-

Posts

3069 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by OctaFX_Farid

-

-

Greek debt market discounting an elevated risk of default BTMU

FXStreet (Barcelona) - The Bank of Tokyo-Mitsubishi UFJ Team, comments that the ongoing negotiations between Greece and its creditors remains frustratingly slow, and with IMF loan repayment near, the Greek government debt market has been discounting for an elevated risk of default.

Key Quotes

The ongoing negotiations between the Greek government and its international creditors continue to remain frustratingly slow. The latest list of economic reforms submitted by the Greek government has shown progress but still fails to fully satisfy the Brussels Group. Negotiations will continue in the week ahead.

The Greek government is running out of time to secure financing. An IMF loan repayment totaling EUR458 million is due on the 9th April. The Greek government debt market is currently discounting an elevated risk of default.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 03,2015

OctaFX.Com News Updates

-

Greek debt market discounting an elevated risk of default BTMU

FXStreet (Barcelona) - The Bank of Tokyo-Mitsubishi UFJ Team, comments that the ongoing negotiations between Greece and its creditors remains frustratingly slow, and with IMF loan repayment near, the Greek government debt market has been discounting for an elevated risk of default.

Key Quotes

The ongoing negotiations between the Greek government and its international creditors continue to remain frustratingly slow. The latest list of economic reforms submitted by the Greek government has shown progress but still fails to fully satisfy the Brussels Group. Negotiations will continue in the week ahead.

The Greek government is running out of time to secure financing. An IMF loan repayment totaling EUR458 million is due on the 9th April. The Greek government debt market is currently discounting an elevated risk of default.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 03,2015

OctaFX.Com News Updates

-

Greek debt market discounting an elevated risk of default BTMU

FXStreet (Barcelona) - The Bank of Tokyo-Mitsubishi UFJ Team, comments that the ongoing negotiations between Greece and its creditors remains frustratingly slow, and with IMF loan repayment near, the Greek government debt market has been discounting for an elevated risk of default.

Key Quotes

The ongoing negotiations between the Greek government and its international creditors continue to remain frustratingly slow. The latest list of economic reforms submitted by the Greek government has shown progress but still fails to fully satisfy the Brussels Group. Negotiations will continue in the week ahead.

The Greek government is running out of time to secure financing. An IMF loan repayment totaling EUR458 million is due on the 9th April. The Greek government debt market is currently discounting an elevated risk of default.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 03,2015

OctaFX.Com News Updates

-

Greek debt market discounting an elevated risk of default BTMU

FXStreet (Barcelona) - The Bank of Tokyo-Mitsubishi UFJ Team, comments that the ongoing negotiations between Greece and its creditors remains frustratingly slow, and with IMF loan repayment near, the Greek government debt market has been discounting for an elevated risk of default.

Key Quotes

The ongoing negotiations between the Greek government and its international creditors continue to remain frustratingly slow. The latest list of economic reforms submitted by the Greek government has shown progress but still fails to fully satisfy the Brussels Group. Negotiations will continue in the week ahead.

The Greek government is running out of time to secure financing. An IMF loan repayment totaling EUR458 million is due on the 9th April. The Greek government debt market is currently discounting an elevated risk of default.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 03,2015

OctaFX.Com News Updates

-

Greek debt market discounting an elevated risk of default BTMU

FXStreet (Barcelona) - The Bank of Tokyo-Mitsubishi UFJ Team, comments that the ongoing negotiations between Greece and its creditors remains frustratingly slow, and with IMF loan repayment near, the Greek government debt market has been discounting for an elevated risk of default.

Key Quotes

The ongoing negotiations between the Greek government and its international creditors continue to remain frustratingly slow. The latest list of economic reforms submitted by the Greek government has shown progress but still fails to fully satisfy the Brussels Group. Negotiations will continue in the week ahead.

The Greek government is running out of time to secure financing. An IMF loan repayment totaling EUR458 million is due on the 9th April. The Greek government debt market is currently discounting an elevated risk of default.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 03,2015

OctaFX.Com News Updates

-

OctaFX.com-How IB program works!

How it works

How to become an IB?

Open a partner account at OctaFX.

Receive your referral link in the "IB Area" section of your Personal Area at OctaFX.

That's it, you are now an IB for OctaFX!

IB conditions!

Promo items for IB.

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

EUR/JPY poised to drop towards 128 SG

FXStreet (Barcelona) - Technical Analysts at Societe Generale, view that EUR/JPY is set to make a move lower towards 128 and even 126.

Key Quotes

The rebound in EUR/JPY during the second half of March appears to have faced resistance near 131.80, the 34-day MA and the 50% retracement from the February high.

With the daily RSI retracing from a resistance, the pair looks poised to drift towards 128 and probably even towards the previous low of 126.

It is noteworthy that the pair is undergoing an extended correction after violating a multi-year upward channel.

The weekly RSI is hovering close to a support, indicating 126 as a key level. A break below will mean the next leg of correction towards 122.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 02,2015

OctaFX.Com News Updates

-

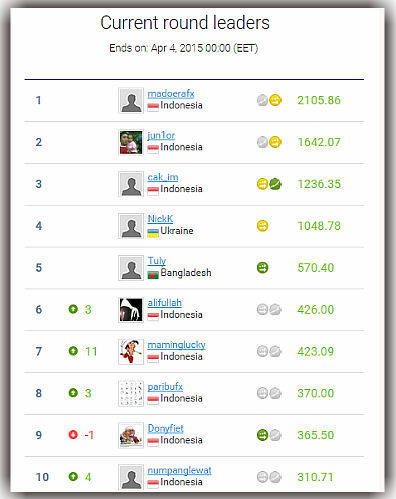

OctaFX.com-OctaFX cTrader Demo Contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Ends on: Apr 4, 2015 00:00 (EET)

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com-OctaFX cTrader Demo Contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Ends on: Apr 4, 2015 00:00 (EET)

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

OctaFX.com-OctaFX cTrader Demo Contest one week, 5 prizes, ultimate competition!

The main aim of the competition remains the same while environment changes: trade your cTrader demo account and end the week in highest profit to receive the prize from OctaFX. The contest round lasts one week from Monday Market opening to Friday Market closing! Prize fund of $400 is distributed between five lucky traders.Prize fund of $400 is distributed between five lucky traders:

Ends on: Apr 4, 2015 00:00 (EET)

Contest rules and regulations

View round standings

Take part now!

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

-

EUR/USD contained by 1.0715

FXStreet (Córdoba) - EUR/USD continues to waver within its recent range, with the pullback from last weeks highs having found interim support at the 1.0715 area.

EUR/USD entered a consolidation phase over the last sessions as investors gear up for the long weekend in Europe and the nonfarm payrolls report in the US. The US Government will publish March employment report on Friday, with consensus calling for a 244K job gain.

Todays data showed the US private sector added fewer jobs than expected (189K vs 225K exp), although this report has been underperforming NFP data over the last months. Strong employment data has supported the view the Fed could begin raising rates in the June-September period, which has driven the USD to multi-year highs versus most competitors in March. As for EUR/USD, the pair struck a 12-year low of 1.0462 on March 13th before staging a significant correction that was capped by the 1.1050 zone.

EUR/USD levels to watch

At time of writing, EUR/USD is trading at 1.0760, with immediate resistances lining up at 1.0800 (daily high/psychological level) and 1.0823 (100-hour SMA). On the flip side, supports are seen at 1.0714 (Mar 31/Apr 1 lows), 1.0700 (psychological level) and 1.0648 (Mar 20 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

EUR/USD contained by 1.0715

FXStreet (Córdoba) - EUR/USD continues to waver within its recent range, with the pullback from last weeks highs having found interim support at the 1.0715 area.

EUR/USD entered a consolidation phase over the last sessions as investors gear up for the long weekend in Europe and the nonfarm payrolls report in the US. The US Government will publish March employment report on Friday, with consensus calling for a 244K job gain.

Todays data showed the US private sector added fewer jobs than expected (189K vs 225K exp), although this report has been underperforming NFP data over the last months. Strong employment data has supported the view the Fed could begin raising rates in the June-September period, which has driven the USD to multi-year highs versus most competitors in March. As for EUR/USD, the pair struck a 12-year low of 1.0462 on March 13th before staging a significant correction that was capped by the 1.1050 zone.

EUR/USD levels to watch

At time of writing, EUR/USD is trading at 1.0760, with immediate resistances lining up at 1.0800 (daily high/psychological level) and 1.0823 (100-hour SMA). On the flip side, supports are seen at 1.0714 (Mar 31/Apr 1 lows), 1.0700 (psychological level) and 1.0648 (Mar 20 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

EUR/USD contained by 1.0715

FXStreet (Córdoba) - EUR/USD continues to waver within its recent range, with the pullback from last weeks highs having found interim support at the 1.0715 area.

EUR/USD entered a consolidation phase over the last sessions as investors gear up for the long weekend in Europe and the nonfarm payrolls report in the US. The US Government will publish March employment report on Friday, with consensus calling for a 244K job gain.

Todays data showed the US private sector added fewer jobs than expected (189K vs 225K exp), although this report has been underperforming NFP data over the last months. Strong employment data has supported the view the Fed could begin raising rates in the June-September period, which has driven the USD to multi-year highs versus most competitors in March. As for EUR/USD, the pair struck a 12-year low of 1.0462 on March 13th before staging a significant correction that was capped by the 1.1050 zone.

EUR/USD levels to watch

At time of writing, EUR/USD is trading at 1.0760, with immediate resistances lining up at 1.0800 (daily high/psychological level) and 1.0823 (100-hour SMA). On the flip side, supports are seen at 1.0714 (Mar 31/Apr 1 lows), 1.0700 (psychological level) and 1.0648 (Mar 20 low).

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

Treasuries: risks skewed to the downside RBS

FXStreet (Barcelona) - With treasuries closing the bearish gap and seeing a barrier at 129-00, Dmytro Bondar, Technical Analyst at RBS, believes that the next move would be lower towards 127-19 onto 126-18 and 126-00.

Key Quotes

Risks remain skewed to the downside after the break above the trendline on the yield chart and the formation of a bearish outside session on the futures price chart, which, contrary to Bunds charts, indicated downside risks for the market.

The breakaway gap at 128-26 was closed, but the 129-00 resistance proved to cap further rallies, as was expected. My bias was that there may be another push higher towards 129-00, but ultimately decline to 127-19+ onto 126-18+ and 126-00.

The push higher has already occurred. With level unbroken, it is now time to expect price decline.

A sustained break above 129-09 would require the view re-assessed, while a break above 129-29 cancels the view+.

Strategy: keep short from 128-29+ for 127-31 onto 127-00, stop 129-29

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

NZD/USD recovers to 0.7440

FXStreet (Mumbai) - The NZD/USD pair, which fell on disappointing Fonterra global diary trade auction, managed to recover back to 0.7440 on the disappointing US manufacturing PMI data.

Gains capped by fall in GDP price index

The pair recovered to trade at 0.7440 from the low of 0.7710 on a weaker-than-expected US ISM manufacturing figure, however, the gains could be capped by a 10.8% fall in the global dairy trade price index at the latest Fonterra auction.

The weakness in the dairy prices could weigh on the Kiwi, thereby limiting gains arising out of a weak ADP employment report and PMI manufacturing report.

NZD/USD Technical Levels

The immediate resistance is seen at 0.7465 (50-DMA), above which gains could be extended to 0.7489. On the flip side, support is seen at 0.7410, under which losses could be extended to 0.7371.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

US: ISM manufacturing PMI declines for fifth month in a row

FXStreet (Córdoba) - US manufacturing sector expanded but a slower pace in March according to the Institute for Supply Management (ISM).

ISM manufacturing PMI fell to 51.5 in March from 52.9 printed in February and missing consensus of 52.5.

Although the sector is still expanding (reading above the 50.0 threshold), the pace has been slowing for fifth month in a row, sending the index to the lowest level in almost two years.

Just a few minutes before the ISM, Markit reported its own manufacturing PMI which rose to 55.7 from 55.1 in February.

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

GBP/USD bearish tone prevails FXStreet

FXStreet (Barcelona) - Valeria Bednarik, Chief Analyst at FXStreet, notes that GBP/USD requires a break below 1.4750 to confirm further intraday declines.

Key Quotes

Technically, the 1 hour chart shows that the price erased half of its intraday losses, still well below its 20 SMA around 1.4830, whilst indicators recover from oversold levels but remain in negative territory.

In the 4 hours chart the bearish tone prevails with the price developing below its 20 SMA and the technical indicators below their mid-lines.

Renewed selling interest below the 1.4750 however, is required to confirm further intraday declines, particularly if the price remains capped below the mentioned 1.4830 price zone.

Support levels: 1.4750 1.4710 1.4660

Resistance levels: 1.4830 1.4990 1.4900

OctaFX.Com - Please click here to see Financial News/Forex News on OctaFx official page

Apr 01,2015

OctaFX.Com News Updates

-

OctaFX.com - 50% deposit bonus!

Supports margin

Open a position of bigger volume

Gain more profit

Automatic payout

Get your bonus instantly after trading required volume

Withdraw able

Withdraw your bonus funds with no restrictions

Promotion rules

Stand out for outstanding with OctaFX!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

OctaFX.com - Keep trading we'll take care of the rest

in Forex Brokers

Posted

OctaFX.com-OctaFX supports Indonesian Super League team Mitra Kukar!

OctaFX company continues to support indonesian sports - ISL football club Mitra Kukar becomes our football partner!

What makes OctaFX loyal to our Indonesian clients is support of the Indonesian community on the whole, especially through backing up sport and its development! Mitra Kukar Football Club is an Indonesian football club based in Tenggarong, Kutai Kartanegara, East Kalimantan competing in the Indonesia Super League. We confide in Mitra Kukar football team and their desire to win.

Mitra Kukar CEO Endri Erawan and OctaFX representative Joanna Archer signed a sponsorship agreement as a part of annual Sponsorship gathering in Jakarta on March 18, 2015.

On behalf of OctaFX, I would like to say how proud we are to be a part of this collaboration. OctaFX supports Indonesian community and the best way to support sport in Indonesia is to invest in successful and skillful football team like Mitra Kukar.

We share the same values, such as hard work, strength, dedication, purposefulness, aspiration towards victory.

We perceive the contract signing as the beginning of our long-lasting collaboration, and we are ready to assist the team in becoming Indonesian Super League champions this year.

Apart from that, teams coach Scot Cooper has a clear-cut strategy, and the team is at the peak of its strength, so with OctaFX support Mitra Kukar becomes invincible!

Joanna Archer, OctaFX

Follow our Sponsorship page to know all the recent news on our fresh collaboration and cheer for Mitra Kukar!

Become a champion with OctaFX!

Open account today and enter the world of requote-free trading and the fastest execution! Join OctaFX today!

Please stay tuned for the news and updates from OctaFX!

Wishing you luck and profitable trading, yours truly, OctaFX!

OctaFX-Most Reliable Forex broker 2014 by FX Empire!