-

Posts

20 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by Alfamart

-

-

Contest Prizes- 1st Place - 650 USD

- 2nd Place - 500 USD

- 3rd Place - 300 USD

- 4th Place - 200 USD

- 5th Place - 100 USD

- 6th - 10th Place - 50 USD

-

On 23/07/2011 at 5:21 AM, Guest mohammadbadr said:

Your capital does not necessarily affect your trading, but it usually do, to explain if you trade with a big capital you will satisfy with your profit even if it was consisting 1% of your capital, because the amount is good at the end, while if it was too small, here the emotions will take place and make you without intention enter with 20% of your capital or more, i think this is the only relation, otherwise it is the same trading.

of course capital will affect usÂ

i mean if your monthly spending is $200 for example. offcourse you will reach that target easily and less stressfull if you trade with $1000 or more balance than $100 balance

-

it varies depends on market conditions, but i always try to trade with 1 risk and 2 rewards

Â

-

Â

Here Is How To Position If BoJ Convenes An Emergency Meeting To Ease- EURUSD: Upticks are seen as an opportunity to sell at better levels. We are bearish and look for resistance in the 1.1130 area to cap a move lower towards initial targets near Friday’s 1.0910 lows and then the 1.0840 area. Beyond there we are looking towards 1.0710.

- USDJPY: We are bearish and would prefer to fade upticks towards the 103.55 former range lows. Our targets are back to Friday’s 99.00 lows and further out towards the 94.80 area.

- GBPUSD: We are overall bearish and would look to use upticks as an opportunity to sell at better levels. The 1.3505 former range lows are expected to provide selling interest for a move lower towards targets near 1.3015 and then the 1.2750 area.

- AUDUSD: We are bearish and would use upticks towards 0.7520 as an opportunity to sell at better levels. A move below our initial targets near 0.7285 would signal lower towards the 0.7145 lows.

- NZDUSD: We would prefer to fade upticks in range towards resistance near 0.7175 and look for a move below our initial targets near 0.6960 to confirm downside traction. Our next targets are towards the 0.6810 area.

-

USDCAD: We are cautiously bearish given the increased volumes on upticks and would fade upticks towards 1.3190. A move below targets near 1.2655 would signal lower towards the 1.2460 year-to-date lows.

-

ForexMart is a forex broker with a lot of advantages like :

- 2 types trading account - Standart dan Zero Spreads

- Fixed Spreads Starts from 2 pips - No Commissions

- Minimum Deposit $1

- Leverage up to 1:5000

- No Trading Strategies Restrictions - News Trading, Scalping, Hedging, EA-

- 30 % Deposit Bonus - Can be used to increase margin

- Multiple Trading Instruments - Forex, Exotic Forex , Spot Metal, CFD Shares, Bitcoin dan Ruble

- Free Swap

- Profitable Partnership Scheme - Friend Refferer, Webmaster, Online Partner, Local Online Partner, Local Office Partner, dan CPA

- No Requote- Fast Executions-

- Popular Trading Platform- MetaTrader 4 -

- Multiple deposit-withdrawal methodes - Bank Transfer, Visa dan Mastercard, Skrill, Neteller, PayCo, Paypal, Qiwi, MegaTransfer, dan Paxum

- Regulated by CySec - Â licence number 266/15

Best Regards

-

Brexit Wins: New Targets For GBP/USD, EUR/GBP - BTMU

Source : EFXNewsWhile the Brexit vote was a shock (we attached a 40/45% probability), we are not surprised by the initial currency market reaction. Cable still remains within our forecasted one-month range between 1.3000 and 1.5000.

In our previous base case scenario assuming that the UK voted to remain within the EU we were expecting cable to stabilise in the year ahead at around the 1.5000-level. However, the initial sharp pound weakness following the Brexit vote is fundamentally justified and is not overshooting in the near-term. The heightened political uncertainty in the UK including today’s resignation from Prime Minister Cameron with a new Conservative leader to be elected in early October, will continue to weigh heavily on the pound. The increased risk of recession in the UK and looser BoE policy in the year ahead justify a weaker pound. Capital inflows into the UK will also be dampened making it more challenging to the finance the UK’s elevated current account deficit requiring a weaker pound.

In these circumstances, we expect cable to fall into the mid-1.2000’s in the second half of this year before rebounding modestly back above the 1.3000- level in 2017 as heightened uncertainty gradually eases. The pound is already significantly weak according to our long-term valuation models which should help to dampen further downside unless there is a run on the pound.

We expect further more modest upside for EUR/GBP as well rising towards the mid to high 0.8000’s in the second half of this year before falling back towards the 0.8000-level in 2017. It is consistent with our alternative Brexit scenario outlined prior to the release of the referendum results.

-

Trade with more capital and gain more profit. When a trader opens a ForexMart account and makes a deposit, he has the opportunity to get 30% of the total amount of money deposited. For example, if he deposits $100, we will deposit $30 bonus in his account. Thus, his total balance will be $130. Our system will generate the right amount of bonus for your account. Remember, bonus comes from our company and is not considered an e-currency.Â

Read more about Bonus TOS Â here

Best Regards

-

-

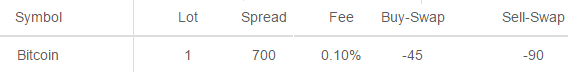

Trade and earn more profit from BitCoin

Bitcoin is a digital currency in which balances are stored and transferred via the Internet. Unlike other payment methods, the relatively new currency offers lower fees and is operated by several servers worldwide. With bitcoin, earning more income has been made possible. . Read more about Bitcoin here

Provide Bitcoin electronic trading with leverage with lowest transaction fees on the industry -

Trade Responsibly With ForeXMart 1:5000 Leverage

Â

No kidding , no joking, here at ForeXMart , we treat our clients seriously.

The Biggest Leverage ever.Â

Could you ever find any 1:5000 leverage with other broker? I bet you Don't !

The most powerful trading tools ever recorded in human history. With 1:5000, you have 5000 times buying power.In English, if you have deposited $1 with ForeXMart, your buying power would be 5000 times greater and more powerful.

Like What Uncle Ben Said : With great power , comes great responsibility

So ForeXMart reminds to our clients : With Great Leverage Comes Greater Buying Power

Trade With Super-LeverageÂ

Trade With ForeXMart -

-

could you define a good brokers?

for me a good broker is a broker who has no trading restrictionns, low minimum deposit , regulated by at least CySec

and found it with forexmart, tried it , and so far satisfied with their fixed 2 pips spreads , and leverage up to 1:1000

-

I think forexmart is a Good broker,

was deposit here with my $200 at may.Â

and already made some withdrawals.Â

highly reccomended broker. my request processed in max 48 hours after request.

a lil bit too long if we compare it with another broker. but i think it is still acceptable and reasonable timeframe.

-

i think i prefer instaforex for small money deposit..

this retail brokerage is a big boom now..

no one does not know this retail brokerage..

many unique contest..and has minimum deposit + cent account..

make me ,as a newbie,can feel how is the real market is

-

Re: Tingkah Aneh Para Trader / Investor

klo gw pas lagi loss..

balikin monitor sambil gw getok2 biar tu harga naek =))

ato matiin kompi,sambil berdoa.,ya Tuhan ,posisiQ d bikin profit dong

-

Re: Indicator. Perlu ga seh?

indikator d bilang perlu ga perlu...menurut gw sih tergantung trading system..klo profit why not,..

tp klo ampe 51 indi,,apa g ngelag tu chart bro?

51 indi=cpt ngabisin quota,.kekekek..

btw saya trading kadang pake..kadang engga...tp lebih nyaman klo pake indi sih bro..

-

Re: I have a dilemma :)

i only understand TA..

IMO FA is for the people that have direct accsess to the news?correct me if i wrong

Daily Market Analysis from ForexMart

in General Forex Discussions

Posted

Tech Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY - UOB

EUR/USD: Bearish: Diminished bearish momentum but downside risk is still clearly intact.

GBP/USD: Bearish: A move to 1.3000 would not be surprising.

AUD/USD: Neutral: Expect choppy trading between 0.7305/0.7510. [No change in view]

.

NZD/USD: Neutral: In a broad 0.6975/0.7170 range. [No change in view]

USD/JPY: Neutral: In a broad 101.00/105.00 range.