⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I think the biggest mistake is people treating prop firm accounts like cash accounts, and visa versa. The most successful prop firm traders I know spend thousands per month on fees, but double or triple that investment. Take FSP, he’ll line up accounts one after another taking the same move, such as buying a pullback. Maybe the first one or two blows but the next few have caught the bottom of it, with size. Not copying trading them at all. Nobody would trade a cash account this way, but it’s effective with props. prop firms are a game, you have to learn how to play the game with the capital you have to invest in them. Risk management between a prop account and cash accounts can and should be different IMHO. Milk them and dump into those profits into a personal account where you can work on a real trading system such as ORB, momentum, IB etc with ris management being priority (the only thing you can control in the market is your own risk) Better yet, start using your personal accounts (or live prop accounts if you like to give firms 10% or more) to hedge your prop firm evals and SIM funded accounts!

-

can someone plz share this indicator i will try to tested, thx

-

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I think it's one of the best uses for it in NT when you want to use Bookmap. It would be great if someone were to crack it.

-

AllIn reacted to a post in a topic:

quantvue.io

AllIn reacted to a post in a topic:

quantvue.io

-

wertamido reacted to a post in a topic:

Market Replay Downloader

wertamido reacted to a post in a topic:

Market Replay Downloader

-

SG8868 reacted to a post in a topic:

quantvue.io

SG8868 reacted to a post in a topic:

quantvue.io

-

wertamido reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

wertamido reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

- Today

-

this is from maker of PJS heikin ashi, https://pjsmith.me.uk/index.php/2021/02/pjsprofilebars-indicator-for-ninjatrader-8/ can u pls look into the files? @N9T

-

I always used the 30 minute ORB and then waited for a reteest. I then would draw my fibs based on that 30 minute ORB. also would look at the middle of the ORB as my long vs short day etc. That is how I was taught at the begging and have been doing it for the last few years and has worked great. There are a few strategies out there but I find doing it manually yields better results each time. This is for my main cash account not my prop firms. I always lock in profit so say I am up $100 I will set my SL at that $100 and then trail it that is hard to do with prop firms due to the draw down where you really have to snipe until you have passed and have payable account. This way of trading works out great once your SL is locked in then profit is profit. With that being said I like to check out all the new indicators and keep up on everything for my own learning and I use them for the prop firms because of the crazy drawdowns. I like to look for the quick moves with the profirms and I also like the higher amounts it gives me a little bit of room to trade.

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

But this also is one of the reasons many new starters just give up and throw whatever indicators or bots that they used. Right off the bat, they got 3 losses in a row. That hurts, yes. They then move on to the next and continue to search for the holy grail. But then not knowing, after those 3 losses, their bot actually makes an insane killing day after day🤫 If only and only, they tried the 4th trade.🤪

-

Happened this week with 5 looses in a row lol. The dev showed a -24k screenshot around the 3 losses in a row.

-

gaxodo8800 joined the community

-

Ohh, I dont use them at all. Sorry to burst your bubbles. I still stick to the old way effective way, yet simple and easy enough for my every trading day. The infamous ORB! I find it effective. Not always of course, as everything else. Gotta have a crappy day. But over all, the winning rate is quite alright for me. Just a few hundred bucks per day is all that I need (or we need). 5 days per week, it adds up pretty decently. Using 5 min time frame, I mark the high and low for this opening 5 min candle. Then switch to 1 min time frame and go from there. Most new traders, I have been there, done that. Immediately enter a trade when they see a candle breaking either the high or the low of the candle. Dont do that. You wanna be patient and watch closely what price is going to do at these levels, how it reacts. You do wanna see price retraces or pulls back into these levels, then look for a confirmation candle which tells you that is the direction price is gonna go or continue. So yes, the pro in entering a trade Immediately when candle breaks level, high or low is that, sometimes, it just doesnt pulls back but soon right after it breaks, it just keeps popping. Then of course, you miss the train. But hey, be disciplined. Stick to the plan and follow through. If you miss then you miss. You didnt loose any money. Still good and cool. Much better than entering too early, only to see a huge candle showing up right after in opposite of your intended direction. Another way I also use a whole lot is, at the start of a trading day, I mark the high and low of premarket. Then when it opens, I mark the high and low of a 5 min candle. Watch how price is now reacting to the levels. Use Fib retracement, seeing when price breaks and retraces to it, then that is my entry. This helps to minimize the wider gap for stoploss, making it smaller. And, target is usually aimed somewhere up there for previous high or resistance and vice versa, somewhere down there at previous low or support area. Good to also measure the range between where you enter and where you place your target. Better take at least half of that range and be done. No need to go for a home run. Unless, you use multiple contracts, then let 1 run. But yeah, you can easily book at least half of the range. Price usually runs enough. Plenty of time, it gets very close to your range target, misses it by a tick or two then baaam, immediately reverses with a huge candle out of nowhere. Now, you gave everything back, plus possibly also in red. Kicking yourself. Punching your PC. Cursing at your cats or dogs.😝 Take reasonable profits. Especially if you are trading with prop firms that have intraday draw down. This rule alone, would kill you.

-

Another Truth Most People Miss Many traders go through that exact phase. Trying everything. Realizing nothing is magic. Accepting that risk management is essential. But there are a few more uncomfortable truths that rarely get discussed. Edge Is Real, But Rare and Earned It’s not true that no method works. It’s true that most people don’t execute any method long enough, clean enough, or consistently enough to see its statistical edge. An edge in trading is not a secret formula. It is a small, repeatable probability advantage executed thousands of times with discipline. The problem is not that methods don’t work. The problem is that humans don’t stick to them. Most Traders Never Collect Real Data People say “this strategy doesn’t work.” But how many trades did they take? 30? 50? 100? Professional traders think in sample sizes of 300, 500, 1000 trades. They track: Win rate Average win Average loss Expectancy Maximum drawdown Time in drawdown Without data, everything feels random. With data, randomness becomes structured probability. Psychology Is Not Just Emotion Control People talk about controlling fear and greed. That’s surface level. Real psychological skill in trading means: Acting when bored Not acting when excited Accepting long periods of stagnation Continuing after a drawdown without changing your system Trusting math over feelings Emotional control is not about being calm. It is about being consistent. Position Sizing Creates or Destroys You Two traders can trade the exact same strategy. One risks 1 percent per trade. The other risks 5 percent. After 10 losing trades: The first is uncomfortable. The second is destroyed. Compounding works both ways. Time in the Market Beats Tool Switching Most traders restart every 3 months. New system. New indicator. New mentor. Meanwhile, professionals refine one model for years. The edge is not in complexity. It is in deep familiarity. Liquidity and Timing Matter More Than People Think Not all hours are equal. Not all days are equal. Not all environments reward the same behavior. Trending markets require different behavior than mean reverting markets. High volatility requires different sizing than low volatility. Adaptation is survival. Capital Is Ammunition You mentioned risk management keeps you alive. That’s true. But capital is not only protection. It is opportunity. The trader who preserves capital long enough eventually meets favorable conditions. The trader who blows up early never reaches that phase. Survival is step one. Longevity is step two. Growth is step three. The Real Difference There is no golden method. But there are golden habits. Consistency Data tracking Patience Discipline Position sizing Adaptability Long term thinking Markets are uncertain. But behavior does not have to be. That is where the real edge lives.

-

Cool updates! by the way I found this tool in this discord, they share strategies there all free if you think you can contribute join: https://discord.gg/CCXHmKUne

-

The Truth No One Tells You I have tried all methods of analysis. From technical analysis to fundamental analysis, from Elliott Wave to Wyckoff, from volume profile to harmonics, from complex indicators to pure price action. I want to be honest: none of these will make you rich. The Harsh Reality of the Market Understand this: where there is money, there is no honesty. Where there is money, there is no clear and definite method. If someone really knew the golden method of making money, they would never teach it to me or you. Why would they? Why do we humans get fooled? Why are we constantly searching for a miraculous method? Why do we think this course, this book, this indicator, this strategy is what will change our lives? Because our mind seeks a simple solution. We want to believe there is a magic formula. But the truth is, in financial markets, certainty does not exist. The Illusion of Advanced Tools You might think professional platforms like Sierra Chart, NinjaTrader, Bookmap, or Quantower are the keys to success. Yes, these are good tools, but not for us. Why is that? Imagine being handed a precise surgical knife and told to perform open-heart surgery. The knife is excellent, sharp, and sterile. But you know nothing about medicine. Because no one has explained the logic behind it to you. The same thing happens in trading. They give us tools and say this is Bookmap, this is Heatmap, this is Orderflow. But they don’t explain the main logic behind them. And even if we know, it still doesn’t guarantee success. A Real-World Example Making money from trading is like searching for gold in an endless desert. Everyone sells you different maps. One says go east, another says west, one says dig deep, another says search shallow. But the truth is: most of these maps lead to mirages. A few people find gold? Yes. But most people just lose their energy, time, and money in the desert. The Only Thing That Really Matters So what remains? If strategies don’t work, if tools aren’t enough, if analyses are incomplete, then what matters? Risk management and capital management. This is the only thing that keeps you alive in this market. Not complex strategies, not magical indicators, not expensive tools. Professional trading means: - Knowing how much of your capital you risk on each trade - Knowing how to build a diversified portfolio so one loss doesn’t destroy you - Knowing when to stay out of the market - Knowing how to manage your emotions

-

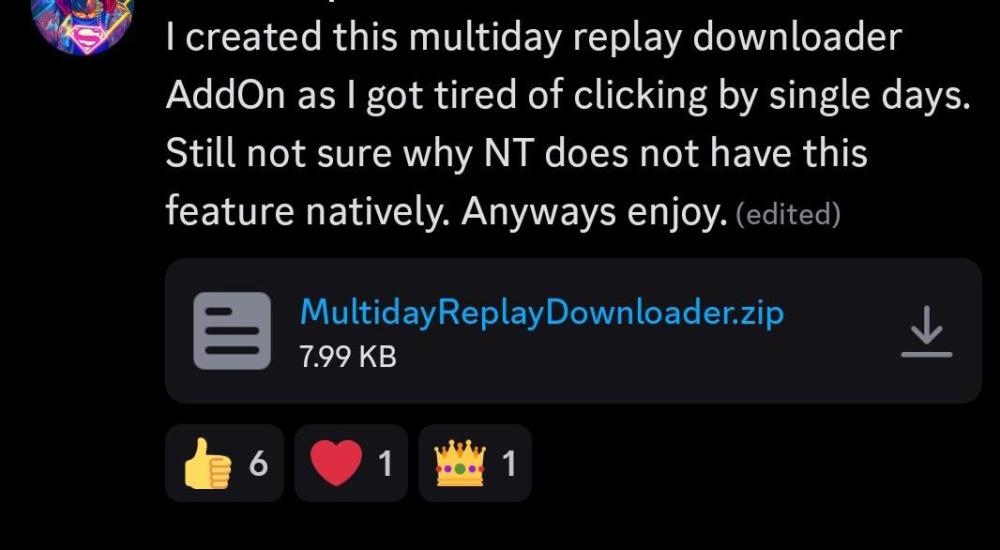

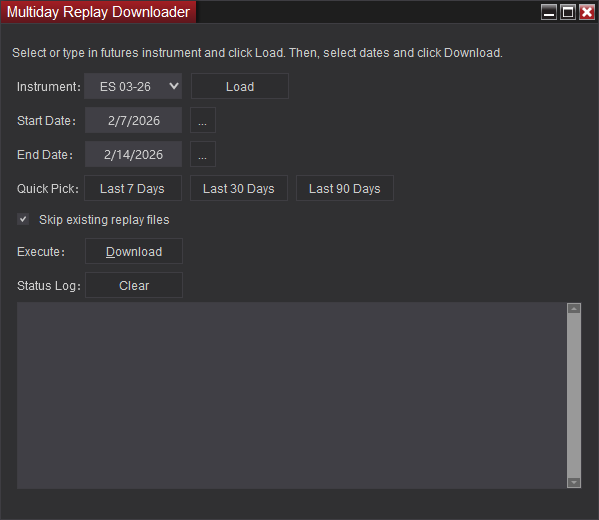

The updated interface is optimized and can also be used with older versions of NinjaTrader 8. MultidayReplayDownloader.zip

-

If you are trading using prop firms, this could blow your accounts, as it wins, then loses, then wins, then loses. The intraday draw down rule would probably kill you.

-

Real Estate Tokenization Development Services

CRYPTOHUSTLER replied to Spark Smith's topic in Cryptocurrencies

Property tokenization development solutions convert real assets into digital tokens on blockchain networks, enabling shared ownership, quicker transfers, and better liquidity. Smart contracts streamline compliance, settlements, and investor records. This approach reduces entry costs, boosts transparency, and widens global participation, helping builders and investors access property markets more efficiently, securely, and flexibly while improving capital circulation and portfolio adaptability.- 1 reply

-

- business

- real estate

-

(and 2 more)

Tagged with:

-

Duecoin delivers quick, affordable transfers and easy entry into digital payments, making it practical for daily use. As crypto adoption expands alongside leaders like Bitcoin, thoughtful investors consider diversified ecosystems. Combining Duecoin with newer assets such as the LMGX token can widen exposure, support adaptable strategies, and prepare portfolios for future, utility-focused growth without depending on one network.

-

@kimsam @apmoo @Ninja_On_The_Roof . Please Educate Sniper Auto Trader Power Trend.