All Activity

- Past hour

-

@Ninja_On_The_Roofcan you send me it too please? Thanks

- Today

-

⭐ RichardGere reacted to a post in a topic:

https://scalpershideout.com

⭐ RichardGere reacted to a post in a topic:

https://scalpershideout.com

-

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

-

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

-

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

fxzero.dark reacted to a post in a topic:

ATR-TradeShield

-

fxzero.dark started following ATR-TradeShield

-

fxzero.dark started following Gretta

-

I know of JIT, haven't seen it around.

-

If possible please share here.

-

techfo reacted to a post in a topic:

PVAutoTrendLines Strategy

techfo reacted to a post in a topic:

PVAutoTrendLines Strategy

-

Please send it to me as well. Thanks.

-

Eric joined the community

-

Can you send to me too please? Thank you

-

I unfortunately fell victim to a scam, and it turned out to be an incredibly challenging experience. I invested thousands of dollars, could not withdraw money in my account and they kept asking for tax when I attempted to request a payout. Despite my efforts involving the police, I faced significant obstacles. Fortunately, until I reported my case to a Cybercrime Units on their website( Cybertecx net ) and their lead investigator was able to trace and recoup my scammed funds without any upfront fees.

-

Olga Morales, Astrology For Gann Traders Advanced level

E-Money replied to poli's topic in Forex Clips & Movies

@tacotrader The man wrote in his original question, "I heard about him one month before my secondary progressed new moon phase at zero Capricorn." You decided to educate a person who was unable to research their own statement via a simple internet search. There is some humor there and is an illustration of the "give me" attitude of people on this forum. -

E-Money reacted to a post in a topic:

Olga Morales, Astrology For Gann Traders Advanced level

E-Money reacted to a post in a topic:

Olga Morales, Astrology For Gann Traders Advanced level

-

I will send you the link to download the software for compiling. One I have been using for years.

-

Wow. What a hostile group. And all these years, I have been here sharing my stuff plus, a touch of words of my own experience. There's really NO NEED for fighting or especially calling one another stupid or clowns or, even assuming that someone is actually meaning to express their views. Enough is enough.

- Yesterday

-

Maybe next time ask for help instead of taking swipes at folks. Anyways, copy this into your NT8 workspaces folder @Playr101 Scalpers Hideout.xml

-

Sharing, no. Selling, yes. Not me but what you are looking for is JITNinja.

-

Gretta reacted to a post in a topic:

Need help decompiling

Gretta reacted to a post in a topic:

Need help decompiling

-

Playr101 reacted to a post in a topic:

ATR-TradeShield

Playr101 reacted to a post in a topic:

ATR-TradeShield

-

⭐ goldeneagle1 reacted to a post in a topic:

ATR-TradeShield

⭐ goldeneagle1 reacted to a post in a topic:

ATR-TradeShield

-

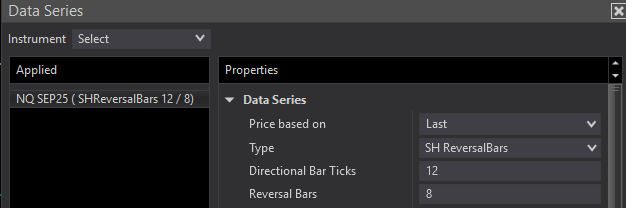

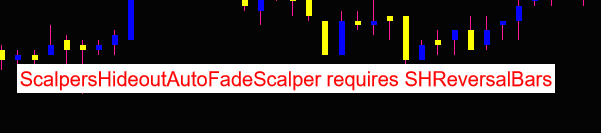

Oh... So, me being the idiot, when I load the "indicator" it doesn't matter what Data Series Type the chart its on because the "indicator" has the SH ReversalBars hard coded? Is that what you are telling me? Smart guy When loading the indicator on any other Data Series Type you get the following. And not that the fact you have to set the Data Series Type to SH ReversalBars? Which have inputs for Directional Bar Ticks and Reversal Bars. So, back to my original question, What Bar Type AND Size (Directional Bar Ticks and Reversal Bars)? OR are you saying it doesn’t matter what you input because the indicator somehow changes the bar type internally?? If so, Changes it based on what?

-

Olga Morales, Astrology For Gann Traders Advanced level

⭐ tacotrader replied to poli's topic in Forex Clips & Movies

She is using secondary progressions. One day represents one year. The position of the moon 28 days after birth should correlate to the 28th year. https://library.keplercollege.org/into-secondary-prog/ -

[GET] Chris Capre's Advanced Price Action Course

⭐ RichardGere replied to a topic in Learning Resources

Hope this is what you wanted. https://t.me/tradewoxo_course/5183 -

Rama joined the community

-

Can someone please re-upload again?

-

As important as a good strategy is also have a good money management. This is something worth having.

-

Yes, I understand your point. There are many algorithms and indicators that don't work as well as they appear in website images, so we need to try them ourselves in the live market or using playback to confirm whether they work well, repaint, or just simply selling an illusion. Personally, I never trust historical backtesting results on NinjaTrader, TradingView, or other platforms. That’s why I always ask the system to test it—to see if it truly works or is just another illusion. If you have the algos or know someone who does, please share it with us so we can all learn. As Thomas Edison said: "I have not failed 1,000 times. I have successfully found 1,000 ways that will not work."

-

@Playr101 What an idiot. Look at the response right after mine. There is a reason i said custom, comes with the indicator. YOU THE TRADER doesnt have any control over bar type or size. its hard coded into the indicator. BUT what do i know, per you, i am a clown 😂

-

OH... ok... thanks for the great answer. 🤡 If one does any research on the strategy, one would know that the strategy only works w/ the Custom SH ReversalBars, but thanks for the enlightenment. I guess if I asked what Instrument you were trading in the chart I would get an answer like, "It's a futures instrument". I asked for the Bar Type AND Size (Directional Bar Ticks and Reversal Bars) But don't worry. I don't need you to spoon feed me. I'll figure it out myself. I was just hoping for a starting point.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 8th August 2025.[/b] [b]Global Markets Struggle for Direction Amid Tariffs, Fed Expectations, and Weak Jobs Data.[/b] Wall Street Ends Mixed as Economic Signals Remain Conflicted Global markets endured another hesitant session on Thursday, with investors balancing disappointing U.S. labour data, central bank actions, and renewed trade tensions. Last week’s weak jobs report and an increase in unemployment claims reinforced expectations of a more dovish Federal Reserve stance in the months ahead. Bond market sentiment turned bearish after a poor 30-year Treasury auction capped a weak August refunding, while a hawkish interest rate cut from the Bank of England earlier in the day also weighed on confidence. An unexpected rise in U.S. productivity provided only a modest lift. Meanwhile, reciprocal tariffs went into effect at various levels, keeping trade policy firmly in focus. Apple’s announcement of a significant U.S. manufacturing investment helped Wall Street open with moderate gains, but momentum faded as dip-buying interest cooled. By the close, the NASDAQ finished 0.35% higher—well off session peaks—while the Dow Jones Industrial Average fell 0.51% and the S&P 500 slipped 0.08%. The CBOE Volatility Index (VIX) eased 1.25% to 16.56, and Treasuries ended mixed. Asian Markets Mixed; Nikkei Nears Record High In Asia, Friday’s trading was mixed. Tokyo’s Nikkei 225 surged 2.2% to 41,977.65, approaching record highs, after Japan confirmed it had resolved a dispute with Washington over tariffs on Japanese goods. The duties, implemented Thursday, initially exceeded the agreed 15% level, but Japan’s chief trade envoy confirmed the U.S. had agreed to make the necessary adjustment. Automakers were among the top performers, with Toyota Motor Corp. rising 3.9% and Honda Motor Co. gaining 4%. Elsewhere, sentiment was softer. Hong Kong’s Hang Seng declined 0.7% to 24,916.15, the Shanghai Composite Index edged up less than 0.1% to 3,642.10, South Korea’s Kospi lost 0.7% to 3,206.86, and Australia’s S&P/ASX 200 slipped 0.2% to 8,813.70. Taiwan’s Taiex gained 0.2%, while India’s Sensex fell 0.5%. Stephen Innes of SPI Asset Management described market momentum as unpredictable, warning that early-week trends can reverse sharply by Friday. Tech Sector Gains Offset by Intel Troubles Technology stocks provided the strongest lift in the U.S. session. Apple rose 3.2% after CEO Tim Cook joined President Donald Trump at the White House to announce an additional $100 billion investment in U.S. manufacturing over the next four years. Semiconductor stocks also advanced after Trump imposed 100% tariffs on imported chips but promised exemptions for companies with substantial U.S. operations. Advanced Micro Devices surged 5.7%, while Nvidia added 0.8%. Intel, however, fell 3.1% after Trump demanded the immediate resignation of CEO Lip-Bu Tan, accusing him of being “highly conflicted” due to his ties with Chinese firms. Tan responded by confirming that Intel is in active talks with the U.S. administration to address concerns and ensure accurate information is provided, while reaffirming the company’s focus on turning around its struggling operations. Oil Prices Head for Steepest Weekly Losses Since June Oil prices were little changed in early Asian trading on Friday but were poised for their sharpest weekly declines since late June. Brent crude futures dipped three cents to $66.40 a barrel at 0050 GMT, on track to fall more than 4% for the week, while U.S. West Texas Intermediate crude slipped six cents to $63.82, set for a weekly loss of over 5%. ANZ Bank analysts warned that the latest U.S. tariffs, which came into force Thursday, have raised fears of slower global economic growth and reduced oil demand. Prices were already under pressure after OPEC+ announced last weekend that it would fully unwind its largest tranche of output cuts in September, months ahead of schedule. WTI futures have now fallen for six consecutive sessions, matching a losing streak last seen in December 2023. A decline on Friday would mark the longest streak since August 2021. Geopolitical Developments Add to Market Uncertainty The Kremlin confirmed on Thursday that Russian President Vladimir Putin will meet U.S. President Donald Trump in the coming days, fueling speculation of a potential diplomatic breakthrough in the war in Ukraine. The U.S. also imposed new tariffs on India over its purchases of Russian crude oil, though analysts at StoneX noted the measures are unlikely to significantly disrupt Russian oil flows to global markets. Trump also indicated that China, the largest buyer of Russian crude, could face similar tariffs. Currency Market Moves In currency trading, the U.S. dollar edged up to 147.16 yen from 147.13, while the euro eased to $1.1660 from $1.1667. With trade disputes intensifying, central banks adjusting policy, and commodity markets under pressure, volatility remains a defining feature of the current global market landscape. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.