-

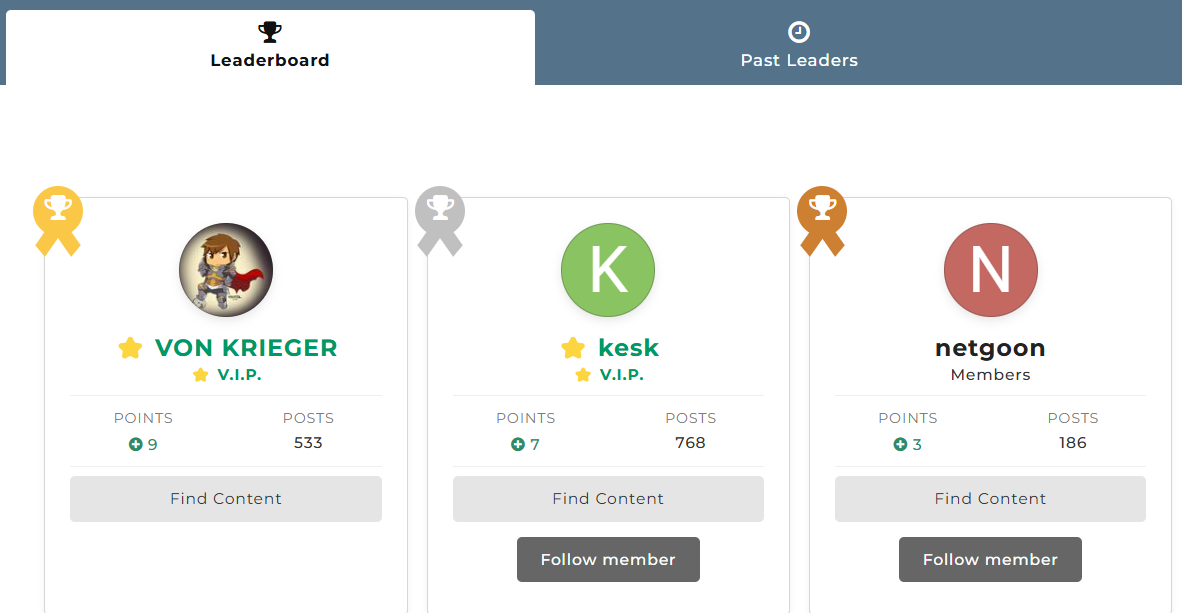

Posts

534 -

Joined

-

Last visited

-

Days Won

28

Reputation Activity

-

⭐ VON KRIEGER got a reaction from ganeshedge in Logical Trading

⭐ VON KRIEGER got a reaction from ganeshedge in Logical Trading

Hi Forks,

I just wanted to share the trading method which is working for me.

Although I have tried many techniques like Market Profile , Point and Figure , Volume Profile and I find logic of these techniques overlaps with what I'm using .

So what am I using?

I'm using Wyckoff , Wave And VSA

Now the obvious question is what is that ?

Before I answer it , just open any chart and add 50 moving average , you will find it's very easy to see what if price is above your MA then it's bullish and vice-versa for bearish.

Maybe in other chart you will find that sometimes price goes above the MA then after sometime it come below it and continue going down instead of up , thus create traps etc ( whatever layman calls it)

Maybe you will notice that price is moving back and forth of MA without making any real progress( not in trend)

All these observations points out one thing , market is RANDON most of the time .

But not all the time , so the obvious question is how to understand when market is not random.

Now to remove the randomness , I use Wyckoff SCHMATICS to understand the script I'm trading is in which phase.

Each phases provide us different Knowledge thus removing the total randomness but still some of it is there.

In other works I use Wyckoff SCHMATICS to understand the structure and phases .

Then comes Price itself , which is difficult if not impossible to read individually. So for that I look at them in terms of Waves.

What is waves? , Well it's a one-sided movement of price until it turned otherwise.

Why waves is important?

Well one can gauge STRENGTH/WEAKNESS by comparing one wave to another ( just like we did in bar/histogram charts in elementary schools :P)

For instance , You may have heard if price is making higher - high then it's in uptrend .

But if you break that logic then what is means is that upwave is large as compare to down wave(thus making lower high) and new upwave is going above previous upwave (thus making higher high)

Now with knowledge of structure I know whether I should look for long or short opportunity, waves strength/weakness confirm my BIAS to a extend.

Then comes Volume , simple put I can Futher confirm my BIAS if volume is in favor of price direction or not . I.e if I'm assuming upmove then can I notice good volumes (which shows interest of smart money aka their participation)

Or perhaps structure was showing me accumulation with good volume .

Maybe I will CHEAT my way in with Delta Volume, or even better Cumulative Delta Volume to understand the true story.

Volume is awesome thing, maybe I will even read volume of bar by bar to understand the current sentiment

Now why I said it overlaps with Market Profile , Volume Profile , Point and Figure etc.

Because all these tools are use to show you one thing that is STRUCTURE

But hey we are 2 step ahead , we are looking at STRUCTURE, along with PRICE WAVE and VOLUME.

"Be a Bull, Be a Bear, Don't be a Pig*""

-Von Krieger

-

⭐ VON KRIEGER got a reaction from Shenong in NT8 - Fixed

⭐ VON KRIEGER got a reaction from Shenong in NT8 - Fixed

/showthread.php/31399-Motiwave-5-4-13?highlight=Motivewave

-

⭐ VON KRIEGER got a reaction from Galanoth in NT8 - Fixed

⭐ VON KRIEGER got a reaction from Galanoth in NT8 - Fixed

https://eu4.proxysite.com/process.php?d=v9DvPI3IS6qjtzFpUFkguG1CfAv35skfkcFCM%2FYRLwBO&b=1&f=norefer -

⭐ VON KRIEGER got a reaction from ⭐ chullankallan in Buy Side Global NT8

⭐ VON KRIEGER got a reaction from ⭐ chullankallan in Buy Side Global NT8

Buy Side Global

https://www55.zippyshare.com/v/D7tkgCHd/file.html

Not exactly sure if it works or not

-

⭐ VON KRIEGER got a reaction from adonis in NT8 - Fixed

⭐ VON KRIEGER got a reaction from adonis in NT8 - Fixed

/showthread.php/31399-Motiwave-5-4-13?highlight=Motivewave

-

⭐ VON KRIEGER got a reaction from Shenong in NT8 - Fixed

⭐ VON KRIEGER got a reaction from Shenong in NT8 - Fixed

Sit tight till month end, I will release something more interesting than NexGent3 -

⭐ VON KRIEGER got a reaction from agunes77 in Req:

⭐ VON KRIEGER got a reaction from agunes77 in Req:

https://www78.zippyshare.com/v/Tnp0J5SU/file.html

CTITOOL

-

⭐ VON KRIEGER got a reaction from ⭐ techyamit in Logical Trading

⭐ VON KRIEGER got a reaction from ⭐ techyamit in Logical Trading

Hi Forks,

I just wanted to share the trading method which is working for me.

Although I have tried many techniques like Market Profile , Point and Figure , Volume Profile and I find logic of these techniques overlaps with what I'm using .

So what am I using?

I'm using Wyckoff , Wave And VSA

Now the obvious question is what is that ?

Before I answer it , just open any chart and add 50 moving average , you will find it's very easy to see what if price is above your MA then it's bullish and vice-versa for bearish.

Maybe in other chart you will find that sometimes price goes above the MA then after sometime it come below it and continue going down instead of up , thus create traps etc ( whatever layman calls it)

Maybe you will notice that price is moving back and forth of MA without making any real progress( not in trend)

All these observations points out one thing , market is RANDON most of the time .

But not all the time , so the obvious question is how to understand when market is not random.

Now to remove the randomness , I use Wyckoff SCHMATICS to understand the script I'm trading is in which phase.

Each phases provide us different Knowledge thus removing the total randomness but still some of it is there.

In other works I use Wyckoff SCHMATICS to understand the structure and phases .

Then comes Price itself , which is difficult if not impossible to read individually. So for that I look at them in terms of Waves.

What is waves? , Well it's a one-sided movement of price until it turned otherwise.

Why waves is important?

Well one can gauge STRENGTH/WEAKNESS by comparing one wave to another ( just like we did in bar/histogram charts in elementary schools :P)

For instance , You may have heard if price is making higher - high then it's in uptrend .

But if you break that logic then what is means is that upwave is large as compare to down wave(thus making lower high) and new upwave is going above previous upwave (thus making higher high)

Now with knowledge of structure I know whether I should look for long or short opportunity, waves strength/weakness confirm my BIAS to a extend.

Then comes Volume , simple put I can Futher confirm my BIAS if volume is in favor of price direction or not . I.e if I'm assuming upmove then can I notice good volumes (which shows interest of smart money aka their participation)

Or perhaps structure was showing me accumulation with good volume .

Maybe I will CHEAT my way in with Delta Volume, or even better Cumulative Delta Volume to understand the true story.

Volume is awesome thing, maybe I will even read volume of bar by bar to understand the current sentiment

Now why I said it overlaps with Market Profile , Volume Profile , Point and Figure etc.

Because all these tools are use to show you one thing that is STRUCTURE

But hey we are 2 step ahead , we are looking at STRUCTURE, along with PRICE WAVE and VOLUME.

"Be a Bull, Be a Bear, Don't be a Pig*""

-Von Krieger

-

⭐ VON KRIEGER got a reaction from ⭐ daytradez in NT8 - Fixed

⭐ VON KRIEGER got a reaction from ⭐ daytradez in NT8 - Fixed

Well I have a simple solution to this problem.

But I will share it on 28th February , on eve of Bday of my Dog, named Toby :) (Toby Fat Boy) yeah I'm creative :P

-

⭐ VON KRIEGER got a reaction from ⭐ fw1admin in Req:

⭐ VON KRIEGER got a reaction from ⭐ fw1admin in Req:

https://ibb.co/Lr6TZxy

https://ibb.co/9TyffhR

That's NexGent3 , work in progress .

-

⭐ VON KRIEGER got a reaction from Rhodan909 in Logical Trading

⭐ VON KRIEGER got a reaction from Rhodan909 in Logical Trading

Hi Forks,

I just wanted to share the trading method which is working for me.

Although I have tried many techniques like Market Profile , Point and Figure , Volume Profile and I find logic of these techniques overlaps with what I'm using .

So what am I using?

I'm using Wyckoff , Wave And VSA

Now the obvious question is what is that ?

Before I answer it , just open any chart and add 50 moving average , you will find it's very easy to see what if price is above your MA then it's bullish and vice-versa for bearish.

Maybe in other chart you will find that sometimes price goes above the MA then after sometime it come below it and continue going down instead of up , thus create traps etc ( whatever layman calls it)

Maybe you will notice that price is moving back and forth of MA without making any real progress( not in trend)

All these observations points out one thing , market is RANDON most of the time .

But not all the time , so the obvious question is how to understand when market is not random.

Now to remove the randomness , I use Wyckoff SCHMATICS to understand the script I'm trading is in which phase.

Each phases provide us different Knowledge thus removing the total randomness but still some of it is there.

In other works I use Wyckoff SCHMATICS to understand the structure and phases .

Then comes Price itself , which is difficult if not impossible to read individually. So for that I look at them in terms of Waves.

What is waves? , Well it's a one-sided movement of price until it turned otherwise.

Why waves is important?

Well one can gauge STRENGTH/WEAKNESS by comparing one wave to another ( just like we did in bar/histogram charts in elementary schools :P)

For instance , You may have heard if price is making higher - high then it's in uptrend .

But if you break that logic then what is means is that upwave is large as compare to down wave(thus making lower high) and new upwave is going above previous upwave (thus making higher high)

Now with knowledge of structure I know whether I should look for long or short opportunity, waves strength/weakness confirm my BIAS to a extend.

Then comes Volume , simple put I can Futher confirm my BIAS if volume is in favor of price direction or not . I.e if I'm assuming upmove then can I notice good volumes (which shows interest of smart money aka their participation)

Or perhaps structure was showing me accumulation with good volume .

Maybe I will CHEAT my way in with Delta Volume, or even better Cumulative Delta Volume to understand the true story.

Volume is awesome thing, maybe I will even read volume of bar by bar to understand the current sentiment

Now why I said it overlaps with Market Profile , Volume Profile , Point and Figure etc.

Because all these tools are use to show you one thing that is STRUCTURE

But hey we are 2 step ahead , we are looking at STRUCTURE, along with PRICE WAVE and VOLUME.

"Be a Bull, Be a Bear, Don't be a Pig*""

-Von Krieger

-

-

⭐ VON KRIEGER got a reaction from K12 in Logical Trading

⭐ VON KRIEGER got a reaction from K12 in Logical Trading

I have created one for myself.. here it is

https://www74.zippyshare.com/v/9kJn61S3/file.html. This is weis wave volume .

https://www20.zippyshare.com/v/u4idtOz0/file.html

This is Weis Wave Zig Zag Panel

P.s file extension is .pine ( I have created it in MS Visual studio code) , open it with notepad if you don't have VS installed

-

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

Hi Forks,

I just wanted to share the trading method which is working for me.

Although I have tried many techniques like Market Profile , Point and Figure , Volume Profile and I find logic of these techniques overlaps with what I'm using .

So what am I using?

I'm using Wyckoff , Wave And VSA

Now the obvious question is what is that ?

Before I answer it , just open any chart and add 50 moving average , you will find it's very easy to see what if price is above your MA then it's bullish and vice-versa for bearish.

Maybe in other chart you will find that sometimes price goes above the MA then after sometime it come below it and continue going down instead of up , thus create traps etc ( whatever layman calls it)

Maybe you will notice that price is moving back and forth of MA without making any real progress( not in trend)

All these observations points out one thing , market is RANDON most of the time .

But not all the time , so the obvious question is how to understand when market is not random.

Now to remove the randomness , I use Wyckoff SCHMATICS to understand the script I'm trading is in which phase.

Each phases provide us different Knowledge thus removing the total randomness but still some of it is there.

In other works I use Wyckoff SCHMATICS to understand the structure and phases .

Then comes Price itself , which is difficult if not impossible to read individually. So for that I look at them in terms of Waves.

What is waves? , Well it's a one-sided movement of price until it turned otherwise.

Why waves is important?

Well one can gauge STRENGTH/WEAKNESS by comparing one wave to another ( just like we did in bar/histogram charts in elementary schools :P)

For instance , You may have heard if price is making higher - high then it's in uptrend .

But if you break that logic then what is means is that upwave is large as compare to down wave(thus making lower high) and new upwave is going above previous upwave (thus making higher high)

Now with knowledge of structure I know whether I should look for long or short opportunity, waves strength/weakness confirm my BIAS to a extend.

Then comes Volume , simple put I can Futher confirm my BIAS if volume is in favor of price direction or not . I.e if I'm assuming upmove then can I notice good volumes (which shows interest of smart money aka their participation)

Or perhaps structure was showing me accumulation with good volume .

Maybe I will CHEAT my way in with Delta Volume, or even better Cumulative Delta Volume to understand the true story.

Volume is awesome thing, maybe I will even read volume of bar by bar to understand the current sentiment

Now why I said it overlaps with Market Profile , Volume Profile , Point and Figure etc.

Because all these tools are use to show you one thing that is STRUCTURE

But hey we are 2 step ahead , we are looking at STRUCTURE, along with PRICE WAVE and VOLUME.

"Be a Bull, Be a Bear, Don't be a Pig*""

-Von Krieger

-

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)

-

⭐ VON KRIEGER got a reaction from Rhodan909 in Logical Trading

⭐ VON KRIEGER got a reaction from Rhodan909 in Logical Trading

depends on how u want to approach market... even if u master simple candlesticks breakout and confirm it with ossciliator , say there is triangle breakout and rsi above 50 , adx about 25, then buy it at 20ma pullback and ride the trend , simple !

easier said then done ! , you need practise thats all :)

-

⭐ VON KRIEGER got a reaction from birdshoof in Logical Trading

⭐ VON KRIEGER got a reaction from birdshoof in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)

-

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

⭐ VON KRIEGER got a reaction from ootl10 in Logical Trading

depends on how u want to approach market... even if u master simple candlesticks breakout and confirm it with ossciliator , say there is triangle breakout and rsi above 50 , adx about 25, then buy it at 20ma pullback and ride the trend , simple !

easier said then done ! , you need practise thats all :)

-

⭐ VON KRIEGER got a reaction from poos in Logical Trading

⭐ VON KRIEGER got a reaction from poos in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)

-

⭐ VON KRIEGER got a reaction from wizard101 in Logical Trading

⭐ VON KRIEGER got a reaction from wizard101 in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)

-

-

⭐ VON KRIEGER reacted to ⭐ syed.quadri81 in Logical Trading

⭐ VON KRIEGER reacted to ⭐ syed.quadri81 in Logical Trading

Thank you very much your contribution will always be appreciated.

Thanks Again

-

⭐ VON KRIEGER got a reaction from ⭐ syed.quadri81 in Logical Trading

⭐ VON KRIEGER got a reaction from ⭐ syed.quadri81 in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)

-

⭐ VON KRIEGER got a reaction from ⭐ syed.quadri81 in Logical Trading

⭐ VON KRIEGER got a reaction from ⭐ syed.quadri81 in Logical Trading

I have created one for myself.. here it is

https://www74.zippyshare.com/v/9kJn61S3/file.html. This is weis wave volume .

https://www20.zippyshare.com/v/u4idtOz0/file.html

This is Weis Wave Zig Zag Panel

P.s file extension is .pine ( I have created it in MS Visual studio code) , open it with notepad if you don't have VS installed

-

⭐ VON KRIEGER got a reaction from Traderbeauty in Logical Trading

⭐ VON KRIEGER got a reaction from Traderbeauty in Logical Trading

https://ibb.co/GMmvScq

Im in top Author list :)