⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Simion_Aretz reacted to a post in a topic:

Phoenix

Simion_Aretz reacted to a post in a topic:

Phoenix

-

Simion_Aretz reacted to a post in a topic:

Phoenix

Simion_Aretz reacted to a post in a topic:

Phoenix

-

Not for anything else but I think he is the best and can solve many problems.

-

⭐ rcarlos1947 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

⭐ rcarlos1947 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I think it's better to buy from @Jhon_snow_0

-

But is this a sharing community or a seller community?

-

They're not willing to share it, best bet is to purchase from Rohit at this point. He's working on the latest release atm

-

Thanks 🙏 is this one educated and ready to go?

-

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I use on a couple apex funded accounts. Couple of red days this week which sucks but I’m sized ok for the DD (I hope lol) IMHO - i think Zeus is good on a funded account when you size right, you have to be able to ride the drawdown. You also have to follow the rules and not enable during news, roll over weeks etc. It’s a good algo that’s performed well over 3 years and still almost always performs well when you look back at 90 / 60 / 30 days etc. I do believe it’s one of the better ones out there. most just don’t have patience and stop using after seeing some red days or of course are just sized way too heavy.

-

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

booster reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

- Today

-

⭐ kapitansb reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

⭐ kapitansb reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

⭐ kapitansb reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

⭐ kapitansb reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

TRADER reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

TRADER reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I have tested a lot of the Strategy posted here and none of them are set and forget. Some of the settings work great for 1 day / week then after that they don't work anymore. I have found the best way to pass the prop firsts is to find a few indicators that work and really try to understand them. I tried for a while to use every strategy and get it dialed it but most seem to not work after a little bit.

-

dex reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

dex reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Hello, I know some of you were looking for these. NinzaATRTradeShield_NT8 NinzaPANAKanal_NT8 RenkoKings_FlazhInfiity_NT8 Here they are. I removed embedded files here and there. They should now work fine with the rest of indicators from NINZA INDICATORS PACK. Click NO to EVERYTHING. https://workupload.com/archive/AXyGQZut4D

-

Does anyone have the emotional manager from Bruno Meza? https://brunomeza.com/index.php/producto/riesgo-gestor-emocional-para-ninjatrader-8/

-

I also thought the point of this place was to share and collaborate with others. Sharing what we have and helping each other out. Guess its going in a different direction.

-

Anyone tried this with propfirm? i tried different setting but i think it's not worth to try

-

Kirua joined the community

-

QZeus_1_2_0_4 https://workupload.com/file/2QLUrDuv6xg

-

Yeah you're Right, sorry @Simion_Aretz

-

@trader04 The time it took you to type this, you could have typed the password or quoted the message that has the password. Lets be kind to each other. As traders, everyone is dealing with a lot.

-

Jahz joined the community

-

Thanks for sharring!Can you share the link password pls?

-

Phoenix strategy Put anything in for license https://workupload.com/file/bE2aDsqRS2f https://futures.aeromir.com/phoenix

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[B]Date: 10th February 2026.[/B] [B]S&P 500 Rebounds as AI Stocks Lead Gains Ahead of Key US Economic Data.[/B] The US stock market witnesses a second consecutive day of significant gains as market sentiment improves. The S&P 500 earlier in the month fell by more than 4%, but has been regaining bullish momentum. The index has now formed a 90% correction. The upward price movement is largely due to sentiment towards technology companies and AI improvements. AI-related companies are mainly driving the bullish momentum. NVIDIA, Microsoft and Broadcom are the main drivers of the trend. Today, the US will release its latest Retail Sales figure, which will trigger some volatility for the stock market. However, the price in the medium-term will largely depend on the upcoming NFP data and US Inflation. US Jobs and Inflation Data The S&P 500 bullish trend is strongly connected to the upcoming US data, as it is likely to indicate how the Federal Reserve will set its path for interest rates. Buyers will ideally be looking for the inflation rate to decline and for employment to remain somewhat stable. Stronger employment data would allow more leeway for the Federal Reserve to make no adjustments to interest rates. Analysts are expecting the Non-Farm Employment Change to add 66,000, similar to the previous months. The US Unemployment Rateis also likely to remain at 4.4%. Analysts project the Consumer Price Index (inflation rate) to fall from 2.7% to 2.5%, the lowest in 8-months. Currently, there is only a 17% chance of an interest rate cut in March according to the Fedwatch Tool. However, the decline in inflation can prompt this statistic to move in favour of the stock market. If indeed the statistics do read as per expectations, the S&P 500 may see further bullish momentum. Another key release will also come from company earnings. Cisco and McDonald’s are due to announce their quarterly earnings report tomorrow. In 2026, Cisco stocks have risen 14% while McDonald's has risen 7%. The two companies make up almost 1% of the total S&P 500. Risks To The Stock Market Goldman Sachs’ closely watched “Panic Index” has surged to near so-called “max fear” levels, underscoring a sharp rise in investor anxiety across US equity markets. The spike reflects growing concern that the recent bout of volatility may not be over, and that a deeper sell-off could be triggered if key technical thresholds give way. According to Goldman’s analysis, positioning and sentiment indicators suggest that as much as $33 billion in equity selling could be unleashed if the S&P 500 breaks below critical support levels that many systematic and momentum-based strategies rely on. However, other indicators related to risk do not support this outlook. The VIX Index, another fear index, is trading slightly higher this morning; however, its weekly performance indicates a positive stock market. For 2026, the VIX Index has traded higher, which is concerning, but if the index continues to fall like the past week, the fear factor will decline. S&P 500 - Technical Analysis HFM - S&P 500 30-Minute Chart The price action and waves within the S&P 500 are following the traditional bullish trend pattern. Price swings continue to form higher highs and higher lows on smaller timeframes, such as the 15-Minute chart. On the 2-hour timeframe, the price is trading above the 75-Bar EMA and 100-Bar SMA, which indicates a bullish sentiment. The price also remains on the positive side of the MACD, but not above the signal line. However, if the price rises above $6,971, the bars within the MACD are likely to cross above the signal line. As a result, bullish signals are likely to strengthen. If bearish momentum gains and the price falls below $6955, bullish sentiment and technical indicators will likely fade. Key Takeaways: S&P 500 rebounds after a 4% pullback, regaining bullish momentum. AI and big tech lead gains, driven by NVIDIA, Microsoft, and Broadcom. Key US data ahead (Retail Sales, NFP, Inflation) will steer market direction. Rate-cut odds remain low, but falling inflation could boost equities. Risk signals are mixed, with panic indicators elevated but technicals still bullish. [B]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/B] [B]Please note that times displayed based on local time zone and are from time of writing this report.[/B] Click [URL='https://www.hfm.com/hf/en/trading-tools/economic-calendar.html'][B]HERE[/B][/URL] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [URL='https://www.hfm.com/en/trading-tools/trading-webinars.html'][B]HERE[/B][/URL] to register for FREE! [URL='https://analysis.hfm.com/'][B]Click HERE to READ more Market news.[/B][/URL] [B]Michalis Efthymiou HFMarkets[/B] [B]Disclaimer:[/B] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

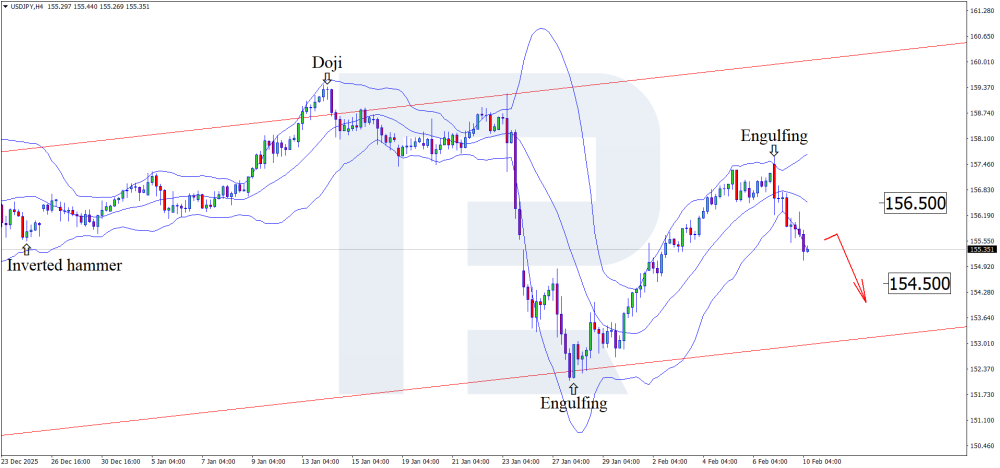

BoJ intervention rumours push USDJPY lower The USD continues to lose ground against the yen, with quotes testing the 156.70 level. Discover more in our analysis for 10 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair formed an Engulfing reversal pattern near the upper Bollinger Band and is trading around the 155.40 level. At this stage, the price may continue its downward wave following the pattern’s signal, with the downside target at 154.50. The yen continues to strengthen against the USD, with technical analysis of USDJPY suggesting a decline towards the 154.50 support level. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team

2026_02_10(12_56_20PM).thumb.png.61aa294349913753335685e0dd34ce31.png)