ll be interesting if there´s interest on this topic, open a new thread to share charts and opinions.

-

Its quite complex to explain how I use Gann here on a post so I´m gonna share @GET training material. Here you´ll find a seminar where late Andy Bushak shares how this tool it is supposed to be used.

https://[email protected]/folder/TdpRnK5a#GjxpiU7h1FT59qTGlYToig

- starion and Karthi_215

-

2

2

-

interesting....anyway if you show how to get AGet you would make a great gift to the forum

Hi Laser, already shared it here

https://indo-investasi.com/forum/forex-forum/trading-platform/785044-get-dvanced-get-soft-pdf-python

-

-

Hello, anyone could please reupload? thanks!

-

-

-

S&P at 3500 on a few weeks, imho

Count relabeled from wave 4 up to 3 down on weekly.

Daily, the oscillator is making a divergence but 5th waves tend to end in a five sequence moves so to reach the bottom we need to make downward move to make de 5 wave move of the 5th wave down.

I hope 3500 holds.

[weekly]

[daily]

-

Took a little tome to measure retracement on SPX from 2000, 2008, 2020 and some minor retracements (or not so), according to AGET on weekly we´re, still, on a wave 4 channels blue and green were broke so making new highs on the near term is unlikely. Ellipse study shows 3700 as a probable medium term stop and there I think we should see a wave counts relabeled to a 5 wave move. I dont think we should see a 50% retracement to 2370 but a 30% ´d leave us on the 3300 range not

too far away.

If anyone got another point of view ´d like to read it.

Cheers!

- Traderbeauty and subterguge

-

2

2

-

Hello, I got this error when tried to reply a thread with an image attached "You are not authorized to create or remove attachments". Dont know if it is my user setting as an standard member o something else. Thanks.

-

-

If you look at the videos only I agree theres not much you can grasp but with the pdf available makes sense to me. It helped me on ways you could think a trade w no fancy indicators

-

-

Cycle Trends Professional cracked

in Trading Platforms

Posted

I use Aget built 7.6 since found it more stable than 9.1. If anyone has esignal 10.6 EOD will be much appreciated. Thanks,