⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Dimdium reacted to a post in a topic:

Bull Barbie Opening Range Breakout Bot and indies (Request)

Dimdium reacted to a post in a topic:

Bull Barbie Opening Range Breakout Bot and indies (Request)

-

Wow. This is very good. I was also twitching, but the results weren't nearly this good. Thank you very much for your work.

-

Oana SSS reacted to a post in a topic:

ORS Fusion and Axios

Oana SSS reacted to a post in a topic:

ORS Fusion and Axios

-

Thank you very much @Ninja_On_The_Roof the indicators look like copy-paste 😄 the only difference are the bar type used.

-

I recall I do have the reversal bar indicator somewhere, I just cant find it now. But, you can for now, try the MQTrenderPro 2. I am quite certain people have it here. They might be able to share it as well. https://workupload.com/file/3nDs76aB2sa As far as for the squeeze indicator, you can use the one from Trading123.net.

-

⭐ nadjib reacted to a post in a topic:

Bull Barbie Opening Range Breakout Bot and indies (Request)

⭐ nadjib reacted to a post in a topic:

Bull Barbie Opening Range Breakout Bot and indies (Request)

-

Can you please share the reversal bar indicator and a screenshot of your idea?

-

TKRapt0r joined the community

-

Yeah. Just add a reversal bar indicator and the famous TM Squeeze for bottom chart then I think you are golden.!

-

works fine on non edu NT8.

-

⭐ goldeneagle1 reacted to a post in a topic:

Composite Volume Profile (needs edu)

⭐ goldeneagle1 reacted to a post in a topic:

Composite Volume Profile (needs edu)

-

⭐ goldeneagle1 reacted to a post in a topic:

15 more indicators by NinZa

⭐ goldeneagle1 reacted to a post in a topic:

15 more indicators by NinZa

-

Thank you @Ninja_On_The_Roof I will check thunderzilla. You're right these srategies can be replicated, what happens is that from my experience I can have a solid strategy but somehow something fails on ninjatrader and I look for strategies that theoricly, good or bad, have been tested and do not give me the troubles I have when I run mine. Thats the main reason.

-

⭐ goldeneagle1 reacted to a post in a topic:

xbrat harmonic pattern & elliot wave

⭐ goldeneagle1 reacted to a post in a topic:

xbrat harmonic pattern & elliot wave

-

⭐ goldeneagle1 reacted to a post in a topic:

Holy Grail Algo need EDU

⭐ goldeneagle1 reacted to a post in a topic:

Holy Grail Algo need EDU

-

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

-

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

-

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

⭐ goldeneagle1 reacted to a post in a topic:

More NinZa indicators 🙃

-

I dont think you wanna spend $100 per month to have these kinds of signals. I mean, just put on some sort of moving averages and use renko chart, you would already be able to see where you should enter. Just to use the Ninza Thunder Zilla, for example...You can definitely automate it using Captain Optimus, Infinity or just the infamous PredatorX. Save yourself some money.

-

working good, thanks. any templates?

- Today

-

ampf started following Praedox 2.0 - Trader's Assistant and ksqueeze.com

-

Does anyone has these indicators and strategies from https://ksqueeze.com? Thanks

-

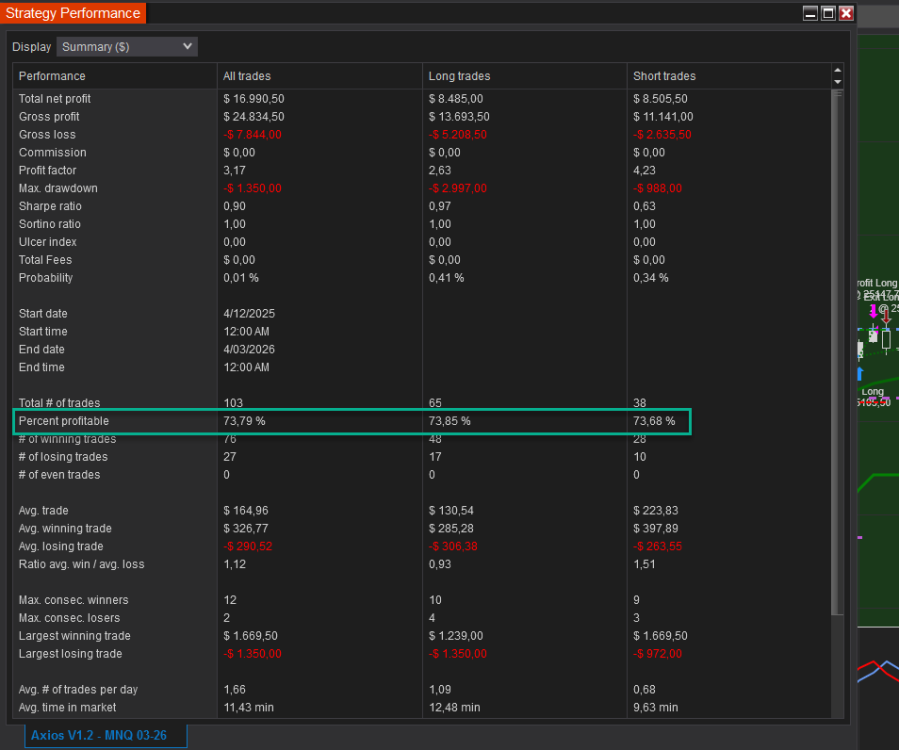

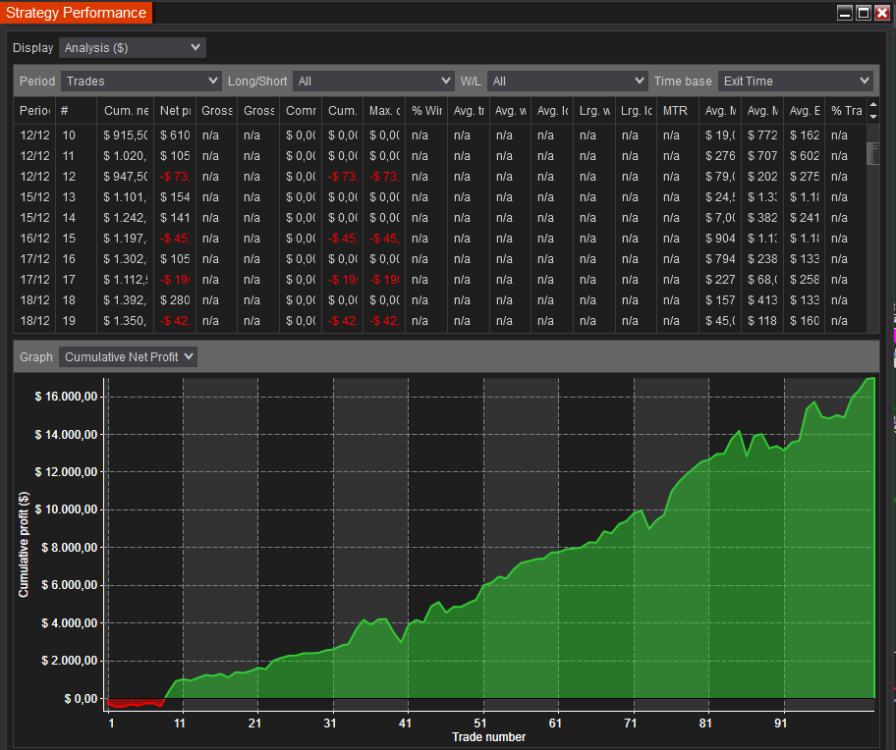

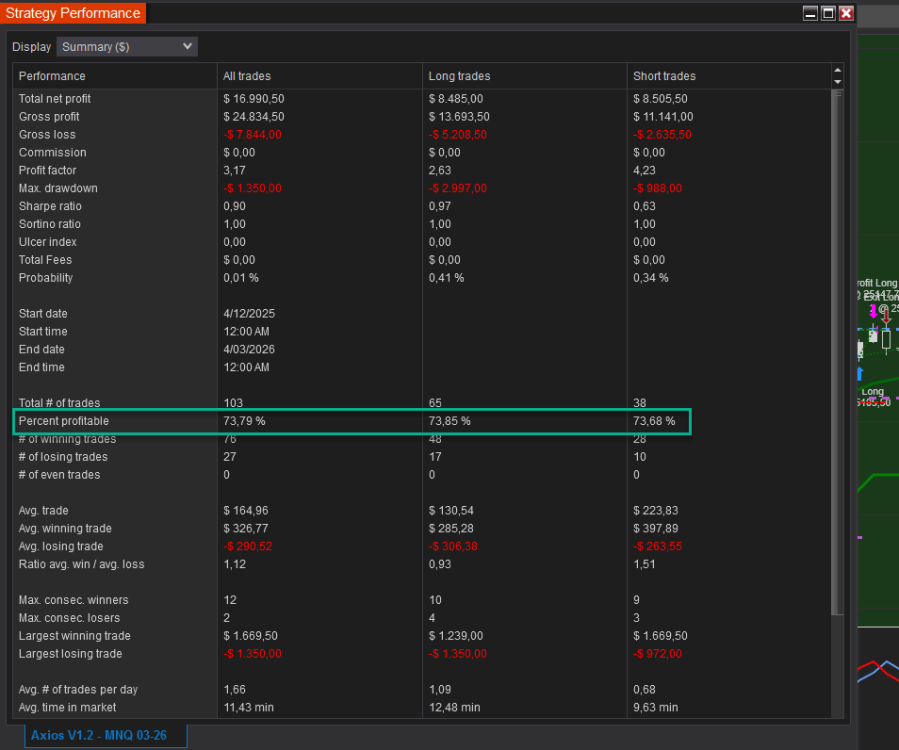

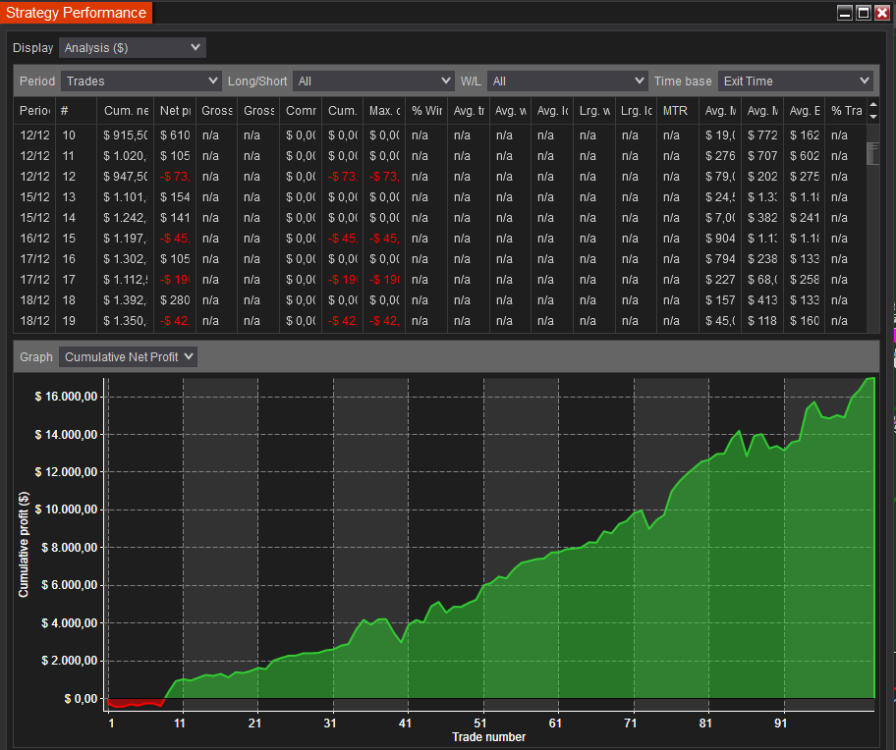

Hey guys, I managed to optimize the Axios strategy. There are some improvements to do with the dropdown size. You can adjust the position size to minimize the impact, but honestly, I've never seen a profitable bot like this one. below is the template file to download Axios 1.5 TEST 68% Nov21-Feb21.xml

-

Hey guys, I managed to optimize the Axios strategy. There are some improvements to do with the dropdown size. You can adjust the position size to minimize the impact, but honestly, I've never seen a profitable bot like this one. below is the template file to download Axios 1.5 TEST 68% Nov21-Feb21.xml

-

No problem. Still thank you for your share.

-

Robots specializing in MGC, with good results, apparently have a machine ID query for release. https://onset-hub-lead-captu-uv1r.bolt.host/ @kimsam@N9T can you support? 830666ee-8883-453e-8be5-423beb284222.zip e154321a-e50e-492c-8154-d4f728e4bc3d.zip

-

Bull Barbie Opening Range Breakout Bot and indies (Request)

sarutobi replied to TraderJoe's topic in Ninja Trader 8

You can automate it with ORB Tradesaber and Predator. I just watched the video and there's nothing impressive about it. -

Sorry I don't but if someone does please post.

-

This has been posted already @roddizon1978🤗 Flex your muscles using this, see if you could be profitable🤪

-

Do you have educated pipflow delta /volume profile ? I'm collecting all the software that type :-). Thank you in advance . Also many thanks for link to Pirate Traders on YT - good stuff -could recommend to anyone !

-

Thank you very much @Minigems Do you have access to the v3 file that you could share here?

-

Cheers: https://workupload.com/archive/nm9WrVDG23

-

I'll be honest, most of the technical side like how the .dll resources are bundled, is a bit over my head! I’m not very tech-savvy, so I just look at how the tools actually perform. I ran both files on a non-EDU version of NinjaTrader, and the results and outputs were exactly the same. Based on that, I concluded the files were identical. Looking for your upcoming 'larger pack'.

-

Looking for this Flex TPO Flex TPO