⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 17th February 2026. Market Wrap: Tech Weakness Extends as AI Fears and Geopolitics Weigh on Sentiment. Global markets reopened Tuesday with a cautious tone as investors returned from the US Presidents’ Day holiday to find risk appetite still fragile. Equity-index futures signalled further downside in US technology stocks, while bond markets attracted renewed demand amid geopolitical uncertainty and shifting expectations around monetary policy. US Futures Point Lower as Tech Slide Deepens Futures linked to the S&P 500 declined roughly 0.4%, while contracts on the Nasdaq 100 dropped nearly 0.8%, indicating that the recent pullback in growth and AI-linked names may not be over. The technology sector, which had driven much of the market’s upside momentum in recent months, continues to face pressure as investors reassess valuations and the longer-term implications of AI disruption. Last week’s inflation data complicated expectations for Federal Reserve rate cuts, and traders now await further signals from upcoming Fed commentary and minutes from January’s policy meeting. Bonds Gain as Safe-Haven Demand Returns US Treasury yields edged lower, with the 10-year yield slipping to around 4.02%, reflecting defensive positioning. The Japanese yen, traditionally viewed as a safe-haven currency, strengthened against the dollar, reinforcing the shift toward caution. In Japan, government bonds rallied across the curve following stronger-than-expected demand at a five-year auction, suggesting that expectations for near-term tightening by the Bank of Japan are softening. Asia Quiet, Europe Under Pressure Trading volumes in Asia were subdued as markets in China, Hong Kong, and several regional centres remained closed for the Lunar New Year. Elsewhere in the region, equity performance was mixed, with Australia and India posting modest gains. European markets have prepared for a weaker open. In the UK, the pound weakened after unemployment climbed to a near five-year high and wage growth moderated, data that could influence the Bank of England’s rate trajectory in the coming months. Middle East Tensions Back in Focus Geopolitical risks re-emerged as a key driver of market tone. Iran’s recent naval drills near a critical shipping route heightened concerns ahead of renewed nuclear discussions with the United States. Diplomatic efforts are ongoing, but rhetoric has intensified. Former President Donald Trump has warned of potential military action should negotiations fail, adding another layer of uncertainty to an already fragile environment. Oil prices held relatively firm amid these developments, though broader commodity markets reflected risk-off sentiment. Precious Metals and Crypto Pull Back Despite geopolitical tensions, precious metals retreated. Gold slipped toward the $4,900 per ounce level, while silver and platinum recorded sharper losses. The decline suggests profit-taking after recent rallies rather than a full unwind of safe-haven positioning. Cryptocurrencies also softened, with Bitcoin trading near $68,300. The pullback comes amid broader volatility across speculative assets as traders recalibrate exposure to high-beta trades. The “AI Cannibalisation” Debate Intensifies Artificial intelligence remains a central theme driving cross-asset volatility. While earnings growth in the US remains resilient, with companies delivering approximately 13% growth this season, concerns are building around what some strategists describe as “AI cannibalisation.” The debate centres on whether AI adoption will enhance productivity or disrupt entire business models, particularly in software, media, and business services. Investment banks are already structuring thematic baskets that go long companies poised to benefit from AI adoption while shorting those potentially vulnerable to workflow displacement. This divergence is adding dispersion within equity markets and amplifying stock-specific volatility. Corporate Movers Several notable corporate developments added to the narrative: BHP Group shares surged after reporting a more than 20% rise in half-year earnings, supported by strong copper prices. Apple Inc. announced a March 4 product launch event, fueling anticipation for new device announcements. Danaher Corporation is reportedly nearing a $10 billion acquisition of Masimo. Alibaba Group unveiled a major upgrade to its flagship AI model, intensifying competition in China’s fast-moving AI race. Advanced Micro Devices announced collaboration plans with Tata Consultancy Services to expand AI data-centre capabilities in India. The Bigger Picture Markets are navigating a complex intersection of themes: Slowing but persistent inflation Uncertainty over the timing of Fed rate cuts Renewed geopolitical risks Earnings resilience versus valuation concerns Structural disruption from artificial intelligence With liquidity thinner due to global holidays and catalysts limited early in the week, volatility may remain elevated as investors look toward fresh economic data and central bank commentary for direction. For now, the tone is defensive. Whether this develops into a deeper correction or merely a consolidation phase will likely depend on upcoming inflation readings, Fed communication, and the sustainability of corporate earnings growth. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

Oana SSS reacted to a post in a topic:

TradingSecretsAIChannels_NT8_1008b needs to fix

Oana SSS reacted to a post in a topic:

TradingSecretsAIChannels_NT8_1008b needs to fix

-

blackhex started following https://purealgocapital.com

-

https://purealgocapital.com/indicators/ anyone has these indicator file ? please share them

-

Whether Bitcoin reaches 100k depends on adoption, liquidity, regulation, macro conditions, and market cycles. Strong demand, ETF inflows, network growth, and favorable policy can push prices higher, while tight liquidity and risk-off markets can delay targets. No outcome is guaranteed. Long-term investors focus on fundamentals, position sizing, and patience rather than fixed price milestones.

-

Cryptocurrencies and gold serve different roles, but taking a position in crypto offers higher growth potential in a digital economy. Gold protects against inflation and uncertainty, while crypto benefits from innovation, network adoption, and global liquidity. A forward-looking strategy favors crypto for long-term upside, with disciplined risk management and diversification to navigate volatility and changing market cycles.

-

Chasing coins thoughtfully means tracking trends, volume shifts, and project updates to sharpen timing and discipline. When done with rules, it builds market awareness, faster decision-making, and risk control. Pair momentum strategies with fundamentals and diversification. Balancing established assets with emerging projects like the LMGX token can broaden exposure while keeping a structured, long-term investing approach.

-

TradingSecretsAIChannels_NT8_1008b needs to fix

Ninja_On_The_Roof replied to TRADER's topic in Ninja Trader 8

I recall this one was educated and posted long ago. -

Please share, thanks

-

thanks but i already had the trial…i need a non time restriction version

-

You should also mention the crack creator.

-

It works just fine @wertamido

-

kingmob6 reacted to a post in a topic:

Ultimate A.I. PRO Indicator

kingmob6 reacted to a post in a topic:

Ultimate A.I. PRO Indicator

-

techfo reacted to a post in a topic:

Market Replay Downloader

techfo reacted to a post in a topic:

Market Replay Downloader

-

techfo reacted to a post in a topic:

Market Replay Downloader

techfo reacted to a post in a topic:

Market Replay Downloader

-

techfo reacted to a post in a topic:

Market Replay Downloader

techfo reacted to a post in a topic:

Market Replay Downloader

-

techfo reacted to a post in a topic:

Market Replay Downloader

techfo reacted to a post in a topic:

Market Replay Downloader

-

techfo reacted to a post in a topic:

lastest version predator traesaber version 3.6.0.0.0 need to edu

techfo reacted to a post in a topic:

lastest version predator traesaber version 3.6.0.0.0 need to edu

-

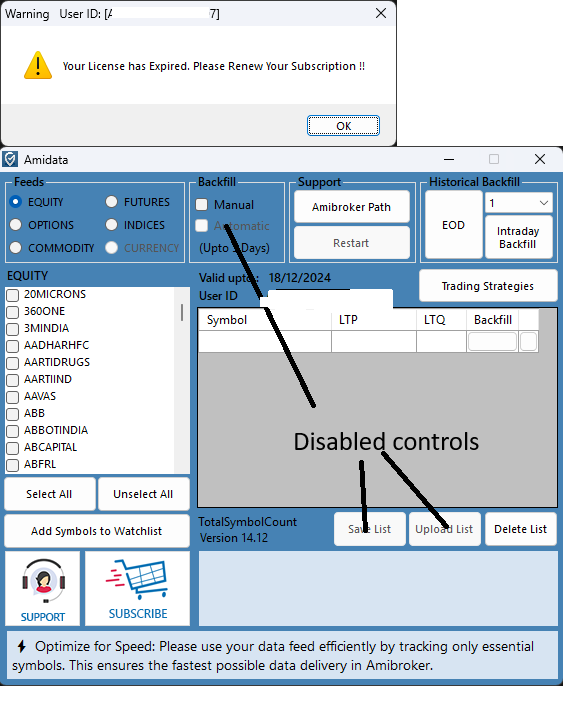

Here it is in the attachment. Also, I just noticed, one can add new symbols and they get to show realtime updates but Amibroker isn't updating in realtime. Notice the disabled controls too. Will check further and update later.

-

@kimsam @N9T and others pl take a look and help.

-

lis22 joined the community

-

TradingSecretsAIChannels_NT8_1008b needs to fix

wertamido replied to TRADER's topic in Ninja Trader 8

is not working at all -

I'm pretty sure N9T has educated it but he's not willing to share. Also who's Ali?

-

For Ninjatrader please Thank you.

- Yesterday

-

Luke SteelWolf started following A.I chatGPT

-

I think it only works on Volume Tools NT8 version . So if Ali could make it work, this is a challenge for you, whether you are better than Ali and his cohorts or not.

-

2 weeks trial: http://files.fibonaccitrader.com/ftgt/ftgtv410setup.exe Updates: http://www.galacticinvestor.com/ftgttrial/ftgt_trial.htm

-

Crazy how bro has educated this and openly said it yet gatekeeps it lol. Nice to see nobody wants to share

-

for Trading View or NT8

-

I never dealt with the expiry since I am still in a valid trial mode LOL will look into it. is it possible to send a screenshot of the expired nag? thanks

-

I will try that and post my results

-

https://workupload.com/file/r7nE6FNszTz

-

erreur : Unable to create instance of ninja script...