⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

fxzero.dark reacted to a post in a topic:

TradeCopier

fxzero.dark reacted to a post in a topic:

TradeCopier

-

fxzero.dark reacted to a post in a topic:

SMM Metrics Time filter refined

fxzero.dark reacted to a post in a topic:

SMM Metrics Time filter refined

-

fxzero.dark reacted to a post in a topic:

SMM Metrics Time filter refined

fxzero.dark reacted to a post in a topic:

SMM Metrics Time filter refined

- Today

-

⭐ goldeneagle1 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

⭐ goldeneagle1 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

-

⭐ epictetus reacted to a post in a topic:

SMM Metrics Time filter refined

⭐ epictetus reacted to a post in a topic:

SMM Metrics Time filter refined

-

⭐ goldeneagle1 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

⭐ goldeneagle1 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

-

techfo reacted to a post in a topic:

SMM Metrics Time filter refined

techfo reacted to a post in a topic:

SMM Metrics Time filter refined

-

⭐ goldeneagle1 reacted to a post in a topic:

DeltaBarType

⭐ goldeneagle1 reacted to a post in a topic:

DeltaBarType

-

⭐ goldeneagle1 reacted to a post in a topic:

indi needs to educate please

⭐ goldeneagle1 reacted to a post in a topic:

indi needs to educate please

-

@kimsam Were you able to convert to NT8?

-

https://workupload.com/file/pFmnbDvQ6Fp

-

@kimsam @apmoo Please assist Thanks 🙏

-

@kimsam that would be awesome

-

Can convert it to ninjatrader .

-

I forgot to mention that this is tested 1 bar after the signal, wich means its only triggering the entry 1 bar later, so, its better because when you get the actual signal, you getting early 1 bar before the entry in the strategy, wich in fact, makes you get in at the actual signal for better prices.

-

-

5 minute time frame for those settings

-

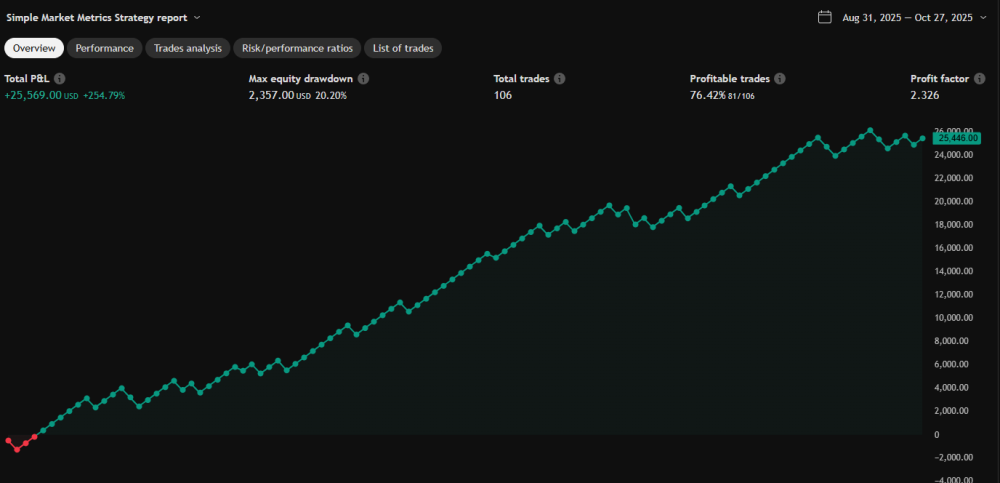

I refined the code in Tradingview, so, backtesting it can be the same as using Predator with the NT8 version. 111tick profit, 156 stop, 76% win rate since Aug 31. I took the test frim the closing of the candle and not the opening, since that reveals where the next candle will open to get the actual trade done. i am still working around win loss ratio and stops, but this one should get you started with those 100K prop acc, since we still have 20% drawdrawn on a 10k investment and a 254%return. I changed the code for time filter. starts at 9am NY till 4 oclock to get those results and stops btw 12 and 12.29 NY lunch. Play around with it Gonna keep trying to work on this but looks decent. @version=5.txt

-

@BC77851620 Yeah we can use the tradesaber's PredatorXOrderEntry

-

Much appreciated @Harrys

-

@apmoo Please can you edu this BOF iceberg indicator? https://workupload.com/archive/jBPrZrz3N5

-

please educate if you can MTRIndicator_v4.0.zip ReversalIndicator_v10.0.zip

-

Hey Crew.. Does anyone know how to turn this indicator into an automated bot for ninja

-

Need some fix .. I'm testing something.. will add it soon

-

what happened kinsam?

-

I am not judge anybody

-

Futures You tube channel Daily Trade

roddizon1978 replied to roddizon1978's topic in General Discussions and Lounge

-

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD falls below 1.4000 The USDCAD rate has slipped below the key 1.4000 level amid a corrective pullback, as markets anticipate an upcoming interest rate cut from the Federal Reserve. Discover more in our analysis for 27 October 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair continues to move lower within its ongoing correction phase. The broader daily trend remains bullish, suggesting that after the current pullback, the pair could resume its upward trajectory. The USDCAD pair has slipped below the psychologically significant 1.4000 level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index slightly recovered, but the decline continues The DE 40 stock index has partially rebounded from its recent losses, but the overall trend remains bearish. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s preliminary manufacturing PMI came in at 49.5 in October 2025 Market impact: the data creates a mixed backdrop for the German equity market Fundamental analysis Germany’s manufacturing PMI for October came in at 49.6 points, slightly above both the consensus forecast of 49.5 and the previous reading of 49.5. The figure indicates that the industrial sector remains in contraction, but with signs of gradual stabilisation near the neutral threshold. For the equity market, this is a moderately positive signal in terms of expectations: the slower pace of decline in manufacturing supports the valuation of future cash flows in cyclical sectors, reduces the risk of margin erosion from underutilised capacity, and may help narrow discounts on industrial assets. However, since the indicator remains below 50, it continues to reflect weakness in domestic and external demand, limiting the upside potential and making it dependent on confirmation of improvement in subsequent data releases. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 349 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Lets engage people 🎯