the5ers

-

Posts

24 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by the5ers

-

-

-

Hi there Gil,

Thanks a lot ! Even it was somehow cryptic, I think I got it! :)

I studied the FTR pattern ( linked with engulfing price action ) and S/R level that it creates and the influence on probabilities of returning a move which goes straight into those S/R levels ...

And I studied also "Over and Under" pattern ( or Quasimodo or whatever ... ) ( linked with sort of fake breakouts ).

I studied those two because when I put those horizontal lines, at the left was almost always one of two.

I want to crunch this for a while, but already my vision has modified: I search now moves which appears very powerful, but their probability of continuing over a S/D zone is weak, and the power of those moves just feed the power of the reversal ( because of weak probability ). Sort of contrarian ... This vision helps me to have a big picture ...

I have one more question, if you have some little time: which timeframes are better to use for identifying the decision points and S/D zones ? And I suppose the answer will be the larger ones .... :)

There is no specific timeframe for price. However the risht approach of this, is to analyse and be aware of all the high timeframe levels, then trade it by Lowertimeframe reaction price-action.

It is really depends on your indevidual subjuctive personality, how pataient you are in waiting for the trade, and in handeling a live one. You should find this aspect while you trade live money acocunt (demo is only good to learn analysis, but not the trading mentality needed for being a good trader).

-

Learn about The5%ers trading Opportunity.

This upcoming Sunday, October 8th at 18:00 GMT, we are hosting a live webinar presentation about The5%ers Trading Fund program.

In the webinar, we will present our background and vision, we will explain how we may enhance your trading potential, and the structure of the fund's work frame.

After the presentation, we will host an open microphone questions and answers session, with Gil Ben Hur, the founder and CEO of The5%ers Trading Fund.

Signup for the webinar in this link below

https://register.gotowebinar.com/register/4041413703384175874

Hope to see you among our crowd

Save the date:

Sunday, October 8th, 2017, 18:00 GMT

-

The5%ers Presentation Webinar + Open mic Q&A Session

Learn about The5%ers trading Opportunity.

This upcoming Sunday, October 8th at 18:00 GMT, we are hosting a live webinar presentation about The5%ers Trading Fund program.

In the webinar, we will present our background and vision, we will explain how we may enhance your trading potential, and the structure of the fund's work frame.

After the presentation, we will host an open microphone questions and answers session, with Gil Ben Hur, the founder and CEO of The5%ers Trading Fund.

Signup for the webinar in this link below

https://register.gotowebinar.com/register/4041413703384175874

Hope to see you among our crowd

Save the date:

Sunday, October 8th, 2017, 18:00 GMT

-

Thank you for your great answer!

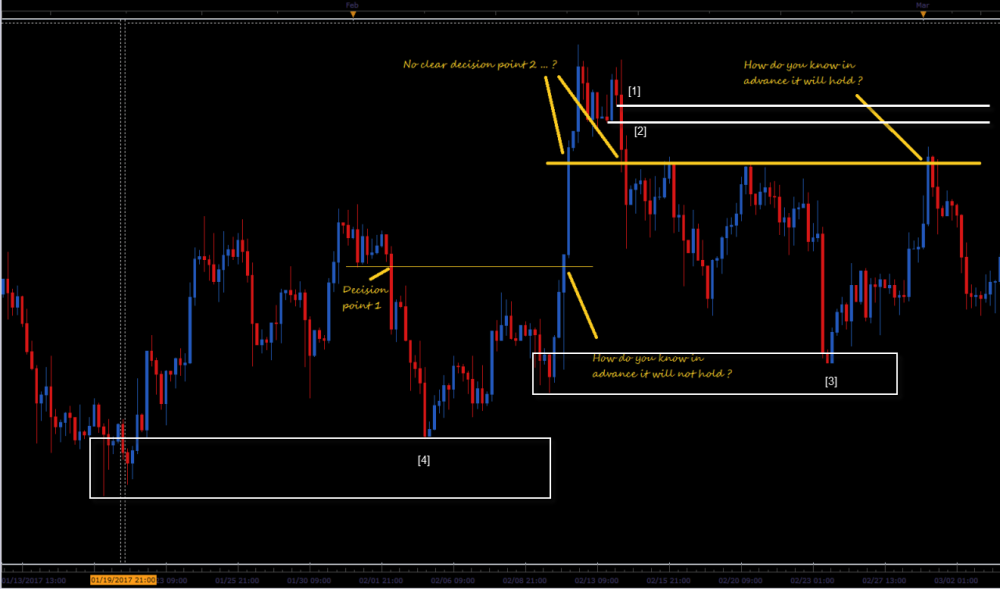

I understood that the micro-macro alignment give different powers ( in terms of probabilities ) to all the movements starting from a S/D zone. Not all of them have the same power ... Like the down move from point 1 into zone 4...it has no probability power, even if it is somewhat intense ... I will crunch this ideea for a while ... And I hope you will touch the micro-macro alignment subject in one of the future webinars ! :)

But, even if you said it's bad ideea to trade that upper decision point ( because of buyers being stronger ) ... I uploaded an image with my vision on this. Can you comment what's wrong there, or how you recommend to trade that situation ?

I mean, how do you know from the chart story that the force balance moved from buyers to sellers ?

Dear Izogrey, thank you for your question. I like your dedication and learnign eager.

I will give you one comment at this point, as I think it is the most fundamental one for price reading.

Put a horizontal line to every High Or Low you mention, then scroll to the left and see the cause of the reaction.

That itself will help you understand how significant that level is. By this information, the picture of the forces balance will start to be clearer for you.

Let me know how it goes...

G

-

-

-

Third Part of Order flow analysis webinars series is about to start in one hour

https://attendee.gotowebinar.com/register/8335832342422327042

-

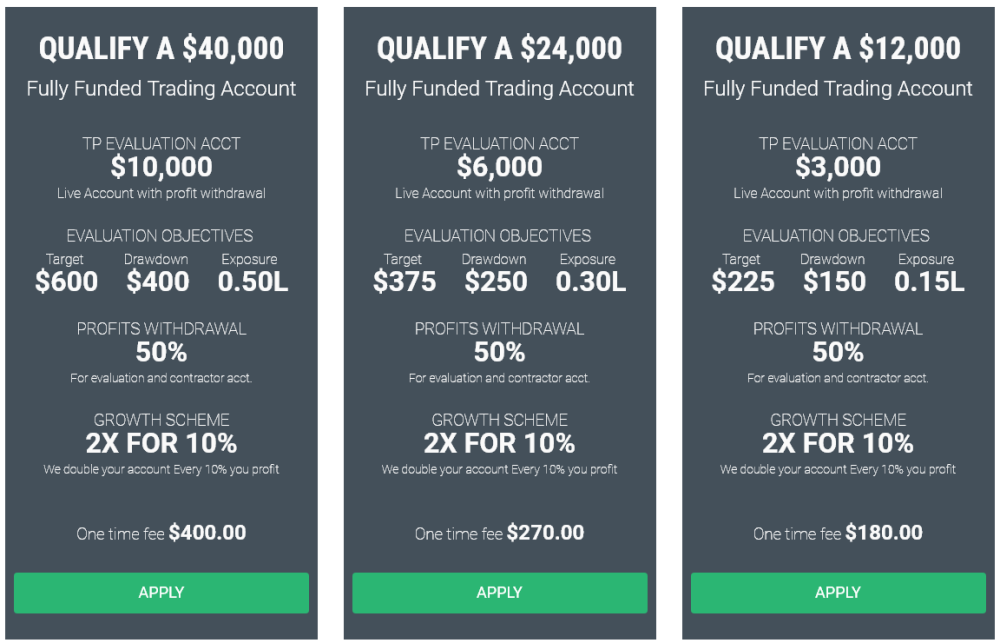

If you agree to trade by The5%ers Risk Guidelines,

You can have a fully funded live trading account for as little as 4% fee.

Here how it works:

The5%ers are looking to recruit profitable FX traders to our portfolio managers traders team,

So, we let any trader show us how his/hers trading can be adapted to our Risk Management Policy.

We want to meet trading talents, for that cause we provide all the trading money, the platform and we cover the full potential risk.

The trader will trade his/hers trading style, on our money under our risk management policy.

The Deal is simple: We will fund a live trading account for you, in which you get 50% share of the gain profits. Your cost is just a fraction 4%.

Get $10,000 Live Account, Evaluation Fee $400

Get $6,000 Live Account, Evalution Fee $370

Get $3,000 Live Account, Evaluation Fee $180

More information on our website www.The5ers.com

-

Hi there,

I have a little question, sorry if it's a little ******, but for me it's somehow important... :)

I noticed on the site that the platform used for trading is MT4. My question is: is MT4 hosted on some VPS ( where I will connect ) or is it just a connection from my locally installed MT4 ?

I ask this because my current network connection is behind a proxy ( which cut the MT4 port ) so I cannot currently use a locally installed MT4. But I could connect to a VPS.

Cheers.

You get to trade from your own client MT4 terminal (installed on your own PC or Mobile)

However, if you have issues using MT4 within your own network, you may take your own VPS to trade with or use the mobile app to execute positions.

-

-

Webinar No. 2. No Demand No Supply.

Enjoy

- ylidor, ⭐ izogrey, ⭐ flipper26 and 2 others

-

5

5

-

My Reply in the image below

I wrote a very long explanation and I lost it before saving my reply.

So you will have to settle for the short concept answer:

Keep reading the full story.

ask yourself who is stronger in that story, we see higher supply printed that result with our breaking demands, that should tell you that buyers are stronger in the market.

Zoom out and see that the main context of copper at that time was also moving up. so you have both micro and macro analysis aligned with you.

Trading the upper decision point you had marked was a bad practice, because according to your analysis price tested that level few times before, and according to what we can know from the chart, the level has un-known orders waiting.

So you should not have take that trade.

I would mark decision points at [1] or [2], in which it would hold either. Mainly because the bigger story is a very strong uptrend loaded from strong demand levels, while supply levels constantly being broken.

-

Tonight the second webinar of the series.

Indications for if a level breaks or holds.

BY order flow analysis

See you inside

-

thanks for replying but where is the link?

yakka

I just published the webinar on its youtube link right here above.

-

We start an educational webinar series about Order Flow Analysis and Trading.

Here is the recording of the first session.

Feel Free to post questions

-

Recording for Part One:

Reading The Story Of The Market - Part 1 - Order Flow

- ktxking, ⭐ flipper26, mariolf and 6 others

-

9

9

-

Here is the link for the upcoming free educational "Orderflow Trading"

hosted by the largest financial website investing.com

19.9 16:00 GMT

https://www.investing.com/education/webinars/reading-the-story-of-the-market---order-flow-12003

Feel free to leave questions under this thread.

-

Trading by Order Flow analysis is a method that combines few concepts such as Supply and Demand, Price Action, Market Profiling and plenty of common sense.

While in central exchange markets like stocks and futures, it is possible to subscribe to a level 2 stream, In Forex there is no reliable Level 2. But the good new is, you can conclude the order flow from simple naked chart observation.

Knowing where the order flow waits, on what price levels there is higher probability of support or resistance, will add the certainty needed for making sensible and logic entries, exits and position holding.

Starting Tuesday, Sep 19th, 2017, I will present my understanding of the Order flow analysis in a series of webinars, hosted in one of the biggest financial markets website portal.

If you are interested to join (it's free to attend), stay tuned to this thread, I will publish the webinar links in here as they come.

After every session, I urge you to post your questions, thoughts, and ideas in here, and I will do my best to help you through this exciting material.

-

Vladimir Ribakov, one of the largest online trading schools, is hosting us for a live Q&A presentation.

The webinar begins in 2 hours

Signup for free here:

https://attendee.gotowebinar.com/register/1259606403665611009

If you miss it, no worries it will be recorded.

-

As a trader for many years now, I have an absolute definition for a successful trade.

It can be a looser trade or a winner trade, as long as it allowed by your trading plan, you should be happy with the out come.

Trading is a long term profession. there is no significance for one trade, although we trade one trade at a time.

Our strategy should allow us to win and to lose some, and the overall sum of the activity should be positive after all.

I urge all my students and colleagues to write a thorough trading-plan, that provide the trade a work frame, and a fine benchmark to when to be satisfied with the trading, even if it is a loss.

-

Here is a question we get a lot in The5%ers Support desk.

Many trades from all levels ask us, what is the difference between a $10,000 evaluation account in The5%ers to a $10,000 account from a retail broker.

First, both are live trading account. Only with The5%ers, you do not deposit and the full amount and put it to risk in the trading.

The $10,000 account is a live trading account made to test traders if they can trade by the risk management rules of the fund. The fund provides the $10,000 for trading, while the trader is paying an application fee of only $400. This amount purpose is to cover the costs of recruitment, evaluation monitoring and possible trading losses in the account. Bottom line, you get $10,000 live trading account for $400.

Another similarity is profits. With both The5%ers and a brokerage account, you can withdraw profits. With The5%ers traders do not need to request for profits withdrawal. We regularly pay the profits every month. And once in an Evaluation account when it is completed. With The5%ers you cannot withdraw the capital balance, as it belongs to the fund. But your 50% share of the profits is absolutely yours to take.

From here the differences between a 5%ers account to a brokerage account are huge.

Earning 10% profits in a 5%ers account will get your account twice as big as if you made a 100% profit. In 7 rounds of making 10% gain, you can build a portfolio account of a 1.4 million dollars. While by the equivalent performance in a retail broker account, you will have $17,000 account.

In the $10,000 evaluation account the increase is even bigger, once you make 6% of profits, The5%ers quad-triple your balance to $40,000. With a 50% profit share, it is equivalent to a $20,000 with 100% profits ownership.

The most important aspect to understand is that when you trade with a 5%ers account, you must trade by our risk guidelines rules. From our experience, many traders appreciate this framework, and they find it rewarding with better consistency and overall performance.

Wishing a great trading day!

-

Hello Traders

This thread was created by The5%ers Trading Fund, to provide answers to the common questions we receive in private.

For anyone who isn't familiar yet with The5%ers Trading fund here is a brief of who we are and what do we serve traders across the globe.

The5%ers Trading fund is a new generation of a proprietary trading fund. We recruit traders from around the world and assign them our money to trade with. We give our traders 50% of the profits, and we offer an un-compatible growth scheme. For every 10% a trader profits, we double the account.

To become a portfolio manager for The5%ers Trading fund, a trader must perform a real time trading evaluation exam. The evaluation plan has a minor cost, but be assure this is the last and only cost you will even have with The5%ers.

The evaluation takes place on a live trading account. Any profits made in this account will be shared with the trader as well. The objective of the evaluation plan is to make 6% of profits without dropping 4% drawdown.

Once passed with success, the trader becomes a 5%er Portfolio Manager, and entitle for the below benefits and advantages:

- Fully Funded Trading Account

- 50% Profit share, paid every month

- Risk-Free Trading. - Never pay for blowing the account (we take the risk on that)

- 2X For 10% Growth scheme - we double the account for every 10% gain.

You may read more information in our website

www.THE5ERS.com

Trading By The Order Flow

in Trading Systems and Strategies

Posted

Last Session of the series

How to trade the fakeouts and why it is the best price action confirmation for accurate entries.

Enjoy