⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

Leaderboard

Popular Content

Showing content with the highest reputation on 11/17/2025 in all areas

-

https://workupload.com/archive/nFvN9qRdfE Don't forget tap that like button Thanks6 points

-

quantvue.io

⭐ goldeneagle1 and 2 others reacted to ⭐ apmoo for a topic

https://workupload.com/file/der7bF3KJAJ I must have missed this one it's from feb-25 Thanks3 points -

Replikanto

⭐ goldeneagle1 and one other reacted to Night for a topic

Hello, here are the latest original versions of Replikanto (for NT 8.1.6 or below) for education, please! Replikanto-1.6.1.2-NT-8.1.6-v4ijog.zipReplikanto-1.6.1.2-awbhff.zip2 points -

quantvue.io

⭐ goldeneagle1 and one other reacted to Night for a topic

Some interesting stats about Banksy strategy with various settings on live execution: https://docs.google.com/spreadsheets/d/1Q6axQgy6PTGS1SRiiSxz89ZkeQdyYq75njwb9sqEpH4/edit?pli=1&gid=1944449642#gid=19444496422 points -

quantvue.io

⭐ goldeneagle1 and one other reacted to Night for a topic

FYI, this is the direct link to the latest QV original files: https://drive.google.com/drive/folders/10glRX5WPfFa8YwJUCnzuA3m5gQXfwxj2 Expect them to put QKronos in there when it's ready. By the way, I couldnt find the "educated" version of QGridEliteStrat_1_0_1_2 . Can someone point me to it if it is available?2 points -

SMM Metrics Time filter refined

⭐ RichardGere reacted to fchot33 for a topic

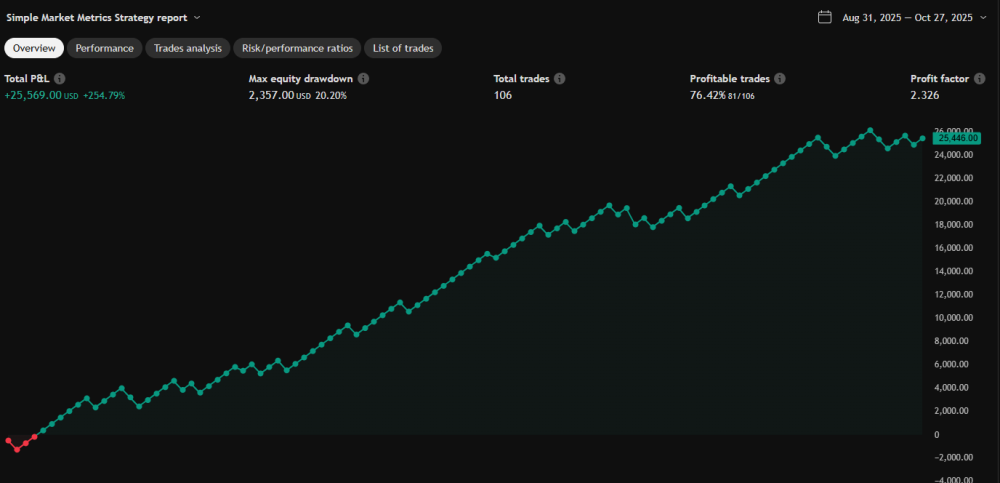

I refined the code in Tradingview, so, backtesting it can be the same as using Predator with the NT8 version. 111tick profit, 156 stop, 76% win rate since Aug 31. I took the test frim the closing of the candle and not the opening, since that reveals where the next candle will open to get the actual trade done. i am still working around win loss ratio and stops, but this one should get you started with those 100K prop acc, since we still have 20% drawdrawn on a 10k investment and a 254%return. I changed the code for time filter. starts at 9am NY till 4 oclock to get those results and stops btw 12 and 12.29 NY lunch. Play around with it Gonna keep trying to work on this but looks decent. @version=5.txt1 point -

1 point

-

1 point

-

I have lifetime license so I can access to latest updates but it's good if they get educated so others can benefit too.1 point

-

TradeTerminator

⭐ goldeneagle1 reacted to Night for a topic

Attached are original tradeTerminator AI bots. Need to educate those pleaseTradeTerminatorStrategyV1_001.zipTradeTerminatorAI_1_13.zip.1 point -

updated https://workupload.com/file/8meW2LstcWW Thanks1 point

-

Ninza Request Thread

⭐ goldeneagle1 reacted to ngatho254 for a topic

Those that cant get Ice berg to plot https://workupload.com/file/AYBpXLGCN74 Open the compressed folder take the folder inside move the folder C:\Users\HOME\Documents\NinjaTrader 8\templates\Indicator Its a template for the indicator that's plotting over her. credit to @apmoo1 point -

Ninza Request Thread

⭐ goldeneagle1 reacted to ⭐ apmoo for a topic

Ok took me a min but i figured it out. In quantum vol delta settings increase screen DPI. Max for me was 500. I hope this helps. Thanks1 point -

https://workupload.com/archive/uCzbLMaN7G Thanks1 point

-

NINZA Bo$$ Order Block

⭐ goldeneagle1 reacted to ⭐ apmoo for a topic

https://workupload.com/file/BmUJVESLEnT Thanks1 point -

It is a trial version valid for 14 days. To remove the trial limit, just remove all files under /Documents/NT8/tmp then you can run it forever.1 point

-

.NinZa-VoluTankArmy

⭐ goldeneagle1 reacted to kimsam for a topic

https://workupload.com/file/rZES3k4Bvks updated .. please confirm if ok1 point -

//@version=5 strategy("Simple Market Metrics Trading Rules [Normal Candles Fixed]", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100) // === REMOVE HEIKIN ASHI WARNING & DEPENDENCY === var bool d7c = true // Disable Heikin Ashi warning var const string x1z = "***** Simple Market Metrics Trading Rules *****" var const string p2k = "\n\n1. How to enter a trade:\n• Wait for a Buy or Sell signal to appear" var const string l4m = "\n• If the signal remains when the candle closes, enter the trade with a market or limit order" var const string b9n = "\n\n2. How to exit a trade:\n• Take profit when the price reaches the profit target line" var const string t8j = "\n• Stop out of the trade if the white dot remains on the opposite side of the profit wave only when the candle has closed." var const string q0z = x1z + p2k + l4m + b9n + t8j var const string e5v = "--------| Frequently Asked Questions |--------" var const string u3b = "\n\n1. What markets can this be traded with?\n• Simple Market Metrics works with any market, but the ES & NQ Futures are the preferred markets to trade this system with." var const string w6t = "\n\n2. What candle type should be used?\n• Simple Market Metrics was designed to be used on Heikin Ashi candles." var const string r1y = "\n\n3. What are the preferred trading hours?\n• The preferred hours to trade are during the New York session between 10:00am EST and 3:00pm EST." var const string z7m = "\n\n4. What timeframe should I trade?\n• The 1 and 2 minute timeframes are preferred with ES & NQ Futures" var const string j9p = "\n\n5. What should I set the profit targets to?\n• ES - 1 min: 4\n• ES - 2 min: 8\n• NQ - 1 min: 20\n• NQ - 2 min: 40" var const string k9z = "\n\n6. How many contracts should I start trading with prop firm accounts?\n• 50k - 5 micros on MES or MNQ \n• 150k - 2 minis on ES or NQ" var const string k3l = e5v + u3b + w6t + r1y + z7m + j9p + k9z var const string d5q = "Some final notes:\n\nThe Simple Market Metrics trading system has been built specifically for trading the ES & NQ Futures markets, with the goal of small but consistent daily profits." var const string c2a = "\n\nAlthough you may trade any market and timeframe you wish, it is up to you to determine the best settings for other markets and timeframes." var const string n4g = "\n\nTrading is risky, do not trade with money you are not comfortable losing.\nControl your risk by managing your position size accordingly, and please practice on a sim account before using real money." var const string f6b = "\n\nIf you need further assistance, contact us at [email protected]" var const string y8s = d5q + c2a + n4g + f6b var const string r0p = "------------------> START HERE <------------------" g1r = input.bool(false, title="Please Read The Trading Rules ----->", group=r0p, tooltip=q0z) h1f = input.bool(false, title="Frequently Asked Questions ------->", group=r0p, tooltip=k3l) b2l = input.bool(false, title="Final Notes & Contact Info --------->", group=r0p, tooltip=y8s) var b8v = '----- Signal Settings -----' n7s = input.bool(true, title='Enable Buy & Sell Signals', group=b8v) c6j = input.color(color.new(#4caf50, 0), 'Buy Signal Color', group=b8v) q8o = input.color(color.new(#b22833, 0), 'Sell Signal Color', group=b8v) m6r = input.bool(true, title='Enable Buy & Sell Price', group=b8v) t7z = input.bool(true, title='Enable Chop Filter', group=b8v, tooltip='This helps to reduce signals during choppy markets, and will produce less signals overall when enabled.') var r7p = '----- Strategy Settings -----' // New user inputs for Take Profit and Stop Loss w3f = input.int(50, title='Take Profit (Ticks/Pips)', group=r7p) s6p = input.int(45, title='Stop Loss (Ticks/Pips)', group=r7p) j4c = input.bool(true, title='Enable Profit Target Lines', group=r7p) v1n = input.int(10, title='Max Profit Target Lines', group=r7p, tooltip='Maximum amount of profit target lines to display on your chart.') y9q = input.color(color.new(color.yellow, 0), 'Profit Target Lines Color', group=r7p) s5d = input.bool(true, "Enable Profit Wave", group=r7p) x3m = input.color(color.new(#00ff8480, 50), 'Profit Wave Bullish Top Color', group=r7p) e4a = input.color(color.new(color.green, 50), 'Profit Wave Bullish Bottom Color', group=r7p) g9j = input.color(color.new(#8c0000, 50), 'Profit Wave Bearish Top Color', group=r7p) u5r = input.color(color.new(#ff0000, 50), 'Profit Wave Bearish Bottom Color', group=r7p) var t6v = '----- Background trendSwitch Settings -----' f3n = input.bool(true, "Enable Background trendSwitch Color", group=t6v) r3k = input.color(color.new(#66ff00, 70), 'Bullish Background Color', group=t6v) y2w = input.color(color.new(#ff0000, 70), 'Bearish Background Color', group=t6v) var p9t = "----- Candle Settings -----" n3b = input.color(color.new(#089981, 0), 'Bullish Candle Color', group=p9t) d9k = input.color(color.new(#f23645, 0), 'Bearish Candle Color', group=p9t) o1m = input.bool(true, title='Enable Candle Color Matching', group=p9t) f2s = input.string("Profit Wave", title='Match Candle Colors To', options=["Profit Wave", "Trend"], group=p9t) var j6z = '----- Support & Resistance Settings -----' m7h = input.bool(true, title='Enable Support & Resistance Lines', group=j6z) z4n = input.color(#ff0000, 'Resistance Lines Color', group=j6z) h4g = input.color(#66ff00, 'Support Lines Color', group=j6z) c5k = input.string("Dotted", options=["Dashed", "Dotted", "Solid"], title="Support & Resistance Lines Style", group=j6z) p8r = input.int(2, "Support & Resistance Lines Width", minval=1, maxval=5, step=1, group=j6z) r9l = input.string('Close', title='Extend Lines Until', options=['Touch', 'Close'], group=j6z, tooltip='Extend the lines until price touches them or a candle closes beyond them.') e6b = 20 g0s = 50 var q5d = '----- Real Price Settings -----' t4n = input(false, title="Enable Real Price Line", group=q5d) l1w = input(false, title="Extend Real Price Line", group=q5d) y0v = input(color.new(color.white, 0), title="Real Price Line Color", group=q5d) s2m = input.string("Thin", options=["Thin", "Thick"], title="Real Price Line Width", group=q5d) n9a = input.string("Dotted", options=["Dotted", "Solid", "Dashed"], title="Real Price Line Style", group=q5d) x8o = input.bool(true, title="Enable Real Close Price Dots", group=q5d) j2l = input(color.new(color.white, 0), title="Real Close Price Dot Color", group=q5d) k9g = input.string("Small", options=["Auto", "Small", "Large"], title="Real Close Price Dot Size", group=q5d) var d3h = '----- Price Channel Settings -----' l7x = input.bool(false, "Enable Price Channel", group=d3h) q6v = input.color(color.green, 'Bottom Price Channel Color', group=d3h) n6b = input.color(#ff0000, 'Top Price Channel Color', group=d3h) g4p = input.bool(false, "Extend Lines Left", group=d3h) b3k = input.bool(false, "Extend Lines Right", group=d3h) var x4a = "----- Dashboard Settings -----" c8y = input.bool(true, title='Enable Buy & Sell Signals on Dashboard', group=x4a) d8w = input.bool(false, "Enable Level Lines", group=x4a) j5r = input.string("Solid", options=["Solid", "Dotted", "Dashed"], title="Level Lines Style", group=x4a) p6t = input.int(1, "trendSwitch Dots Size", minval=1, maxval=10, step=1, group=x4a) q1r = input.int(3, "Signal Dots Size", minval=3, maxval=10, step=1, group=x4a) u7m = input.color(color.lime, 'Money Flow Bullish Color', group=x4a) r0n = input.color(color.red, 'Money Flow Bearish Color', group=x4a) // --- New Time Filter Section --- var z1t = '----- Time Filter -----' c0s = input.bool(true, "Enable Time Filter", group=z1t) z2j = time(timeframe.period, "1600-0859", "America/New_York") w1p = time(timeframe.period, "1200-1229", "America/New_York") isForbiddenTime = c0s and (z2j or w1p) // --- End New Time Filter Section --- z9f = chart.is_heikinashi if not z9f and not d7c f3n := false n7s := false j4c := false o1m := false s5d := false m7h := false middle_price = (high + low) / 2 visible_bar_count = bar_index - ta.valuewhen(time == chart.left_visible_bar_time, bar_index, 0) middle_bar_index = bar_index[visible_bar_count / 2] var label j1l = na if (bar_index > 0) label.delete(j1l) warningText = "\n⚠️ WARNING!!! ⚠️\n\nYou MUST set the chart candle type\nto Heikin Ashi for the signals to display correctly.\n\nThis message will disappear when you've done so.\n" j1l := label.new(x=middle_bar_index, y=middle_price, text=warningText, xloc=xloc.bar_index, yloc=yloc.price, style=label.style_label_center, color=color.red, textcolor=color.white, size=size.huge, textalign=text.align_center, force_overlay=true) srcHlc3 = hlc3 srcOpen = open srcHigh = high srcLow = low srcClose = close real_price = ticker.new(prefix=syminfo.prefix, ticker=syminfo.ticker) real_close = request.security(symbol=real_price, timeframe='', expression=close, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off) profitWaveEmaFast = ta.ema(srcClose, 😎 profitWaveEmaMedium = ta.ema(srcClose, 13) profitWaveEmaSlow = ta.ema(srcClose, 21) u8t = 1 r7c = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1]))) p5y = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0 d4h = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0 v5g = 0.0 v5g := nz(v5g[1]) - (nz(v5g[1]) / u8t) + r7c p1b = 0.0 p1b := nz(p1b[1]) - (nz(p1b[1]) / u8t) + p5y b6t = 0.0 b6t := nz(b6t[1]) - (nz(b6t[1]) / u8t) + d4h x9n = p1b / v5g * 100 d1v = b6t / v5g * 100 t5c = (srcHigh + srcLow) / 2 - (1.3 * ta.atr(8)) j6r = (srcHigh + srcLow) / 2 + (1.3 * ta.atr(8)) float r8d = na float t9f = na x2m = 0 r8d := srcClose[1] > r8d[1] ? math.max(t5c, r8d[1]) : t5c t9f := srcClose[1] < t9f[1] ? math.min(j6r, t9f[1]) : j6r x2m := srcClose > t9f[1] ? 1 : srcClose < r8d[1] ? -1 : nz(x2m[1], 1) u9z = x2m == 1 ? r8d : t9f y2g = u9z == r8d w1r = u9z == t9f b7f = color.gray b7f := if (srcClose > srcOpen) n3b else if (srcClose < srcOpen) d9k else b7f[1] if (o1m and f2s == "Trend") b7f := if (y2g) n3b else if (w1r) d9k else b7f[1] else if (o1m and f2s == "Profit Wave") b7f := if (srcClose > profitWaveEmaSlow) n3b else if (srcClose < profitWaveEmaSlow) d9k else b7f[1] plotcandle(srcOpen, srcHigh, srcLow, srcClose, "SMM Candles", color=b7f, wickcolor=b7f, bordercolor=b7f, force_overlay=true) x5y = color.white if (y2g) x5y := r3k else if (w1r) x5y := y2w else x5y := x5y[1] bgcolor(f3n ? x5y : na, force_overlay=true) var bool o1z = false var bool k8s = false o1z := u9z == r8d k8s := u9z == t9f mfl = ta.mfi(srcHlc3, 10) enum w0y buy = "Buy Mode" sell = "Sell Mode" none = "none" var w0y y7c = w0y.none if (x5y != x5y[1]) y7c := w0y.none a4h = srcClose > srcOpen and srcOpen == srcLow and real_close > profitWaveEmaFast and real_close > profitWaveEmaSlow p4r = srcClose < srcOpen and srcOpen == srcHigh and real_close < profitWaveEmaFast and real_close < profitWaveEmaSlow v7g = m6r ? "\n$" + str.tostring(real_close, format.mintick) : "" bool e1p = true bool t2y = true if (t7z) e1p := math.floor(x9n) > math.floor(d1v) and math.floor(x9n) >= 45 t2y := math.floor(d1v) > math.floor(x9n) and math.floor(d1v) >= 45 else e1p := true t2y := true var int u0k = na w2f = t7z ? mfl > 52 : true o4k = o1z and y2g and a4h and y7c != w0y.buy and w2f and e1p if (o4k and n7s) y7c := w0y.buy label.new(bar_index, low, style=label.style_label_up, color=c6j, size=size.normal, yloc=yloc.belowbar, text="Buy" + v7g, textcolor=color.white, force_overlay=true) u0k := bar_index b7m = t7z ? mfl < 48 : true o5t = k8s and w1r and p4r and y7c != w0y.sell and b7m and t2y if (o5t and n7s) y7c := w0y.sell label.new(bar_index, high, style=label.style_label_down, color=q8o, size=size.normal, yloc=yloc.abovebar, text="Sell" + v7g, textcolor=color.white, force_overlay=true) u0k := bar_index // Strategy entry with TP and SL. Now includes time filter. if (o4k and n7s and not isForbiddenTime) strategy.entry("Long", strategy.long, when=barstate.isconfirmed) strategy.exit("TP/SL Long", from_entry="Long", profit=w3f, loss=s6p) if (o5t and n7s and not isForbiddenTime) strategy.entry("Short", strategy.short, when=barstate.isconfirmed) strategy.exit("TP/SL Short", from_entry="Short", profit=w3f, loss=s6p) // The original exit logic based on the Profit Wave has been removed, as the `strategy` functions handle // exits based on profit and loss targets. You can still manually close a trade based on that rule // when using the strategy tester and visual backtesting. var line[] n9r = array.new_line(0) var label[] r2j = array.new_label(0) var float x0l = na if ((o4k or o5t) and n7s and j4c) if array.size(n9r) >= v1n o9m = array.get(n9r, 0) k2f = array.get(r2j, 0) line.delete(o9m) label.delete(k2f) array.remove(n9r, 0) array.remove(r2j, 0) x0l := o4k ? real_close + (w3f * syminfo.mintick) : o5t ? real_close - (w3f * syminfo.mintick) : na a2d = line.new(bar_index - 7, x0l, bar_index + 5, x0l, color=y9q, width=2, force_overlay=true) array.push(n9r, a2d) q9p = label.new(bar_index - 3, x0l, text="$" + str.tostring(x0l, format.mintick), style=label.style_none, textcolor=y9q, force_overlay=true) array.push(r2j, q9p) o7g = if not na(u0k) and bar_index > u0k y7c == w0y.buy ? srcHigh >= x0l : y7c == w0y.sell ? srcLow <= x0l : na alertcondition(condition=o4k and e1p, title='Buy alert', message='Buy') alertcondition(condition=o5t and t2y, title='Sell alert', message='Sell') alertcondition(condition=n7s and j4c ? o7g : na, title="Profit Target", message="Profit Target Hit!") if o7g x0l := na u0k := na p3f = plot(s5d ? profitWaveEmaFast : na, title="Profit Wave Line 1", color=color.new(color.white, 100), linewidth=1, force_overlay=true) h3m = plot(s5d ? profitWaveEmaMedium : na, title="Profit Wave Line 2", color=color.new(color.white, 100), linewidth=1, force_overlay=true) b0y = plot(s5d ? profitWaveEmaSlow : na, title="Profit Wave Line 3", color=color.new(color.white, 100), linewidth=1, force_overlay=true) a3c = real_close > profitWaveEmaSlow ? x3m : color.new(color.lime, 100) s8k = real_close > profitWaveEmaSlow ? e4a : color.new(color.green, 100) fill(p3f, h3m, a3c) fill(h3m, b0y, s8k) q4m = real_close < profitWaveEmaSlow ? u5r : color.new(#ff0000, 100) g7n = real_close < profitWaveEmaSlow ? g9j : color.new(#8c0000, 100) fill(p3f, h3m, q4m) fill(h3m, b0y, g7n) w4z = switch c5k "Solid" => line.style_solid "Dotted" => line.style_dotted "Dashed" => line.style_dashed ph1 = ta.pivothigh(srcHigh, e6b, e6b) lp8 = ta.pivotlow(srcLow, e6b, e6b) var line[] j3r = array.new_line(0) var line[] u5x = array.new_line(0) var int[] f4z = array.new_int(0) var int[] d5m = array.new_int(0) q6x = 500 f_manage_line_limit(a5h, p2x) => if array.size(a5h) > g0s line.delete(array.shift(a5h)) array.shift(p2x) if (m7h and not na(ph1) and bar_index[e6b] >= bar_index - q6x) h9s = srcHigh[e6b] y3k = bar_index[e6b] x4m = line.new(y3k, h9s, bar_index + 1, h9s, style=w4z, width=p8r, color=z4n, extend=extend.right, force_overlay=true) array.push(j3r, x4m) array.push(f4z, na) f_manage_line_limit(j3r, f4z) if (m7h and not na(lp8) and bar_index[e6b] >= bar_index - q6x) p0k = srcLow[e6b] l9h = bar_index[e6b] g9t = line.new(l9h, p0k, bar_index + 1, p0k, style=w4z, width=p8r, color=h4g, extend=extend.right, force_overlay=true) array.push(u5x, g9t) array.push(d5m, na) f_manage_line_limit(u5x, d5m) if array.size(j3r) > 0 z8v = r9l == 'Close' ? srcClose : srcHigh for i = 0 to array.size(j3r) - 1 b2m = array.get(j3r, i) o6p = line.get_y1(b2m) q3n = array.get(f4z, i) if na(q3n) line.set_x2(b2m, bar_index) line.set_extend(b2m, extend.none) if na(q3n) and z8v >= o6p line.set_x2(b2m, bar_index) line.set_extend(b2m, extend.none) array.set(f4z, i, bar_index) if array.size(u5x) > 0 t0w = r9l == 'Close' ? srcClose : srcLow for i = 0 to array.size(u5x) - 1 a2r = array.get(u5x, i) v0g = line.get_y1(a2r) z9l = array.get(d5m, i) if na(z9l) line.set_x2(a2r, bar_index) line.set_extend(a2r, extend.none) if na(z9l) and t0w <= v0g line.set_x2(a2r, bar_index) line.set_extend(a2r, extend.none) array.set(d5m, i, bar_index) v4n = (x8o and k9g == "Auto" ? display.all : display.none) p1s = (x8o and k9g == "Small" ? display.all : display.none) m0x = (x8o and k9g == "Large" ? display.all : display.none) g9v = switch s2m "Thin" => 1 "Thick" => 2 if (t4n and (n9a == "Solid")) t2r = line.new(bar_index[1], real_close, bar_index, real_close, xloc.bar_index, (l1w ? extend.both : extend.right), y0v, line.style_solid, g9v, force_overlay=true) line.delete(t2r[1]) if (t4n and (n9a == "Dotted")) k2h = line.new(bar_index[1], real_close, bar_index, real_close, xloc.bar_index, (l1w ? extend.both : extend.right), y0v, line.style_dotted, g9v, force_overlay=true) line.delete(k2h[1]) if (t4n and (n9a == "Dashed")) n7r = line.new(bar_index[1], real_close, bar_index, real_close, xloc.bar_index, (l1w ? extend.both : extend.right), y0v, line.style_dashed, g9v, force_overlay=true) line.delete(n7r[1]) // Real Price Line + Dots logic originally created by PHVNTOM_TRADER plotchar(series=real_close, title="Real Close dots", location=location.absolute, color=j2l, editable=false, char="•", size=size.auto, display=v4n, force_overlay=true) plotchar(series=real_close, title="Real Close dots", location=location.absolute, color=j2l, editable=false, char="•", size=size.tiny, display=p1s, force_overlay=true) plotshape(series=real_close, title="Real Close dots", location=location.absolute, color=j2l, editable=false, style=shape.circle, size=size.auto, display=m0x, force_overlay=true) l5v = 9 c8k = 2.0 d3n = 100 v0x = switch g4p and b3k => extend.both g4p => extend.left b3k => extend.right => extend.none var f5k = array.new_line(0) var g5w = array.new_line(0) h7a(p1q, a3l, y4m, u9g, l0k, i8r, is1t) => line.set_xy1(p1q, a3l, y4m) line.set_xy2(p1q, u9g, l0k) line.set_color(p1q, i8r) line.set_style(p1q, is1t ? line.style_dotted : line.style_solid) if l7x if barstate.isfirst for i = 1 to l5v array.push(f5k, line.new(na, na, na, na, extend=v0x, force_overlay=true)) array.push(g5w, line.new(na, na, na, na, extend=v0x, force_overlay=true)) n1l = bar_index c5n = ta.variance(srcClose, d3n) z7r = ta.correlation(srcClose, n1l, d3n) a6v = z7r * (math.sqrt(c5n) / ta.stdev(n1l, d3n)) w5j = ta.sma(srcClose, d3n) - a6v * ta.sma(n1l, d3n) t2d = math.sqrt(c5n - c5n * math.pow(z7r, 2)) * c8k if barstate.islast v9l = a6v * (n1l - d3n + 1) + w5j - t2d k0y = a6v * n1l + w5j - t2d w8g = false for i = 0 to l5v - 2 q7p = i / (l5v - 1) g0f = q7p * t2d * 2 p9g = color.from_gradient(q7p, 0, 0.5, color.new(q6v, 00), color.new(q6v, 75)) r4n = color.from_gradient(q7p, 0.5, 1, color.new(n6b, 60), color.new(n6b, 25)) u2x = color.white if (q7p == 0.5) u2x := color.white w8g := true if q7p < 0.5 u2x := p9g if q7p > 0.5 u2x := r4n h7a(array.get(f5k, i), n1l - d3n + 1, v9l + g0f, n1l, k0y + g0f, u2x, w8g) w8g := false h7a(array.get(f5k, l5v - 1), n1l - d3n + 1, v9l + t2d * 2, n1l, k0y + t2d * 2, n6b, w8g) u4n = math.sqrt(c5n - c5n * math.pow(z7r, 2)) * 1 b3d = switch j5r "Solid" => hline.style_solid "Dotted" => hline.style_dotted "Dashed" => hline.style_dashed p0n = hline(100, color=color.new(#ff1b1b, 50), linestyle=hline.style_solid) h3r = hline(90, color=color.new(#ff2626, 50), linestyle=hline.style_solid) n9l = hline(80, color=color.new(#ff3f3f, 50), linestyle=hline.style_solid) a1t = hline(d8w ? 70 : na, color=color.new(#ff5050, 50), linestyle=b3d) d0g = hline(d8w ? 60 : na, color=color.new(#ff6464, 50), linestyle=b3d) v2c = hline(d8w ? 50 : na, color=color.new(#ff6464, 100), linestyle=b3d) l5n = hline(0, color=color.new(#047200, 50), linestyle=hline.style_solid) z1h = hline(10, color=color.new(#047e00, 50), linestyle=hline.style_solid) k6r = hline(20, color=color.new(#048900, 50), linestyle=hline.style_solid) b9t = hline(d8w ? 30 : na, color=color.new(#059f00, 50), linestyle=b3d) h4w = hline(d8w ? 40 : na, color=color.new(#06b200, 50), linestyle=b3d) y5g = hline(d8w ? 50 : na, color=color.new(#06b200, 100), linestyle=b3d) fill(p0n, h3r, color=color.new(#ff1b1b, 20), title="Overbought Extreme Background") fill(h3r, n9l, color=color.new(#ff2626, 40), title="Overbought Start Background") fill(l5n, z1h, color=color.new(#047200, 10), title="Oversold Start Background") fill(k6r, z1h, color=color.new(#047e00, 40), title="Oversold Extreme Background") t5n = y2g ? #66ff00 : #ff0000 plot(50, color=t5n, style=plot.style_circles, title="Dashboard Center Line trendSwitch Dots", linewidth=p6t) plotshape(o4k and c8y and e1p ? 10 : na, title='Dashboard Buy Signal', style=shape.labelup, location=location.absolute, text='Buy', textcolor=color.white, color=c6j) plotshape(o5t and c8y and t2y ? 90 : na, title='Dashboard Sell Signal', style=shape.labeldown, location=location.absolute, text='Sell', textcolor=color.white, color=q8o) u2t = if (mfl > 50) u7m else if (mfl < 50) r0n else color.white plot(mfl, "Dashboard Money Flow Line", color=u2t, style=plot.style_stepline) plot(o4k ? 50 : na, color=#66ff00, style=plot.style_circles, linewidth=q1r, title='Dashboard Crossover Up Dots') plot(o5t ? 50 : na, color=#ff0000, style=plot.style_circles, linewidth=q1r, title='Dashboard Crossover Down Dots')1 point

-

updated https://workupload.com/file/cAEjb32LvNw Thanks1 point

-

NINZA Bo$$ Order Block

⭐ goldeneagle1 reacted to ⭐ fryguy1 for a topic

Non-edu NinZaBossOrderBlock_NT8.zip1 point -

1 point

-

Oh i see now, in the last 72hrs i received over 30 pm asking for this quantvue. New users popping up out of nowhere. The likes are under 10 that's sad. The like button needs to be utilized. Yes I'm talking to you if you are not tapping that like button Thanks1 point