⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Does anyone have shinobi Zeus settings?

-

suyuvu joined the community

-

Daimon Rigor started following Timingsolution & Nifty Updates - 3

- Today

-

anyone has this Ninza indicator its really good and profitable saw it in action sometime back kindly share if you have thanks SpaceGPS Satellite Trading System For NinjaTrader 8 - ninZa.co

-

Bambang Sugiarto reacted to a post in a topic:

What do you think about foreign brokers offering large bonuses — opportunity or marketing trap?

Bambang Sugiarto reacted to a post in a topic:

What do you think about foreign brokers offering large bonuses — opportunity or marketing trap?

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[B]Date: 14th November 2025.[/B] [B]Fed Comments Have Traders Fearing a December Pause![/B] Doubts continue to grow over the Federal Reserve’s December rate decision impacting both Gold and the stock market. The US shutdown has come to an end, but agencies have not yet released economic data to help investors determine the state of the US economy and employment sector. Economists are now advising that certain data such as the NFP figures for October, may not be released at all. This would make it even more difficult for the Federal Reserve to determine if a rate cut is necessary. Particularly if no extreme figures are seen for November. According to the Chicago exchange, the possibility of a rate cut in December is at 50%, the lowest in over a month. NASDAQ (USA100) - Stock Market Declines The stock market saw its strongest decline of the week yesterday, with the NASDAQ falling by 2.20% and the Dow Jones by 1.65%. The decline is largely being attributed to fears the Federal Reserve will hold interest rates unchanged in December. NASDAQ (USA100) - Daily Chart Tech heavyweights also contributed to the decline as investors worried about fewer expected Federal Reserve rate cuts. NVIDIA illustrates this effect clearly. Overall, 84% of the NASDAQ’s most influential stocks fell on Thursday, signalling strong downward momentum. NVIDIA was one of the main drivers as the stock fell 3.58% and is the most influential stock holding the largest weight. NVIDIA also continued to decline on Friday, with the stock trading 0.50% lower during the Asian session. A key factor for NVIDIA and the technology market will be NVIDIA’s earnings report on November 19th. Analysts’ expectations vary, with estimates ranging from $1.17 to $1.23. Some forecast stronger results, while others remain cautious. They also note the figure must exceed expectations by at least 5–6% to boost demand. As per yesterday’s article, a lack of Fed rate cuts may distort the market’s pricing of US indices. In that case, the NASDAQ may continue falling toward $24,303.10. This decline could continue as long as the Fed issues dovish guidance for 2026. If the Federal Reserve takes a more hawkish approach, the decline could potentially be even stronger. However, this is not something which economists are currently indicating. Most economists advise the Federal Reserve will continue to cut, but the frequency is not known. US Dollar Index - Hawkish Fed Comments Unable to Support The Dollar The US Dollar continued to decline on Thursday despite the more hawkish tone from the Federal Open Market Committee. However, there is still some concern over the potential for the Dollar to maintain its value while the Fed lowers rates. Reports from the last 24 hours confirm that European officials are exploring the option of pooling Dollars among non-US central banks. This is being done in order to reduce reliance on US funding mechanisms and the US financial system. US Dollar Index 3-Hour Chart The hawkish tone from the Federal Reserve does not yet support the US Dollar Index. However, investors will continue to monitor this. Atlanta Fed President Raphael Bostic said he supports holding rates steady until inflation shows clear progress. Boston Fed President Susan Collins agreed that rates should remain unchanged while the labour market stays stable. Collins’ stance is especially notable because she previously voted twice in favour of easing monetary policy, yet now appears more cautious. With these shifting views, a pause in the Fed’s “dovish” cycle in December seems increasingly likely. However, upcoming economic data, set to flow again as the government restarts operations, will play a critical role in shaping officials’ final decisions. Even a modest uptick in inflation, from 3.0% to 3.1%, could prompt the Federal Reserve to adopt a more hawkish position on rate cuts. In such a scenario, the US Dollar may strengthen, while gold and equity markets could face renewed downward pressure. Key Takeaway Points: Market chances for a December rate cut fell to 50%, the lowest in over a month. Stocks and Gold reacted negatively. If the Fed does not cut in December, the NASDAQ may potentially keep falling toward $24,303.10 US stocks fell sharply, with NASDAQ down 2.20%, driven by tech heavyweights like NVIDIA. NVIDIA remains a key market driver, with 19 November earnings needing 5-6% above expectations to boost demand. US Dollar Index weakened despite hawkish Fed signals; European officials are considering pooling dollars to reduce reliance on the US. [B]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/B] [B]Please note that times displayed based on local time zone and are from time of writing this report.[/B] Click [URL='https://www.hfm.com/hf/en/trading-tools/economic-calendar.html'][B]HERE[/B][/URL] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [URL='https://www.hfm.com/en/trading-tools/trading-webinars.html'][B]HERE[/B][/URL] to register for FREE! [URL='https://analysis.hfm.com/'][B]Click HERE to READ more Market news.[/B][/URL] [B]Michalis Efthymiou HFMarkets[/B] [B]Disclaimer:[/B] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

chillstep reacted to a post in a topic:

W.D. Gann's Master Forecast Method

chillstep reacted to a post in a topic:

W.D. Gann's Master Forecast Method

-

Market Technical Analysis by RoboForex

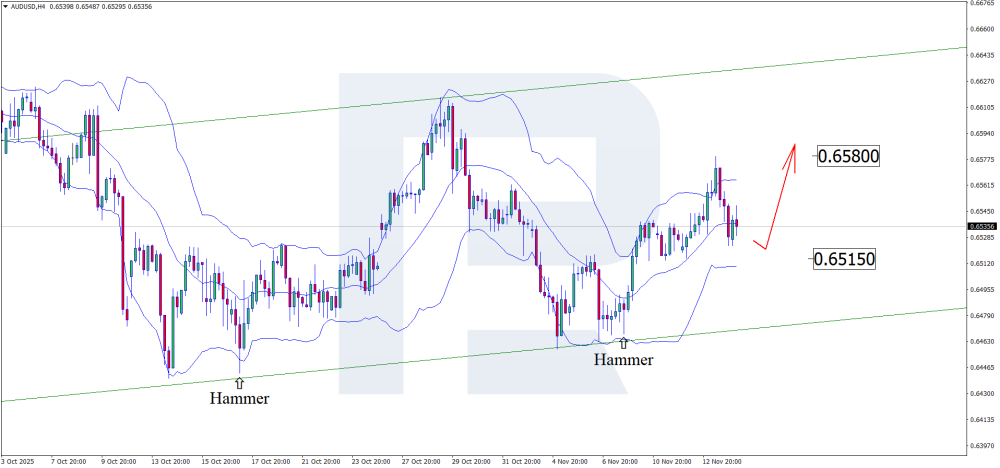

RBFX Support replied to RBFX Support's topic in Technical Analysis

Australian dollar on the offensive: AUDUSD gears up for a strong rally Amid positive economic data from Australia, the AUDUSD pair continues to rise, trading near 0.6535. Discover more in our analysis for 14 November 2025. AUDUSD technical analysis On the H4 chart, the AUDUSD pair formed a Hammer reversal pattern after testing the lower Bollinger Band. The price currently maintains its upward trajectory following the signal. The upside target could be the 0.6580 resistance level. Positive economic data from Australia continues to support the Australian dollar. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) prepares to break above its highs Gold (XAUUSD) prices have resumed growth, reaching 4,190 USD. Further highs remain possible. Find more details in our analysis for 14 November 2025. XAUUSD forecast: key trading points Gold (XAUUSD) appears strong after a brief correction Demand for safe-haven assets will keep gold supported XAUUSD forecast for 14 November 2025: 4,245 Fundamental analysis Gold (XAUUSD) prices climbed back to 4,190 USD per ounce on Friday after an earlier attempt to retest three-week highs. The market reversed amid a broad asset sell-off following the US government’s reopening. The rally at the start of the week was driven by expectations that official data, delayed due to the shutdown, would reveal labour market weakness, reinforcing the case for a Federal Reserve rate cut. However, as Treasury yields rose, demand for non-yielding assets weakened, prompting some investors to take profits. Comments from Federal Reserve officials also cooled expectations, as most emphasised that a December rate cut is not guaranteed. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 362 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

ttthjjh reacted to a post in a topic:

quantvue.io

ttthjjh reacted to a post in a topic:

quantvue.io

-

kimsam reacted to a post in a topic:

Ninza Request Thread

kimsam reacted to a post in a topic:

Ninza Request Thread

-

fxtrader99 reacted to a post in a topic:

QRENKO Candles For stratgies

fxtrader99 reacted to a post in a topic:

QRENKO Candles For stratgies

-

Does anyone here have the OmniScan non-EDU version and would be willing to share it?

-

AlabamaTrader reacted to a post in a topic:

quantvue.io

AlabamaTrader reacted to a post in a topic:

quantvue.io

-

-

check the first post

-

Traderbeauty reacted to a post in a topic:

QRENKO Candles For stratgies

Traderbeauty reacted to a post in a topic:

QRENKO Candles For stratgies

-

Thanks kimsam. Where can I get the Ninza Resources?

-

Thank you sir

-

Hey, Here's the educated version. @ynr searched the thread and it was ninzarenko that was shared and proedge heikenashi shared. Found the educated version, if anybody needs it. The right one to be used on quantvue, any strategies. Tested it out and can't be enjoyed. We still need to educate the last version I posted. Also moneyball and the rest of indicators are not working and do need to be educated too. QRenko_1_1_Vendor.rar

- Yesterday

-

these are educated long back, search in this forum you will get it.

-

luludulu started following QRENKO Candles For stratgies

-

Hey, i'm posting here the Qrenko needed by quantvue. Wanted to know if it's possible to actually educate them @apmoo They're necessary for back testing and having the best results the rest candles are not that good, but even bestrenkos are not giving an edge. Let me know, Hope it will help QRenko_1_1_Vendor.zip

-

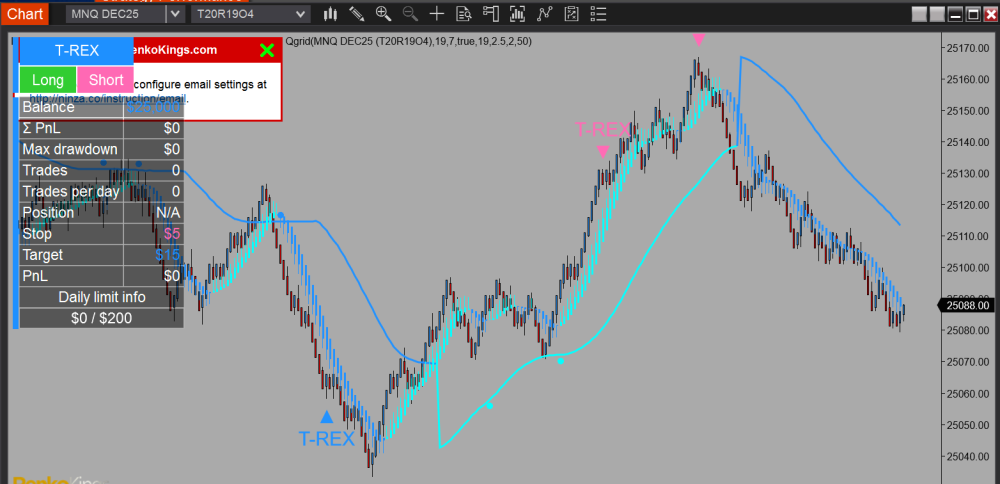

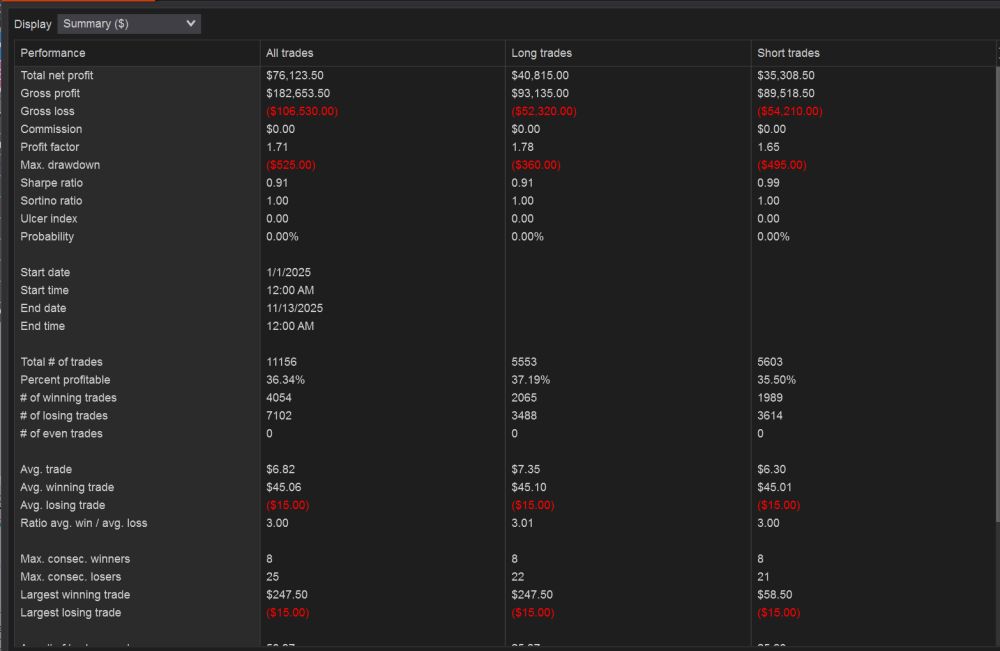

T/REX and QMomentum seems to be a good match for divergences.

-

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

i have a ninza resource file that was added with RenkoKings SolarWind indicator and its add under References but still same error comes up

-

ScramblerScholar joined the community

-

HWX started following Any body educated these file for me thanks

-

Ninza Resources..needed

-

-

i did everything but I cant find any ninza indicators on the add indicator list on multi timeframe fusion indicator anyone know what could be wrong