⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

sneg reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

sneg reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

-

alexstar3224 reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

alexstar3224 reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

-

https://workupload.com/file/jxm6BZQuhQD

-

For the analisys of Candelsticks Greg Morris' JCPR substitute this file mswin.chm in C:\Program Files (x86)\MetaStock\MetaStock RT for XENITH https://workupload.com/file/aqgntrsbSMH

-

raj1301 reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

raj1301 reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

- Today

-

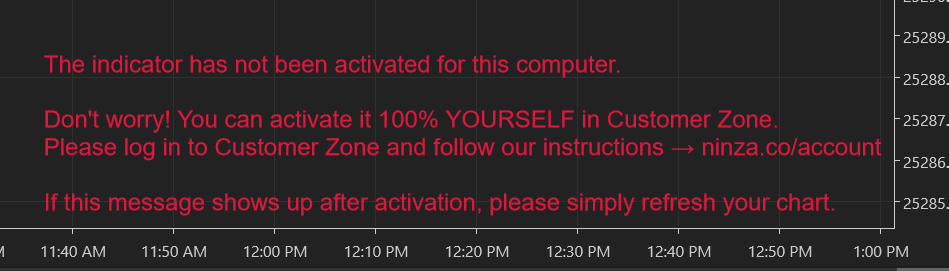

Ninza Williams Fractal Pro & Ninza DWIN Reversal

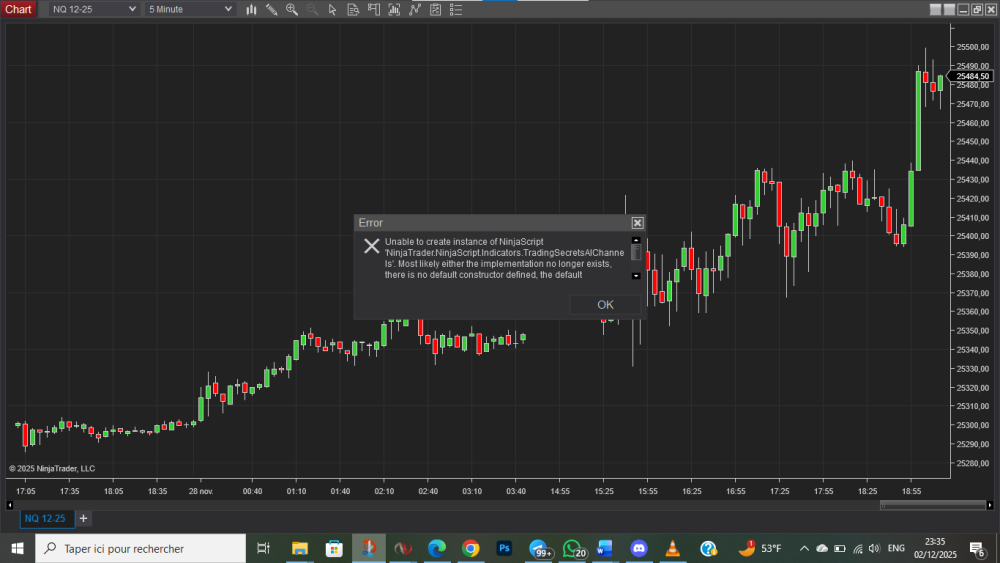

TRADER replied to ngatho254's topic in Ninja Trader 8

bro replace the ressource file , so easy this indi is alreagy cracked -

Ninza Williams Fractal Pro & Ninza DWIN Reversal

sudheer4066 replied to ngatho254's topic in Ninja Trader 8

Can some one help me how to figure out thanks in advance -

Ninza Williams Fractal Pro & Ninza DWIN Reversal

sudheer4066 replied to ngatho254's topic in Ninja Trader 8

-

Harrys reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

Harrys reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

-

st4nd4rt reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

st4nd4rt reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

-

st4nd4rt reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

st4nd4rt reacted to a post in a topic:

LegendaryTrader Indicator - Newest Versions

-

https://workupload.com/file/S2XNytXgWNG @apmoo @kimsamu can fix this indi please

-

st4nd4rt reacted to a post in a topic:

QuantVue QkronosEVO

st4nd4rt reacted to a post in a topic:

QuantVue QkronosEVO

-

st4nd4rt reacted to a post in a topic:

QuantVue QkronosEVO

st4nd4rt reacted to a post in a topic:

QuantVue QkronosEVO

-

can u unlock this indi please @apmoohttps://workupload.com/archive/9xSUFs6nbY

-

Is this from Zeus?

-

https://workupload.com/file/LwUD6xJMD4V Thanks

-

1kitt1 joined the community

-

bump

-

Fridays can be good only if they helps in making more profits because markets may sometimes either continue the same trends or make retracements as well.

-

Are prizes and awards from brokers real?

bluemac replied to hafidfx's topic in Trading Contests & Bonuses

Agreed since the traders have the ability to work under pressure while managing the losing trades as well. -

i’d quess who has the files got the licence as well since the devs does not provide trial

-

LegendaryTrader Indicator - Newest Versions

Ricardo44 replied to Ricardo44's topic in Ninja Trader 8

Hey @apmoo I hope you are goood! There is a new version. Can you help with that one as well? Thanks! https://workupload.com/file/DVn89Wq6z2Q -

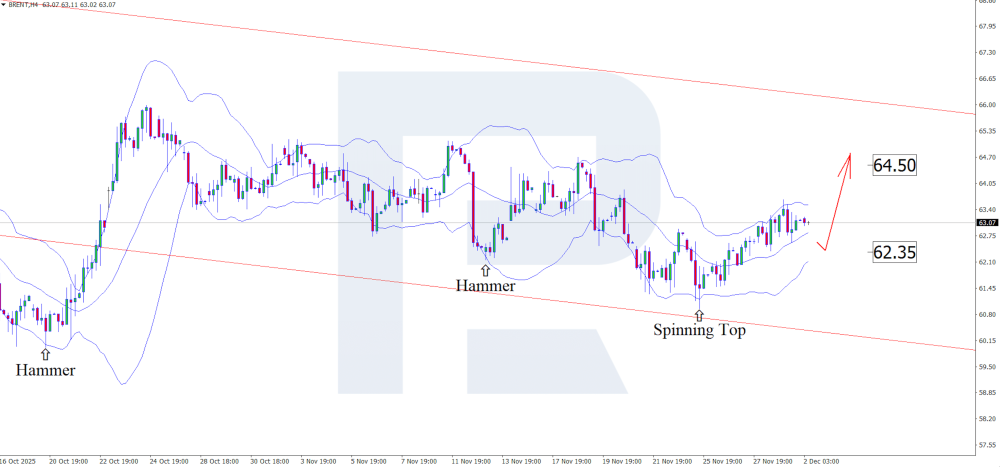

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent prepares for a surge – what is next The Brent forecast appears positive, with prices likely to maintain their upward trajectory towards 64.50 USD. Discover more in our analysis for 2 December 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent quotes formed a Spinning Top reversal pattern on the H4 chart. They are currently following this signal, forming a bullish wave. Tensions between Venezuela and the United States support crude oil prices. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index resumed growth but correction risk remains high US 500 has shifted into an uptrend, but the likelihood of a slight pullback remains high. The US 500 forecast for today is negative. US 500 forecast: key trading points Recent data: US manufacturing PMI for November came in at 52.2 Market impact: these figures are generally positive for the equity market Fundamental analysis The US manufacturing PMI in the latest release came in at 52.2 points versus a forecast of 51.9 and the previous reading of 52.5. This means the manufacturing sector remains in expansion territory (readings above 50.0 indicate growth), but the pace of expansion slowed slightly compared to the previous month. At the same time, the higher-than-expected reading suggests that business conditions are somewhat better than the market anticipated. For the US 500, the impact is cautiously positive. Since the index includes industrial, technology, and consumer companies, a moderately strong PMI supports the soft landing narrative: the economy continues to grow, but without excessive acceleration that could force the Fed back into tightening. Within the index, stocks of real-sector companies sensitive to manufacturing activity may perform slightly better under such conditions. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 374 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

legriyagrille joined the community

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

Backtesting will not be reliable due to HA candles. You have to use market replay. Often you have worse entry compared to backtest. But the bot does take some good trades, especially when there is continuation. GC is good for scalping 5 points overnight. -

The analisys of candlesticks for Metastock 19 real time: Candelsticks Greg Morris' JCPR https://e.pcloud.link/publink/show?code=XZnfgAZbNUAEYdMskhfVbq4h3xz5LoMzby7

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Oana SSS replied to luludulu's topic in Ninja Trader 8

Thank you. I started to use it myself after seeing your comment and until now 2 wins and one loss. The backtest look incredible, but probably because of the HA candles. Is the bot really that good? Looking on the chart backwards, it shows mostly wins. -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 2nd December 2025. Asian Markets Steady as BoJ Rate-Hike Signals Boost Global Yields and Trigger Bitcoin Drop. Asian markets held steady on Tuesday following a volatile start to the week, as strong demand for Japanese government bonds helped stabilise sentiment after hawkish signals from the Bank of Japan unsettled global markets. Investors had been reacting to fresh expectations of a potential Bank of Japan rate hike, a shift that pushed global bond yields higher and weighed on risk assets. A successful auction of 10-year Japanese government bonds offered some reassurance. Solid demand, particularly from domestic pension funds, signalled that investors still see value in JGBs even as Japanese bond yields rise to multi-year highs. This helped calm a market that has been on edge since Governor Kazuo Ueda’s recent comments revived speculation of policy tightening as early as this month. The yen stabilised after Monday’s swings, and Japanese equities closed slightly higher, supported by financial stocks that typically benefit from higher interest rates. The backdrop of a weak yen and elevated import costs continues to place pressure on households and small businesses, further fuelling expectations that the BoJ may need to act sooner rather than later. Carry Trade Risks in Focus as Investors Watch Yen Volatility The renewed rise in global yields and the steady decline of the yen have also reignited discussions around the yen carry trade, a strategy where investors borrow yen cheaply to invest in higher-yielding assets abroad. While some fear that growing currency volatility could trigger an unwind, several economists noted that current market conditions do not yet suggest a large-scale reversal. Asia-Pacific Markets Mixed After Wall Street Pullback Across the wider region, Asian markets delivered a mixed performance. Hong Kong and South Korea posted notable gains, with the Kospi supported by strong demand for technology names such as Samsung Electronics and SK Hynix. Mainland Chinese shares were more subdued. This followed a soft session on Wall Street, where major indices retreated as rising global bond yields reduced appetite for equities. Investors continue to reassess expectations for Federal Reserve policy, especially as US manufacturing data indicates ongoing pressure on hiring and supply chains. Bitcoin Price Drops on Thin Liquidity and Macro Stress Cryptocurrencies faced sharper declines. Bitcoin fell below key support levels in a fast, liquidity-driven drop that traders attributed to the combination of thin weekend markets and the sudden spike in global yields following the BoJ’s policy shift. Another emerging concern is the pending MSCI methodology review that may affect companies with heavy crypto exposure on their balance sheets. A potential reclassification could force index funds to adjust positions, prompting capital outflows. Market participants say traders are already factoring in the possibility of such forced moves. Despite broader market weakness, selective crypto ETFs, particularly those tracking Solana and XRP, continued to attract inflows. On-chain data also shows that leverage in the system has been gradually declining, which may help reduce future volatility even if short-term sentiment remains cautious. Bank of England Loosens Capital Requirements as UK Banks Pass Stress Tests In the UK, the Bank of England introduced a notable regulatory shift by lowering its benchmark for bank capital requirements, the first major adjustment since the post-2008 reforms. After major banks passed the latest stress tests with a comfortable buffer, the BoE signalled confidence in the sector’s resilience and encouraged lenders to support households and businesses more actively. The central bank also noted that capital requirements in the UK remain comparatively high relative to the US and EU, prompting a review of leverage rules. The move has been welcomed by banks and is expected to support credit conditions in the coming year. UK Pension Funds Reduce US Equity Exposure Amid Tech Concentration Risks Meanwhile, several large UK pension schemes managing more than £200bn have been reducing their exposure to US equities. The rapid rise of the Nasdaq, driven largely by a handful of megacap technology companies, has raised concerns about concentration risk and the possibility of an AI-fuelled valuation bubble. To safeguard retirement savers, many funds have diversified into other regions or added hedging strategies to mitigate the risk of sharp corrections in overvalued sectors. Outlook: December Set to Shape Global Market Direction Looking ahead, investors expect December to be a defining month for global markets. The Bank of Japan’s rate decision will be crucial for yen stability and Asian markets. The Federal Reserve meeting could confirm whether rate cuts are nearing. Crypto markets remain sensitive to potential MSCI-related reclassifications. UK banks will be adjusting to new capital rules. For now, the easing of JGB volatility and selective gains across Asian equities provide a measure of stability. But with rising global yields, currency swings, and fragile liquidity in several asset classes, markets remain braced for further shifts as year-end approaches. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Servan joined the community

-

Cryptocurrency mining involves choosing a coin, obtaining suitable hardware, installing mining software, and joining a mining pool for steady rewards. Configure a secure wallet, adjust settings for efficiency, and monitor performance. Profitability depends on electricity costs, hardware power, and market prices, so research thoroughly before investing to reduce potential losses.