All Activity

- Past hour

-

Jhon had stopped selling mboxwave. Reasons unknown. There is also a free working version from Val1312q but unfortunately it flags for the MSILZilla trojan with Bitdefender and 30/63 positive with Virustotal.com. This trojan allows outside taking control of your computer without you being aware of it. It could be a false positive but those who want to use it must accept the risk. Incidentally, Val free channel has been banned in TG. Hopefully he will set up a new channel soon.

-

Whatever happened to his promise to make us rich?🤫

-

Awesome!😂 Play around with settings, I am sure you will have a match, or at least, close to the ProEdge signals.

-

kimsam reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

kimsam reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

-

Never mind, I found the spymoney indicators.

- Today

-

ah ok thanks. It's working now.

-

alodante reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

alodante reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

-

alodante reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

alodante reacted to a post in a topic:

Ninza Captain Optimus Strong Needs Unlocking

-

contact him @jhon_snow_0

-

kkreg reacted to a post in a topic:

proedgetrading.com

kkreg reacted to a post in a topic:

proedgetrading.com

-

kkreg reacted to a post in a topic:

ScalperIntel IFVG

kkreg reacted to a post in a topic:

ScalperIntel IFVG

-

Would you mind sharing the spymoney moneyflow indicator?

-

geo9425 reacted to a post in a topic:

aep-international.net

geo9425 reacted to a post in a topic:

aep-international.net

-

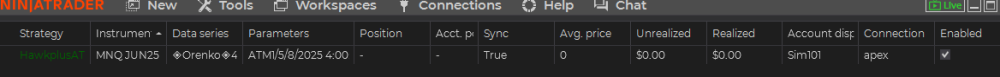

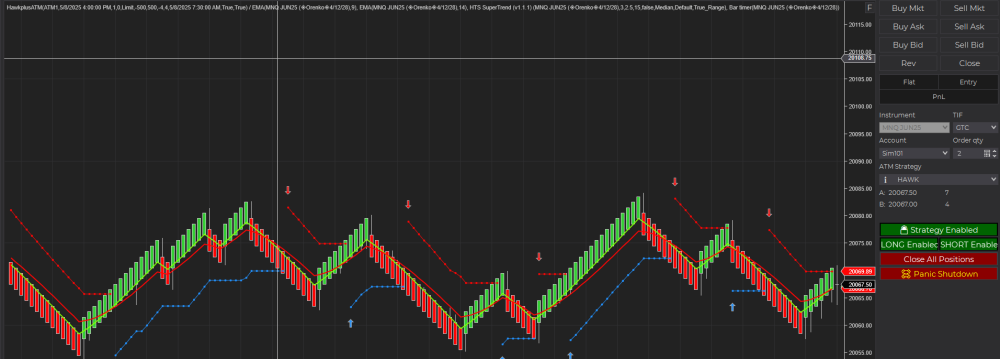

Ouch! I tried to play around with Apex Copier yesterday and bit after my stupid story. This time, I used SIM account as a leader and the rest to follow. This is what happened on my end. SIM one got filled instantly. Then I checked the other accounts one by one. I found out to my surprise, some of the followers had ghost orders on my chart, waiting and hanging. This ain't cool at all. No wonder I had opposite trades. I am currently checking out the free one from Ecosys.

-

Ninza Captain Optimus Strong Needs Unlocking

Ninja_On_The_Roof replied to TickHunter's topic in Ninja Trader 8

It is somewhat limited to many of your favorite indicators that you want to use for entries. It can only pick up indicators that have some types of "signal", up down... Thank you for sharing. -

Try 1m candles first. Then play around.

-

Yes, I use 1m, but in the atm under stop strategy click edit and change the frequency to 1. Below before 10am as people close positions before news.

-

geo9425 reacted to a post in a topic:

@apmoo Can you teach / Guide us?

geo9425 reacted to a post in a topic:

@apmoo Can you teach / Guide us?

-

Anyone who has it- please upload the ocean theory book and vids separately.

-

-

Kermit 1981 reacted to a post in a topic:

ScalperIntel IFVG

Kermit 1981 reacted to a post in a topic:

ScalperIntel IFVG

-

Ok .. need to check this

-

Thank you! I will try it. Is it profitable for you?

-

Example put the atm in your templates atm strategy folder select it in ninja in hawk, Type the word HAWK same as atm, then enable the strategy. HAWK.xml

-

can he do mboxwave ?

-

Liwulong joined the community

-

You have to make a ATM and name it, put the same name in hawk

-

fxtrader99 reacted to a post in a topic:

ScalperIntel IFVG

fxtrader99 reacted to a post in a topic:

ScalperIntel IFVG

-

Is it working for anybody? I turn on the bot but it's not placing any trades.

-

Sidi volume and sidi levels https://workupload.com/archive/sy4GpmCZsZ need to fix @kimsam @apmoo

-

https://workupload.com/file/H3eduZd7bcL indicator needs to fix , great indicators

-

What is the Best Course for Begginer

⭐ trader65 replied to momo10's topic in General Forex Discussions

I recommend Al Brooks trading course -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 08th May 2025.[/b] [b]Markets Rally as Fed Holds Rates, Trump Teases Major Trade Deal With UK.[/b] US stocks surged midweek as investors reacted to a flurry of market-moving developments—from Federal Reserve policy decisions and trade deal speculation to AI regulations and geopolitical tensions. Federal Reserve Holds Rates Amid Political Pressure Despite mounting pressure from former President Donald Trump to lower interest rates ahead of a potential economic slowdown, the Federal Open Market Committee (FOMC) unanimously voted to maintain the benchmark interest rate in the 4.25% to 4.5% range. This decision follows a full percentage point cut made in late 2024. ‘Uncertainty’ remains the name of the game for the FOMC as well as the markets. Though the word was used only once in the statement, Chair Powell used it, or variations of it, many times in his presser, ultimately saying his gut tells him ‘uncertainty’ over the economy's path is extremely elevated. Powell warned of ongoing risks from global trade tensions and tariffs, stating, ‘If sustained, large increases in tariffs could lead to higher inflation, slower growth, and increased unemployment.’ He acknowledged that the Fed remains vigilant, especially as uncertainties around international trade persist. The major takeaway is that the Fed is firmly on the sidelines monitoring the many tariff-related unknowns regarding their ‘scale, scope, timing, and persistence’ and their impacts on the economy. The Fed is in no hurry and awaits clear evidence to dictate the appropriate policy response. Federal Reserve Chair Jerome Powell reaffirmed the central bank’s independence on Wednesday, dismissing political influence from the White House. Addressing reporters, Powell emphasised, ‘President Trump doesn’t affect our doing our job at all,’ and reiterated that he has never—and will never—request a meeting with any US president. Trump Sparks Market Rally With UK Trade Deal Tease Equity markets jumped late Wednesday after Donald Trump posted on Truth Social that the US had secured a ‘MAJOR TRADE DEAL WITH A BIG, AND HIGHLY RESPECTED, COUNTRY.’ Sources familiar with the matter indicated the United Kingdom is expected to be named as the trade partner during a scheduled White House press conference Thursday morning. US stock futures surged on the news: Dow Jones Industrial Average futures rose 0.6% S&P 500 futures gained 0.7% Nasdaq 100 futures climbed 1% Gold is down 0.7%, sliding to $3,336 — edging closer to the crucial 100-hour moving average at $3,330. Expectations for a broader US-UK economic agreement added to investor optimism, alongside plans for high-level trade talks between the US and China in Switzerland. However, Trump’s statement that tariffs on Chinese imports would remain in place ahead of the negotiations tempered some enthusiasm. Asian Markets and Geopolitical Concerns Asian stock markets followed the US momentum on Thursday: Japan’s Nikkei 225 rose 0.2% Australia’s ASX 200 increased 0.2% South Korea’s Kospi added 0.3% Hong Kong’s Hang Seng surged 0.8% Shanghai Composite advanced 0.8% However, ongoing geopolitical tensions, particularly the escalating conflict between India and Pakistan, introduced fresh risks. Pakistan has vowed retaliation for missile strikes it says were carried out by India, resulting in over 30 civilian deaths in Pakistan-administered Kashmir and Punjab. The situation has drawn international concern over the potential for wider instability in the region. Nvidia, AMD Surge as AI Export Rules Get Revamped Tech stocks, particularly in the semiconductor sector, also benefited from a regulatory shift. Nvidia (NVDA) closed up 3% following reports that the Trump administration will repeal AI chip export restrictions imposed by the Biden administration. The US Commerce Department confirmed the policy reversal, describing the previous rules as ‘overly bureaucratic’ and vowing to implement a streamlined framework that ‘unleashes American innovation.’ Advanced Micro Devices (AMD) also climbed nearly 1.8% on the news, though both chipmakers saw their shares ease slightly in after-hours trading. The Walt Disney Co. led the earnings-driven rally, soaring 10.8% after beating profit forecasts, raising guidance, and reporting over one million new streaming subscribers. BoE Expected to Cut Today The BoE is widely expected to lower the Bank Rate by another 25 bp to 4.25% on May 8. U.K. inflation is still expected to pick up again before retreating, but lower oil prices and a stronger pound will likely prompt the BoE to lower inflation forecasts with the updated Monetary Policy Report, which will pave the way for lower rates. And with growth risks intensifying thanks to US tariff jitters and the impact of the autumn budget, the chances of back-to-back cuts are rising, especially as U.K. rates remain relatively high. Stagflation risks continue to linger, but BoE head Bailey warned last week that a trade war would hurt the U.K. economy, despite the fact that it is facing lower ‘reciprocal’ tariffs than others. Bailey stressed that ‘it is not just the relationship between the US and the UK, it is the relationship between the US, the U.K. and the rest of the world that matters, because the UK is such an open economy.’ ‘We have to take very seriously the risk to growth’, Bailey warned, adding that ‘fragmenting the world economy will be bad for growth.’ Outlook: Economic Growth Meets Policy Uncertainty Despite global uncertainties, the Fed noted that the US economy continues to grow at a ‘solid pace.’ However, Powell cautioned that persistent tariff threats and rising inflation could put the central bank in a precarious position,risking a scenario of stagflation, where economic stagnation coincides with rising prices. With trade negotiations looming, rate cuts paused, and geopolitical risks rising, investors will be closely monitoring headlines for clues on the next moves in markets and monetary policy. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.