⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

kratos194

⭐ V.I.P.-

Posts

45 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Articles

Everything posted by kratos194

-

-

Should we join forces with TGF Community? [Answer please]

⭐ kratos194 replied to MrAdmin's topic in Announcements

If TopGold.forum is based in Europe or America, it will no longer be possible to share copyrighted books, courses, or resources, so indo-investment will disappear. To increase forum revenue, you can increase advertisements and sponsors, as all forums in the world do (some examples): https://www.elitetrader.com/et/ https://www.trade2win.com/ https://nexusfi.com/index.php?s=ff7144f4fae703f2adf3394944821933 -

- How Legendary Traders Made Millions by John Boik (Jesse Livermore, Nicolas Darvas, Richard Wyckoff, William O'Neil, Bernard Baruch, Gerald Loeb, Jack Dreyfus, Jim Roppel): https://shorturl.at/fzAvJ

-

Regarding CopyTrading and the guaranteed gains of 5% > 10% per month, I found this video particularly interesting: https://www.youtube.com/watch?v=xvIY2WPcMUM

- 10 replies

-

- binary option

- scam

-

(and 5 more)

Tagged with:

-

Waiting for someone to share the book asked for in previous posts, here it is: The Jack Gillen - July 10-2001 Commodity Seminar (161 pages): hxxps://pdfcoffee.com/gillen-seminar-pdf-free.html more resources by Jack Gillen: https://indo-investasi.com/topic/92878-jack-gillen-simplified-astrology-course/?do=findComment&comment=716622&_rid=143510

-

-

Bill Williams - Profitunity home study course

⭐ kratos194 replied to trott's topic in Forex Clips & Movies

If it is helpful, here is his book: Trading Chaos (251 pages): hxxps://pdfcoffee.com/bill-williams-2000-trading-chaos-applying-expert-techniques-pdf-free.html -

Forecast 2024 S&P index - pls add on

⭐ kratos194 replied to dmyy3k's topic in Trading Systems and Strategies

-

- Short Term Trading Strategies That Work by Larry Connors and Cesar Alvarez: hxxps://scribd.vpdfs.com/doc/100324184/Short-Term-Trading-Strategies-That-Work-by-Larry-Connors-and-Cesar-Alvarez - An introduction to ConnorsRSI: hxxps://scribd.vpdfs.com/document/178302260/ConnorsRSI-Pullbacks-Guidebook - Short Selling Stocks With ConnorsRSI: hxxps://scribd.vpdfs.com/document/320443169/Short-Selling-Stocks-with-ConnorsRSI-2013-pdf

-

Input: Length(10), BrkOuts(2), TrailStp(6), exit_proft(1000); Vars: HighChannel(0), LowChannel(0), BreakOutCounter(0), BreakUnderCounter(0); HighChannel = Highest( High , Length )[1]; LowChannel = Lowest( Low , Length )[1]; If High > HighChannel then Begin BreakOutCounter = BreakOutCounter+ 1; BreakUnderCounter = 0; End; If Low < LowChannel then Begin BreakUnderCounter = BreakUnderCounter + 1; BreakOutCounter= 0; End; If BreakOutCounter >= BrkOuts then Begin Buy this bar on Close; BreakOutCounter = 1; End; If BreakUnderCounter >= BrkOuts then Begin Sellshort this bar on Close; BreakUnderCounter = 1; End; {Sell next bar at Lowest( Low , TrailStp ) Stop; Buytocover next bar at Highest( High , TrailStp ) Stop;} SetProfitTarget (exit_proft);

-

Inputs: AvgPeriod1(17), AvgPeriod2(17), LRSlopePeriod(12); Variables: TotalPrice(0), Trend(0), MAL(0), MAH(0), C1(false), C2(false); { calcs } TotalPrice = (O+H++L+C) / 4; MAL = Average(Low, AvgPeriod1); MAH = Average(High, AvgPeriod2); Trend = LinearRegSlope(TotalPrice, LRSlopePeriod); C1 = Trend[1] > 0; C2 = Trend[1] < 0; { long entry logic } If MarketPosition = 0 and C1 then Buy ("LE") next bar at MAL[1] Limit; { short entry logic } If MarketPosition = 0 and C2 then SellShort ("SE") next bar at MAH[1] Limit; { exits } If MarketPosition = 1 and C2 then Sell ("LX") next bar at MAH[1] Limit; If MarketPosition = -1 and C1 then BuyToCover ("SX") next bar at MAL[1] Limit;

-

Larry Connors - Connors On Advanced Trading Strategies (299 pages): hxxps://scribd.vpdfs.com/document/319980056/Connors-Larry-Connors-On-Advanced-Trading-Strategies-pdf

-

Inputs: RSI_Period(2), RSI_Overbought(10), RSI_OverSold(10), MA_Exit_Period(5), stop_loss(2000); Variables: RSI_Value(0), Exit_MA(0); RSI_Value = RSI(Close,RSI_Period); Exit_MA = Average(Close, MA_Exit_Period); If (RSI_Value <= RSI_Overbought) then buy this bar at close; If (MarketPosition <> 0 ) And (Close > Exit_MA ) then sell this bar at close; If (RSI_Value >= RSI_OverSold) then sellshort this bar at close; If (MarketPosition <> 0 ) And (Close < Exit_MA ) then buytocover this bar at close; SetStopLoss(stop_loss);

-

inputs: Per(3),Perc(0.05); vars: LevelLong(0),LevelShort(0); vars: BandWidth(0),Percentuale(0); LevelLong = HighestFC(H,Per); LevelShort = LowestFC(L,Per); BandWidth = BollingerBand(C,20,2)-BollingerBand(C,20,-2); Percentuale = Perc*C[1]; if BandWidth<Percentuale then begin buy next bar LevelLong stop; sellshort next bar LevelShort stop; end;

-

Inputs:AtrMult(3),AtrLen(21); Vars:HClose(-99999),LClose(99999); Value1=AtrMult*WAverage(TrueRange, AtrLen); HClose=IFF(C>HClose,C,HClose); LClose=IFF(C<LClose,C,LClose); If CurrentBar=1 then Value2=HClose-Value1; If C < Value2 then begin Value2=LClose+Value1; HClose=C; End; If C > Value2 then begin Value2=HClose-Value1; LClose=C; End; If Close crosses above Value2 then Buy this bar at close; If Close crosses below Value2 then Sellshort this bar at close;

-

Forecast 2024 S&P index - pls add on

⭐ kratos194 replied to dmyy3k's topic in Trading Systems and Strategies

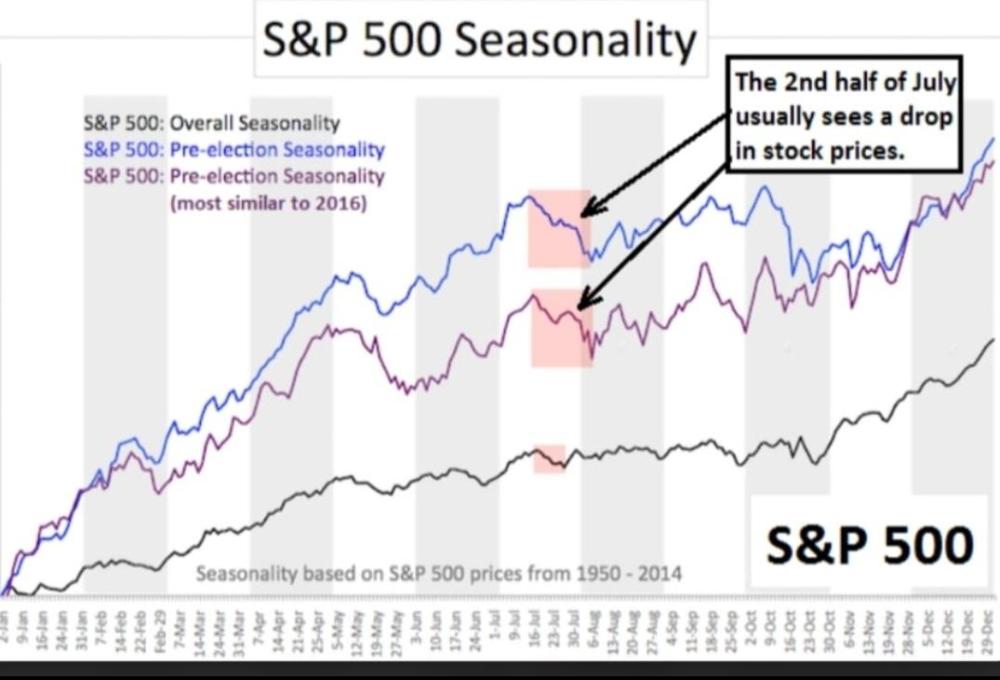

In Larry Williams' video (see previous post) there is also this long-term forecast: https://postimg.cc/23gK4KLs -

For those who have: Kindle Unlimited, the book is free: https://www.amazon.com/Tao-Jones-Averages-Whole-Brained-Investing-ebook/dp/B00FKZN4W6

-

Forecast 2024 S&P index - pls add on

⭐ kratos194 replied to dmyy3k's topic in Trading Systems and Strategies

In this video by Larry Williams from January 28: hxxps://www.youtube.com/watch?v=dILq3u1nHQ0 there is this prediction of 2024, the blue line being the most reliable: https://postimg.cc/dZ9QfDZ7 -

These files can be downloaded here: - Laurence Connors - Trading Stocks and Options With MA: hxxps://scribd.vpdfs.com/document/415084801/Laurence-Connors-Trading-Stocks-and-Options-with-MA-pdf - Laurence Connors - S P 500 Trading With ConnorsRSI: hxxs://scribd.vpdfs.com/document/224323177/Laurence-Connors-S-P-500-Trading-With-ConnorsRSI

-

Inputs: n1(12), n2(25), n3(12), n4(25); If ADX(n1) > n2 and DMIPlus(14) > DMIMinus(14) and ((L<L[1] and L[1]<L[2] and L[2]<L[3]) {three lower lows} or (L[1]<L[2] and L[2]<L[3] and (H<H[1] and L>L[1])) {or two lower lows and an inside day} or ((L[2]>L[3] and H[2]<H[3]) and L<L[1] and L[1]<L[2])) {or an inside day and two lower lows} then buy this bar; If ADX(n3) > n4 and DMIPlus(14) < DMIMinus(14) and ((H>H[1] and H[1]>H[2] and H[2]>H[3]) {three higher highs} or (H[1]>H[2] and H[2]>H[3] and (H<H[1] and L>L[1])) {or two higher highs and an inside day} or ((L[2]>L[3] and H[2]<H[3]) and H>H[1] and H[1]>H[2])) {or an inside day and two higher highs} then sellshort this bar;

-

If there is no Function: BollingerBand in Multicharts, I will add it in the code ------------------------------------------------------------------------------------------------ Inputs: bollingerLengths(50),liqLength(50),rocCalcLength(30); Vars: upBand(0),dnBand(0),liqDays(50),rocCalc(0); upBand = BollingerBand(Close,bollingerLengths,1.25); dnBand = BollingerBand(Close,bollingerLengths,-1.25); rocCalc = Close - Close[rocCalcLength-1]; {remember to subtract 1} if(MarketPosition <> 1 and rocCalc > 0) then Buy("BanditBuy")tomorrow upBand stop; if(MarketPosition <>-1 and rocCalc < 0) then SellShort("BanditSell") tomorrow dnBand stop; if(MarketPosition = 0) then liqDays = liqLength; if(MarketPosition <> 0) then begin liqDays = liqDays - 1; liqDays = MaxList(liqDays,10); end; if(MarketPosition = 1 and barssinceentry>=6 and Average(Close,liqDays) < upBand) then Sell("Long Liq") tomorrow Average(Close,liqDays) stop; if(MarketPosition = -1 and barssinceentry>=6 and Average(Close,liqDays) > dnBand) then BuyToCover("Short Liq") tomorrow Average(Close,liqDays) stop;