⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

-

Posts

106 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Articles

Everything posted by g1080

-

-

Have you tryed chatgpt? i solved python and thinkscript codes with chatgpt. also i dont fully understand whats supposed to do, put an X on higher highs and lower lows?

-

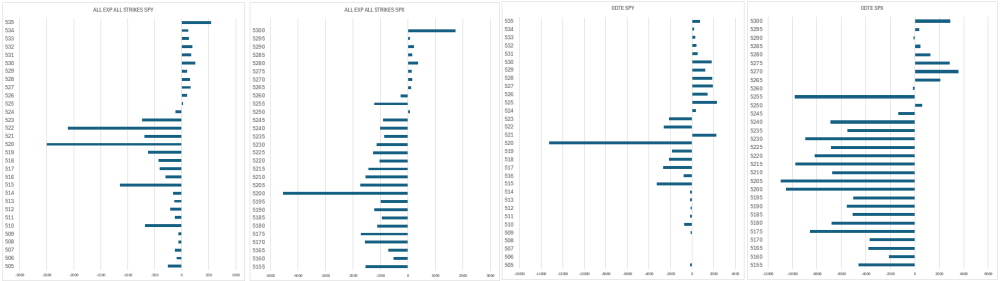

Hi Leafpile, thats plain excel file with i belive CBOE data (free data), https://www.cboe.com/delayed_quotes/spx/quote_table

-

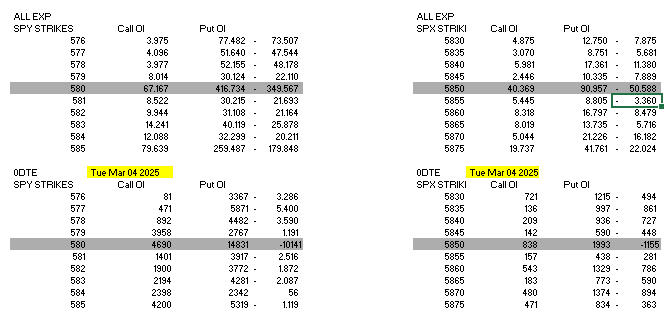

Hi @RichardGere , do you use Search function to scan ? I `ve loaded all parameters i `ve found in manuals and forums sometimes not getting much results on trending markets, just to know if you use something different.

-

Esignal 12 shared can be installed but requires an active user ID and pass to run.

-

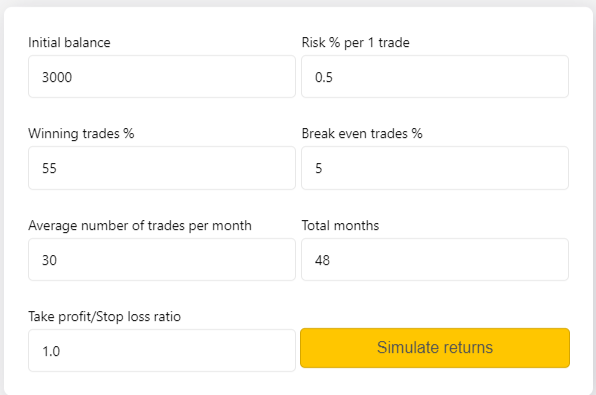

Monte Carlo Simulation is a computer simulation technique used to estimate the possible outcomes The goal of our Monte Carlo tool is to help illustrate and predict the variability of your trading returns with confidence. The simulation is based upon your trading strategy metrics. Link

-

-

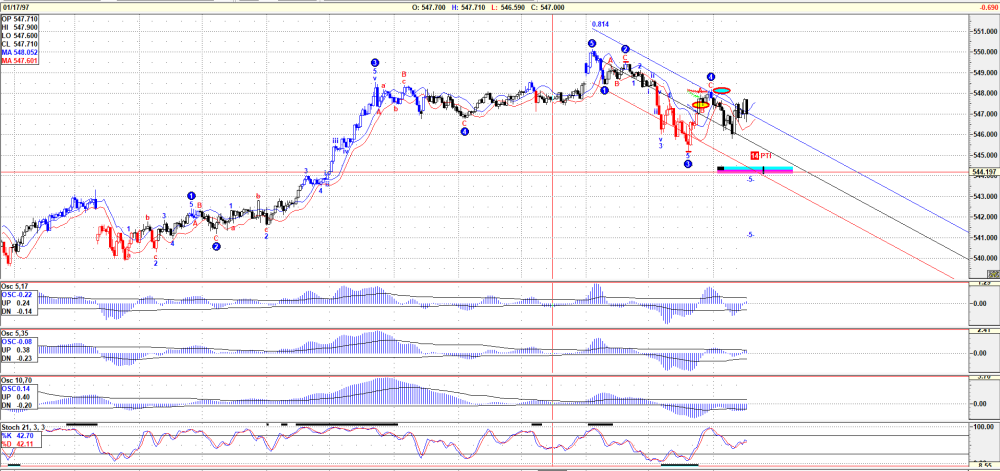

Old important support files of advanced get by marc rinehart

⭐ g1080 replied to ⭐ bunty's topic in Trading Platforms

These are the ones I managed to find over the years. Link -

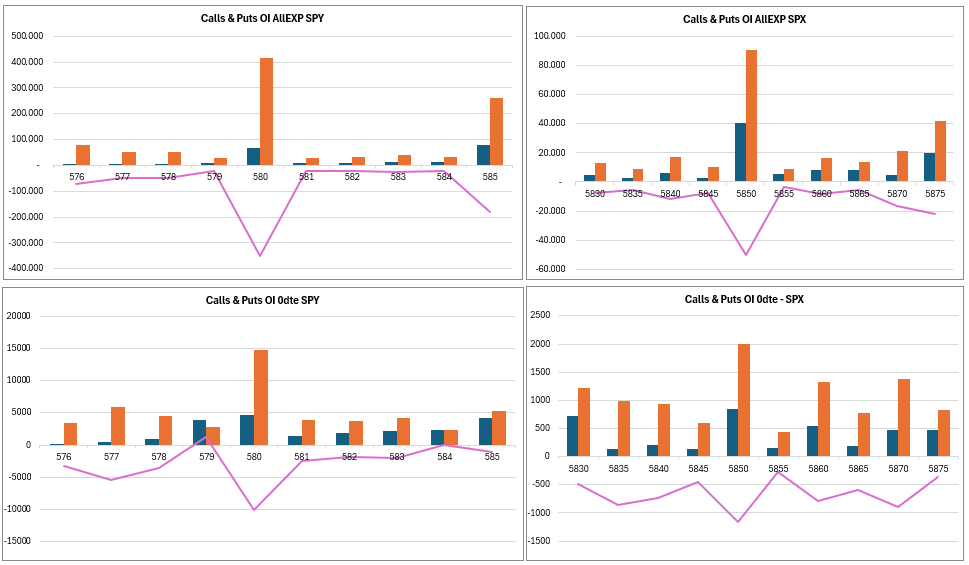

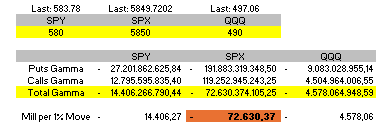

htn4653 , it gives you an idea of where funds have to hedge. Check this ↓↓ https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/

-

Selling 0 DTE naked consumes a lot of buying power, defined risk strategies lower BPR but risk/reward worsens. Its purely what suits you best and being right about direction. 30 delta, with USD 1500 gives you 50 trades if 50% of the time you´re wrong but when you´re right you collect 1.6 you risk, you have a positive expectancy.

-

Straight call/put buy, 30 delta , >0.1 Gamma. Pure directional no overnight position.

-

-

-

-

I use Aget built 7.6 since found it more stable than 9.1. If anyone has esignal 10.6 EOD will be much appreciated. Thanks,

-

Hi I just followed this instructions and make my own, also found some made in python in github. https://perfiliev.co.uk/market-commentary/how-to-calculate-gamma-exposure-and-zero-gamma-level/ This is CBOE link. https://www.cboe.com/delayed_quotes/spy/quote_table